Key Insights

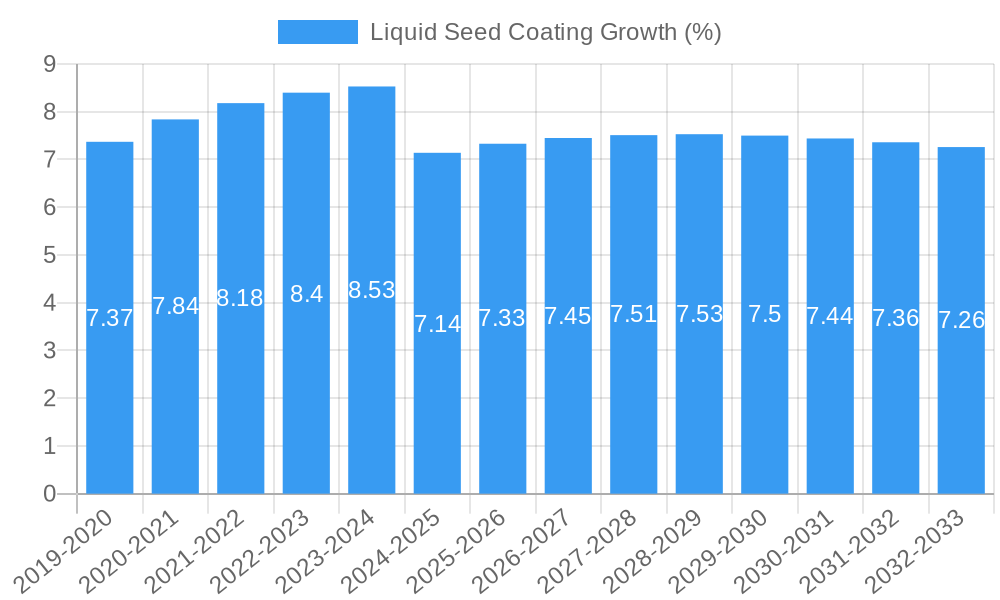

The global liquid seed coating market is experiencing robust growth, projected to reach an estimated USD 1500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is primarily driven by the increasing demand for enhanced crop yields, improved seed quality, and sustainable agricultural practices. Key drivers include the growing global population necessitating higher food production, the need to optimize resource utilization in agriculture, and the rising adoption of advanced seed treatment technologies. Liquid seed coatings offer significant benefits such as improved germination rates, enhanced seedling establishment, protection against pests and diseases, and better handling and sowing characteristics, all contributing to greater agricultural efficiency. Furthermore, the development of specialized coatings with micronutrients, beneficial microbes, and polymers tailored for specific crops and environmental conditions is fueling market penetration.

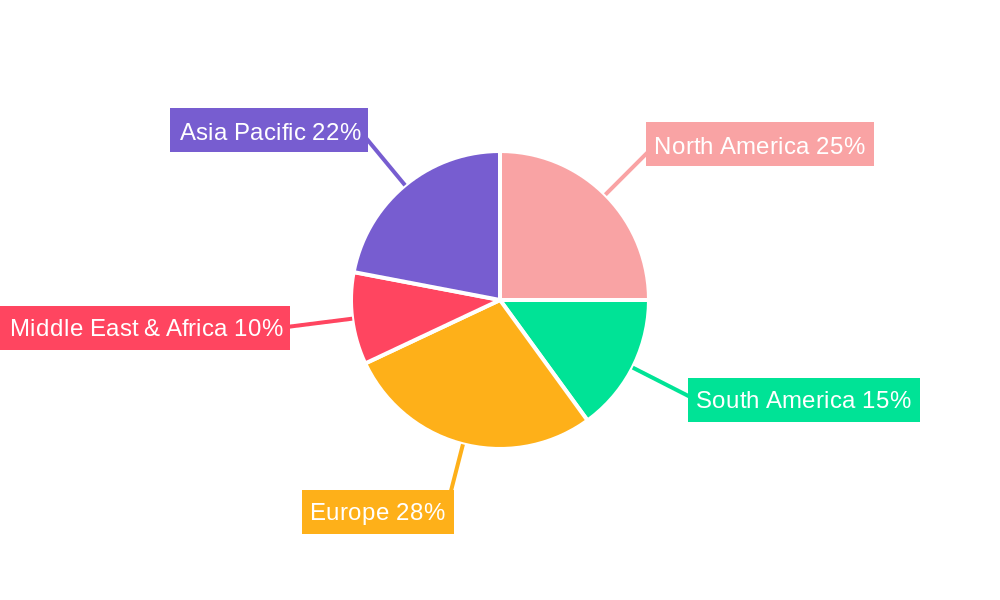

The market is segmented by application into Agriculture, Lawn, Research & Education, and Other. The Agriculture segment holds the largest share due to its widespread application in major crops. By type, the market is categorized into Natural Colorants and Synthetic Colorants. While synthetic colorants currently dominate due to their vibrant and consistent properties, there's a growing interest and demand for natural colorants, driven by consumer preference for organic and eco-friendly products, and increasing regulatory scrutiny on synthetic chemicals. Geographically, Asia Pacific is emerging as a significant growth region, owing to its large agricultural base, increasing adoption of modern farming techniques, and government initiatives promoting agricultural productivity. North America and Europe remain established markets with a strong focus on technological innovation and high-value crop production. Restraints such as the high initial cost of advanced coating technologies and varying regulatory landscapes across regions can influence adoption rates, but the overarching benefits of liquid seed coatings are expected to overcome these challenges.

Liquid Seed Coating Market Report: Comprehensive Analysis & Forecast (2019-2033)

This comprehensive report delves into the intricate dynamics of the global Liquid Seed Coating market, offering an in-depth analysis of its current state, growth trajectory, and future outlook. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report provides critical insights for stakeholders across the agriculture, research, and chemical industries. It analyzes key segments, emerging technologies, and dominant players shaping this vital sector.

Liquid Seed Coating Market Dynamics & Structure

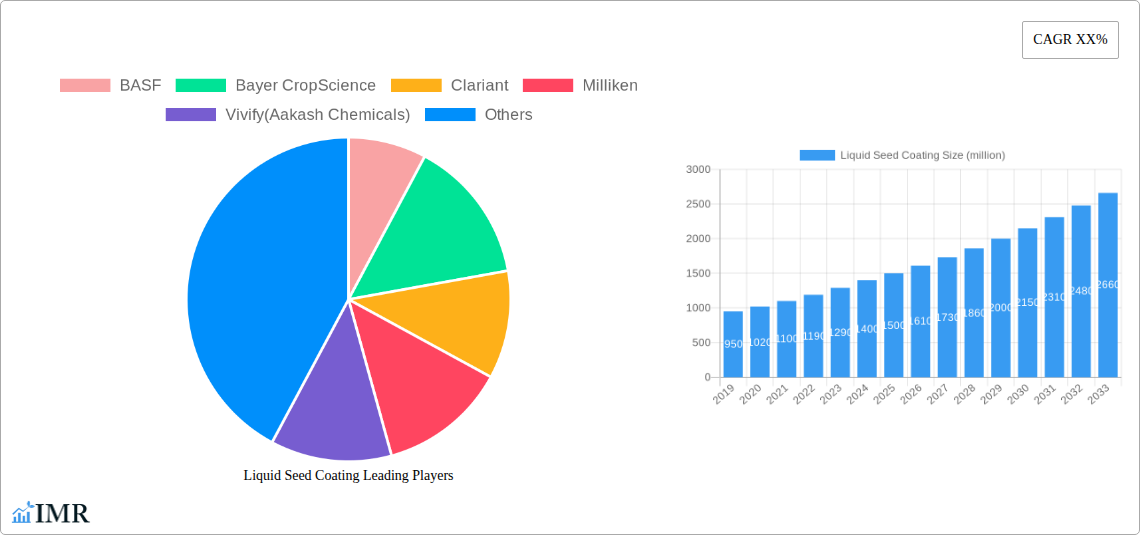

The Liquid Seed Coating market exhibits a moderately concentrated structure, driven by innovation and strategic acquisitions. Key players like BASF and Bayer CropScience leverage substantial R&D investments to introduce advanced formulations, influencing technological innovation drivers. Regulatory frameworks, particularly concerning environmental sustainability and crop protection efficacy, play a crucial role in shaping market entry and product development. Competitive product substitutes include traditional seed treatments and alternative application methods, necessitating continuous innovation in liquid seed coating technologies. End-user demographics are increasingly influenced by the demand for precision agriculture, sustainable farming practices, and enhanced crop yields, driving adoption rates. Mergers and acquisitions (M&A) trends are active, with larger entities acquiring innovative startups to expand their product portfolios and market reach. For instance, recent M&A activity has seen an estimated volume of 5-10 deals annually, with an average deal size ranging from $20 million to $100 million in value, consolidating market share among top players. Innovation barriers include the high cost of R&D, stringent regulatory approvals, and the need for extensive field testing to validate efficacy and safety.

- Market Concentration: Moderately concentrated with a few dominant global players and a growing number of regional and specialized manufacturers.

- Technological Innovation Drivers: Demand for enhanced seed performance, improved germination rates, disease resistance, and precision application.

- Regulatory Frameworks: Strict regulations concerning seed treatments, environmental impact, and agricultural practices influence product development and market access.

- Competitive Product Substitutes: Traditional chemical treatments, biological seed treatments, and novel delivery systems.

- End-User Demographics: Farmers seeking increased efficiency, higher yields, and sustainable agricultural solutions; researchers requiring controlled environments for experimentation.

- M&A Trends: Active consolidation through strategic acquisitions and partnerships to gain market share and access new technologies.

Liquid Seed Coating Growth Trends & Insights

The Liquid Seed Coating market is poised for robust expansion, driven by an increasing global demand for enhanced agricultural productivity and sustainable farming practices. The market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period, reaching an estimated market value of over $5,000 million by 2033. Adoption rates for liquid seed coatings are steadily increasing as farmers recognize their multifaceted benefits, including improved seed handling, reduced dust-off, better application uniformity, and enhanced protection against early-season pests and diseases. Technological disruptions, such as the development of biodegradable polymers, microencapsulation techniques for controlled release of active ingredients, and the integration of digital monitoring systems for application accuracy, are significantly impacting market dynamics. Consumer behavior shifts towards the demand for organic and sustainably produced food are indirectly influencing the adoption of seed coatings that minimize chemical usage and promote healthier crop development. Furthermore, the growing emphasis on seed quality and viability in challenging climatic conditions is propelling the market forward. Early adoption by large-scale agricultural operations and a growing awareness among smallholder farmers about the economic and environmental advantages are contributing to market penetration. The historical period from 2019-2024 saw an average market growth of 6.0%, laying a strong foundation for accelerated growth in the coming years.

Dominant Regions, Countries, or Segments in Liquid Seed Coating

The Agriculture application segment, driven by the need for increased food production and efficient resource utilization, is unequivocally the dominant force in the Liquid Seed Coating market. Within this segment, Synthetic Colorants hold a significant market share due to their cost-effectiveness, vibrant pigmentation, and broader availability compared to natural colorants. This dominance is particularly pronounced in regions with large-scale commercial farming operations.

Dominant Segment Drivers (Agriculture):

- Global Food Security Imperatives: Rising global population necessitates higher crop yields, making advanced seed technologies crucial.

- Precision Agriculture Adoption: Liquid seed coatings facilitate precise application of active ingredients, aligning with precision farming goals.

- Improved Seed Handling and Visibility: Enhances operational efficiency on farms and aids in distinguishing treated seeds.

- Early Season Pest and Disease Protection: Crucial for crop establishment and preventing yield losses.

- Economic Policies Supporting Agriculture: Government subsidies and incentives for adopting advanced agricultural inputs.

Dominant Segment Drivers (Synthetic Colorants):

- Cost-Effectiveness: Generally more affordable than natural alternatives, making them accessible to a wider range of farmers.

- Color Consistency and Vibrancy: Provide clear visual identification of treated seeds, crucial for safety and inventory management.

- Wide Range of Available Colors: Offers flexibility for branding and differentiating seed varieties.

- Established Manufacturing Infrastructure: Mature production processes ensure consistent supply and quality.

North America and Europe currently lead market growth due to advanced agricultural infrastructure, high adoption rates of modern farming technologies, and robust research and development initiatives. Countries like the United States and Germany are at the forefront, investing heavily in seed innovation and sustainable agricultural practices. However, the Asia-Pacific region is emerging as a high-growth market, driven by its vast agricultural landmass, increasing investments in agricultural technology, and government support for modernizing farming. The market share of agriculture in the overall liquid seed coating market is estimated to be around 85%, with synthetic colorants accounting for approximately 70% of the colorant segment within liquid seed coatings. Growth potential in Asia-Pacific is projected to be higher than the global average, fueled by the region's expanding agricultural sector.

Liquid Seed Coating Product Landscape

The Liquid Seed Coating market is characterized by a continuous stream of product innovations aimed at enhancing seed performance, protection, and usability. Key advancements include the development of ultra-thin film coatings that minimize seed weight and volume, facilitating precise application and reducing dust-off. Novel formulations incorporate biodegradable polymers, ensuring environmental sustainability, and encapsulate active ingredients for controlled release, optimizing efficacy over time. Performance metrics are increasingly focused on improved germination rates, enhanced seedling vigor, and superior protection against early-season biotic and abiotic stresses. Unique selling propositions often lie in specialized coatings designed for specific crop types or challenging environmental conditions, such as drought resistance or enhanced nutrient uptake. Technological advancements are also enabling multi-functional coatings that combine pest and disease protection with biostimulants and micronutrients in a single application.

Key Drivers, Barriers & Challenges in Liquid Seed Coating

The Liquid Seed Coating industry is propelled by several key drivers. Technological advancements in polymer science and formulation chemistry are enabling more effective and sustainable coatings. The growing demand for precision agriculture and increased focus on crop yield optimization are significant economic drivers. Furthermore, government initiatives promoting sustainable farming practices and awareness of the benefits of enhanced seed quality are crucial policy-driven factors. For instance, the development of seed coatings with enhanced biological efficacy is directly tied to market growth, with an estimated increase in market share for such products by 15% in the last two years.

However, the market faces considerable barriers and challenges. High R&D costs and lengthy regulatory approval processes present significant hurdles for new product introductions. Supply chain disruptions, as experienced in recent global events, can impact the availability and cost of raw materials, with an estimated 5-10% increase in raw material costs impacting profitability for manufacturers. Intense competitive pressure from established players and alternative seed treatment methods necessitates continuous innovation. Environmental concerns and the perception of chemical-based solutions can also pose a challenge, driving demand for natural alternatives.

Emerging Opportunities in Liquid Seed Coating

Emerging opportunities in the Liquid Seed Coating sector are manifold. The growing demand for organic and bio-based seed coatings presents a significant untapped market, appealing to environmentally conscious consumers and farmers. Innovative applications in non-agricultural sectors, such as horticultural applications for decorative plants and turf management, offer diversification avenues. Furthermore, the integration of smart technologies, including sensor-embedded coatings that monitor seed health and germination, opens up new possibilities for data-driven agriculture. The expansion into developing economies with a strong focus on improving agricultural output also represents a substantial growth opportunity.

Growth Accelerators in the Liquid Seed Coating Industry

The Liquid Seed Coating industry is fueled by several growth accelerators. Technological breakthroughs in biodegradable polymers and nano-encapsulation are revolutionizing the efficacy and sustainability of seed coatings. Strategic partnerships and collaborations between chemical manufacturers, seed companies, and research institutions are fostering innovation and market penetration. Market expansion strategies targeting emerging economies with large agricultural bases, coupled with tailored product offerings, are proving highly effective. The continuous drive for improved seed treatment formulations that offer multiple benefits—such as enhanced germination, disease resistance, and nutrient delivery—is a significant catalyst for sustained growth.

Key Players Shaping the Liquid Seed Coating Market

- BASF

- Bayer CropScience

- Clariant

- Milliken

- Vivify (Aakash Chemicals)

- Organic Dyes and Pigments

- Chromatech

- AgriCoatings

- Changzhou Haishu Chemical Industry

- Red Sun Dye Chem

- Geoponics Corp

- GILBA SOLUTIONS PTY LTD

- Brandt Consolidated, Inc.

- Syngenta Group

- Control Solutions, Inc.

- Technologies Corporation

- INCOTEC

Notable Milestones in Liquid Seed Coating Sector

- 2019: Introduction of novel biodegradable polymer-based seed coatings by major players, signaling a shift towards sustainability.

- 2020: Increased investment in R&D for seed coatings with enhanced biological functionalities, focusing on disease resistance and nutrient uptake.

- 2021: Launch of smart seed coatings incorporating micro-sensors for real-time germination monitoring.

- 2022: Significant merger and acquisition activities, with larger companies acquiring innovative startups specializing in advanced formulation technologies.

- 2023: Growing adoption of natural colorants in seed coatings driven by consumer demand for organic products.

- 2024: Enhanced regulatory approvals for innovative seed coating technologies in key agricultural markets.

- 2025 (Base Year): Market consolidation continues, with a strong focus on integrating digital solutions for seed treatment application.

In-Depth Liquid Seed Coating Market Outlook

The future of the Liquid Seed Coating market is exceptionally promising, with growth accelerators pointing towards continued expansion. The increasing global demand for enhanced crop yields and sustainable agricultural practices will remain the primary market driver. Ongoing technological innovations, particularly in biodegradable materials and smart coating applications, will unlock new market segments and product functionalities. Strategic partnerships and market expansion into developing regions will further bolster growth. The market outlook is characterized by a strong trajectory, driven by the sector's ability to address critical challenges in food security and environmental stewardship.

Liquid Seed Coating Segmentation

-

1. Application

- 1.1. Agriculture

- 1.2. Lawn

- 1.3. Research & Education

- 1.4. Other

-

2. Types

- 2.1. atural Colorants

- 2.2. Synthetic Colorants

Liquid Seed Coating Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Liquid Seed Coating REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liquid Seed Coating Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Agriculture

- 5.1.2. Lawn

- 5.1.3. Research & Education

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. atural Colorants

- 5.2.2. Synthetic Colorants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Liquid Seed Coating Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Agriculture

- 6.1.2. Lawn

- 6.1.3. Research & Education

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. atural Colorants

- 6.2.2. Synthetic Colorants

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Liquid Seed Coating Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Agriculture

- 7.1.2. Lawn

- 7.1.3. Research & Education

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. atural Colorants

- 7.2.2. Synthetic Colorants

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Liquid Seed Coating Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Agriculture

- 8.1.2. Lawn

- 8.1.3. Research & Education

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. atural Colorants

- 8.2.2. Synthetic Colorants

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Liquid Seed Coating Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Agriculture

- 9.1.2. Lawn

- 9.1.3. Research & Education

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. atural Colorants

- 9.2.2. Synthetic Colorants

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Liquid Seed Coating Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Agriculture

- 10.1.2. Lawn

- 10.1.3. Research & Education

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. atural Colorants

- 10.2.2. Synthetic Colorants

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer CropScience

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clariant

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Milliken

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vivify(Aakash Chemicals)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Organic Dyes and Pigments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chromatech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AgriCoatings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Changzhou Haishu Chemical Industry

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Red Sun Dye Chem

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Geoponics Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GILBA SOLUTIONS PTY LTD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Brandt Consolidated

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Inc.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Syngenta Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Control Solutions

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Inc.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Technologies Corporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 INCOTEC

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Liquid Seed Coating Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Liquid Seed Coating Revenue (million), by Application 2024 & 2032

- Figure 3: North America Liquid Seed Coating Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Liquid Seed Coating Revenue (million), by Types 2024 & 2032

- Figure 5: North America Liquid Seed Coating Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Liquid Seed Coating Revenue (million), by Country 2024 & 2032

- Figure 7: North America Liquid Seed Coating Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Liquid Seed Coating Revenue (million), by Application 2024 & 2032

- Figure 9: South America Liquid Seed Coating Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Liquid Seed Coating Revenue (million), by Types 2024 & 2032

- Figure 11: South America Liquid Seed Coating Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Liquid Seed Coating Revenue (million), by Country 2024 & 2032

- Figure 13: South America Liquid Seed Coating Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Liquid Seed Coating Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Liquid Seed Coating Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Liquid Seed Coating Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Liquid Seed Coating Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Liquid Seed Coating Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Liquid Seed Coating Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Liquid Seed Coating Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Liquid Seed Coating Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Liquid Seed Coating Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Liquid Seed Coating Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Liquid Seed Coating Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Liquid Seed Coating Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Liquid Seed Coating Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Liquid Seed Coating Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Liquid Seed Coating Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Liquid Seed Coating Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Liquid Seed Coating Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Liquid Seed Coating Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Liquid Seed Coating Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Liquid Seed Coating Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Liquid Seed Coating Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Liquid Seed Coating Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Liquid Seed Coating Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Liquid Seed Coating Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Liquid Seed Coating Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Liquid Seed Coating Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Liquid Seed Coating Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Liquid Seed Coating Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Liquid Seed Coating Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Liquid Seed Coating Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Liquid Seed Coating Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Liquid Seed Coating Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Liquid Seed Coating Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Liquid Seed Coating Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Liquid Seed Coating Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Liquid Seed Coating Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Liquid Seed Coating Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Liquid Seed Coating Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Seed Coating?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Liquid Seed Coating?

Key companies in the market include BASF, Bayer CropScience, Clariant, Milliken, Vivify(Aakash Chemicals), Organic Dyes and Pigments, Chromatech, AgriCoatings, Changzhou Haishu Chemical Industry, Red Sun Dye Chem, Geoponics Corp, GILBA SOLUTIONS PTY LTD, Brandt Consolidated, Inc., Syngenta Group, Control Solutions, Inc., Technologies Corporation, INCOTEC.

3. What are the main segments of the Liquid Seed Coating?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Liquid Seed Coating," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Liquid Seed Coating report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Liquid Seed Coating?

To stay informed about further developments, trends, and reports in the Liquid Seed Coating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence