Key Insights

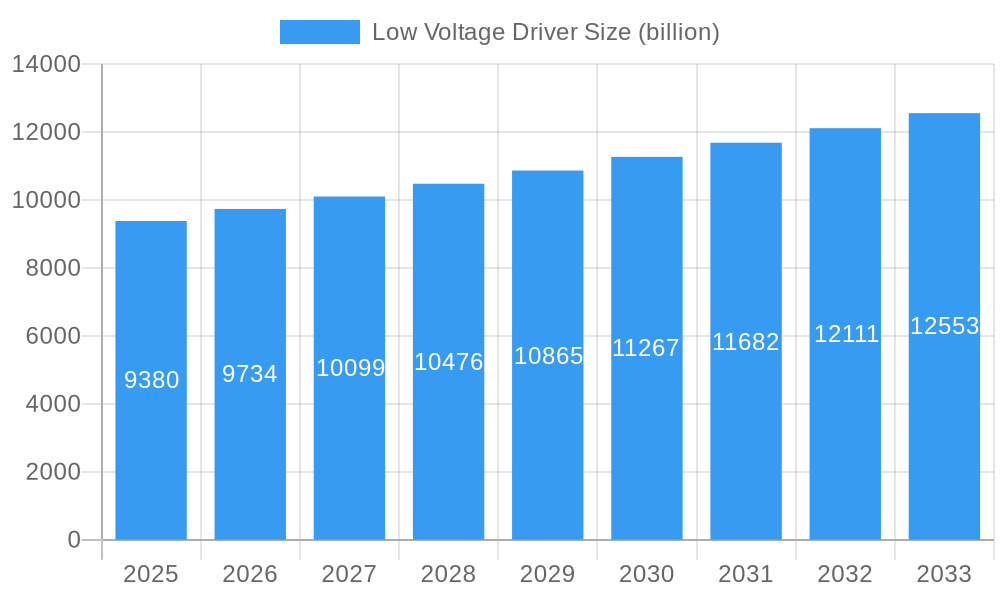

The global Low Voltage Driver market is poised for robust expansion, reaching an estimated $9.38 billion in 2025. This growth is fueled by several significant market drivers, including the increasing adoption of industrial automation across diverse sectors, the escalating demand for energy-efficient solutions in manufacturing and building management, and the continuous technological advancements in motor control technology, leading to more sophisticated and compact driver designs. The market is also witnessing a pronounced trend towards smart and connected drives, enabling real-time monitoring, predictive maintenance, and seamless integration with Industry 4.0 initiatives. Furthermore, the growing emphasis on reducing operational costs and enhancing productivity is compelling businesses to invest in advanced low voltage drivers.

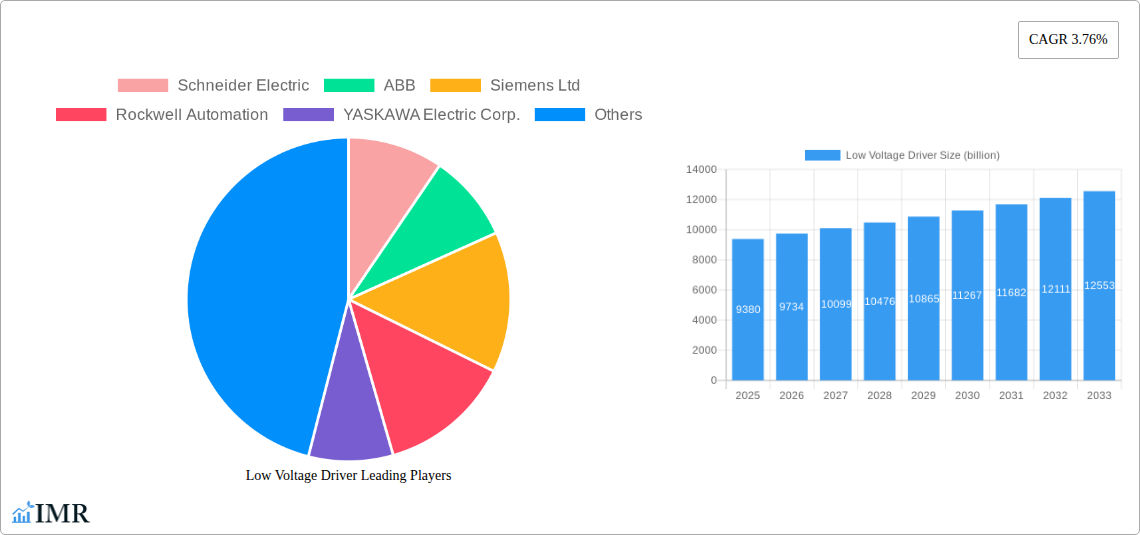

Low Voltage Driver Market Size (In Billion)

Projected to grow at a Compound Annual Growth Rate (CAGR) of 3.76% from 2025 through 2033, the market's trajectory indicates sustained development. Key application segments are expected to include industrial machinery, HVAC systems, pumps and fans, and material handling, each contributing to the overall market dynamism. Within these applications, advancements in variable frequency drives (VFDs) and servo drives are particularly noteworthy. However, the market is not without its restraints. High initial investment costs for advanced systems and the need for specialized expertise for installation and maintenance can present challenges. Additionally, the availability of alternative, albeit less efficient, motor control methods in certain niche applications could pose a minor hurdle. Nevertheless, the overwhelming benefits of improved efficiency, precise control, and extended equipment lifespan are expected to drive widespread adoption, solidifying the market's positive outlook.

Low Voltage Driver Company Market Share

Comprehensive Low Voltage Driver Market Report: Dynamics, Trends, and Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global Low Voltage Driver market, offering critical insights for stakeholders, manufacturers, and investors. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, regional dominance, product innovation, key challenges, emerging opportunities, and strategic imperatives. We analyze the intricate interplay of parent and child markets, providing a holistic view of this vital industrial sector.

Low Voltage Driver Market Dynamics & Structure

The global Low Voltage Driver market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Technological innovation remains a primary driver, fueled by the increasing demand for energy efficiency, automation, and advanced control systems across various industries. Regulatory frameworks, particularly those focused on energy conservation and emissions reduction, are shaping product development and market entry. Competitive product substitutes, such as mechanical drives and simpler control systems, exist but are increasingly outpaced by the superior performance and flexibility offered by low voltage drivers. End-user demographics are shifting towards industries prioritizing digitalization and smart manufacturing. Merger and acquisition (M&A) activity, while not at an extreme level, contributes to market consolidation and the expansion of product portfolios. For instance, an estimated 4-6 significant M&A deals are anticipated annually within the broader industrial automation sector impacting low voltage drivers. Key innovation barriers include the high cost of advanced component development and the need for specialized expertise.

- Market Concentration: Moderately concentrated, with key players like Schneider Electric, ABB, and Siemens Ltd. dominating.

- Technological Innovation Drivers: Energy efficiency mandates, Industry 4.0 adoption, IoT integration, and advancements in power electronics.

- Regulatory Frameworks: Stringent energy efficiency standards (e.g., IE4, IE5), emissions regulations, and safety compliance directives.

- Competitive Product Substitutes: Traditional mechanical linkages, older AC motor control methods, and basic on/off switching mechanisms.

- End-User Demographics: Growing demand from manufacturing, infrastructure, renewable energy, and building automation sectors.

- M&A Trends: Strategic acquisitions aimed at expanding product lines, entering new geographical markets, and acquiring innovative technologies.

Low Voltage Driver Growth Trends & Insights

The Low Voltage Driver market is poised for robust expansion, driven by a confluence of technological advancements and evolving industrial needs. The estimated market size for 2025 is USD 12.3 billion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033, reaching an estimated USD 20.9 billion by the end of the forecast period. This impressive growth is underpinned by increasing adoption rates in emerging economies and the continuous integration of smart technologies within existing infrastructure. Technological disruptions, such as the miniaturization of components, enhanced software capabilities for predictive maintenance, and the development of more efficient power semiconductors, are continuously redefining performance benchmarks. Consumer behavior shifts are also playing a crucial role, with end-users prioritizing solutions that offer greater operational efficiency, reduced energy consumption, and enhanced control precision. The parent market, industrial automation, is experiencing a significant uplift, directly benefiting the low voltage driver segment. Child markets like electric vehicle charging infrastructure and advanced HVAC systems are also contributing to this upward trajectory. Market penetration is deepening across traditional manufacturing sectors while rapidly expanding into new application areas.

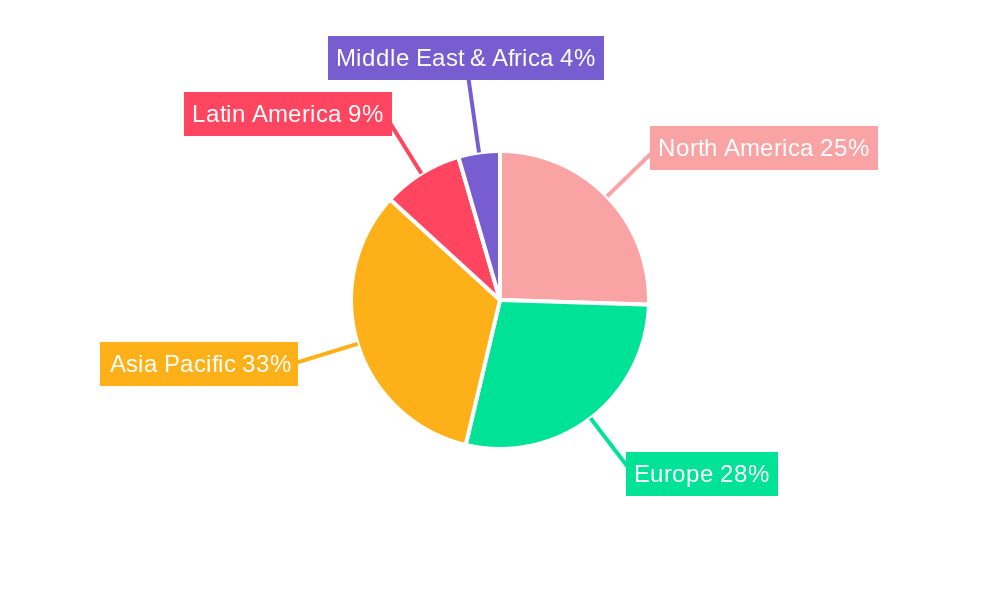

Dominant Regions, Countries, or Segments in Low Voltage Driver

The Asia-Pacific region is emerging as the dominant force in the Low Voltage Driver market, primarily driven by China, Japan, and South Korea. This dominance is propelled by several key factors, including rapid industrialization, substantial government investments in manufacturing and infrastructure development, and a growing adoption of automation technologies in sectors like automotive, electronics, and textiles. The region's expansive manufacturing base creates a substantial and consistent demand for low voltage drivers across various applications. For the Application segment, Industrial Automation stands out as the primary growth engine, encompassing a wide array of manufacturing processes, material handling, and robotics. Within the Type segment, Variable Frequency Drives (VFDs) are experiencing the most significant growth due to their unparalleled ability to control motor speed and torque, leading to substantial energy savings and improved process efficiency. The increasing implementation of Industry 4.0 principles and the surge in smart factory initiatives across Asia-Pacific further solidify the region's leadership. Economic policies that encourage technological adoption and infrastructure development, such as the Belt and Road Initiative, are creating fertile ground for market expansion. The estimated market share for Asia-Pacific in 2025 is projected to be around 35-40% of the global market, with a projected CAGR of 8.5% for the forecast period, outpacing other regions.

- Dominant Region: Asia-Pacific, with China as a key contributor.

- Key Drivers in Asia-Pacific: Industrialization, government support for automation, robust manufacturing sector, and smart factory initiatives.

- Dominant Application Segment: Industrial Automation, covering manufacturing, material handling, and assembly lines.

- Dominant Type Segment: Variable Frequency Drives (VFDs) due to energy efficiency and precise control capabilities.

- Market Share (Asia-Pacific, 2025): ~35-40%

- CAGR (Asia-Pacific, 2025-2033): ~8.5%

Low Voltage Driver Product Landscape

The Low Voltage Driver product landscape is characterized by a relentless pursuit of enhanced efficiency, intelligence, and connectivity. Manufacturers are focusing on developing compact and modular designs, enabling easier integration into existing systems. Innovations include advanced algorithms for predictive maintenance, remote diagnostics capabilities through IoT integration, and improved thermal management for increased reliability. The performance metrics are consistently being pushed higher, with drivers offering wider speed ranges, higher torque densities, and greater precision control. Unique selling propositions revolve around energy savings, reduced operational costs, and seamless integration into smart grids and automated workflows. Technological advancements are also leaning towards greater interoperability with various communication protocols and a more intuitive user interface for simplified configuration and operation.

Key Drivers, Barriers & Challenges in Low Voltage Driver

The Low Voltage Driver market is propelled by several key forces:

- Technological Advancements: Continuous innovation in power electronics, control algorithms, and connectivity features.

- Energy Efficiency Mandates: Growing global emphasis on reducing energy consumption and carbon emissions.

- Industrial Automation & Industry 4.0: The widespread adoption of smart manufacturing and automated processes.

- Growth in Renewable Energy: Increasing demand for efficient motor control in wind turbines and solar tracking systems.

Key challenges and restraints include:

- Supply Chain Disruptions: Geopolitical factors and component shortages can impact production and lead times, with an estimated 5-10% increase in production costs due to these disruptions in certain periods.

- High Initial Investment Costs: The upfront cost of advanced low voltage drivers can be a barrier for smaller enterprises.

- Technical Expertise Requirements: Installation, configuration, and maintenance require skilled personnel.

- Intense Competition: A highly competitive market landscape can put pressure on profit margins.

Emerging Opportunities in Low Voltage Driver

Emerging opportunities in the Low Voltage Driver sector are vast and diverse. The increasing electrification of transportation, including electric vehicles and industrial logistics, presents a significant growth avenue for specialized low voltage drivers. The expansion of smart grid technologies and the integration of distributed energy resources (DERs) will drive demand for intelligent control solutions. Furthermore, the growing adoption of robotics and automation in emerging economies, particularly in sectors like e-commerce fulfillment and agricultural automation, offers untapped potential. The demand for energy-efficient solutions in building automation and HVAC systems is also expected to surge, creating new market niches.

Growth Accelerators in the Low Voltage Driver Industry

Several catalysts are accelerating growth in the Low Voltage Driver industry. The ongoing digital transformation across industries, emphasizing the need for intelligent and connected systems, is a primary accelerator. Strategic partnerships between low voltage driver manufacturers and automation solution providers are fostering greater market penetration and product innovation. The development of AI-powered control systems and edge computing capabilities within drivers will unlock new levels of operational efficiency and predictive capabilities. Moreover, the increasing focus on sustainability and the circular economy is driving demand for drivers that optimize energy usage and extend the lifespan of machinery.

Key Players Shaping the Low Voltage Driver Market

- Schneider Electric

- ABB

- Siemens Ltd

- Rockwell Automation

- YASKAWA Electric Corp.

- Nidec Industrial Solutions

- Danfoss A/S

- SEW EURODRIVE

- RENESAS

- KEB Automation KG

- Infineon

- teracontrols

Notable Milestones in Low Voltage Driver Sector

- 2019: Introduction of advanced predictive maintenance algorithms integrated into VFDs.

- 2020: Increased focus on cybersecurity features for connected low voltage drivers.

- 2021: Significant advancements in GaN (Gallium Nitride) and SiC (Silicon Carbide) power semiconductors leading to more efficient drivers.

- 2022: Expansion of IoT connectivity options, enabling remote monitoring and control of driver fleets.

- 2023: Growing adoption of AI for real-time motor optimization and fault detection.

- 2024: Enhanced modular designs for easier integration and customization in industrial applications.

In-Depth Low Voltage Driver Market Outlook

The future outlook for the Low Voltage Driver market is exceptionally bright, characterized by sustained high growth and continuous innovation. The convergence of digital transformation, energy efficiency imperatives, and the rise of smart infrastructure will act as significant growth accelerators. Strategic collaborations and the development of more intelligent, connected, and sustainable low voltage driver solutions will define the competitive landscape. The market is set to witness an increasing demand for integrated automation solutions, where low voltage drivers play a pivotal role in optimizing performance and minimizing energy consumption across diverse industrial and commercial applications. The ongoing advancements in power electronics and artificial intelligence will further unlock new application potentials, solidifying the indispensable role of low voltage drivers in shaping the future of industry.

Low Voltage Driver Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Low Voltage Driver Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Low Voltage Driver Regional Market Share

Geographic Coverage of Low Voltage Driver

Low Voltage Driver REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Voltage Driver Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Low Voltage Driver Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Low Voltage Driver Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Low Voltage Driver Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Low Voltage Driver Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Low Voltage Driver Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Schneider Electric

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rockwell Automation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 YASKAWA Electric Corp.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nidec Industrial Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danfoss A/S

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SEW EURODRIVE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RENESAS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KEB Automation KG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 infineon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 teracontrols

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Schneider Electric

List of Figures

- Figure 1: Global Low Voltage Driver Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: undefined Low Voltage Driver Revenue (billion), by Application 2025 & 2033

- Figure 3: undefined Low Voltage Driver Revenue Share (%), by Application 2025 & 2033

- Figure 4: undefined Low Voltage Driver Revenue (billion), by Type 2025 & 2033

- Figure 5: undefined Low Voltage Driver Revenue Share (%), by Type 2025 & 2033

- Figure 6: undefined Low Voltage Driver Revenue (billion), by Country 2025 & 2033

- Figure 7: undefined Low Voltage Driver Revenue Share (%), by Country 2025 & 2033

- Figure 8: undefined Low Voltage Driver Revenue (billion), by Application 2025 & 2033

- Figure 9: undefined Low Voltage Driver Revenue Share (%), by Application 2025 & 2033

- Figure 10: undefined Low Voltage Driver Revenue (billion), by Type 2025 & 2033

- Figure 11: undefined Low Voltage Driver Revenue Share (%), by Type 2025 & 2033

- Figure 12: undefined Low Voltage Driver Revenue (billion), by Country 2025 & 2033

- Figure 13: undefined Low Voltage Driver Revenue Share (%), by Country 2025 & 2033

- Figure 14: undefined Low Voltage Driver Revenue (billion), by Application 2025 & 2033

- Figure 15: undefined Low Voltage Driver Revenue Share (%), by Application 2025 & 2033

- Figure 16: undefined Low Voltage Driver Revenue (billion), by Type 2025 & 2033

- Figure 17: undefined Low Voltage Driver Revenue Share (%), by Type 2025 & 2033

- Figure 18: undefined Low Voltage Driver Revenue (billion), by Country 2025 & 2033

- Figure 19: undefined Low Voltage Driver Revenue Share (%), by Country 2025 & 2033

- Figure 20: undefined Low Voltage Driver Revenue (billion), by Application 2025 & 2033

- Figure 21: undefined Low Voltage Driver Revenue Share (%), by Application 2025 & 2033

- Figure 22: undefined Low Voltage Driver Revenue (billion), by Type 2025 & 2033

- Figure 23: undefined Low Voltage Driver Revenue Share (%), by Type 2025 & 2033

- Figure 24: undefined Low Voltage Driver Revenue (billion), by Country 2025 & 2033

- Figure 25: undefined Low Voltage Driver Revenue Share (%), by Country 2025 & 2033

- Figure 26: undefined Low Voltage Driver Revenue (billion), by Application 2025 & 2033

- Figure 27: undefined Low Voltage Driver Revenue Share (%), by Application 2025 & 2033

- Figure 28: undefined Low Voltage Driver Revenue (billion), by Type 2025 & 2033

- Figure 29: undefined Low Voltage Driver Revenue Share (%), by Type 2025 & 2033

- Figure 30: undefined Low Voltage Driver Revenue (billion), by Country 2025 & 2033

- Figure 31: undefined Low Voltage Driver Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Low Voltage Driver Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Low Voltage Driver Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Low Voltage Driver Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Low Voltage Driver Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Low Voltage Driver Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Low Voltage Driver Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Low Voltage Driver Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Low Voltage Driver Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Low Voltage Driver Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Low Voltage Driver Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Low Voltage Driver Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Low Voltage Driver Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Low Voltage Driver Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Low Voltage Driver Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Low Voltage Driver Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Low Voltage Driver Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Low Voltage Driver Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Low Voltage Driver Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Voltage Driver?

The projected CAGR is approximately 3.76%.

2. Which companies are prominent players in the Low Voltage Driver?

Key companies in the market include Schneider Electric, ABB, Siemens Ltd, Rockwell Automation, YASKAWA Electric Corp., Nidec Industrial Solutions, Danfoss A/S, SEW EURODRIVE, RENESAS, KEB Automation KG, infineon, teracontrols.

3. What are the main segments of the Low Voltage Driver?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.38 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Voltage Driver," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Voltage Driver report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Voltage Driver?

To stay informed about further developments, trends, and reports in the Low Voltage Driver, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence