Key Insights

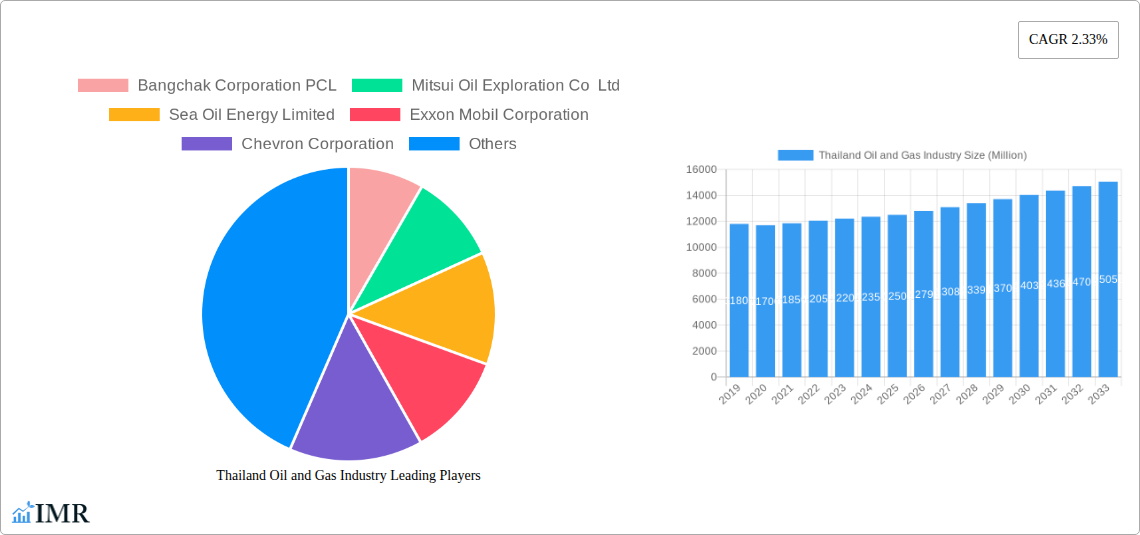

The Thailand Oil and Gas Industry is projected for robust expansion, with an estimated market size of 17.5 billion in 2024, growing at a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This growth is propelled by sustained domestic energy demand from industrial and transportation sectors, alongside significant investments in exploration and production. Key drivers include government initiatives for energy security, the imperative to maintain domestic output, and technological advancements enhancing extraction efficiency. The upstream sector will witness continued activity, especially in offshore exploration. Midstream operations will benefit from increased production and logistical demands. The downstream sector, vital for domestic fuel supply and petrochemical production, is supported by refinery modernization to meet efficiency and environmental standards. Leading companies such as PTT Public Company Limited and Bangchak Corporation PCL are pivotal through their integrated operations and strategic investments.

Thailand Oil and Gas Industry Market Size (In Billion)

However, industry growth is moderated by several constraints. Global crude oil price volatility impacts profitability and investment. Increasingly stringent environmental regulations require substantial investment in cleaner technologies, escalating operational costs. The global transition to renewable energy poses a long-term challenge, necessitating diversification and the adoption of lower-carbon solutions. Discovering new, economically viable reserves is becoming more challenging. Infrastructure limitations and aging assets also present hurdles. Despite these challenges, the industry's strategic importance to Thailand's economy, coupled with operational optimization and exploration of petrochemical derivatives, ensures its continued relevance.

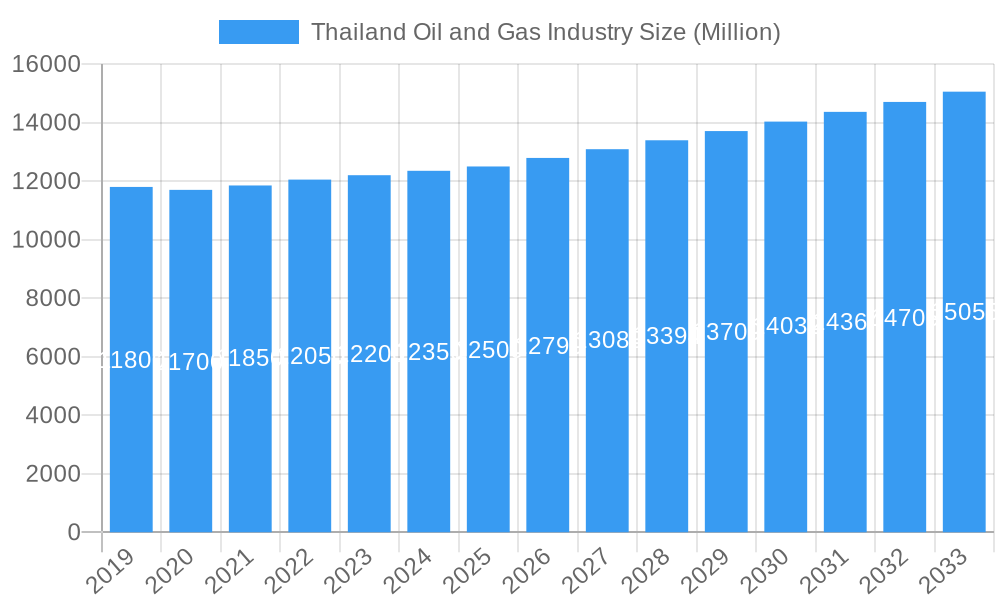

Thailand Oil and Gas Industry Company Market Share

Thailand Oil and Gas Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a holistic overview of the Thailand oil and gas industry, meticulously analyzing market dynamics, growth trends, and strategic opportunities. Covering the historical period (2019-2024) and projecting to 2033, with a base and estimated year of 2025, this research is an indispensable resource for stakeholders seeking to understand the intricacies of Thailand's energy landscape. We delve into parent and child markets, delivering actionable insights on segments such as Upstream (oil and gas exploration and production), Midstream (transportation and storage), and Downstream (refining and marketing). All quantitative data is presented in millions of units for clarity and comparability.

Thailand Oil and Gas Industry Market Dynamics & Structure

The Thailand oil and gas industry exhibits a moderately concentrated market structure, with major players like PTT Public Company Limited and Bangchak Corporation PCL dominating key segments. Technological innovation is primarily driven by advancements in exploration techniques, enhanced oil recovery (EOR) methods, and the integration of digital solutions for operational efficiency. Regulatory frameworks, shaped by government policies aimed at energy security and environmental sustainability, play a crucial role in market access and development. While direct competitive product substitutes are limited in the core oil and gas sector, the growing adoption of renewable energy sources presents an indirect challenge. End-user demographics are diverse, spanning industrial sectors, transportation, and residential consumers. Mergers and acquisitions (M&A) trends, while not overtly aggressive, reflect strategic consolidations and partnerships aimed at optimizing portfolios and expanding capabilities. Key M&A activities in the historical period involved asset acquisitions and joint ventures focused on strengthening upstream capabilities and downstream distribution networks.

- Market Concentration: Dominated by state-owned enterprises and a few large private companies.

- Technological Innovation: Focus on efficiency in exploration, production, and digital integration.

- Regulatory Frameworks: Emphasis on energy security, environmental standards, and local content.

- Competitive Landscape: Direct competition within segments, indirect pressure from renewables.

- End-User Demographics: Diverse, from industrial giants to individual consumers.

- M&A Trends: Strategic partnerships and asset acquisitions for portfolio enhancement.

Thailand Oil and Gas Industry Growth Trends & Insights

The Thailand oil and gas industry is poised for significant evolution, driven by a confluence of factors shaping its market size and trajectory. Projections indicate a steady CAGR of XX% over the forecast period (2025-2033), reflecting sustained demand and strategic investments. The adoption rates for advanced technologies in upstream operations, such as seismic imaging and automated drilling, are steadily increasing, enhancing discovery and extraction efficiency. Midstream infrastructure development, including pipelines and LNG terminals, is crucial for meeting growing energy needs and ensuring supply chain resilience. In the downstream sector, refining capacities are adapting to evolving fuel standards and the increasing demand for petrochemical products. Consumer behavior shifts, particularly towards cleaner energy alternatives and greater fuel efficiency, are influencing product development and marketing strategies. Technological disruptions, such as the exploration of unconventional resources and the integration of smart grid technologies, are also beginning to impact the market. Market penetration of specific products and services is influenced by economic growth, industrial output, and governmental energy policies. The overall market size is projected to reach approximately XX Million USD by 2033.

- Market Size Evolution: Anticipated robust growth driven by domestic demand and strategic investments.

- Adoption Rates: Increasing adoption of advanced exploration, production, and digital technologies.

- Technological Disruptions: Potential impact from unconventional resource exploration and smart grid integration.

- Consumer Behavior Shifts: Growing demand for cleaner fuels and energy-efficient solutions.

- Market Penetration: Influenced by economic factors, industrial activity, and policy incentives.

Dominant Regions, Countries, or Segments in Thailand Oil and Gas Industry

Within the Thailand oil and gas industry, the Upstream segment stands out as a primary driver of growth and investment. This dominance is propelled by several key factors, including the government's commitment to enhancing domestic energy production and securing national energy security. The discovery and development of offshore gas fields in the Gulf of Thailand remain a cornerstone of this segment's activity. Economic policies actively encourage exploration and production (E&P) investments, with fiscal incentives designed to attract both international and domestic players. Infrastructure development, particularly the expansion of offshore platforms and subsea pipelines, supports the operational efficiency of the upstream sector.

The Midstream segment plays a crucial supporting role, facilitating the transportation of crude oil and natural gas from production sites to refineries and distribution centers. Investments in expanding pipeline networks and enhancing LNG receiving and regasification capacities are vital for accommodating growing import volumes and ensuring a stable supply. The development of storage facilities also contributes to market stability by managing seasonal demand fluctuations.

The Downstream segment, encompassing refining and petrochemical operations, is also a significant contributor, driven by domestic consumption and export opportunities. Thailand's strategic location and established refining infrastructure allow it to serve regional markets effectively. The petrochemical sub-sector, in particular, benefits from the availability of feedstock from domestic and imported sources, supporting industries such as plastics, textiles, and automotive manufacturing.

- Upstream Dominance: Driven by energy security goals and exploration of offshore resources.

- Key Drivers: Government incentives for E&P, offshore field development, advancements in exploration technology.

- Market Share: Historically a significant contributor to GDP and employment.

- Growth Potential: Continual exploration of new reserves and optimization of existing fields.

- Midstream Support: Essential for efficient supply chain management and infrastructure connectivity.

- Key Drivers: Expansion of pipeline networks, LNG terminal development, storage capacity enhancement.

- Role: Facilitating the flow of resources from production to consumption centers.

- Downstream Contribution: Meeting domestic demand and serving regional export markets.

- Key Drivers: Growing demand for refined products and petrochemicals, strategic refining capacity.

- Applications: Fuel production, petrochemical feedstock for various industries.

Thailand Oil and Gas Industry Product Landscape

The product landscape of the Thailand oil and gas industry is characterized by a spectrum of refined fuels, petrochemicals, and increasingly, cleaner energy solutions. Innovations are focused on improving fuel efficiency, reducing emissions, and developing higher-value petrochemical derivatives. Performance metrics for refined products are aligned with international standards, emphasizing purity and environmental compliance. Unique selling propositions often revolve around reliability of supply, competitive pricing, and adherence to stringent quality controls. Technological advancements are seen in the development of specialized lubricants, advanced polymers, and biofuels, catering to evolving market demands and sustainability initiatives.

Key Drivers, Barriers & Challenges in Thailand Oil and Gas Industry

Key Drivers

- Growing Domestic Energy Demand: Fueled by economic growth and population expansion.

- Government Support for Energy Security: Policies aimed at increasing local production and diversifying supply.

- Strategic Location: Facilitating regional trade and investment opportunities.

- Technological Advancements: Enhancing exploration, production, and refining efficiencies.

Barriers & Challenges

- Depleting Domestic Reserves: Increasing reliance on imports for certain feedstocks.

- Environmental Regulations and Sustainability Pressures: Stricter emission standards and the transition to cleaner energy.

- Geopolitical Volatility: Fluctuations in global crude oil prices impacting profitability and investment decisions.

- Infrastructure Deficiencies: Need for continuous upgrades and expansion of transportation and storage networks.

- Competition from Renewables: Growing market share of alternative energy sources.

Emerging Opportunities in Thailand Oil and Gas Industry

Emerging opportunities in the Thailand oil and gas industry lie in the expansion of liquefied natural gas (LNG) infrastructure to support diversified gas supply, and the development of petrochemical complexes for higher-value chemical products. The growing emphasis on sustainability presents opportunities in the production of lower-carbon fuels, such as biofuels and potentially hydrogen. Furthermore, advancements in digital technologies, including AI and IoT, offer potential for optimizing operations, improving safety, and enhancing predictive maintenance across the value chain. The untapped potential in offshore exploration, particularly in deeper waters, also represents a significant avenue for future growth.

Growth Accelerators in the Thailand Oil and Gas Industry Industry

Long-term growth in the Thailand oil and gas industry will be significantly accelerated by strategic investments in advanced exploration technologies to unlock new domestic reserves and optimize existing ones. Partnerships between national oil companies and international energy firms will continue to foster knowledge transfer and access to capital. The expansion of midstream infrastructure, particularly LNG import terminals and pipeline networks, will be crucial for ensuring supply security and flexibility. Furthermore, the downstream sector's focus on developing high-demand petrochemical products will drive value addition and economic diversification. Embracing digital transformation and automation across all segments will lead to substantial operational efficiencies and cost reductions, further bolstering growth.

Key Players Shaping the Thailand Oil and Gas Industry Market

- Bangchak Corporation PCL

- Mitsui Oil Exploration Co Ltd

- Sea Oil Energy Limited

- Exxon Mobil Corporation

- Chevron Corporation

- Pan Orient Energy (Siam) Ltd

- TotalEnergies SE

- Royal Dutch Shell PLC

- MedcoEnergi

- PTT Public Company Limited

Notable Milestones in Thailand Oil and Gas Industry Sector

- June 2023: PTT Exploration and Production Public Company Limited (PTTEP) and Domestic Production Asset Group signed Production Sharing Contracts (PSCs) for Block G1/65 and Block G3/65 with the Minister of Energy. PTTEP was awarded the two offshore blocks in the 24th Thailand Petroleum Bidding Round.

- May 2023: PTT, Thailand's largest oil and gas conglomerate, planned to import up to 6 million tonnes of liquefied natural gas (LNG) this year due to a surge in demand nationwide.

- May 2022: PTT Exploration and Production Public Company Limited (PTTEP), responsible for developing the business in petroleum exploration, development, and production to support Thailand's energy security nations, decided to shift all of its equity crude production from its Oman location project to domestic Thai refineries rather than trading the barrels in the international market.

In-Depth Thailand Oil and Gas Industry Market Outlook

The Thailand oil and gas industry is charting a course towards robust future growth, underpinned by strategic initiatives to bolster energy security and meet escalating domestic demand. Key growth accelerators include substantial investments in unlocking untapped offshore reserves and enhancing the efficiency of existing fields through cutting-edge exploration and production technologies. The strategic expansion of liquefied natural gas (LNG) import capabilities and the modernization of midstream infrastructure are paramount for ensuring a stable and diversified energy supply. Furthermore, a focused development of high-value petrochemical products will drive economic diversification and revenue generation. The industry’s embrace of digital transformation, encompassing automation and advanced analytics, is set to optimize operational performance and mitigate risks. These strategic moves position Thailand’s oil and gas sector for sustained expansion and enhanced global competitiveness in the coming years.

Thailand Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Thailand Oil and Gas Industry Segmentation By Geography

- 1. Thailand

Thailand Oil and Gas Industry Regional Market Share

Geographic Coverage of Thailand Oil and Gas Industry

Thailand Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas

- 3.3. Market Restrains

- 3.3.1. Government Policies to Shift Towards Cleaner Fuels

- 3.4. Market Trends

- 3.4.1. Downstream Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bangchak Corporation PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsui Oil Exploration Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sea Oil Energy Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exxon Mobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pan Orient Energy (Siam) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TotalEnergies SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MedcoEnergi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PTT Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bangchak Corporation PCL

List of Figures

- Figure 1: Thailand Oil and Gas Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Thailand Oil and Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand Oil and Gas Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 2: Thailand Oil and Gas Industry Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 3: Thailand Oil and Gas Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 4: Thailand Oil and Gas Industry Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 5: Thailand Oil and Gas Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 6: Thailand Oil and Gas Industry Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 7: Thailand Oil and Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Thailand Oil and Gas Industry Volume Thousand Forecast, by Region 2020 & 2033

- Table 9: Thailand Oil and Gas Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 10: Thailand Oil and Gas Industry Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 11: Thailand Oil and Gas Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 12: Thailand Oil and Gas Industry Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 13: Thailand Oil and Gas Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 14: Thailand Oil and Gas Industry Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 15: Thailand Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Thailand Oil and Gas Industry Volume Thousand Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Oil and Gas Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Thailand Oil and Gas Industry?

Key companies in the market include Bangchak Corporation PCL, Mitsui Oil Exploration Co Ltd, Sea Oil Energy Limited, Exxon Mobil Corporation, Chevron Corporation, Pan Orient Energy (Siam) Ltd, TotalEnergies SE, Royal Dutch Shell PLC, MedcoEnergi, PTT Public Company Limited.

3. What are the main segments of the Thailand Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas.

6. What are the notable trends driving market growth?

Downstream Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Government Policies to Shift Towards Cleaner Fuels.

8. Can you provide examples of recent developments in the market?

June 2023: PTT Exploration and Production Public Company Limited (PTTEP) and Domestic Production Asset Group signed Production Sharing Contracts (PSCs) for Block G1/65 and Block G3/65 with the Minister of Energy. PTTEP was awarded the two offshore blocks in the 24th Thailand Petroleum Bidding Round.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Thailand Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence