Key Insights

The Distributed Energy Generation (DEG) market is projected for significant expansion, anticipating a market size of $538.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6%. This robust growth is driven by the escalating demand for dependable and sustainable energy solutions, especially in areas facing grid instability and rising electricity expenses. Key growth factors include the growing need for energy independence, rapid advancements and cost reductions in renewable technologies such as Solar PV, and the increasing adoption of Microgrids for enhanced grid resilience. Supportive regulatory frameworks for cleaner energy sources and the imperative to reduce carbon emissions are also significantly boosting the market penetration of DEG systems. The industry is clearly shifting towards cleaner, more efficient generation methods, with Solar PV at the forefront, complemented by advancements in battery storage and smart grid integration.

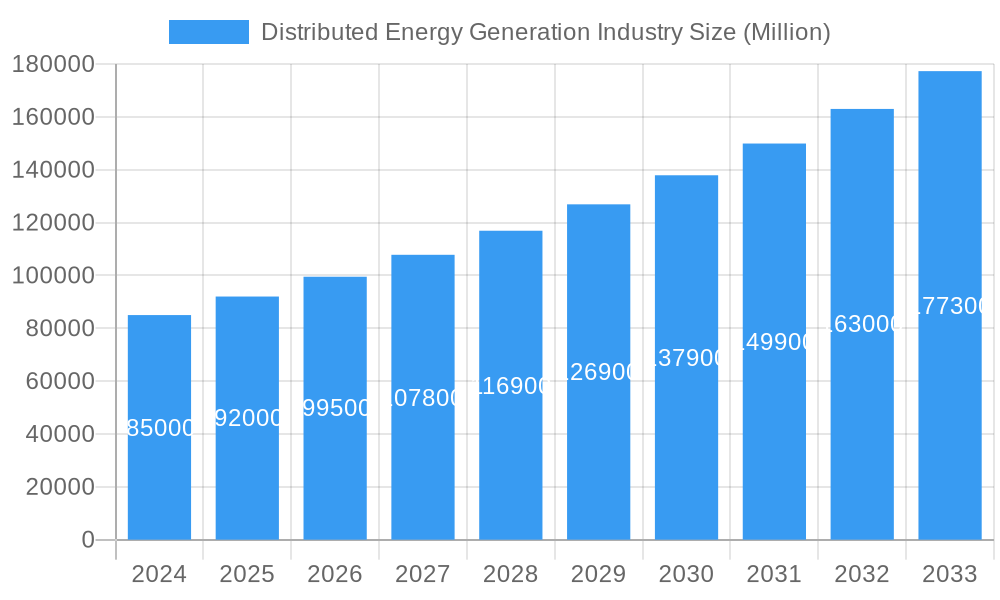

Distributed Energy Generation Industry Market Size (In Billion)

The DEG market encompasses a variety of technologies, including Solar PV, Diesel Generators (still vital for backup in specific markets despite environmental considerations), Natural Gas Generators, and the rapidly growing Microgrids sector. Leading companies such as Siemens AG, General Electric Co., and Cummins Inc. are actively innovating and expanding their offerings to meet the demands of this dynamic market. Emerging trends emphasize the integration of advanced digital technologies for optimized performance, demand-side management, and grid modernization. While the overall market outlook is exceptionally strong, potential restraints like high initial capital investment for certain technologies and complex regulatory environments in some regions may present challenges. Nevertheless, the inherent advantages of DEG, including reduced transmission losses, improved grid reliability, and enhanced energy security, are expected to overcome these obstacles, ensuring sustained and accelerated market growth globally.

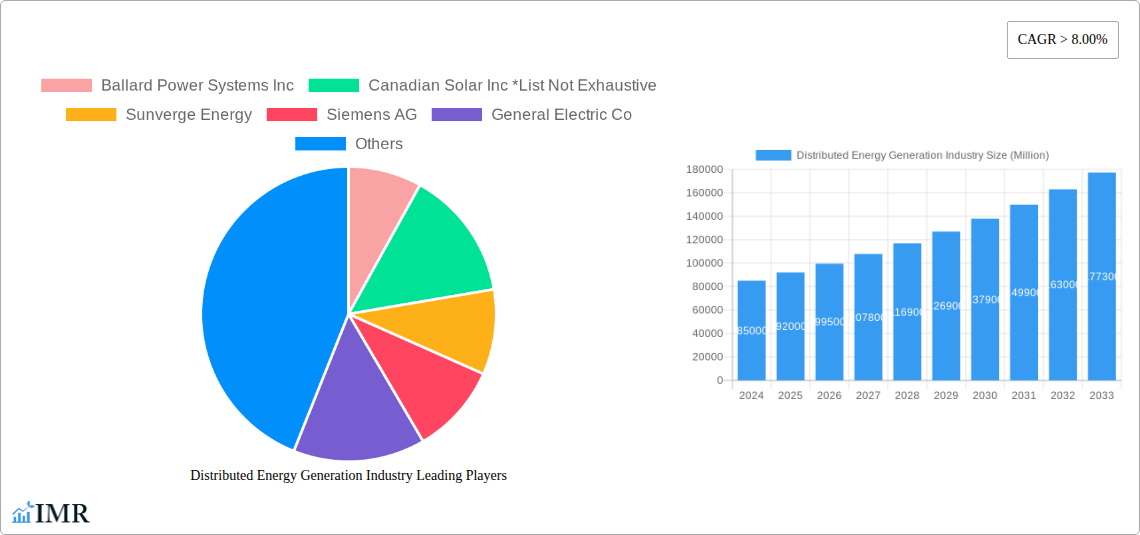

Distributed Energy Generation Industry Company Market Share

Distributed Energy Generation Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the rapidly evolving Distributed Energy Generation (DEG) industry, providing an in-depth analysis of market dynamics, growth trajectories, and future opportunities. With a focus on renewable energy solutions, microgrids, and energy efficiency, this study is essential for stakeholders seeking to understand the landscape of on-site power generation. Our analysis covers the global distributed energy generation market, examining key parent market trends and the intricate nuances of various child markets, including solar energy generation, fuel cell technology, and backup power solutions.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Distributed Energy Generation Industry Market Dynamics & Structure

The distributed energy generation market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demographics. Market concentration varies significantly across different technologies and regions, with established players like Siemens AG and General Electric Co. coexisting with agile innovators such as Bloom Energy and Fuelcell Energy Inc. Technological innovation drivers are primarily fueled by the growing demand for clean energy, grid resilience, and cost reduction. Regulatory frameworks play a pivotal role, with government incentives and mandates for renewable energy adoption directly influencing market penetration. Competitive product substitutes are abundant, ranging from traditional fossil fuel-based generators to increasingly sophisticated solar PV systems and advanced microgrid solutions. End-user demographics are diversifying, encompassing residential, commercial, and industrial sectors, each with unique energy needs and adoption patterns. Mergers and acquisitions (M&A) trends are indicative of market consolidation and strategic expansion, with companies seeking to broaden their technology portfolios and geographic reach.

- Market Concentration: Fragmented in some technology segments (e.g., solar PV), more consolidated in others (e.g., large-scale natural gas gensets).

- Technological Innovation Drivers: Cost reduction of renewable technologies, advancements in battery storage, development of smart grid integration, and increasing demand for energy independence.

- Regulatory Frameworks: Government subsidies, renewable portfolio standards, net metering policies, and supportive policies for microgrid development are key influences.

- Competitive Product Substitutes: Traditional grid electricity, battery energy storage systems (BESS), and other decentralized generation technologies.

- End-User Demographics: Growing adoption by homeowners seeking energy independence and cost savings, businesses aiming for operational continuity and reduced carbon footprint, and utilities modernizing their grids.

- M&A Trends: Strategic acquisitions by larger energy companies to integrate renewable and distributed generation capabilities, and consolidation among smaller technology providers to achieve economies of scale.

Distributed Energy Generation Industry Growth Trends & Insights

The global distributed energy generation market is poised for substantial growth, driven by a confluence of factors including the escalating urgency of climate change, the declining costs of renewable energy technologies, and the increasing demand for grid reliability and energy independence. The market is projected to witness robust expansion, with a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. This upward trajectory is underpinned by significant advancements in solar photovoltaic (PV) technology, making it an increasingly attractive and accessible option for both residential and commercial applications. Furthermore, the burgeoning interest in energy storage solutions, particularly advanced battery technologies, is acting as a crucial enabler for DEG, allowing for greater grid integration and utilization of intermittent renewable sources.

Consumer behavior is undergoing a notable shift, with a growing segment of the population actively seeking alternatives to traditional centralized power grids. This is driven by a desire for lower electricity bills, a reduced environmental impact, and enhanced resilience against power outages. The penetration of distributed generation systems, especially solar PV coupled with storage, is steadily increasing across developed and developing economies. Technological disruptions, such as the integration of artificial intelligence (AI) for grid management and the development of more efficient fuel cell technologies, are further accelerating adoption rates. The distributed generation market size is expected to reach over $250,000 Million by 2033, a significant increase from its estimated value of $120,000 Million in 2025. This growth is not merely incremental; it represents a fundamental transformation in how energy is produced, distributed, and consumed, moving towards a more decentralized, cleaner, and resilient energy future. The increasing adoption of electric vehicles (EVs) also presents a synergistic opportunity, as smart charging infrastructure can be integrated with DEG systems for optimized energy management.

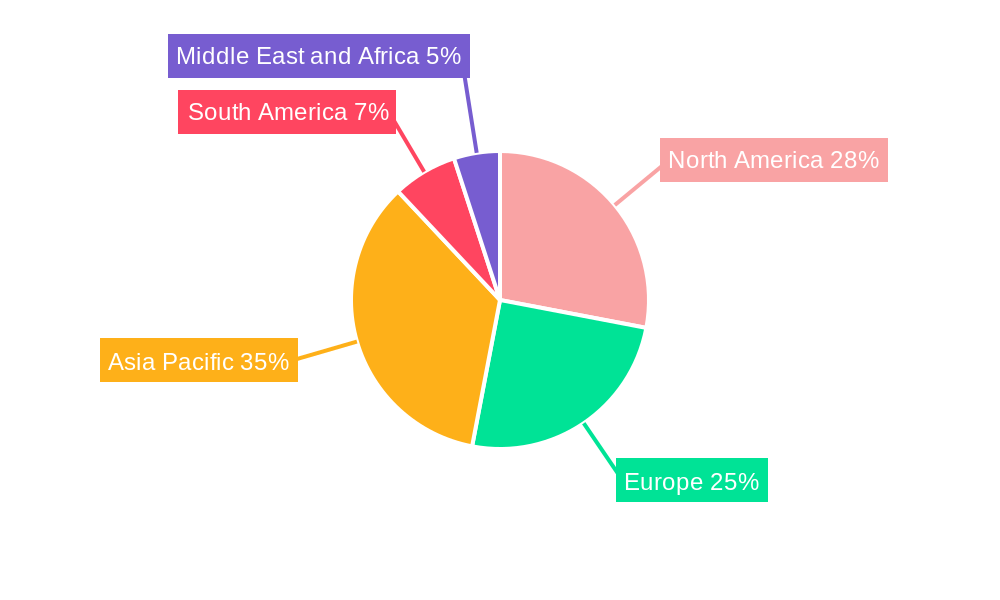

Dominant Regions, Countries, or Segments in Distributed Energy Generation Industry

The global distributed energy generation (DEG) market is experiencing significant growth, with several regions and technologies vying for dominance. Among the technology segments, Solar PV stands out as a primary growth driver, propelled by declining manufacturing costs, supportive government policies, and increasing environmental consciousness. The market share of Solar PV in the DEG sector is projected to exceed 50% by 2033. This dominance is further bolstered by advancements in panel efficiency and integration with energy storage systems, making it a viable and often preferred choice for both residential and commercial applications seeking sustainable and cost-effective energy solutions.

North America, particularly the United States, and Europe are emerging as dominant regions due to robust policy frameworks, substantial investments in renewable energy, and a high concentration of technological innovation. The United States, with its diverse energy needs and strong federal and state incentives for distributed generation, is a key market. Initiatives like the one observed in Michigan, where the distributed generation program saw a 37% rise and added thousands of customers, exemplify the regional commitment to on-site power generation. This trend is amplified by the increasing adoption of microgrids, which are gaining traction for their ability to enhance grid resilience and provide reliable power in areas prone to outages or with unreliable central grids.

The parent market for distributed energy is influenced by the overall energy transition, while child markets like Solar PV and Microgrids are experiencing rapid expansion. The growth potential in these segments is further enhanced by the increasing demand for energy security and the desire to reduce carbon emissions. Economic policies that favor renewable energy deployment, such as tax credits and feed-in tariffs, are crucial for fostering growth. Infrastructure development, including smart grid technologies and advanced metering, also plays a vital role in enabling seamless integration of distributed energy resources. While other segments like Natural Gas Gensets and Diesel Gensets continue to hold a significant share, particularly for backup power and in regions with less developed renewable infrastructure, the long-term growth is undeniably skewed towards cleaner and more sustainable technologies like Solar PV and integrated microgrid solutions. The market share of Microgrids is also expected to grow substantially, reaching an estimated $35,000 Million by 2033, reflecting their increasing importance in enhancing energy security and resilience.

Distributed Energy Generation Industry Product Landscape

The distributed energy generation product landscape is characterized by a diverse range of innovative solutions designed to meet varying energy needs. Solar PV panels, ranging from high-efficiency monocrystalline to more affordable polycrystalline modules, are central to residential and commercial installations. These are increasingly complemented by advanced inverter technologies that optimize energy conversion and grid synchronization. Fuel cell systems, including Ballard Power Systems Inc.'s proton exchange membrane (PEM) fuel cells and Bloom Energy's solid oxide fuel cells (SOFCs), offer clean and reliable baseload power for industrial and commercial applications. Microgrid controllers and software platforms are emerging as critical products, enabling seamless integration and management of various distributed energy resources, including renewables, storage, and conventional generators, thereby enhancing grid stability and resilience. Battery energy storage systems (BESS) are also integral, with lithium-ion and emerging flow battery technologies providing essential grid-balancing and backup power capabilities.

Key Drivers, Barriers & Challenges in Distributed Energy Generation Industry

The distributed energy generation industry is propelled by a strong set of drivers, including the escalating demand for clean and sustainable energy sources, coupled with the imperative to enhance grid reliability and resilience against extreme weather events and cyber threats. Technological advancements in solar PV, battery storage, and fuel cell efficiency are continually reducing costs and improving performance, making DEG more accessible and economically viable. Supportive government policies, such as tax incentives, renewable portfolio standards, and favorable net metering regulations, play a crucial role in accelerating adoption. The desire for energy independence and cost savings among end-users, both residential and commercial, further fuels market growth.

However, the industry faces significant barriers and challenges. Intermittency of renewable sources like solar and wind necessitates robust energy storage solutions, which can still be cost-prohibitive for some applications. Complex and evolving regulatory frameworks across different jurisdictions can create uncertainty and hinder project development. Grid interconnection challenges, including the need for grid modernization and upgraded infrastructure, can also slow down deployment. Furthermore, supply chain disruptions for critical components, such as semiconductors and rare earth minerals, can impact manufacturing and lead to project delays. Competitive pressures from established utilities and the inherent capital costs associated with DEG installations remain considerable obstacles.

Emerging Opportunities in Distributed Energy Generation Industry

Emerging opportunities within the distributed energy generation industry are vast and increasingly sophisticated. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) presents a significant avenue for optimizing DEG system performance, predictive maintenance, and energy management, creating "smart" decentralized grids. The growing demand for electrifying transportation fuels opportunities for integrated charging infrastructure with DEG. Furthermore, the increasing focus on energy resilience for critical infrastructure, such as hospitals and data centers, is driving demand for advanced microgrid solutions and hybrid DEG systems. Untapped markets in developing economies, where grid infrastructure is nascent, offer substantial potential for leapfrogging traditional centralized systems with decentralized solutions. The circular economy and the increasing emphasis on sustainability are also driving innovation in recycling and repurposing of DEG components.

Growth Accelerators in the Distributed Energy Generation Industry Industry

Several key catalysts are accelerating the growth of the distributed energy generation industry. Continuous technological breakthroughs in solar panel efficiency, battery energy density, and fuel cell lifespan are making DEG solutions more competitive and reliable. Strategic partnerships between technology providers, energy developers, and financial institutions are crucial for de-risking investments and facilitating large-scale deployments. Market expansion strategies, including entering new geographic regions and targeting underserved customer segments, are also driving growth. The increasing recognition of DEG's role in achieving national and global decarbonization targets, coupled with evolving carbon pricing mechanisms, will further incentivize adoption. The development of innovative financing models, such as power purchase agreements (PPAs) and green bonds, is making DEG more accessible to a wider range of customers.

Key Players Shaping the Distributed Energy Generation Industry Market

- Ballard Power Systems Inc

- Canadian Solar Inc

- Sunverge Energy

- Siemens AG

- General Electric Co

- Schneider Electric SE

- Caterpillar Inc

- Fuelcell Energy Inc

- Cummins Inc

- Ansaldo Energia SpA

- Capstone Turbine Corporation

- Bloom Energy

Notable Milestones in Distributed Energy Generation Industry Sector

- December 2022: Phase 2 of the grid-connected rooftop solar scheme was commenced by Bangalore Electricity Supply Company Limited (BESCOM), focusing on solar panel installations. BESCOM was mandated by the Union Ministry of New and Renewable Energy (MNRE) to install 10 MW of capacity, significantly promoting distributed energy generation.

- November 2022: Michigan's distributed generation program experienced a substantial rise of 37%, adding 3,709 customers and bringing the total to 14,262 customers with 14,446 installations. This initiative empowers customers to generate their own electricity, primarily through solar projects, thereby reducing household electricity bills.

In-Depth Distributed Energy Generation Industry Market Outlook

The outlook for the distributed energy generation industry remains exceptionally strong, driven by the global imperative for a sustainable energy future. Growth accelerators, including ongoing technological advancements in solar PV and energy storage, are making DEG more cost-effective and reliable. Strategic partnerships between diverse stakeholders are fostering innovation and expanding market reach. The increasing integration of DEG into smart grid architectures and its vital role in enhancing energy resilience are creating new revenue streams and market opportunities. The industry is set to witness a significant transformation as it moves towards a more decentralized, intelligent, and decarbonized energy landscape, with substantial future market potential and compelling strategic opportunities for all participants.

Distributed Energy Generation Industry Segmentation

-

1. Technology

- 1.1. Solar PV

- 1.2. Diesel Gensets

- 1.3. Natural Gas Gensets

- 1.4. Microgrids

- 1.5. Other Technologies

Distributed Energy Generation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Distributed Energy Generation Industry Regional Market Share

Geographic Coverage of Distributed Energy Generation Industry

Distributed Energy Generation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries

- 3.3. Market Restrains

- 3.3.1. 4.; The Technology's Exorbitant Costs and Environmental Impacts

- 3.4. Market Trends

- 3.4.1. Solar PV to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Distributed Energy Generation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar PV

- 5.1.2. Diesel Gensets

- 5.1.3. Natural Gas Gensets

- 5.1.4. Microgrids

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Distributed Energy Generation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Solar PV

- 6.1.2. Diesel Gensets

- 6.1.3. Natural Gas Gensets

- 6.1.4. Microgrids

- 6.1.5. Other Technologies

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Distributed Energy Generation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Solar PV

- 7.1.2. Diesel Gensets

- 7.1.3. Natural Gas Gensets

- 7.1.4. Microgrids

- 7.1.5. Other Technologies

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Distributed Energy Generation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Solar PV

- 8.1.2. Diesel Gensets

- 8.1.3. Natural Gas Gensets

- 8.1.4. Microgrids

- 8.1.5. Other Technologies

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Distributed Energy Generation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Solar PV

- 9.1.2. Diesel Gensets

- 9.1.3. Natural Gas Gensets

- 9.1.4. Microgrids

- 9.1.5. Other Technologies

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Distributed Energy Generation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Solar PV

- 10.1.2. Diesel Gensets

- 10.1.3. Natural Gas Gensets

- 10.1.4. Microgrids

- 10.1.5. Other Technologies

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ballard Power Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Canadian Solar Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sunverge Energy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schneider Electric SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Caterpillar Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fuelcell Energy Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cummins Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ansaldo Energia SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Capstone Turbine Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bloom Energy

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Ballard Power Systems Inc

List of Figures

- Figure 1: Global Distributed Energy Generation Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Distributed Energy Generation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Distributed Energy Generation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Distributed Energy Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Distributed Energy Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Distributed Energy Generation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 7: Europe Distributed Energy Generation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 8: Europe Distributed Energy Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Distributed Energy Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Distributed Energy Generation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 11: Asia Pacific Distributed Energy Generation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Asia Pacific Distributed Energy Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Distributed Energy Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Distributed Energy Generation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: South America Distributed Energy Generation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: South America Distributed Energy Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Distributed Energy Generation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Distributed Energy Generation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 19: Middle East and Africa Distributed Energy Generation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Middle East and Africa Distributed Energy Generation Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Distributed Energy Generation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Distributed Energy Generation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Distributed Energy Generation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Distributed Energy Generation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global Distributed Energy Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Distributed Energy Generation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global Distributed Energy Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Distributed Energy Generation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Distributed Energy Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Distributed Energy Generation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global Distributed Energy Generation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Distributed Energy Generation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Global Distributed Energy Generation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Distributed Energy Generation Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Distributed Energy Generation Industry?

Key companies in the market include Ballard Power Systems Inc, Canadian Solar Inc *List Not Exhaustive, Sunverge Energy, Siemens AG, General Electric Co, Schneider Electric SE, Caterpillar Inc, Fuelcell Energy Inc, Cummins Inc, Ansaldo Energia SpA, Capstone Turbine Corporation, Bloom Energy.

3. What are the main segments of the Distributed Energy Generation Industry?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 538.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries.

6. What are the notable trends driving market growth?

Solar PV to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Technology's Exorbitant Costs and Environmental Impacts.

8. Can you provide examples of recent developments in the market?

December 2022: Phase 2 of the grid-connected rooftop solar scheme was commenced by Bangalore Electricity Supply Company Limited (BESCOM), which was expected to focus on the installation of solar panels. BESCOM was given a mandate to install 10 MW of capacity by the Union Ministry of New and Renewable Energy (MNRE) to promote distributed energy generation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Distributed Energy Generation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Distributed Energy Generation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Distributed Energy Generation Industry?

To stay informed about further developments, trends, and reports in the Distributed Energy Generation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence