Key Insights

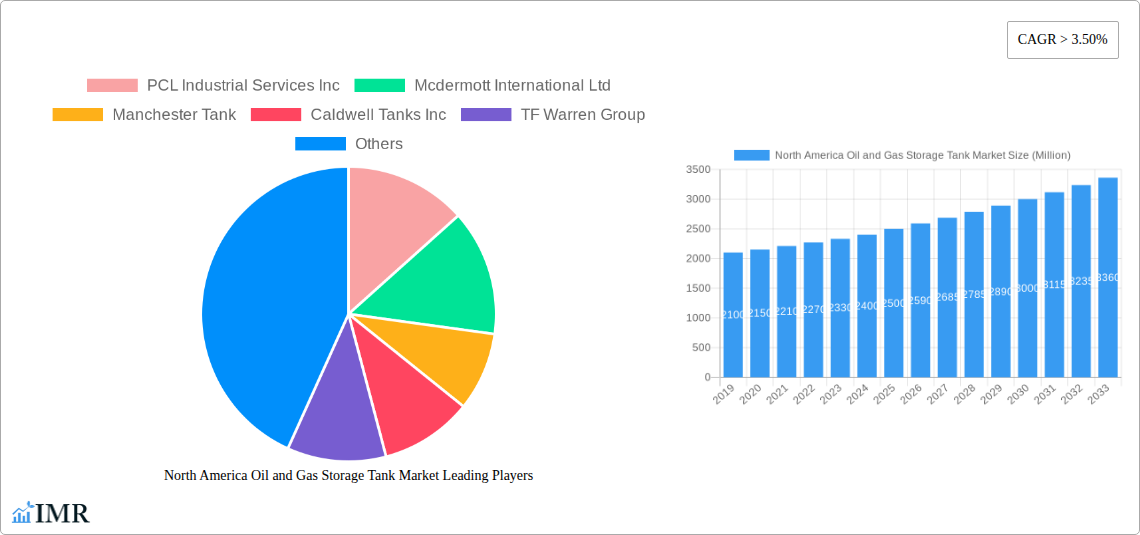

The North America Oil and Gas Storage Tank Market is projected for significant expansion, with an estimated market size of $10.8 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033. This growth is driven by increasing continental energy demand, necessitating enhanced storage for refined petroleum products and natural gas. Key factors include ongoing exploration and production in major regions like the United States and Canada, driving demand for advanced storage infrastructure. Stringent regulatory compliance for hydrocarbon storage and the rise of Liquefied Natural Gas (LNG) also present significant market opportunities. Demand for durable materials like steel and carbon steel, designed for harsh environments, is also a key trend.

North America Oil and Gas Storage Tank Market Market Size (In Billion)

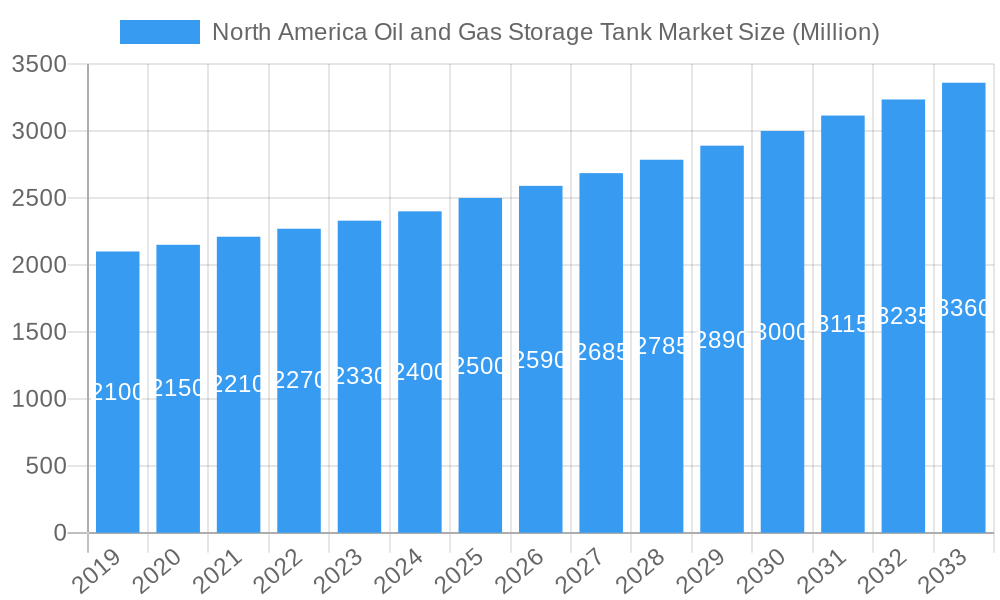

Emerging trends include the integration of smart technologies for real-time monitoring and maintenance, boosting operational efficiency and safety. Advancements in tank design and manufacturing, focusing on corrosion resistance and leak detection, are shaping market evolution. Potential restraints include fluctuating crude oil prices and high initial capital investment for large-scale infrastructure. The United States is anticipated to lead the market due to its extensive refining capacity and shale gas production. Canada and Mexico are also expected to experience steady growth, contributing to the North American energy landscape. Key market segments include crude oil, LNG, and diesel storage, attracting substantial investments. Leading companies such as PCL Industrial Services Inc., McDermott International Ltd., and Manchester Tank are focusing on innovation and portfolio expansion to meet evolving industry needs.

North America Oil and Gas Storage Tank Market Company Market Share

North America Oil and Gas Storage Tank Market: Comprehensive Report & Analysis (2019-2033)

This in-depth report provides a definitive analysis of the North America oil and gas storage tank market, covering historical trends, current dynamics, and future projections from 2019 to 2033. We delve into key market segments, technological advancements, regulatory landscapes, and competitive strategies shaping this critical industry. With a base year of 2025 and a forecast period extending to 2033, this report offers invaluable insights for stakeholders seeking to navigate and capitalize on market opportunities.

North America Oil and Gas Storage Tank Market Market Dynamics & Structure

The North America oil and gas storage tank market exhibits a moderately concentrated structure, with a blend of established multinational corporations and specialized regional players. Technological innovation is a significant driver, particularly in areas like advanced materials, smart tank monitoring systems, and enhanced safety features to meet stringent environmental regulations. The regulatory framework, encompassing API standards, EPA guidelines, and local building codes, profoundly influences tank design, material selection, and operational protocols. Competitive product substitutes, while limited in the core storage function, are emerging in the form of modular storage solutions and advanced containment technologies. End-user demographics are diverse, ranging from large integrated oil and gas companies and midstream operators to petrochemical plants and industrial facilities. Mergers and acquisitions (M&A) trends indicate a strategic consolidation to enhance market reach, acquire technological capabilities, and secure larger project pipelines.

- Market Concentration: Characterized by a few dominant players and a significant number of smaller, specialized manufacturers.

- Technological Innovation Drivers: Focus on leak detection, corrosion resistance, automation, and digital integration for enhanced efficiency and safety.

- Regulatory Frameworks: Stringent adherence to environmental and safety standards by agencies like the EPA and industry bodies like API is paramount.

- Competitive Product Substitutes: Development of advanced containment systems and prefabricated modular solutions.

- End-User Demographics: Oil & gas exploration and production, refining, petrochemicals, and fuel distribution sectors.

- M&A Trends: Strategic acquisitions aimed at expanding service portfolios and geographical presence. For instance, a projected increase in M&A deal volumes of 15-20% over the forecast period.

North America Oil and Gas Storage Tank Market Growth Trends & Insights

The North America oil and gas storage tank market is poised for robust growth, driven by increasing energy demand, infrastructure development, and a growing emphasis on efficient and secure energy storage solutions. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. Adoption rates for advanced storage technologies, such as those incorporating IoT sensors for real-time monitoring and predictive maintenance, are steadily increasing. Technological disruptions, including the development of lighter and more durable materials and innovative tank designs for specialized products like LNG, are revolutionizing the sector. Consumer behavior shifts are also playing a role, with a greater demand for transparent and environmentally responsible energy storage practices, pushing manufacturers towards more sustainable and leak-proof solutions. The market penetration of smart storage technologies is expected to grow from 30% in the base year 2025 to over 55% by 2033.

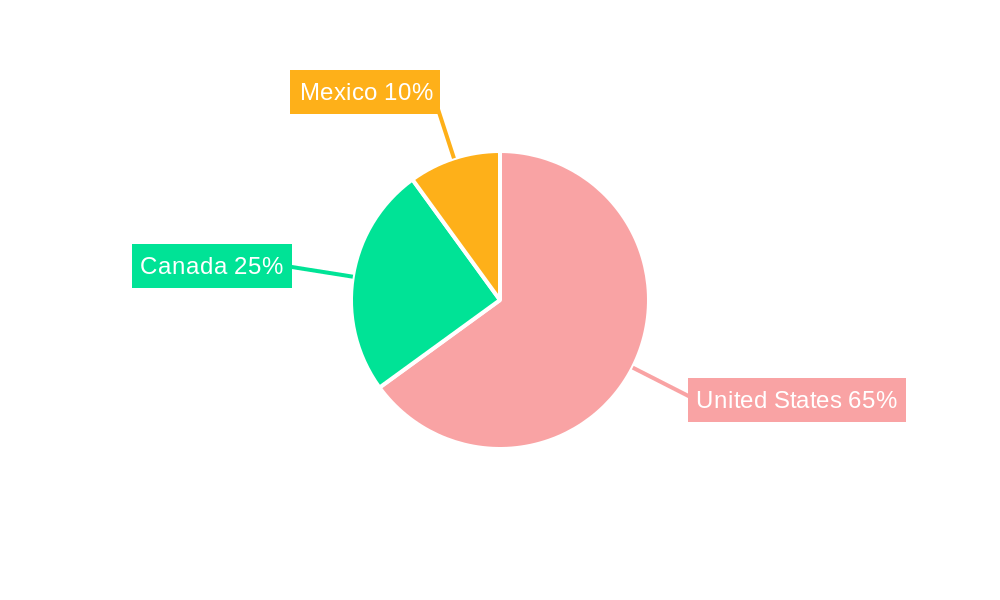

Dominant Regions, Countries, or Segments in North America Oil and Gas Storage Tank Market

The United States unequivocally dominates the North America oil and gas storage tank market, driven by its vast energy reserves, extensive refining capacity, and significant investments in infrastructure for both conventional and emerging energy sources. Within the United States, the Crude Oil and Liquefied Natural Gas (LNG) segments are particularly dominant, reflecting the country's leading positions in oil production and its growing role in the global LNG export market. The extensive network of oil fields, refineries, and export terminals necessitates a substantial volume of storage tanks. Furthermore, the push for energy independence and the strategic importance of natural gas have led to massive investments in LNG liquefaction facilities and associated storage infrastructure, further bolstering the LNG tank market. The Steel material segment, particularly Carbon Steel, remains the backbone of the industry due to its durability, cost-effectiveness, and proven track record in handling a wide range of hydrocarbons, contributing to a significant market share within the overall material landscape.

- Dominant Country: United States, accounting for an estimated 75% of the North American market share.

- Dominant Products:

- Crude Oil: Driven by extensive upstream production and refining activities.

- Liquefied Natural Gas (LNG): Fueled by export terminal expansion and domestic demand growth.

- Dominant Material:

- Steel (especially Carbon Steel): Preferred for its strength, reliability, and cost-efficiency.

- Key Drivers:

- Economic Policies: Government incentives for energy production and export.

- Infrastructure Development: Continuous investment in pipelines, refineries, and export terminals.

- Energy Security: Strategic importance of reliable energy storage.

- Technological Advancements: Improved welding techniques and material science enhancing tank longevity.

North America Oil and Gas Storage Tank Market Product Landscape

The North America oil and gas storage tank market is characterized by a dynamic product landscape focused on enhancing safety, efficiency, and environmental compliance. Innovations in Crude Oil and Liquefied Natural Gas (LNG) storage tanks are prominent. For LNG, advancements include double-walled construction, advanced insulation techniques, and sophisticated vapor control systems to minimize boil-off losses. For crude oil, developments are geared towards larger capacity tanks, integrated corrosion protection systems, and smart monitoring capabilities for real-time inventory and integrity checks. The application of high-strength steels and advanced coatings significantly improves tank lifespan and reduces maintenance costs. Performance metrics are increasingly evaluated on factors such as volumetric efficiency, thermal insulation capabilities, and adherence to stringent safety and emission standards.

Key Drivers, Barriers & Challenges in North America Oil and Gas Storage Tank Market

The North America oil and gas storage tank market is propelled by several key drivers. The sustained global demand for oil and gas, coupled with North America's significant production capabilities, necessitates continuous expansion and maintenance of storage infrastructure. Government initiatives supporting energy independence and the growth of the LNG export market are significant policy-driven accelerators. Technological advancements in materials science and manufacturing processes are also driving innovation and efficiency.

- Key Drivers:

- Rising global energy demand.

- Expansion of oil and gas production and refining capacity.

- Growth in LNG exports and domestic natural gas consumption.

- Technological advancements in tank design and materials.

- Government support for energy infrastructure development.

However, the market faces several barriers and challenges. Stringent environmental regulations and the increasing focus on sustainability can lead to higher compliance costs and longer project approval timelines. Supply chain disruptions, particularly for specialized components and skilled labor, can impact project delivery schedules and costs. The mature nature of some segments and the potential for price volatility in oil and gas markets can also create investment uncertainties.

- Key Barriers & Challenges:

- Increasingly stringent environmental regulations.

- Potential for supply chain disruptions and labor shortages.

- High capital investment requirements for new infrastructure.

- Price volatility in the oil and gas commodity markets.

- Competition from alternative energy sources.

Emerging Opportunities in North America Oil and Gas Storage Tank Market

Emerging opportunities in the North America oil and gas storage tank market lie in the growing demand for storage solutions for renewable energy byproducts and the increasing adoption of advanced monitoring technologies. The development of specialized tanks for hydrogen storage, as the hydrogen economy gains traction, presents a significant untapped market. Furthermore, the retrofitting of existing storage facilities with smart technology for enhanced safety and efficiency offers substantial growth potential. The need for more environmentally friendly and robust containment solutions in regions prone to extreme weather events also creates new avenues for innovative product development.

Growth Accelerators in the North America Oil and Gas Storage Tank Market Industry

The North America oil and gas storage tank market industry is experiencing growth acceleration fueled by several strategic factors. Technological breakthroughs in areas such as advanced welding techniques, superior corrosion-resistant coatings, and the integration of IoT sensors for real-time data analytics are enhancing the performance and longevity of storage tanks. Strategic partnerships between tank manufacturers, engineering firms, and energy companies are facilitating larger-scale projects and the development of bespoke solutions. Market expansion strategies, particularly in emerging LNG markets and for specialized products like liquefied petroleum gas (LPG), are further stimulating growth. The ongoing investment in revitalizing and expanding existing energy infrastructure also acts as a significant catalyst.

Key Players Shaping the North America Oil and Gas Storage Tank Market Market

- PCL Industrial Services Inc

- Mcdermott International Ltd

- Manchester Tank

- Caldwell Tanks Inc

- TF Warren Group

- Hassco Industries

- Imperial Industries Inc

- Matrix NAC

- Shawcor

- Heatec Inc

Notable Milestones in North America Oil and Gas Storage Tank Market Sector

- February 2022: Mcdermott bagged a new contract for the engineering of two LNG storage tanks for the Plaquemines LNG project, located on the Mississippi River, to the south of New Orleans, United States. The company was contracted to build two 200,000 cubic-meter LNG storage tanks for Venture Global.

In-Depth North America Oil and Gas Storage Tank Market Market Outlook

The future outlook for the North America oil and gas storage tank market is exceptionally strong, driven by ongoing energy transition dynamics and continued demand for conventional hydrocarbons. Growth accelerators such as the escalating investments in LNG export infrastructure, coupled with the increasing focus on energy security and the development of domestic gas reserves, will sustain robust demand. The market is expected to witness further innovation in materials science and digital integration, leading to the development of smarter, more efficient, and environmentally compliant storage solutions. Strategic collaborations and the continuous pursuit of operational excellence by key players will shape a competitive yet expanding landscape, promising significant opportunities for market participants.

North America Oil and Gas Storage Tank Market Segmentation

-

1. Product

- 1.1. Crude Oil

- 1.2. Liquefied Natural Gas (LNG)

- 1.3. Diesel

- 1.4. Gasoline

- 1.5. Kerosene

- 1.6. Liquefied Petroleum Gas (LPG)

- 1.7. Other Products

-

2. Material

- 2.1. Steel

- 2.2. Carbon Steel

- 2.3. Fiberglass-reinforced Plastic

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Oil and Gas Storage Tank Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Oil and Gas Storage Tank Market Regional Market Share

Geographic Coverage of North America Oil and Gas Storage Tank Market

North America Oil and Gas Storage Tank Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Private Participation in the Country's Power Sector

- 3.4. Market Trends

- 3.4.1. Liquefied Natural Gas (LNG) Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Crude Oil

- 5.1.2. Liquefied Natural Gas (LNG)

- 5.1.3. Diesel

- 5.1.4. Gasoline

- 5.1.5. Kerosene

- 5.1.6. Liquefied Petroleum Gas (LPG)

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Steel

- 5.2.2. Carbon Steel

- 5.2.3. Fiberglass-reinforced Plastic

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Crude Oil

- 6.1.2. Liquefied Natural Gas (LNG)

- 6.1.3. Diesel

- 6.1.4. Gasoline

- 6.1.5. Kerosene

- 6.1.6. Liquefied Petroleum Gas (LPG)

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Steel

- 6.2.2. Carbon Steel

- 6.2.3. Fiberglass-reinforced Plastic

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Crude Oil

- 7.1.2. Liquefied Natural Gas (LNG)

- 7.1.3. Diesel

- 7.1.4. Gasoline

- 7.1.5. Kerosene

- 7.1.6. Liquefied Petroleum Gas (LPG)

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Steel

- 7.2.2. Carbon Steel

- 7.2.3. Fiberglass-reinforced Plastic

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Crude Oil

- 8.1.2. Liquefied Natural Gas (LNG)

- 8.1.3. Diesel

- 8.1.4. Gasoline

- 8.1.5. Kerosene

- 8.1.6. Liquefied Petroleum Gas (LPG)

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Steel

- 8.2.2. Carbon Steel

- 8.2.3. Fiberglass-reinforced Plastic

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 PCL Industrial Services Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Mcdermott International Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Manchester Tank

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Caldwell Tanks Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 TF Warren Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hassco Industries

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Imperial Industries Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Matrix NAC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Shawcor

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Heatec Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 PCL Industrial Services Inc

List of Figures

- Figure 1: North America Oil and Gas Storage Tank Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Oil and Gas Storage Tank Market Share (%) by Company 2025

List of Tables

- Table 1: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 4: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 5: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 12: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 13: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 20: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 21: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Product 2020 & 2033

- Table 26: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Material 2020 & 2033

- Table 28: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 29: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: North America Oil and Gas Storage Tank Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Oil and Gas Storage Tank Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the North America Oil and Gas Storage Tank Market?

Key companies in the market include PCL Industrial Services Inc, Mcdermott International Ltd, Manchester Tank, Caldwell Tanks Inc, TF Warren Group, Hassco Industries, Imperial Industries Inc, Matrix NAC, Shawcor, Heatec Inc.

3. What are the main segments of the North America Oil and Gas Storage Tank Market?

The market segments include Product, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network.

6. What are the notable trends driving market growth?

Liquefied Natural Gas (LNG) Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Private Participation in the Country's Power Sector.

8. Can you provide examples of recent developments in the market?

February 2022: Mcdermott bagged a new contract for the engineering of two LNG storage tanks for the Plaquemines LNG project, located on the Mississippi River, to the south of New Orleans, United States. The company was contracted to build two 200,000 cubic-meter LNG storage tanks for Venture Global.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Oil and Gas Storage Tank Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Oil and Gas Storage Tank Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Oil and Gas Storage Tank Market?

To stay informed about further developments, trends, and reports in the North America Oil and Gas Storage Tank Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence