Key Insights

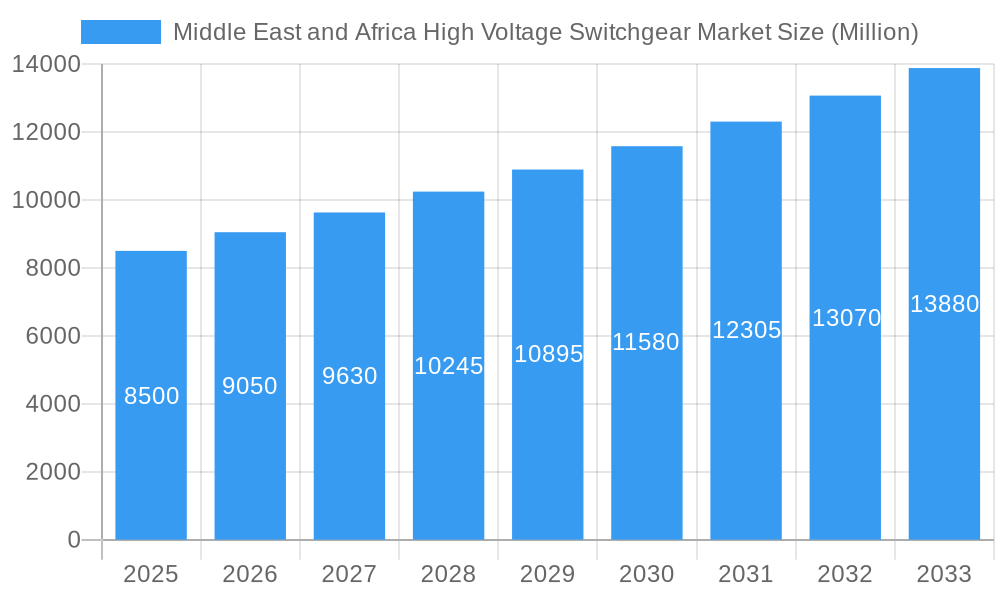

The Middle East and Africa (MEA) High Voltage Switchgear Market is poised for robust expansion, projected to reach a significant market size by 2033. With a Compound Annual Growth Rate (CAGR) exceeding 6.00%, this dynamic sector is a critical component of the region's evolving energy infrastructure. The substantial growth is primarily fueled by escalating demand for electricity, driven by rapid urbanization, industrial development, and the need for modernizing aging power grids across both established and emerging economies within the MEA. Investments in renewable energy projects, such as solar and wind farms, also necessitate advanced high voltage switchgear for grid integration and efficient power distribution. Furthermore, the increasing adoption of smart grid technologies and the ongoing expansion of transmission and distribution networks are key growth catalysts. The market is segmented by type, with Gas-insulated switchgear (GIS) likely dominating due to its space-saving, reliable, and low-maintenance characteristics, particularly in densely populated urban areas. Air-insulated switchgear (AIS) will continue to hold a significant share, especially in less demanding applications. End-user segments are led by the Industrial & Utilities sector, reflecting the significant infrastructure development and energy consumption in these areas. The Commercial & Residential segments will also contribute steadily as urban expansion and improved living standards increase power demands.

Middle East and Africa High Voltage Switchgear Market Market Size (In Billion)

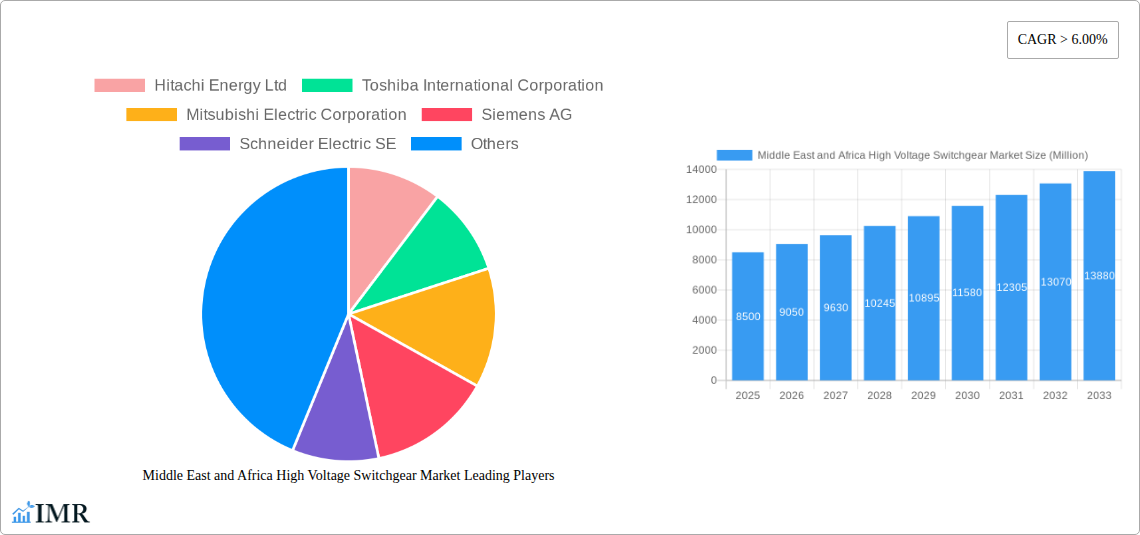

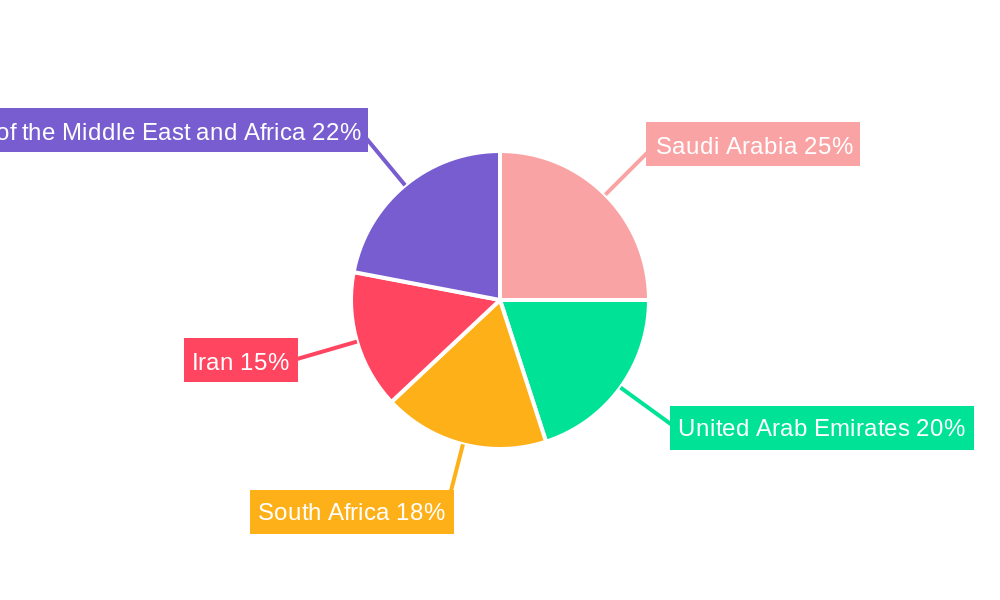

Geographically, Saudi Arabia and the United Arab Emirates are expected to spearhead market growth, driven by ambitious national visions focused on infrastructure development, diversification of energy sources, and technological advancement in their power sectors. South Africa, with its established industrial base and ongoing efforts to address power deficits, will also represent a substantial market. Iran, despite geopolitical complexities, possesses a large population and a fundamental need for grid modernization and expansion. The "Rest of the Middle East and Africa" segment encompasses a broad range of countries with varying levels of development, but collectively presents significant untapped potential for high voltage switchgear deployment. Key market players like Hitachi Energy Ltd, Toshiba International Corporation, Mitsubishi Electric Corporation, Siemens AG, and Schneider Electric SE are actively competing through product innovation, strategic partnerships, and investments in local manufacturing and service capabilities to capture this burgeoning market. Restraints such as the high initial cost of advanced switchgear and challenges in regulatory frameworks in some regions might temper growth, but the overarching need for reliable and efficient power transmission and distribution will continue to drive market expansion.

Middle East and Africa High Voltage Switchgear Market Company Market Share

Middle East and Africa High Voltage Switchgear Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Middle East and Africa (MEA) High Voltage Switchgear Market, encompassing historical performance, current market dynamics, and a robust forecast up to 2033. With a focus on high-voltage switchgear, gas-insulated switchgear (GIS), air-insulated switchgear (AIS), and critical end-user segments like industrial and utilities and commercial & residential, this study offers unparalleled insights for stakeholders. Explore the intricate market structure, growth trajectories, regional dominance, product innovations, and the strategic landscape shaped by leading companies. This report is crucial for understanding investment opportunities in the rapidly expanding MEA power infrastructure.

Market Size: The MEA High Voltage Switchgear Market was valued at approximately USD 5,800 Million in 2025 and is projected to reach USD 8,200 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period.

Middle East and Africa High Voltage Switchgear Market Market Dynamics & Structure

The MEA High Voltage Switchgear Market is characterized by a moderately concentrated competitive landscape, with key players like Siemens AG, Schneider Electric SE, and Hitachi Energy Ltd. holding significant market share. Technological innovation remains a primary driver, with ongoing advancements in gas-insulated switchgear (GIS) and hybrid switchgear offering enhanced efficiency, reduced footprint, and improved environmental performance. Robust regulatory frameworks, particularly concerning grid modernization and renewable energy integration, are shaping market demand. While air-insulated switchgear (AIS) continues to hold a substantial share due to its cost-effectiveness, the increasing demand for substations in dense urban areas and harsh environmental conditions is bolstering the adoption of GIS. End-user demographics are shifting, with a growing demand from industrial and utilities sectors for reliable power infrastructure to support energy-intensive projects, alongside an increasing need for advanced switchgear in large-scale commercial and residential developments. Merger and acquisition (M&A) trends are evident as companies seek to expand their geographical reach and product portfolios. For instance, acquisitions of smaller, specialized switchgear manufacturers could become more prevalent to enhance technological capabilities. Innovation barriers include the high cost of R&D for cutting-edge technologies and the need for specialized expertise in manufacturing and installation.

- Market Concentration: Moderately concentrated, with top players dominating market share.

- Technological Innovation Drivers: Development of advanced GIS, SF6-free alternatives, and smart grid-compatible switchgear.

- Regulatory Frameworks: Focus on grid reliability, renewable energy integration mandates, and environmental standards.

- Competitive Product Substitutes: While direct substitutes for high-voltage switchgear are limited, advancements in flexible AC transmission systems (FACTS) and high-voltage direct current (HVDC) technologies can influence transmission infrastructure design.

- End-User Demographics: Increasing demand from utility companies for grid expansion and upgrades, alongside growth in industrial and large-scale commercial projects.

- M&A Trends: Potential for strategic acquisitions to gain market access and technological expertise.

Middle East and Africa High Voltage Switchgear Market Growth Trends & Insights

The MEA High Voltage Switchgear Market is on a robust growth trajectory, fueled by extensive investments in power generation, transmission, and distribution infrastructure across the region. The increasing demand for electricity, driven by population growth, urbanization, and industrial expansion, necessitates significant upgrades and expansions of existing grid networks. Saudi Arabia and the United Arab Emirates are leading this surge with ambitious national vision plans that prioritize energy security and the development of smart grids. The adoption of gas-insulated switchgear (GIS) is experiencing a notable upswing due to its compact design, enhanced safety features, and suitability for environments with limited space and high pollution levels, which are prevalent in many MEA urban centers. Conversely, air-insulated switchgear (AIS), while still a significant segment due to its lower initial cost, is facing increasing competition from GIS in new projects and critical applications.

The industrial and utilities segment is the primary consumer of high-voltage switchgear, driven by the need to support power-intensive industries such as oil and gas, petrochemicals, and mining, as well as the expansion of national power grids. The commercial and residential segment is also contributing to growth, particularly with the development of large-scale infrastructure projects like smart cities, airports, and high-rise residential complexes. Technological disruptions are playing a pivotal role, with a growing emphasis on digitalization, automation, and the integration of intelligent features into switchgear systems. This includes advanced monitoring, diagnostics, and remote control capabilities that enhance grid reliability and operational efficiency. Consumer behavior is shifting towards seeking sustainable and efficient energy solutions, pushing manufacturers to develop environmentally friendly alternatives, such as SF6-free switchgear. The market penetration of these advanced technologies is expected to increase significantly as governments and utilities prioritize decarbonization efforts and grid resilience. The report will delve deeper into specific growth drivers, including the impact of large-scale renewable energy projects and the increasing demand for reliable power in remote areas, which are crucial for driving the market forward. The forecast period of 2025-2033 will witness a sustained expansion as these trends continue to shape the MEA energy landscape.

Dominant Regions, Countries, or Segments in Middle East and Africa High Voltage Switchgear Market

The Middle East and Africa High Voltage Switchgear Market is a dynamic landscape with distinct regions and segments driving growth. Among the geographies, Saudi Arabia stands out as a dominant force, owing to its Vision 2030 initiatives that involve massive investments in infrastructure development, including power transmission and distribution networks. The country's commitment to diversifying its economy and reducing its reliance on oil revenue is leading to significant projects in renewable energy and industrial expansion, all requiring robust high-voltage switchgear solutions. The United Arab Emirates is another key market, with its focus on smart city development, large-scale infrastructure projects, and a strong emphasis on sustainable energy solutions, further boosting the demand for advanced switchgear.

Within the Type segment, Gas-Insulated Switchgear (GIS) is witnessing exceptional growth and is projected to become increasingly dominant. Its compact footprint, enhanced safety, and superior performance in harsh environmental conditions, prevalent in parts of the MEA region, make it the preferred choice for new substations and critical grid expansions. While Air-Insulated Switchgear (AIS) continues to hold a substantial market share, particularly in retrofitting and smaller substations due to its cost-effectiveness, GIS is outpacing it in terms of growth rate for new installations. The Industrial & Utilities end-user segment is the largest contributor to the market's volume and value. This is directly attributable to the substantial investments made by utility companies in upgrading and expanding their grids to meet the growing demand for electricity. Furthermore, the booming oil and gas sector, petrochemical industries, and large-scale industrial complexes across the MEA region necessitate reliable and high-capacity power supply, driving the demand for high-voltage switchgear.

- Dominant Geography: Saudi Arabia, driven by Vision 2030 and massive infrastructure investments.

- Key Growth Drivers in Saudi Arabia: Renewable energy projects, industrial diversification, smart grid development.

- Significant Player: United Arab Emirates, with its focus on smart cities and sustainable energy.

- Dominant Type Segment: Gas-Insulated Switchgear (GIS), due to its efficiency and suitability for regional conditions.

- Growth Drivers for GIS: Space constraints, harsh environments, enhanced safety and reliability requirements.

- Largest End-User Segment: Industrial & Utilities, supporting grid expansion and energy-intensive industries.

- Factors Driving Industrial & Utilities Demand: Oil & gas, petrochemicals, mining, and national grid modernization.

Middle East and Africa High Voltage Switchgear Market Product Landscape

The Middle East and Africa High Voltage Switchgear Market is witnessing significant product innovation focused on enhancing efficiency, reliability, and environmental sustainability. Manufacturers are actively developing advanced gas-insulated switchgear (GIS) with a reduced environmental impact, including SF6-free alternatives that utilize cleaner insulation gases. These innovations offer a smaller footprint, making them ideal for space-constrained urban environments. Performance metrics are being elevated through the integration of digital technologies, enabling real-time monitoring, advanced diagnostics, and predictive maintenance capabilities. This translates to improved operational uptime and reduced maintenance costs for utilities and industrial clients. Unique selling propositions include enhanced arc quenching technologies for increased safety, modular designs for flexible installation and expansion, and improved insulation systems for greater resilience against extreme weather conditions prevalent in certain MEA regions. The trend towards smart grid integration is also driving the development of switchgear with embedded communication protocols and cybersecurity features, ensuring seamless connectivity and secure operation.

Key Drivers, Barriers & Challenges in Middle East and Africa High Voltage Switchgear Market

Key Drivers:

The MEA High Voltage Switchgear Market is propelled by several powerful forces. The burgeoning demand for electricity, driven by rapid population growth, urbanization, and industrialization across the region, necessitates substantial investments in grid expansion and modernization. Ambitious government initiatives, such as Saudi Arabia's Vision 2030 and similar national development plans in other MEA countries, are fueling large-scale infrastructure projects that directly impact the high-voltage switchgear market. The increasing integration of renewable energy sources, including solar and wind power, also requires robust and flexible grid infrastructure, creating significant demand for advanced switchgear solutions to manage intermittent power generation and ensure grid stability. Furthermore, the ongoing development of smart cities and the electrification of transportation are creating new avenues for market growth.

Barriers & Challenges:

Despite the positive growth outlook, the market faces notable challenges. High initial capital expenditure for the procurement and installation of high-voltage switchgear, particularly advanced GIS, can be a barrier for some utilities and smaller industrial players. The complex regulatory landscape and lengthy approval processes in certain MEA countries can also lead to project delays. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities in the region, can impact project timelines and costs. Additionally, the availability of skilled labor for the installation, operation, and maintenance of sophisticated switchgear systems remains a concern, requiring significant investment in training and development. Competitive pressures from established global players and emerging local manufacturers can also influence pricing and market access.

Emerging Opportunities in Middle East and Africa High Voltage Switchgear Market

Emerging opportunities in the MEA High Voltage Switchgear Market are primarily centered around the increasing adoption of renewable energy integration and grid modernization. The development of smart grids across the region presents a significant opportunity for switchgear manufacturers to offer intelligent, digitally enabled solutions that enhance grid flexibility, reliability, and control. The growing focus on energy efficiency and sustainability is also driving demand for advanced SF6-free switchgear and other eco-friendly technologies. Furthermore, the expansion of industrial zones and the development of new megaprojects, particularly in the petrochemical, mining, and manufacturing sectors, will continue to fuel demand for high-capacity and reliable high-voltage switchgear. Untapped markets within Africa, with their growing energy needs and ongoing infrastructure development, also represent a significant long-term growth potential.

Growth Accelerators in the Middle East and Africa High Voltage Switchgear Market Industry

Several key factors are accelerating the growth of the Middle East and Africa High Voltage Switchgear Market. The continuous and substantial government investments in power infrastructure, driven by national development agendas and the need to meet escalating electricity demand, are foundational. The aggressive push towards renewable energy integration, including massive solar and wind projects, necessitates upgrades and expansions in transmission and distribution networks, directly benefiting the switchgear market. Technological advancements, such as the increasing adoption of digital substations, intelligent switchgear with advanced monitoring capabilities, and the development of more compact and efficient gas-insulated switchgear (GIS), are enhancing grid performance and driving market penetration. Strategic partnerships between global manufacturers and local players are also accelerating market access and facilitating technology transfer, further boosting growth.

Key Players Shaping the Middle East and Africa High Voltage Switchgear Market Market

- Hitachi Energy Ltd

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Larson & Turbo Limited

- General Electric Company

- Bharat Heavy Electricals Limited

Notable Milestones in Middle East and Africa High Voltage Switchgear Market Sector

- March 2023: Hitachi Energy and Gulf Cooperation Council Interconnection Authority (GCCIA) announced signing a contract to upgrade the Al-Fadhili high-voltage direct current (HVDC) converter station under the GCCIA authority in Saudi Arabia. Hitachi Energy's HVDC solution incorporates world-leading expertise in HVDC converter valves, high-voltage switchgear, system studies, design and engineering, supply, installation supervision, and commissioning. This signifies a significant advancement in regional grid interconnection and highlights the critical role of advanced switchgear in enhancing power transmission capabilities.

- November 2022: Hitachi Energy and Schneider Electric collaborated to speed the energy transition. This collaboration aimed to accelerate the deployment of sustainable and smart energy management solutions and complementary portfolios in medium and high-voltage technologies to provide greater customer value. This partnership underscores the industry's commitment to innovation and sustainability, driving the development and adoption of next-generation switchgear solutions.

In-Depth Middle East and Africa High Voltage Switchgear Market Market Outlook

The future outlook for the Middle East and Africa High Voltage Switchgear Market is exceptionally promising, driven by sustained investments in infrastructure, a resolute commitment to renewable energy integration, and the relentless pursuit of technological innovation. The ongoing digital transformation of power grids, with an increasing emphasis on smart substations and advanced control systems, will further propel the adoption of intelligent switchgear. Manufacturers are poised to benefit from the growing demand for SF6-free switchgear as environmental regulations become more stringent and sustainability gains prominence. Strategic collaborations and a focus on localized manufacturing and service capabilities will be crucial for players seeking to capitalize on the diverse and expanding opportunities across this vibrant region. The market's trajectory indicates a sustained period of growth, solidifying its importance in the global energy landscape.

Middle East and Africa High Voltage Switchgear Market Segmentation

-

1. Type

- 1.1. Gas-insulated

- 1.2. Air-insulated

- 1.3. Other Types

-

2. End User

- 2.1. Commercial & Residential

- 2.2. Industrial & Utilities

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. Iran

- 3.3. South Africa

- 3.4. United Arab Emirates

- 3.5. Rest of the Middle East and Africa

Middle East and Africa High Voltage Switchgear Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Iran

- 3. South Africa

- 4. United Arab Emirates

- 5. Rest of the Middle East and Africa

Middle East and Africa High Voltage Switchgear Market Regional Market Share

Geographic Coverage of Middle East and Africa High Voltage Switchgear Market

Middle East and Africa High Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Infrastructure Projects in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; High Operations and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Gas-Insulated Switchgear to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gas-insulated

- 5.1.2. Air-insulated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial & Residential

- 5.2.2. Industrial & Utilities

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. Iran

- 5.3.3. South Africa

- 5.3.4. United Arab Emirates

- 5.3.5. Rest of the Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. Iran

- 5.4.3. South Africa

- 5.4.4. United Arab Emirates

- 5.4.5. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Gas-insulated

- 6.1.2. Air-insulated

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial & Residential

- 6.2.2. Industrial & Utilities

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. Iran

- 6.3.3. South Africa

- 6.3.4. United Arab Emirates

- 6.3.5. Rest of the Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Iran Middle East and Africa High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Gas-insulated

- 7.1.2. Air-insulated

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial & Residential

- 7.2.2. Industrial & Utilities

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. Iran

- 7.3.3. South Africa

- 7.3.4. United Arab Emirates

- 7.3.5. Rest of the Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle East and Africa High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Gas-insulated

- 8.1.2. Air-insulated

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial & Residential

- 8.2.2. Industrial & Utilities

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. Iran

- 8.3.3. South Africa

- 8.3.4. United Arab Emirates

- 8.3.5. Rest of the Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United Arab Emirates Middle East and Africa High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Gas-insulated

- 9.1.2. Air-insulated

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial & Residential

- 9.2.2. Industrial & Utilities

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. Iran

- 9.3.3. South Africa

- 9.3.4. United Arab Emirates

- 9.3.5. Rest of the Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of the Middle East and Africa Middle East and Africa High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Gas-insulated

- 10.1.2. Air-insulated

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial & Residential

- 10.2.2. Industrial & Utilities

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. Iran

- 10.3.3. South Africa

- 10.3.4. United Arab Emirates

- 10.3.5. Rest of the Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hitachi Energy Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba International Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Electric Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schneider Electric SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Larson & Turbo Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bharat Heavy Electricals Limited*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Hitachi Energy Ltd

List of Figures

- Figure 1: Middle East and Africa High Voltage Switchgear Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa High Voltage Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 19: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 23: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Middle East and Africa High Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa High Voltage Switchgear Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Middle East and Africa High Voltage Switchgear Market?

Key companies in the market include Hitachi Energy Ltd, Toshiba International Corporation, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Larson & Turbo Limited, General Electric Company, Bharat Heavy Electricals Limited*List Not Exhaustive.

3. What are the main segments of the Middle East and Africa High Voltage Switchgear Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Infrastructure Projects in the Region.

6. What are the notable trends driving market growth?

Gas-Insulated Switchgear to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Operations and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

March 2023: Hitachi Energy and Gulf Cooperation Council Interconnection Authority (GCCIA) announced signing a contract to upgrade the Al-Fadhili high-voltage direct current (HVDC) converter station under the GCCIA authority in Saudi Arabia. Hitachi Energy's HVDC solution incorporates world-leading expertise in HVDC converter valves, high-voltage switchgear, system studies, design and engineering, supply, installation supervision, and commissioning.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa High Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa High Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa High Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa High Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence