Key Insights

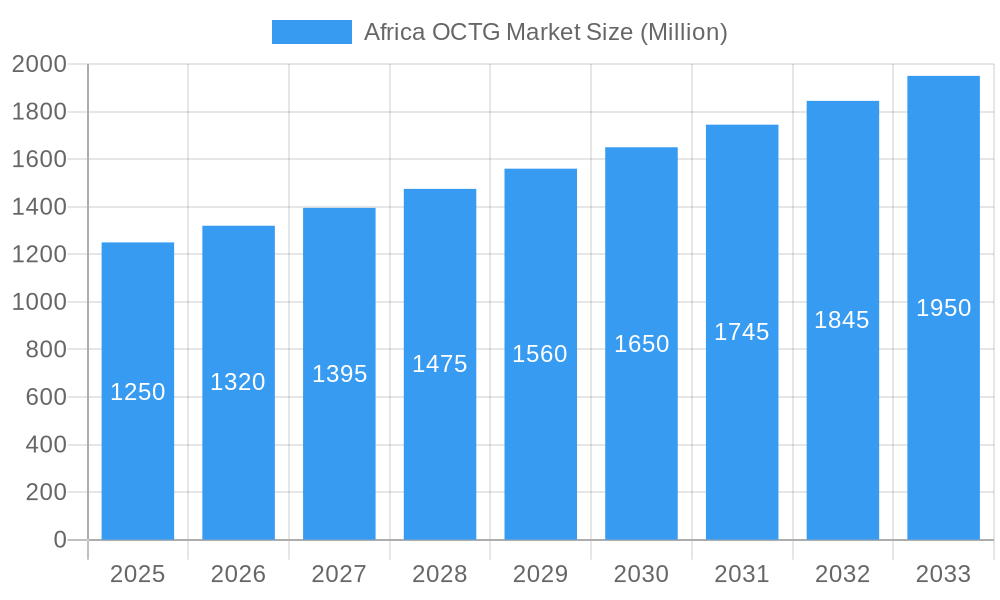

The African Oil Country Tubular Goods (OCTG) market is projected for substantial growth, anticipating a Compound Annual Growth Rate (CAGR) of 6.09%. This expansion is fueled by significant investments in oil and gas exploration and production (E&P) across the continent, notably in Nigeria, Angola, and Algeria. Demand for premium and API-grade OCTG is rising as operators prioritize enhanced performance, durability, and safety in complex extraction environments. Key market participants are strategically expanding manufacturing and supply chain capabilities within Africa to address burgeoning local demand and streamline logistics, positioning them to meet evolving energy sector needs and capitalize on immense growth potential.

Africa OCTG Market Market Size (In Billion)

The market dynamics are shaped by several drivers and restraints. Increased upstream investment and initiatives to boost domestic oil production are key growth catalysts. Technological advancements in OCTG manufacturing, yielding more resilient and corrosion-resistant products, are further propelling market adoption. However, challenges include volatile crude oil prices impacting exploration budgets and stringent regulatory environments in select regions. Geopolitical instability and logistical complexities in remote operational areas also present significant constraints. Despite these hurdles, the fundamental requirement for reliable OCTG solutions to support Africa's substantial hydrocarbon reserves ensures a positive market outlook.

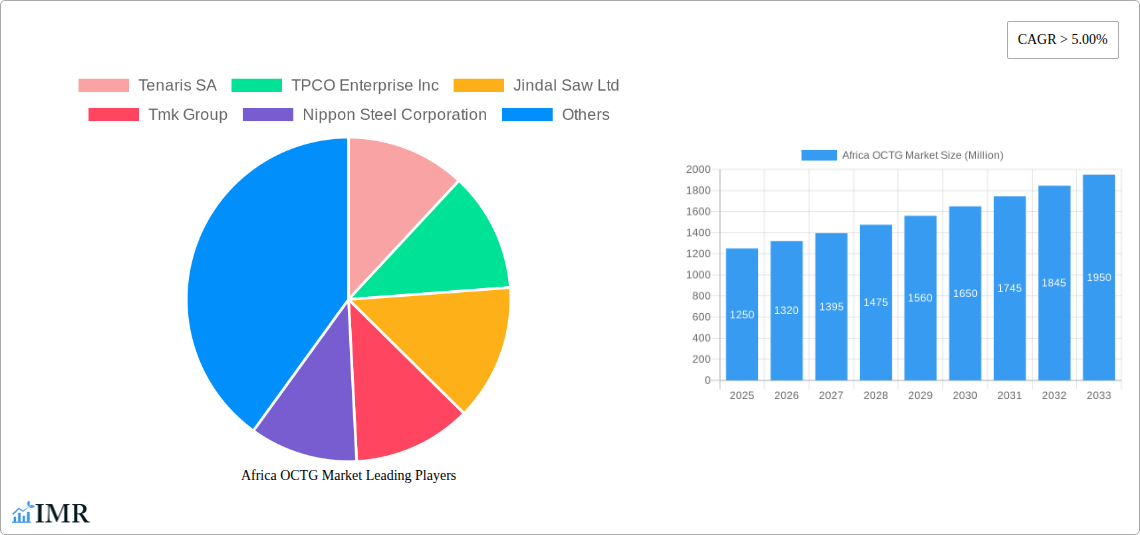

Africa OCTG Market Company Market Share

This comprehensive report offers in-depth analysis of the Africa Oil Country Tubular Goods (OCTG) market, providing critical insights into its dynamics, growth trajectories, and future outlook. Covering the forecast period from 2019 to 2033, with a base year of 2025, the report details market size, segmentation, competitive landscape, and key influencing factors. The estimated market size is 37.82 billion, with the unit being billion. This report is an indispensable resource for OCTG manufacturers, oil and gas exploration companies, investors, and industry stakeholders seeking to understand and leverage the expanding African OCTG market.

Africa OCTG Market Market Dynamics & Structure

The Africa OCTG market is characterized by a moderate concentration, with a few prominent global players holding significant market share, yet offering ample space for niche and regional contenders to emerge. Technological innovation is a key driver, with advancements in OCTG materials and manufacturing processes directly impacting performance and efficiency in challenging African exploration environments. Regulatory frameworks, though varied across nations, are increasingly aligning to promote foreign investment and ensure operational safety and environmental compliance. Competitive product substitutes, primarily in the form of advanced materials and integrated solutions, are continually challenging traditional OCTG offerings. End-user demographics are dominated by national oil companies (NOCs) and international oil companies (IOCs) operating in exploration and production (E&P) activities. Merger and acquisition (M&A) trends are observed as companies seek to consolidate market presence, acquire new technologies, or gain access to lucrative African reserves.

- Market Concentration: Dominated by key global players with a growing presence of regional specialized manufacturers.

- Technological Innovation Drivers: Focus on corrosion resistance, high-pressure/high-temperature (HPHT) applications, and advanced threading technologies.

- Regulatory Frameworks: Evolving policies around local content, environmental standards, and import/export duties.

- Competitive Product Substitutes: Emerging composite materials, advanced coatings, and integrated wellbore solutions.

- End-User Demographics: Primarily IOCs and NOCs engaged in upstream oil and gas exploration and production.

- M&A Trends: Strategic acquisitions for market entry, technology acquisition, and vertical integration.

Africa OCTG Market Growth Trends & Insights

The Africa OCTG market is poised for significant growth, driven by increasing exploration activities and the demand for advanced OCTG solutions to access challenging reserves. The adoption rate of premium-grade OCTG is steadily rising as operators push for enhanced well integrity and operational efficiency in deepwater and unconventional plays. Technological disruptions, such as the development of smart OCTG and digital monitoring systems, are beginning to influence market trends, offering real-time performance data and predictive maintenance capabilities. Consumer behavior shifts are evident, with a growing preference for suppliers offering comprehensive OCTG management services, including logistics, installation support, and repair.

The market size evolution for Africa OCTG is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025-2033). This growth is underpinned by substantial investments in offshore and onshore exploration projects across key African nations. For instance, Nigeria, a long-standing major producer, continues to see demand for OCTG, especially for aging fields requiring enhanced recovery techniques. Angola, with its prolific deepwater basins, represents another significant market driver. The forecast estimates the total market size for OCTG in Africa to reach approximately USD 4,500 million by 2033, up from an estimated USD 2,800 million in 2025.

Market penetration of premium OCTG grades is expected to accelerate, as exploration targets become more complex and demanding. Historically, API grades have dominated due to their cost-effectiveness for conventional reserves. However, the increasing focus on maximizing recovery from mature fields and developing marginal reserves necessitates the use of OCTG with superior mechanical properties and corrosion resistance. This shift is projected to increase the share of premium grade OCTG in the overall market from around 30% in the historical period (2019-2024) to over 45% by the end of the forecast period.

Technological advancements are not merely about product specifications but also about the integration of digital solutions. The adoption of intelligent OCTG, equipped with sensors and communication capabilities, is still in its nascent stages but holds immense potential to revolutionize well management and reduce operational risks. Companies are increasingly looking for OCTG providers that can offer end-to-end solutions, from material selection and manufacturing to installation and lifecycle management. This evolving demand dynamic is pushing OCTG manufacturers to innovate beyond traditional product offerings and develop comprehensive service packages.

The geographical distribution of demand will continue to be influenced by the intensity of exploration and production activities. While North Africa, particularly Algeria, remains a stable market for API grades, Sub-Saharan Africa, with its vast offshore potential, is driving the demand for premium OCTG. The Rest of Africa segment, encompassing countries like Ghana, Congo, and Mozambique, is also expected to contribute significantly to market growth as new discoveries are brought online. The competitive landscape will likely see further consolidation and strategic alliances as companies vie for larger market shares and technological leadership.

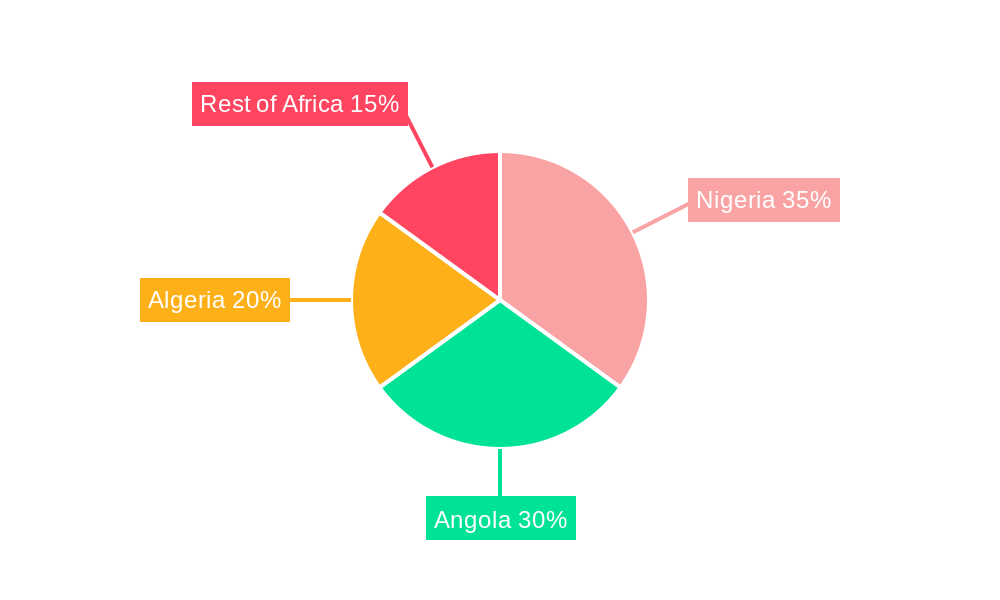

Dominant Regions, Countries, or Segments in Africa OCTG Market

The African OCTG market's dominance is intricately linked to its geographical and product segment dynamics. Among the listed geographies, Nigeria is a consistently dominant force, driven by its established oil and gas industry, substantial reserves, and ongoing E&P investments. Its large onshore and offshore fields, coupled with the need for infrastructure upgrades and enhanced oil recovery (EOR) in mature assets, perpetually fuel the demand for a wide range of OCTG, including both API and premium grades. The country's regulatory emphasis on local content also encourages OCTG manufacturers and service providers to establish a strong local presence, further solidifying Nigeria's market leadership. The estimated market share for Nigeria within the African OCTG market stands at approximately 35% in the base year 2025, projected to grow at a CAGR of 4.8% during the forecast period.

Angola emerges as another pivotal region, primarily driven by its prolific deepwater offshore exploration and production activities. The complexity and harsh conditions of these deepwater environments necessitate the use of high-performance, premium-grade OCTG, making Angola a key consumer of specialized tubular goods. Significant ongoing projects and new field developments in the Angolan pre-salt and post-salt basins contribute substantially to the market’s growth. Angola is estimated to hold around 28% of the African OCTG market share in 2025, with a projected CAGR of 5.2%.

Algeria, representing a significant portion of the Rest of Africa's North African market, continues to be a substantial consumer, largely driven by its mature onshore gas fields and ongoing efforts to boost production. While demand here may lean more towards standard API grades, the exploration of unconventional resources and the need for improved infrastructure also contribute to its market presence. Algeria's market share is estimated at 18% in 2025, with a CAGR of 3.9%.

The Rest of Africa segment, encompassing a multitude of emerging oil and gas frontiers such as Ghana, Congo (Brazzaville and DRC), Mozambique, and Senegal, collectively represents a rapidly growing and increasingly important market. These regions are characterized by significant new discoveries, particularly in offshore deepwater and ultra-deepwater prospects. As these projects move from exploration to production, the demand for advanced OCTG solutions, including premium grades and specialized materials, is expected to surge. This segment, while currently smaller individually, exhibits the highest growth potential with a combined CAGR of over 6.5%. By 2033, the Rest of Africa segment is projected to capture a substantial portion of the market, potentially reaching 19% of the total African OCTG market.

In terms of product segments, API Grade OCTG continues to hold a significant market share due to its widespread application in conventional oil and gas fields and its cost-effectiveness. This segment is crucial for maintaining production from mature fields and supporting exploration in less challenging geological formations across the continent. However, the Premium Grade segment is experiencing the fastest growth. Driven by the increasing complexity of exploration targets (deepwater, HPHT environments, sour gas) and the drive for enhanced well integrity and production efficiency, premium OCTG, offering superior strength, corrosion resistance, and advanced connection technologies, is becoming indispensable. By 2025, premium grade OCTG is estimated to represent 40% of the market value, with its share projected to climb to 55% by 2033.

Africa OCTG Market Product Landscape

The Africa OCTG market's product landscape is evolving to meet the increasingly stringent demands of oil and gas exploration and production. Innovations are focused on enhancing OCTG performance under extreme conditions, including high pressure, high temperature, and corrosive environments. Manufacturers are introducing advanced steel grades with superior tensile strength and yield strength, alongside sophisticated internal and external coatings that offer enhanced resistance to H2S, CO2, and other corrosive agents. The development of proprietary premium connections, designed for superior sealing integrity and ease of make-up, is a key area of product differentiation. These advanced OCTG solutions are critical for maximizing wellbore integrity, ensuring operational safety, and extending the lifespan of wells, thereby reducing overall operational costs for E&P companies.

Key Drivers, Barriers & Challenges in Africa OCTG Market

Key Drivers:

- Increasing Exploration & Production Activities: Significant investments in both offshore and onshore oil and gas exploration across Africa, particularly in deepwater and frontier basins, are the primary growth engine for the OCTG market.

- Demand for Enhanced Oil Recovery (EOR): Mature fields require advanced OCTG solutions to optimize production and extend their economic lifespan.

- Technological Advancements: Development and adoption of premium OCTG grades and advanced connection technologies to address challenging well conditions (HPHT, sour service).

- Growing Natural Gas Demand: Increased focus on natural gas exploration and production drives demand for specific OCTG specifications.

Key Barriers & Challenges:

- Price Volatility of Crude Oil: Fluctuations in global oil prices directly impact E&P spending and, consequently, OCTG demand.

- Infrastructure Deficiencies: Limited logistical and transportation infrastructure in certain regions can increase lead times and costs for OCTG delivery and installation.

- Political Instability and Regulatory Uncertainty: Geopolitical risks and unpredictable regulatory changes in some African nations can deter investment and hinder market growth.

- Financing Constraints: Access to capital for large-scale E&P projects can be a challenge, impacting the overall OCTG market demand.

- Skilled Labor Shortages: A lack of locally available skilled labor for OCTG handling, installation, and inspection can pose operational challenges.

- Intense Price Competition: Pressure to reduce costs can lead to increased competition on price, potentially impacting profit margins for manufacturers.

Emerging Opportunities in Africa OCTG Market

Emerging opportunities in the Africa OCTG market lie in the development of advanced materials and smart OCTG solutions. As exploration ventures into more challenging environments, there is a growing demand for OCTG with superior corrosion resistance, higher mechanical strength, and enhanced fatigue life. The adoption of IoT-enabled "smart" OCTG, equipped with sensors for real-time monitoring of wellbore conditions, presents a significant opportunity for improved operational efficiency and predictive maintenance. Furthermore, the increasing focus on natural gas exploration and production, particularly in regions like East Africa, opens new avenues for OCTG suppliers. The development of integrated OCTG management services, encompassing logistics, inventory management, and lifecycle support, also represents a promising avenue for value-added offerings.

Growth Accelerators in the Africa OCTG Market Industry

Several catalysts are accelerating long-term growth in the Africa OCTG market. Technological breakthroughs in metallurgy and manufacturing are leading to the creation of OCTG that can withstand increasingly extreme wellbore conditions, enabling access to previously uneconomical reserves. Strategic partnerships and joint ventures between global OCTG manufacturers and local African entities are crucial for navigating regulatory landscapes, enhancing local content compliance, and improving supply chain efficiency. Furthermore, market expansion strategies, including the establishment of local manufacturing and service hubs, are vital for reducing lead times, offering cost-competitiveness, and fostering stronger customer relationships across the continent. The increasing global emphasis on energy security and the significant untapped hydrocarbon potential in Africa will continue to fuel sustained investment in the sector.

Key Players Shaping the Africa OCTG Market Market

- Tenaris SA

- TPCO Enterprise Inc

- Jindal Saw Ltd

- Tmk Group

- Nippon Steel Corporation

- Vallourec SA

- National-Oilwell Varco Inc

- ArcelorMittal SA

Notable Milestones in Africa OCTG Market Sector

- 2022/07: Tenaris SA announces expansion of its OCTG manufacturing facilities in Saudi Arabia to better serve the Middle East and Africa region, indicating a strategic focus on emerging markets.

- 2023/03: Vallourec SA secures a significant contract for premium OCTG supply for a major offshore project in West Africa, highlighting the increasing demand for high-performance solutions.

- 2023/11: TPCO Enterprise Inc. announces strategic partnerships with several African oil and gas operators to enhance OCTG supply chain efficiency and local content development.

- 2024/01: Nippon Steel Corporation invests in advanced coating technologies for its OCTG products, aiming to improve their performance in corrosive environments prevalent in many African fields.

- 2024/05: Jindal Saw Ltd. expands its distribution network across Eastern and Southern Africa, strengthening its presence in growing E&P regions.

In-Depth Africa OCTG Market Market Outlook

The Africa OCTG market is projected for robust and sustained growth, driven by significant upstream investments and the imperative to access complex hydrocarbon reserves. Growth accelerators include ongoing technological advancements in materials science and manufacturing, leading to the development of OCTG solutions capable of withstanding extreme wellbore conditions. Strategic partnerships and the establishment of localized supply chains will further bolster market expansion and operational efficiency. The increasing global demand for energy, coupled with Africa's substantial untapped hydrocarbon potential, ensures a positive outlook for the OCTG sector, presenting lucrative opportunities for market participants to invest in innovation and strategic market penetration.

Africa OCTG Market Segmentation

-

1. Grade

- 1.1. Premium Grade

- 1.2. API Grade

-

2. Geography

- 2.1. Nigeria

- 2.2. Angola

- 2.3. Algeria

- 2.4. Rest of Africa

Africa OCTG Market Segmentation By Geography

- 1. Nigeria

- 2. Angola

- 3. Algeria

- 4. Rest of Africa

Africa OCTG Market Regional Market Share

Geographic Coverage of Africa OCTG Market

Africa OCTG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing

- 3.3. Market Restrains

- 3.3.1. 4.; High Exploration Cost

- 3.4. Market Trends

- 3.4.1. Premium Grade OCTG to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa OCTG Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Premium Grade

- 5.1.2. API Grade

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Angola

- 5.2.3. Algeria

- 5.2.4. Rest of Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Angola

- 5.3.3. Algeria

- 5.3.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Nigeria Africa OCTG Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Premium Grade

- 6.1.2. API Grade

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Angola

- 6.2.3. Algeria

- 6.2.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Angola Africa OCTG Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Premium Grade

- 7.1.2. API Grade

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Angola

- 7.2.3. Algeria

- 7.2.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Algeria Africa OCTG Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Premium Grade

- 8.1.2. API Grade

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Angola

- 8.2.3. Algeria

- 8.2.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. Rest of Africa Africa OCTG Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Premium Grade

- 9.1.2. API Grade

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Angola

- 9.2.3. Algeria

- 9.2.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Tenaris SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TPCO Enterprise Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jindal Saw Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tmk Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nippon Steel Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vallourec SA*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 National-Oilwell Varco Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ArcelorMittal SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Tenaris SA

List of Figures

- Figure 1: Africa OCTG Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa OCTG Market Share (%) by Company 2025

List of Tables

- Table 1: Africa OCTG Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 2: Africa OCTG Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Africa OCTG Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Africa OCTG Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 5: Africa OCTG Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Africa OCTG Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Africa OCTG Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 8: Africa OCTG Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Africa OCTG Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Africa OCTG Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 11: Africa OCTG Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Africa OCTG Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Africa OCTG Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 14: Africa OCTG Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Africa OCTG Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa OCTG Market?

The projected CAGR is approximately 6.09%.

2. Which companies are prominent players in the Africa OCTG Market?

Key companies in the market include Tenaris SA, TPCO Enterprise Inc, Jindal Saw Ltd, Tmk Group, Nippon Steel Corporation, Vallourec SA*List Not Exhaustive, National-Oilwell Varco Inc, ArcelorMittal SA.

3. What are the main segments of the Africa OCTG Market?

The market segments include Grade, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.82 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing.

6. What are the notable trends driving market growth?

Premium Grade OCTG to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Exploration Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa OCTG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa OCTG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa OCTG Market?

To stay informed about further developments, trends, and reports in the Africa OCTG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence