Key Insights

India's Waste-to-Energy (WTE) market is experiencing robust expansion, propelled by rising waste generation and government initiatives promoting sustainable waste management. The market, valued at an estimated $1.2 billion in the base year 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2%. This growth is driven by urbanization, increased environmental awareness, and the imperative to minimize landfill dependency. Supportive government policies, including incentives for renewable energy and waste management projects, further stimulate investment and development. The expansion of the WTE sector is vital for addressing India's waste crisis and achieving its renewable energy objectives.

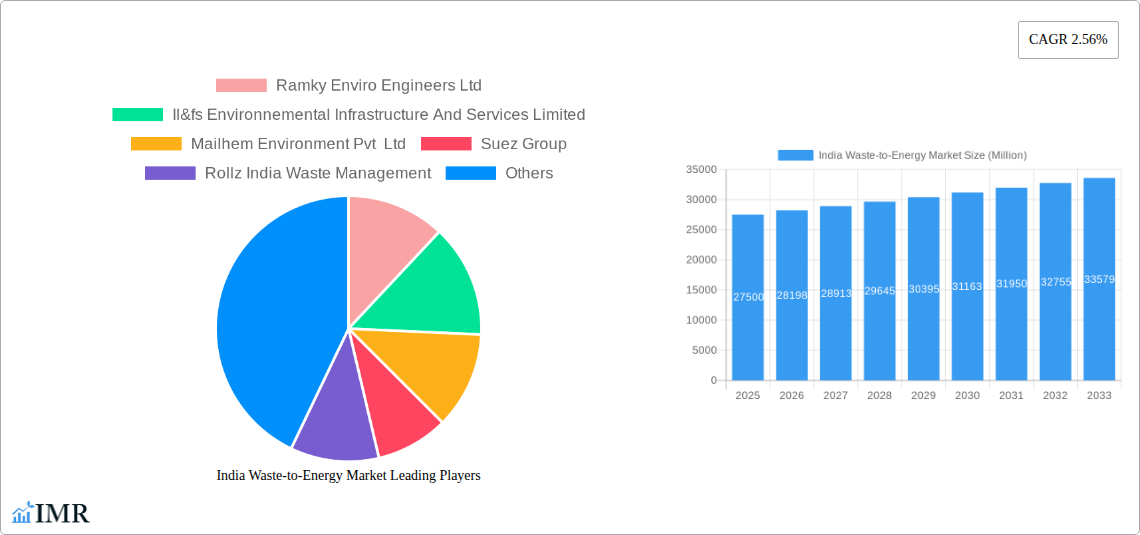

India Waste-to-Energy Market Market Size (In Billion)

The Indian WTE market features a diverse array of technologies and disposal methods for various waste streams. Thermal processes such as incineration, pyrolysis, and gasification are increasingly adopted for their efficiency with mixed waste. Biochemical technologies are also gaining prominence, particularly for organic waste. While landfilling persists, a clear shift towards waste processing and recycling is evident, with WTE playing a crucial role in waste diversion and energy generation. Leading companies are actively investing and expanding, underscoring a competitive landscape focused on innovation and sustainability. This dynamic environment transforms India's waste management challenges into valuable energy resources, delivering both environmental and economic advantages.

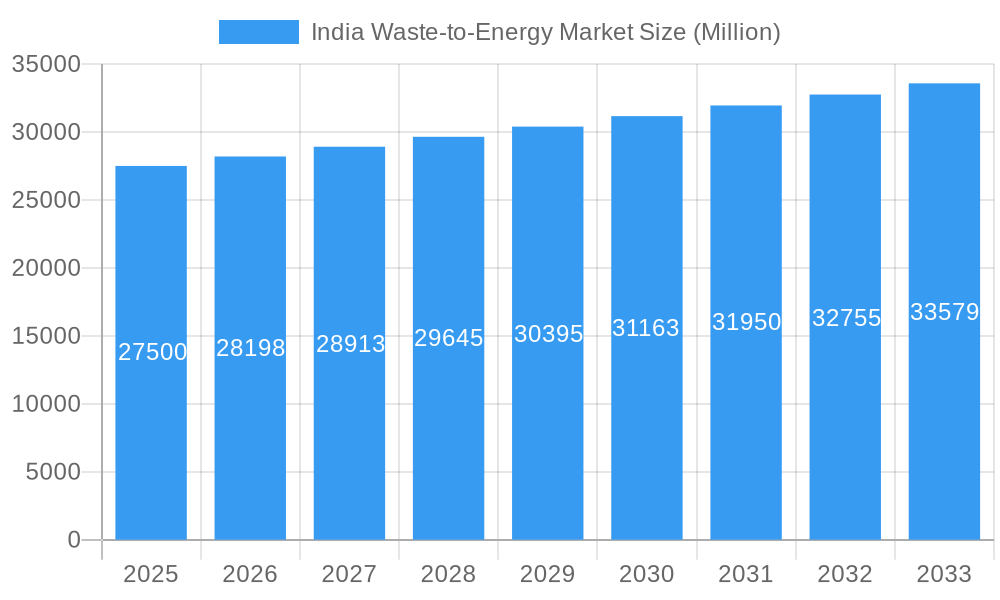

India Waste-to-Energy Market Company Market Share

India Waste-to-Energy Market: Comprehensive Report with Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This in-depth report provides a comprehensive analysis of the burgeoning India Waste-to-Energy (WTE) market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook from 2019 to 2033. With a base year of 2025 and a forecast period of 2025–2033, this report leverages extensive data and expert insights to offer unparalleled value to industry professionals, investors, and policymakers seeking to understand the intricate workings and immense potential of India's waste management and renewable energy sector. The report covers parent and child markets to provide a holistic view, with all values presented in Million units.

India Waste-to-Energy Market Market Dynamics & Structure

The Indian waste-to-energy market is characterized by a moderately concentrated structure, with a growing number of players vying for dominance. Technological innovation is a significant driver, fueled by increasing environmental concerns and government mandates for cleaner energy solutions. Regulatory frameworks, such as the Solid Waste Management Rules, 2016, are becoming more stringent, creating a favorable environment for WTE adoption. Competitive product substitutes primarily include traditional landfilling and advanced recycling technologies, though WTE offers a unique solution for residual waste. End-user demographics are shifting towards urbanized populations generating larger waste volumes, thus increasing the demand for efficient waste management. Mergers and acquisitions (M&A) are also on the rise as established companies seek to expand their portfolios and smaller innovators aim to scale their operations. The market is witnessing a trend of consolidation, with larger entities acquiring promising startups to enhance their technological capabilities and market reach. The increasing landfill scarcity and associated environmental liabilities are pushing municipalities and private enterprises towards WTE solutions, creating a dynamic and evolving market landscape.

- Market Concentration: Moderately concentrated with key players like Ramky Enviro Engineers Ltd. and Il&fs Environnemental Infrastructure And Services Limited holding significant market share.

- Technological Innovation Drivers: Government incentives, R&D investments, and the need for sustainable waste management are propelling innovation in WTE technologies.

- Regulatory Frameworks: Stringent environmental regulations and waste management policies are crucial in shaping market entry and operational standards.

- Competitive Product Substitutes: Traditional landfilling remains a substitute, but its environmental impact is increasingly unfavorable. Advanced recycling and other waste valorization techniques are also emerging as alternatives.

- End-User Demographics: Rapid urbanization and population growth are leading to increased waste generation, creating a direct demand for WTE solutions in urban and peri-urban areas.

- M&A Trends: An increasing number of strategic acquisitions and partnerships are observed, indicating industry consolidation and the pursuit of synergistic growth.

India Waste-to-Energy Market Growth Trends & Insights

The India waste-to-energy market is poised for exponential growth, driven by a confluence of factors including escalating waste generation, a growing imperative for sustainable energy, and supportive government policies. The market size is projected to witness a significant CAGR of XX% during the forecast period. Adoption rates for WTE technologies are steadily increasing as awareness of their environmental and economic benefits grows. Technological disruptions are continuously reshaping the market, with advancements in thermal processes like gasification and pyrolysis offering more efficient and cleaner energy conversion. Consumer behavior is shifting towards greater environmental consciousness, leading to increased demand for sustainable waste management solutions from both municipal bodies and industrial sectors. The penetration of WTE plants is expected to expand significantly, moving beyond major metropolitan areas to tier-2 and tier-3 cities. This expansion will be facilitated by declining technology costs, improved operational efficiencies, and a clearer understanding of the economic viability of converting waste into energy. The growing emphasis on circular economy principles further amplifies the importance of WTE as a critical component in resource recovery and waste minimization strategies. The evolving energy landscape in India, with its ambitious renewable energy targets, provides a fertile ground for WTE to contribute substantially to the national energy mix.

Dominant Regions, Countries, or Segments in India Waste-to-Energy Market

The Indian waste-to-energy market's dominance is primarily driven by the Thermal Technology segment, specifically Incineration. This dominance stems from its established track record, relatively mature technology, and its ability to handle diverse waste streams with high energy recovery efficiency. Regions with high population density and significant industrial activity, such as the Western and Southern regions of India, are leading the charge due to their substantial waste generation and greater capacity for infrastructure investment.

Key Drivers for Thermal Technology Dominance:

- Proven Efficacy: Incineration technology is well-understood and has a long history of successful implementation globally, instilling confidence in its adoption.

- High Energy Yield: Thermal processes, especially advanced incineration with energy recovery systems, offer a substantial amount of electricity generation from waste.

- Volume Reduction: Incineration significantly reduces the volume of waste requiring disposal, thereby alleviating pressure on limited landfill space.

- Sterilization: High-temperature incineration effectively sterilizes hazardous waste, mitigating public health risks.

- Government Support: Policies often favor technologies that can process large volumes of municipal solid waste (MSW) efficiently, with thermal methods being a prime candidate.

Dominance Factors in Western and Southern Regions:

- Urbanization & Population Density: These regions host major metropolitan cities like Mumbai, Delhi (though geographically North, often considered in development discussions), Bengaluru, Chennai, and Hyderabad, leading to higher waste generation.

- Industrial Hubs: Significant industrial presence in states like Gujarat, Maharashtra, Tamil Nadu, and Karnataka contributes to industrial waste streams that can be utilized in WTE plants.

- Economic Development & Investment Capacity: Higher economic development allows for greater investment in advanced waste management infrastructure, including WTE facilities.

- Environmental Awareness & Policy Implementation: These regions often exhibit higher levels of environmental awareness and proactive implementation of waste management policies by local governments.

- Availability of Land (relatively): While land is a constraint, these regions have historically seen more concerted efforts in identifying and acquiring suitable land for large-scale infrastructure projects.

The Disposal Method: Waste Processing is intrinsically linked to the dominance of WTE, as it represents a shift from simple landfilling to value-added waste management. As WTE technologies mature and become more cost-effective, their share in the overall waste management ecosystem is expected to grow substantially, directly impacting the decline of traditional landfilling and the rise of recycling and resource recovery.

India Waste-to-Energy Market Product Landscape

The product landscape in the Indian waste-to-energy market is evolving rapidly, showcasing a spectrum of advanced technologies designed for efficient waste conversion. Innovations primarily focus on enhancing energy output, minimizing emissions, and improving operational reliability. Key technologies include advanced incineration systems with sophisticated pollution control mechanisms, modern pyrolysis units capable of producing biofuels and syngas, and gasification plants that generate synthesis gas for power generation or chemical production. Performance metrics emphasize higher calorific value utilization, reduced residual ash content, and compliance with stringent emission standards. Unique selling propositions revolve around the ability to process diverse waste streams, including municipal solid waste, industrial waste, and agricultural residues, while generating clean energy and valuable by-products. Technological advancements are geared towards modular plant designs for scalability and decentralized waste management solutions.

Key Drivers, Barriers & Challenges in India Waste-to-Energy Market

Key Drivers:

- Escalating Waste Generation: Rapid urbanization and population growth are creating an unprecedented volume of waste, necessitating advanced disposal solutions.

- Government Initiatives & Policy Support: Favorable policies, subsidies, and targets for renewable energy and waste management are crucial accelerators.

- Environmental Concerns: Growing awareness of the detrimental impacts of landfills on air, water, and soil quality drives demand for cleaner alternatives.

- Energy Security & Renewable Energy Targets: WTE contributes to India's renewable energy portfolio, reducing reliance on fossil fuels and enhancing energy independence.

- Circular Economy Principles: The global shift towards circular economy models encourages waste valorization and resource recovery, with WTE playing a vital role.

Barriers & Challenges:

- High Capital Investment: WTE plants require significant upfront capital, posing a financial challenge for many municipalities and private entities.

- Waste Segregation & Collection Infrastructure: Inconsistent waste segregation at source and inadequate collection mechanisms lead to sub-optimal feedstock quality, impacting plant efficiency.

- Feedstock Variability & Quality: The inconsistent calorific value and composition of municipal solid waste can pose operational challenges and affect energy output.

- Regulatory Hurdles & Permitting Delays: Complex environmental regulations and lengthy approval processes can slow down project development and implementation.

- Public Perception & Social Acceptance: Misconceptions about incineration, particularly regarding emissions, can lead to public opposition, requiring effective communication and demonstration of safety measures.

- Technological Maturity & Maintenance: While technologies are advancing, ensuring the long-term operational efficiency and maintenance of complex WTE plants requires skilled manpower and robust support systems.

Emerging Opportunities in India Waste-to-Energy Market

Emerging opportunities in the India waste-to-energy market lie in the development of advanced feedstock preparation and pre-treatment technologies to ensure consistent waste quality for WTE plants. There is significant potential in exploring the integration of WTE with other waste management solutions, such as advanced recycling and composting, to create comprehensive waste valorization ecosystems. The development of smaller, modular WTE plants suitable for tier-2 and tier-3 cities presents an untapped market. Furthermore, exploring waste-to-chemicals and waste-to-fuels through advanced thermal processes like pyrolysis and gasification offers lucrative avenues beyond just electricity generation. Evolving consumer preferences for sustainable products and services also create opportunities for companies that can demonstrate responsible waste management practices.

Growth Accelerators in the India Waste-to-Energy Market Industry

Long-term growth in the India waste-to-energy market will be significantly accelerated by continuous technological breakthroughs, leading to higher efficiency, lower costs, and improved environmental performance of WTE plants. Strategic partnerships between technology providers, project developers, and municipal corporations will be crucial for de-risking investments and streamlining project execution. Market expansion strategies, including the development of decentralized WTE solutions for smaller towns and the integration of WTE with industrial waste management, will unlock new revenue streams. Government policies that provide long-term financial incentives, such as feed-in tariffs or tax benefits, will further stimulate investment and drive adoption. The increasing focus on achieving net-zero emissions targets will also push for the adoption of cleaner energy solutions like WTE.

Key Players Shaping the India Waste-to-Energy Market Market

- Ramky Enviro Engineers Ltd

- Il&fs Environnemental Infrastructure And Services Limited

- Mailhem Environment Pvt Ltd

- Suez Group

- Rollz India Waste Management

- Veolia Environnement SA

- Abellon Clean Energy Ltd

- Hitachi Zosen Inova

- A2z Group

- Ecogreen Energy Pvt Ltd

- Hydroair Techtonics (pcd) Limited

- Gj Eco Power Pvt Ltd

- Jitf Urban Infrastructure Limited

Notable Milestones in India Waste-to-Energy Market Sector

- March 2022: The WASTE-TO-ENERGY Recycling Plant, a flagship project of the Greater Visakhapatnam Municipal Corporation (GVMC), commenced operating at Kapuluppada in Visakhapatnam. The plant generates approximately 9.90 MW of power per day using one boiler. As per the agreement between Jindal Group and the GVMC, the recycling plant is targeted to generate around 15 MW of electricity daily by processing approximately 1,200 tonnes of waste per day. The corporation is also exploring transporting 260 tonnes of garbage from Srikakulam, Vizianagaram, and Nellimarla municipalities to augment the feedstock.

- January 2022: The Brihanmumbai Municipal Corporation proposed the construction of a waste-to-energy plant with a capacity of 600 metric tonnes per day at Mumbai's Deonar dumping ground, spanning 12.19 hectares and estimated at an investment of INR 5.04 billion.

In-Depth India Waste-to-Energy Market Market Outlook

The India waste-to-energy market outlook is exceptionally promising, fueled by a sustained increase in waste generation and a national imperative to embrace sustainable development. Growth accelerators such as advancements in thermal processes, efficient waste-to-fuel technologies, and the development of decentralized WTE solutions are set to expand the market's reach. Strategic partnerships and increasing private sector investment, coupled with robust government policy support, will play a pivotal role in overcoming initial capital barriers. The market's potential is further amplified by the alignment with India's renewable energy targets and the global shift towards a circular economy, positioning WTE as a critical component of future waste management and energy infrastructure. The outlook is characterized by innovation, expansion, and a significant contribution to environmental sustainability and energy security.

India Waste-to-Energy Market Segmentation

-

1. Technology

-

1.1. Thermal

- 1.1.1. Incineration

- 1.1.2. Pyrolysis

- 1.1.3. Gasification

- 1.2. Bio-Chemical

- 1.3. Other Technologies

-

1.1. Thermal

-

2. Disposal Method

- 2.1. Landfill

- 2.2. Waste Processing

- 2.3. Recycling

India Waste-to-Energy Market Segmentation By Geography

- 1. India

India Waste-to-Energy Market Regional Market Share

Geographic Coverage of India Waste-to-Energy Market

India Waste-to-Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Energy Demand4.; Increasing Export Opportunities

- 3.3. Market Restrains

- 3.3.1 Establishing WTE facilities requires substantial initial investment

- 3.3.2 which can be a barrier for many stakeholders. The high upfront costs may deter potential investors and slow market expansion

- 3.4. Market Trends

- 3.4.1 The adoption of advanced technologies

- 3.4.2 such as gasification and pyrolysis

- 3.4.3 is enhancing the efficiency and environmental performance of WTE plants. These technologies offer cleaner and more efficient energy recovery from waste

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waste-to-Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Thermal

- 5.1.1.1. Incineration

- 5.1.1.2. Pyrolysis

- 5.1.1.3. Gasification

- 5.1.2. Bio-Chemical

- 5.1.3. Other Technologies

- 5.1.1. Thermal

- 5.2. Market Analysis, Insights and Forecast - by Disposal Method

- 5.2.1. Landfill

- 5.2.2. Waste Processing

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ramky Enviro Engineers Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Il&fs Environnemental Infrastructure And Services Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mailhem Environment Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Suez Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rollz India Waste Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veolia Environnement SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abellon Clean Energy Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Zosen Inova

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A2z Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ecogreen Energy Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hydroair Techtonics (pcd) Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gj Eco Power Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Jitf Urban Infrastructure Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Ramky Enviro Engineers Ltd

List of Figures

- Figure 1: India Waste-to-Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Waste-to-Energy Market Share (%) by Company 2025

List of Tables

- Table 1: India Waste-to-Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: India Waste-to-Energy Market Revenue billion Forecast, by Disposal Method 2020 & 2033

- Table 3: India Waste-to-Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Waste-to-Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: India Waste-to-Energy Market Revenue billion Forecast, by Disposal Method 2020 & 2033

- Table 6: India Waste-to-Energy Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waste-to-Energy Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the India Waste-to-Energy Market?

Key companies in the market include Ramky Enviro Engineers Ltd, Il&fs Environnemental Infrastructure And Services Limited, Mailhem Environment Pvt Ltd, Suez Group, Rollz India Waste Management, Veolia Environnement SA, Abellon Clean Energy Ltd, Hitachi Zosen Inova, A2z Group, Ecogreen Energy Pvt Ltd, Hydroair Techtonics (pcd) Limited, Gj Eco Power Pvt Ltd, Jitf Urban Infrastructure Limited.

3. What are the main segments of the India Waste-to-Energy Market?

The market segments include Technology, Disposal Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Energy Demand4.; Increasing Export Opportunities.

6. What are the notable trends driving market growth?

The adoption of advanced technologies. such as gasification and pyrolysis. is enhancing the efficiency and environmental performance of WTE plants. These technologies offer cleaner and more efficient energy recovery from waste.

7. Are there any restraints impacting market growth?

Establishing WTE facilities requires substantial initial investment. which can be a barrier for many stakeholders. The high upfront costs may deter potential investors and slow market expansion.

8. Can you provide examples of recent developments in the market?

March 2022: The WASTE-TO-ENERGY Recycling Plant, a flagship project of the Greater Visakhapatnam Municipal Corporation (GVMC), commenced operating at Kapuluppada in Visakhapatnam. The plant generates about 9.90 MW of power per day using one boiler. According to the agreement between Jindal Group and the GVMC, the recycling plant will generate about 15 MW of electricity daily. To generate 15 MW of power, GVMC focused on providing about 1,200 tones of waste per day. The corporation is mulling to transport 260 tones of garbage from Srikakulam, Vizianagaram, and Nellimarla municipalities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waste-to-Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waste-to-Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waste-to-Energy Market?

To stay informed about further developments, trends, and reports in the India Waste-to-Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence