Key Insights

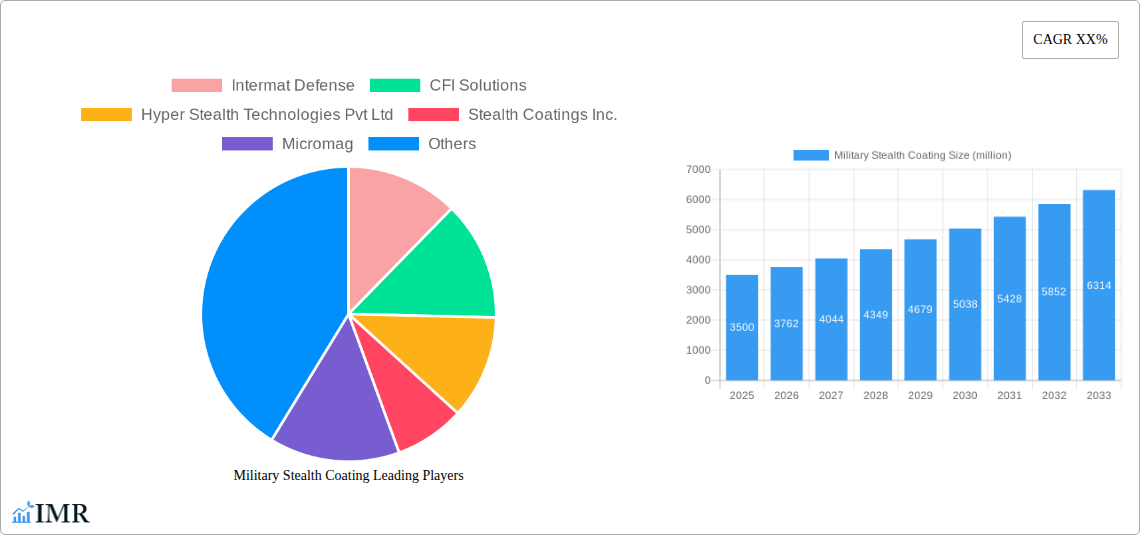

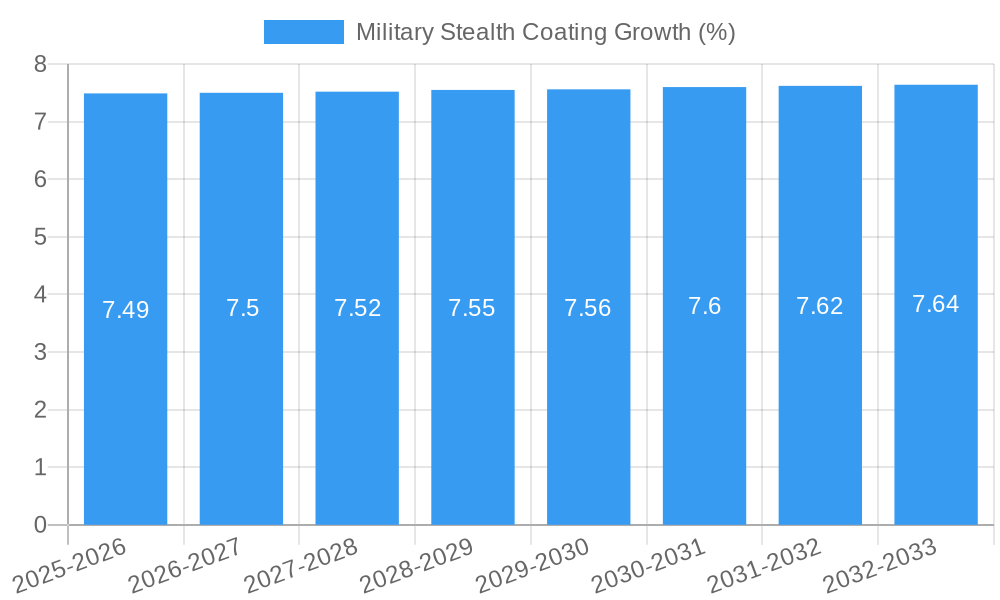

The global Military Stealth Coating market is poised for significant expansion, projected to reach a robust market size of approximately USD 3,500 million by 2025, and is expected to witness a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This substantial growth is primarily fueled by the escalating geopolitical tensions and the increasing demand for advanced defense capabilities. Governments worldwide are heavily investing in modernizing their military fleets and infrastructure, with a particular focus on reducing the radar cross-section (RCS) and infrared signature of combat vehicles, aircraft, and naval vessels. This surge in defense spending directly translates into a heightened need for sophisticated stealth coating technologies. Furthermore, the continuous innovation in material science, leading to the development of more effective, durable, and cost-efficient stealth solutions, is a key driver. The versatility of these coatings across various applications, from protecting sensitive equipment like rot shields and parachutes to enhancing the survivability of pop-up tents and camouflage nets, further solidifies their market importance.

The market is characterized by a dynamic interplay of advanced material types and diverse applications. Polyurethane and epoxy-based stealth coatings are currently dominating the market due to their established performance and cost-effectiveness, while polyimide coatings are gaining traction for high-performance applications requiring extreme temperature resistance and durability. The ongoing research and development efforts are focused on creating next-generation stealth materials with multi-spectral absorption capabilities, active camouflage features, and enhanced electromagnetic interference (EMI) shielding properties. Key players are actively engaged in strategic collaborations, mergers, and acquisitions to expand their technological portfolios and geographical reach, aiming to capitalize on the growing demand from major defense hubs. While the market presents a promising outlook, potential restraints include the high cost of advanced stealth materials, the stringent regulatory approvals required for defense applications, and the challenge of developing coatings that are both highly effective and environmentally sustainable. However, the overarching strategic imperative for enhanced national security is expected to outweigh these challenges, propelling the military stealth coating market forward.

This in-depth report provides a detailed analysis of the global Military Stealth Coating market, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. Designed for industry professionals, defense contractors, material scientists, and strategic planners, this report offers actionable insights and quantitative data to navigate the evolving landscape of advanced defense materials.

Military Stealth Coating Market Dynamics & Structure

The Military Stealth Coating market exhibits a moderately concentrated structure, with a few key players holding significant market share, yet offering ample space for emerging innovators. Technological innovation remains a paramount driver, fueled by relentless advancements in material science and a continuous demand for enhanced battlefield survivability. Emerging nanotechnology-based stealth coatings and metamaterial applications are disrupting traditional offerings, promising superior radar absorption and thermal signature reduction. Regulatory frameworks, primarily driven by national security interests and defense procurement policies, significantly influence market entry and product development cycles. Competitive product substitutes are limited, given the specialized nature of stealth technologies, but advancements in active camouflage and electronic warfare systems present indirect competition. End-user demographics are strictly defined, focusing on military and defense organizations globally. Mergers and acquisitions (M&A) are a notable trend, as larger defense conglomerates seek to integrate cutting-edge stealth capabilities into their portfolios, evidenced by approximately 2-3 significant M&A deals annually in the past three years. Innovation barriers include high R&D costs, stringent testing and qualification processes, and intellectual property protection challenges.

- Market Concentration: Moderately concentrated with key players like Intermat Defense and CFI Solutions dominating certain niches.

- Technological Innovation: Driven by nanotechnology, metamaterials, and adaptive camouflage systems.

- Regulatory Frameworks: National security directives, defense procurement, and export controls are critical.

- Competitive Product Substitutes: Limited, but active camouflage and EW systems are indirect competitors.

- End-User Demographics: Primarily governmental defense agencies and prime defense contractors.

- M&A Trends: Active consolidation driven by strategic acquisitions of advanced material capabilities.

Military Stealth Coating Growth Trends & Insights

The global Military Stealth Coating market is poised for robust growth, projected to expand from an estimated $2,500 million in 2025 to over $4,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This expansion is underpinned by escalating geopolitical tensions, increased defense spending across major economies, and the persistent need for enhanced operational effectiveness and force protection. The adoption rate of advanced stealth coatings is accelerating as militaries recognize their critical role in reducing radar cross-section (RCS), infrared (IR) signatures, and visual detectability, thereby minimizing the risk of detection and engagement. Technological disruptions are primarily centered around novel materials, including graphene-infused coatings, frequency-selective surfaces (FSS), and electrically tunable stealth materials, which offer unprecedented performance enhancements. Consumer behavior shifts, though not in the traditional sense, are observed in the increasing demand for customizable, multi-functional coatings that can adapt to various operational environments and threat profiles. The market penetration of these sophisticated coatings is steadily increasing across all major defense platforms, from ground vehicles and aircraft to naval vessels and individual soldier equipment. The historical period (2019-2024) witnessed a steady growth trajectory, with a market size estimated at $2,100 million in 2024, laying a strong foundation for future expansion.

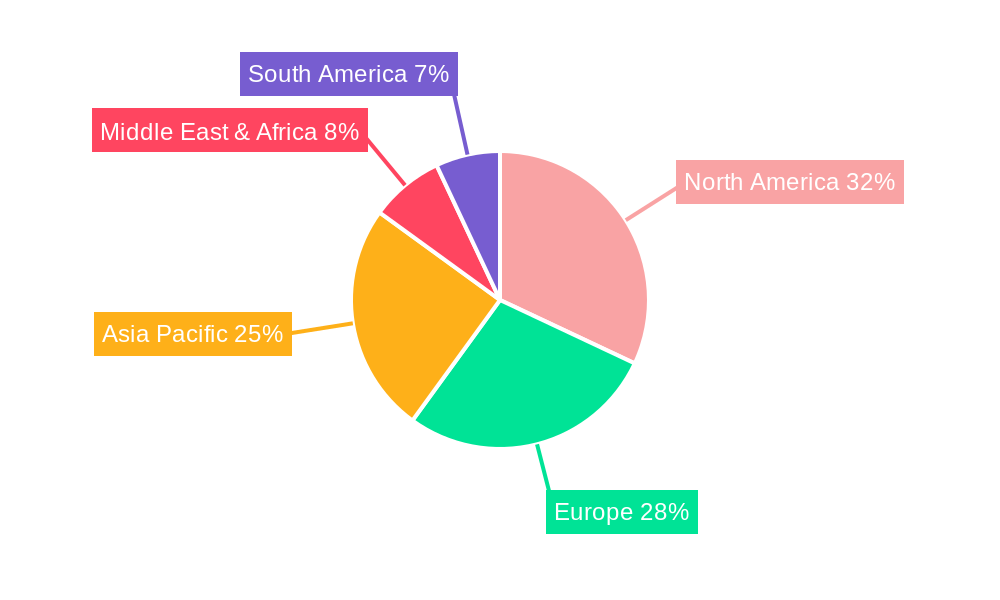

Dominant Regions, Countries, or Segments in Military Stealth Coating

The North American region, specifically the United States, is currently the dominant force in the Military Stealth Coating market, projected to account for approximately 45% of the global market share in 2025. This dominance is attributed to substantial government investment in defense research and development, a highly advanced aerospace and defense industrial base, and a proactive stance in adopting cutting-edge military technologies. The US military's continuous modernization programs, particularly in areas like tactical aircraft, naval fleets, and unmanned aerial systems (UAS), significantly drive the demand for sophisticated stealth coatings. Key drivers include generous R&D funding through agencies like DARPA, a robust ecosystem of specialized material science companies such as Stealth Coatings Inc. and Veil Corporation, and stringent performance requirements for deployed defense assets.

Within the Application segment, Rot Shields and Camouflage Nets are expected to be the largest contributors to market growth. Rot Shields, crucial for protecting sensitive electronic components and airframes from environmental degradation and enhancing survivability, are witnessing increased demand due to the deployment of advanced, sensor-laden military hardware. Camouflage Nets, evolving beyond simple visual concealment to incorporate multi-spectral signature management, are also critical for modern warfare. The Types segment is dominated by Polyurethane and Epoxy-based coatings due to their established performance, cost-effectiveness, and versatility in various applications. However, the forecast period is expected to see a rise in the adoption of Polyimide-based solutions, especially in high-temperature and extreme environment applications, driven by their superior thermal stability and chemical resistance.

- Dominant Region: North America (primarily the United States).

- Key Drivers in North America: High defense R&D spending, advanced industrial base, continuous modernization programs.

- Leading Applications: Rot Shields and Camouflage Nets.

- Dominant Types: Polyurethane and Epoxy, with growing demand for Polyimide.

- Market Share (Region): North America expected to hold ~45% in 2025.

- Market Share (Application - Rot Shields): Estimated 25% in 2025.

- Market Share (Application - Camouflage Nets): Estimated 22% in 2025.

Military Stealth Coating Product Landscape

The Military Stealth Coating product landscape is characterized by continuous innovation aimed at enhancing multi-spectral signature reduction. Leading companies are developing advanced coatings that offer not only superior radar absorption (RA) across a broad frequency spectrum but also effective thermal and infrared (IR) signature management. Innovations include lightweight, flexible coatings for conformal applications on aircraft and vehicles, as well as durable, self-healing variants designed for extended operational lifespans in harsh environments. The integration of smart functionalities, such as adaptive coloration and electromagnetic wave manipulation, is emerging as a key differentiator.

Key Drivers, Barriers & Challenges in Military Stealth Coating

Key Drivers:

- Escalating Geopolitical Tensions: Increased defense spending and demand for advanced survivability solutions globally.

- Technological Advancements: Breakthroughs in nanotechnology, metamaterials, and advanced polymer science.

- Airframe and Vehicle Modernization: Demand for next-generation coatings to enhance existing and new platforms.

- Asymmetric Warfare: Need for effective signature management against increasingly sophisticated detection systems.

Barriers & Challenges:

- High R&D and Production Costs: Significant investment required for development, testing, and manufacturing.

- Stringent Qualification and Certification: Lengthy and complex approval processes by defense agencies.

- Supply Chain Volatility: Reliance on specialized raw materials and potential disruptions in their availability.

- Environmental Regulations: Increasing scrutiny and demand for eco-friendly coating formulations.

- Competitive Pressures: Intense competition among established players and emerging innovators.

Emerging Opportunities in Military Stealth Coating

Emerging opportunities lie in the development of bio-inspired stealth coatings mimicking natural camouflage phenomena for adaptive signature management. The increasing focus on electronic warfare is driving demand for stealth coatings integrated with electromagnetic spectrum control capabilities. Furthermore, the expansion of drone technology is creating a nascent but rapidly growing market for specialized stealth coatings for unmanned aerial systems (UAS). Untapped markets in emerging economies with increasing defense budgets also present significant growth potential.

Growth Accelerators in the Military Stealth Coating Industry

Long-term growth in the Military Stealth Coating industry will be propelled by breakthroughs in adaptive stealth technologies that can dynamically alter their signature based on environmental conditions and threat profiles. Strategic partnerships between material science innovators and prime defense contractors will accelerate the integration of these advanced coatings into military platforms. Furthermore, the increasing adoption of additive manufacturing (3D printing) for complex coating structures will enable mass customization and reduce production lead times, further fueling market expansion.

Key Players Shaping the Military Stealth Coating Market

- Intermat Defense

- CFI Solutions

- Hyper Stealth Technologies Pvt Ltd

- Stealth Coatings Inc.

- Micromag

- Veil Corporation

- Defense Advanced Research Projects Agency (DARPA) - (As a research driver)

Notable Milestones in Military Stealth Coating Sector

- 2019: DARPA initiates research into novel metamaterial-based stealth applications.

- 2020: Stealth Coatings Inc. announces a breakthrough in broadband radar-absorbent materials.

- 2021: Intermat Defense acquires a specialized nanotechnology firm to enhance its stealth coating portfolio.

- 2022: CFI Solutions develops a new generation of environmentally friendly, low-VOC stealth coatings.

- 2023: Hyper Stealth Technologies Pvt Ltd demonstrates advanced adaptive camouflage capabilities for ground vehicles.

- 2024: Veil Corporation secures a significant contract for advanced stealth coatings for next-generation fighter aircraft.

In-Depth Military Stealth Coating Market Outlook

- 2019: DARPA initiates research into novel metamaterial-based stealth applications.

- 2020: Stealth Coatings Inc. announces a breakthrough in broadband radar-absorbent materials.

- 2021: Intermat Defense acquires a specialized nanotechnology firm to enhance its stealth coating portfolio.

- 2022: CFI Solutions develops a new generation of environmentally friendly, low-VOC stealth coatings.

- 2023: Hyper Stealth Technologies Pvt Ltd demonstrates advanced adaptive camouflage capabilities for ground vehicles.

- 2024: Veil Corporation secures a significant contract for advanced stealth coatings for next-generation fighter aircraft.

In-Depth Military Stealth Coating Market Outlook

The future outlook for the Military Stealth Coating market is exceptionally strong, driven by an unyielding demand for enhanced survivability and operational dominance. The convergence of cutting-edge material science, advanced manufacturing techniques, and strategic defense investments will continue to accelerate innovation. Key growth accelerators include the development of fully adaptive and programmable stealth systems, seamless integration with networked warfare capabilities, and the expanding application across a wider array of military assets, from individual soldier gear to large naval vessels. This sustained innovation and strategic expansion promise significant market potential and lucrative opportunities for stakeholders.

Military Stealth Coating Segmentation

-

1. Application

- 1.1. Rot Shields

- 1.2. Camouflage Nets

- 1.3. Parachutes

- 1.4. Pop-up Tents

- 1.5. Others

-

2. Types

- 2.1. Epoxy

- 2.2. Polyurethane

- 2.3. Polyimide

- 2.4. Others

Military Stealth Coating Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Military Stealth Coating REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Stealth Coating Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Rot Shields

- 5.1.2. Camouflage Nets

- 5.1.3. Parachutes

- 5.1.4. Pop-up Tents

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Epoxy

- 5.2.2. Polyurethane

- 5.2.3. Polyimide

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Military Stealth Coating Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Rot Shields

- 6.1.2. Camouflage Nets

- 6.1.3. Parachutes

- 6.1.4. Pop-up Tents

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Epoxy

- 6.2.2. Polyurethane

- 6.2.3. Polyimide

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Military Stealth Coating Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Rot Shields

- 7.1.2. Camouflage Nets

- 7.1.3. Parachutes

- 7.1.4. Pop-up Tents

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Epoxy

- 7.2.2. Polyurethane

- 7.2.3. Polyimide

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Military Stealth Coating Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Rot Shields

- 8.1.2. Camouflage Nets

- 8.1.3. Parachutes

- 8.1.4. Pop-up Tents

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Epoxy

- 8.2.2. Polyurethane

- 8.2.3. Polyimide

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Military Stealth Coating Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Rot Shields

- 9.1.2. Camouflage Nets

- 9.1.3. Parachutes

- 9.1.4. Pop-up Tents

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Epoxy

- 9.2.2. Polyurethane

- 9.2.3. Polyimide

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Military Stealth Coating Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Rot Shields

- 10.1.2. Camouflage Nets

- 10.1.3. Parachutes

- 10.1.4. Pop-up Tents

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Epoxy

- 10.2.2. Polyurethane

- 10.2.3. Polyimide

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intermat Defense

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CFI Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hyper Stealth Technologies Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stealth Coatings Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Micromag

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Veil Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Defense Advanced Research Projects Agency

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Intermat Defense

List of Figures

- Figure 1: Global Military Stealth Coating Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Military Stealth Coating Revenue (million), by Application 2024 & 2032

- Figure 3: North America Military Stealth Coating Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Military Stealth Coating Revenue (million), by Types 2024 & 2032

- Figure 5: North America Military Stealth Coating Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Military Stealth Coating Revenue (million), by Country 2024 & 2032

- Figure 7: North America Military Stealth Coating Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Military Stealth Coating Revenue (million), by Application 2024 & 2032

- Figure 9: South America Military Stealth Coating Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Military Stealth Coating Revenue (million), by Types 2024 & 2032

- Figure 11: South America Military Stealth Coating Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Military Stealth Coating Revenue (million), by Country 2024 & 2032

- Figure 13: South America Military Stealth Coating Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Military Stealth Coating Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Military Stealth Coating Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Military Stealth Coating Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Military Stealth Coating Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Military Stealth Coating Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Military Stealth Coating Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Military Stealth Coating Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Military Stealth Coating Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Military Stealth Coating Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Military Stealth Coating Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Military Stealth Coating Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Military Stealth Coating Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Military Stealth Coating Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Military Stealth Coating Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Military Stealth Coating Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Military Stealth Coating Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Military Stealth Coating Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Military Stealth Coating Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Stealth Coating Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Military Stealth Coating Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Military Stealth Coating Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Military Stealth Coating Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Military Stealth Coating Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Military Stealth Coating Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Military Stealth Coating Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Military Stealth Coating Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Military Stealth Coating Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Military Stealth Coating Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Military Stealth Coating Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Military Stealth Coating Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Military Stealth Coating Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Military Stealth Coating Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Military Stealth Coating Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Military Stealth Coating Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Military Stealth Coating Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Military Stealth Coating Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Military Stealth Coating Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Military Stealth Coating Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Stealth Coating?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Military Stealth Coating?

Key companies in the market include Intermat Defense, CFI Solutions, Hyper Stealth Technologies Pvt Ltd, Stealth Coatings Inc., Micromag, Veil Corporation, Defense Advanced Research Projects Agency.

3. What are the main segments of the Military Stealth Coating?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Stealth Coating," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Stealth Coating report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Stealth Coating?

To stay informed about further developments, trends, and reports in the Military Stealth Coating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence