Key Insights

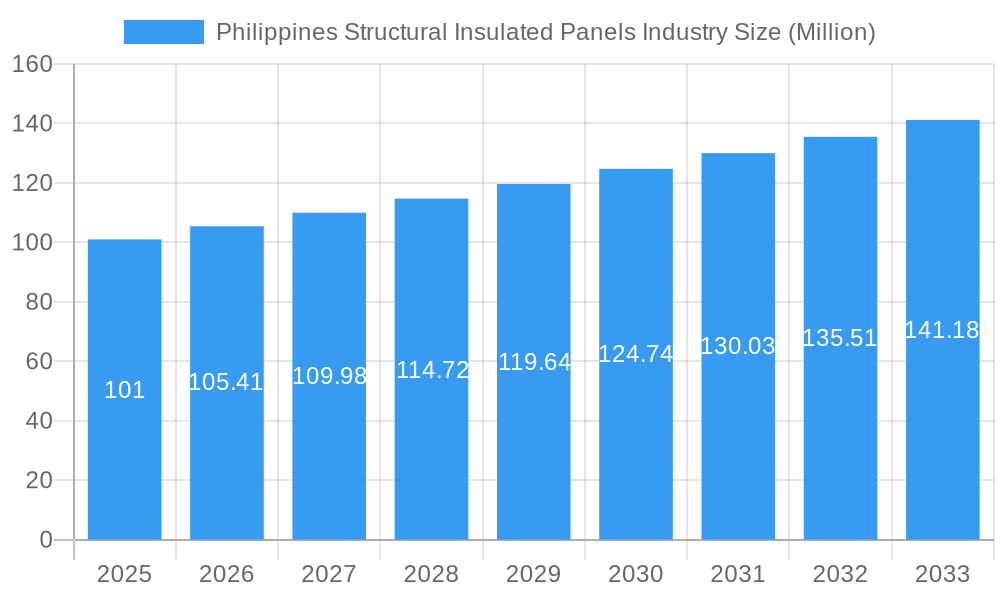

The Philippines structural insulated panels (SIPs) market, valued at $101 million in 2025, is projected to experience robust growth, exceeding a compound annual growth rate (CAGR) of 4% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for energy-efficient and sustainable building solutions in the Philippines is fueling the adoption of SIPs, which offer superior thermal performance compared to traditional construction methods. The government's initiatives promoting green building practices and stricter energy codes further bolster market growth. Secondly, the rising construction activity across residential and commercial sectors creates significant demand for faster, cost-effective, and durable building materials, advantages offered by SIPs. The ease and speed of SIP installation also contribute to reduced labor costs and project timelines, making them attractive to developers. However, the market faces some restraints, including the relatively high initial cost of SIPs compared to conventional materials and a lack of widespread awareness among builders and consumers regarding the benefits of SIPs. Nevertheless, the long-term cost savings associated with reduced energy consumption and maintenance are expected to overcome these initial barriers. Key players like ENERCON Specialty Building Systems Corporation, iSTEEL, and Kingspan Group are actively shaping the market, fostering innovation and competition.

Philippines Structural Insulated Panels Industry Market Size (In Million)

The projected market growth trajectory indicates a steady increase in market value year-on-year. The CAGR of over 4% suggests a considerable expansion in market size over the forecast period (2025-2033). While specific regional data within the Philippines is not provided, market penetration is likely to be higher in urban centers and regions with strong construction activities. Furthermore, the increasing awareness of sustainable building practices and the government's support for green building initiatives are expected to drive significant growth in the less-developed regions of the country as well. The competitive landscape features both international and domestic players, signifying a dynamic market with opportunities for both established companies and emerging players. Future growth will likely depend on effective marketing campaigns to increase awareness and address existing cost and awareness barriers.

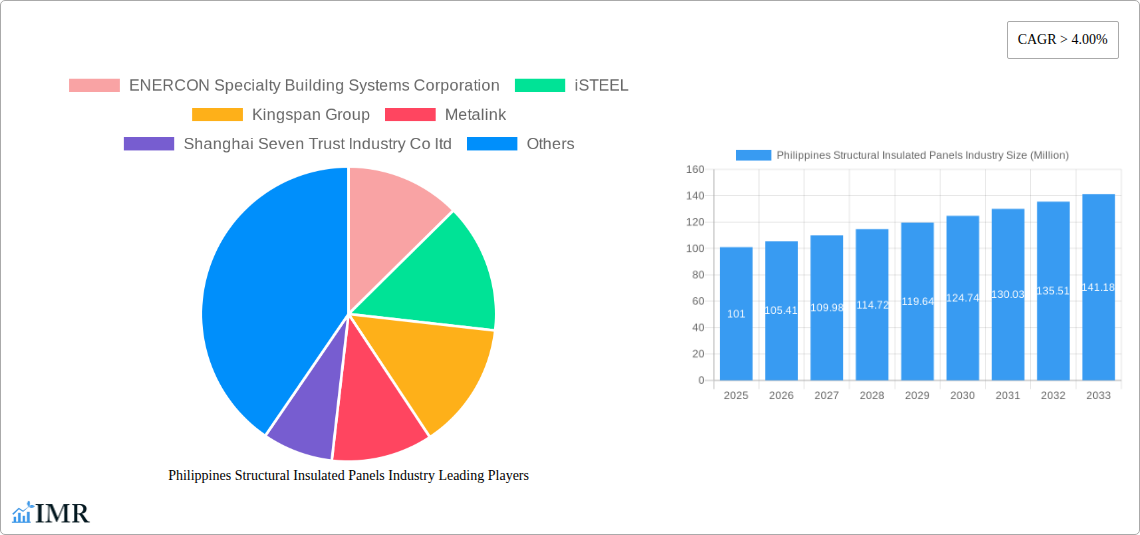

Philippines Structural Insulated Panels Industry Company Market Share

Philippines Structural Insulated Panels Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Philippines structural insulated panels (SIPs) industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report caters to industry professionals, investors, and researchers seeking a detailed understanding of this dynamic market.

Philippines Structural Insulated Panels Industry Market Dynamics & Structure

The Philippines SIPs market, valued at xx million units in 2024, exhibits a moderately concentrated structure, with several key players holding significant market share. Technological innovation, driven by the demand for energy-efficient buildings and sustainable construction practices, is a primary driver. Regulatory frameworks, such as building codes promoting energy efficiency, are influencing market growth. Competitive substitutes include traditional construction materials like concrete and brick, while emerging materials like cross-laminated timber (CLT) also pose some level of competition. The end-user demographics are primarily focused on the construction and residential sectors. M&A activity in the industry is steadily increasing, indicated by approximately xx deals in the last five years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on reduced-CO2 panels, improved insulation performance, and faster installation methods.

- Regulatory Framework: Building codes increasingly incorporate energy efficiency standards, favoring SIPs adoption.

- Competitive Substitutes: Traditional construction materials (concrete, brick), CLT.

- End-User Demographics: Primarily construction companies, residential developers, and individual homebuilders.

- M&A Trends: xx deals over the past five years, signaling industry consolidation and investment.

Philippines Structural Insulated Panels Industry Growth Trends & Insights

The Philippines SIPs market has witnessed steady growth throughout the historical period (2019-2024). Driven by increasing urbanization, rising disposable incomes, and government initiatives promoting sustainable construction, the market size expanded from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. Technological advancements, such as the introduction of lighter and more efficient panels, have accelerated adoption rates. Consumer behavior shifts towards energy-efficient and environmentally friendly building practices are bolstering market demand. The forecast period (2025-2033) projects continued growth, propelled by similar drivers, with an estimated market size of xx million units in 2033 and a projected CAGR of xx%.

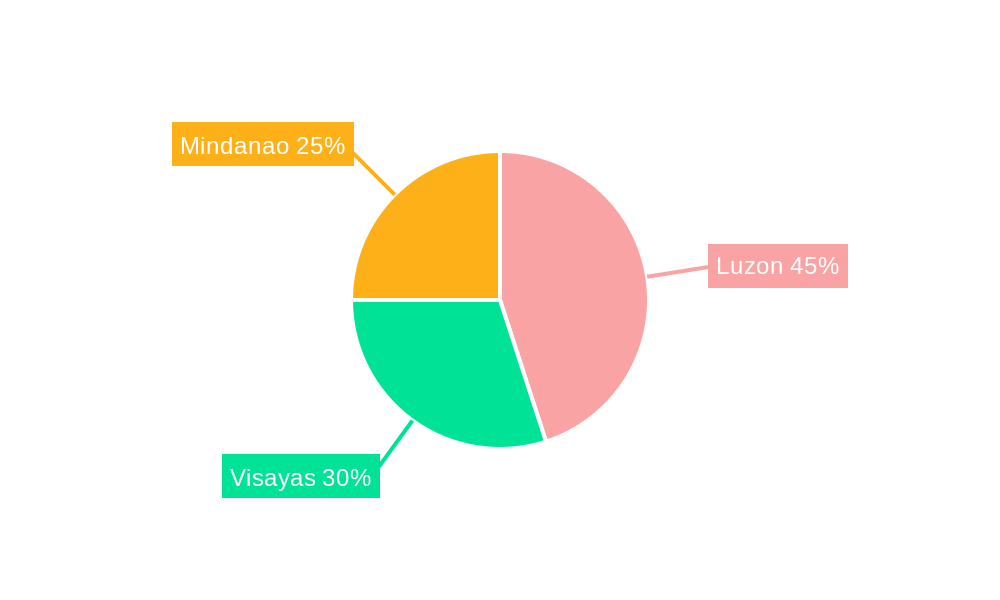

Dominant Regions, Countries, or Segments in Philippines Structural Insulated Panels Industry

The National Capital Region (NCR) and other major urban centers are leading the Philippines SIPs market growth. This dominance stems from higher construction activity, greater awareness of energy efficiency, and the presence of a large concentration of developers and construction firms. Governmental infrastructural projects and investments in green building initiatives are further stimulating market expansion in these regions. The residential segment is the largest contributor to overall demand, driven by the increasing preference for energy-efficient homes.

- Key Drivers (NCR and major urban centers): High construction activity, strong developer presence, government infrastructure investments, and growing awareness of energy-efficient buildings.

- Dominance Factors: Higher concentration of construction projects, significant investment in real estate development, and robust government support for sustainable construction.

- Growth Potential: Continued urbanization, increasing disposable income, and sustained infrastructure investment contribute to substantial growth potential.

Philippines Structural Insulated Panels Industry Product Landscape

The Philippines SIPs market offers a range of products varying in core material (polyisocyanurate, polyurethane, etc.), thickness, and performance characteristics. Recent innovations include reduced-CO2 panels and panels with enhanced insulation properties. These advancements improve energy efficiency and reduce the environmental footprint of buildings. Key selling propositions include faster construction times, improved energy efficiency, reduced labor costs, and superior durability compared to traditional construction methods.

Key Drivers, Barriers & Challenges in Philippines Structural Insulated Panels Industry

Key Drivers:

- Growing demand for energy-efficient buildings.

- Government initiatives promoting sustainable construction.

- Increasing urbanization and infrastructure development.

- Rising disposable incomes and improving living standards.

Key Barriers & Challenges:

- High initial cost compared to traditional materials.

- Limited awareness and knowledge of SIPs among builders and consumers.

- Potential supply chain disruptions and material cost fluctuations.

- Lack of skilled labor experienced in SIP installation.

Emerging Opportunities in Philippines Structural Insulated Panels Industry

Emerging opportunities lie in expanding SIP applications beyond residential construction to include commercial and industrial buildings, as well as in leveraging innovative manufacturing techniques to reduce production costs. Untapped markets in rural areas present significant growth potential. Exploring collaborations with architectural firms to showcase SIPs' design flexibility could also drive adoption.

Growth Accelerators in the Philippines Structural Insulated Panels Industry

Long-term growth will be fueled by technological advancements in panel design and manufacturing processes, leading to further cost reductions and performance improvements. Strategic partnerships between SIP manufacturers and construction companies, coupled with targeted marketing campaigns to increase consumer awareness, will be crucial for driving market expansion. Government incentives and policies supporting green building initiatives will play a significant role.

Key Players Shaping the Philippines Structural Insulated Panels Industry Market

- ENERCON Specialty Building Systems Corporation

- iSTEEL

- Kingspan Group

- Metalink

- Shanghai Seven Trust Industry Co ltd

- SUPERSONIC MANUFACTURING INC

- Ultra Insulated Panel Systems Corporation (UIPSC)

- Union Galvasteel Corporation

- VBLLU INC

- List Not Exhaustive

Notable Milestones in Philippines Structural Insulated Panels Industry Sector

- July 2022: ENERCON Specialty Building Systems Corporation established an agreement with DNB Bank ASA for the construction of a wind farm (Note: This event is indirectly related to the SIPs market, impacting the overall energy sector and potentially creating positive externalities).

- October 2022: Kingspan Group acquired Invespanel, expanding its product portfolio and market reach within the insulation panel sector.

- January 2023: Kingspan Group launched QuadCore LEC panels, offering reduced-CO2 insulation solutions, enhancing its competitiveness and appealing to environmentally conscious customers.

In-Depth Philippines Structural Insulated Panels Industry Market Outlook

The Philippines SIPs market presents substantial future potential, driven by consistent urbanization, rising construction activity, and a growing focus on sustainable building practices. Strategic opportunities exist for companies to capitalize on market expansion by focusing on technological innovation, enhancing supply chain efficiency, and increasing consumer awareness through targeted marketing initiatives. Further growth is anticipated through government support for green building programs and the continued adoption of SIPs in diverse construction sectors.

Philippines Structural Insulated Panels Industry Segmentation

-

1. Product

- 1.1. Expanded Polystyrene (EPS) Panels

- 1.2. Rigid Po

- 1.3. Glass Wool Panels

- 1.4. Other Products

-

2. Application

- 2.1. Building Wall

- 2.2. Building Roof

- 2.3. Cold Storage

Philippines Structural Insulated Panels Industry Segmentation By Geography

- 1. Philippines

Philippines Structural Insulated Panels Industry Regional Market Share

Geographic Coverage of Philippines Structural Insulated Panels Industry

Philippines Structural Insulated Panels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from the Construction Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand for EPS Panels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Structural Insulated Panels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Expanded Polystyrene (EPS) Panels

- 5.1.2. Rigid Po

- 5.1.3. Glass Wool Panels

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Building Wall

- 5.2.2. Building Roof

- 5.2.3. Cold Storage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ENERCON Specialty Building Systems Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 iSTEEL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kingspan Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Metalink

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shanghai Seven Trust Industry Co ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUPERSONIC MANUFACTURING INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ultra Insulated Panel Systems Corporation (UIPSC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Union Galvasteel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VBLLU INC *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ENERCON Specialty Building Systems Corporation

List of Figures

- Figure 1: Philippines Structural Insulated Panels Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Structural Insulated Panels Industry Share (%) by Company 2025

List of Tables

- Table 1: Philippines Structural Insulated Panels Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Philippines Structural Insulated Panels Industry Volume Million Forecast, by Product 2020 & 2033

- Table 3: Philippines Structural Insulated Panels Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Philippines Structural Insulated Panels Industry Volume Million Forecast, by Application 2020 & 2033

- Table 5: Philippines Structural Insulated Panels Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Philippines Structural Insulated Panels Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: Philippines Structural Insulated Panels Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Philippines Structural Insulated Panels Industry Volume Million Forecast, by Product 2020 & 2033

- Table 9: Philippines Structural Insulated Panels Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Philippines Structural Insulated Panels Industry Volume Million Forecast, by Application 2020 & 2033

- Table 11: Philippines Structural Insulated Panels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Philippines Structural Insulated Panels Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Structural Insulated Panels Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Philippines Structural Insulated Panels Industry?

Key companies in the market include ENERCON Specialty Building Systems Corporation, iSTEEL, Kingspan Group, Metalink, Shanghai Seven Trust Industry Co ltd, SUPERSONIC MANUFACTURING INC, Ultra Insulated Panel Systems Corporation (UIPSC), Union Galvasteel Corporation, VBLLU INC *List Not Exhaustive.

3. What are the main segments of the Philippines Structural Insulated Panels Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand for EPS Panels.

7. Are there any restraints impacting market growth?

Increasing Demand from the Construction Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

January 2023: Kingspan Group launched a range of reduced-CO2 insulation panels called QuadCore LEC. The newly launched 100mm-thick QuadCore AWP panel has 40% lower embodied CO2 than an EN15804-A2 standard insulation panel of the same thickness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Structural Insulated Panels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Structural Insulated Panels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Structural Insulated Panels Industry?

To stay informed about further developments, trends, and reports in the Philippines Structural Insulated Panels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence