Key Insights

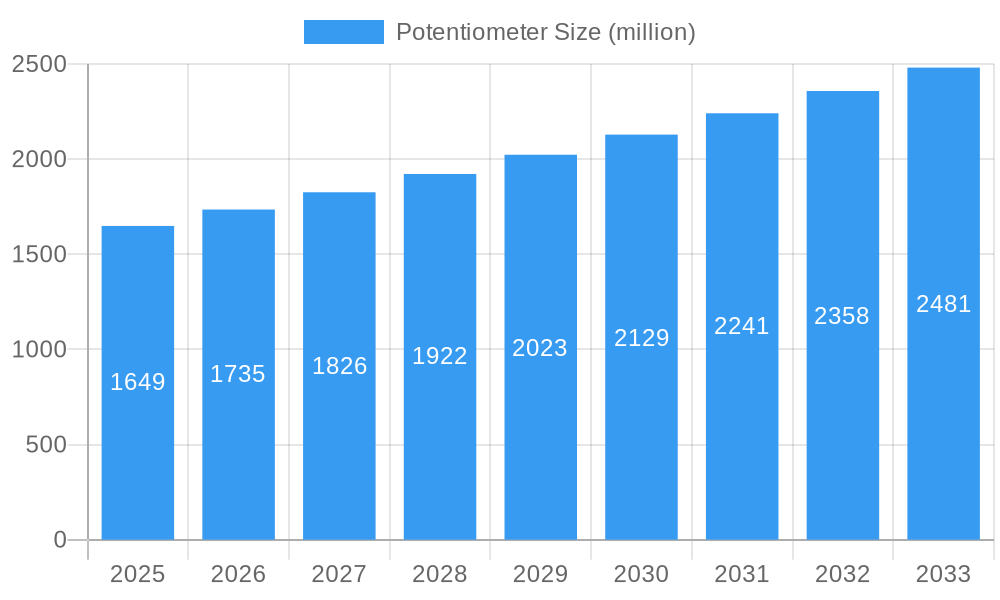

The global potentiometer market is projected to reach a substantial $1,649 million in 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of 5.2% over the forecast period from 2025 to 2033. This expansion is primarily driven by the increasing demand from key application sectors such as home appliances, where advanced control and user interface functionalities are becoming standard. The automotive industry is another significant contributor, fueled by the proliferation of electronic systems for advanced driver-assistance systems (ADAS), infotainment, and powertrain control. Industrial applications, encompassing automation, robotics, and process control, continue to be a steady source of demand as industries embrace digital transformation and smart manufacturing. The market is segmented by type into rotary and linear potentiometers, each catering to specific control needs across these diverse applications.

Potentiometer Market Size (In Billion)

Emerging trends like the miniaturization of electronic components and the integration of smart features are shaping the potentiometer market. The growing adoption of IoT devices and the increasing complexity of consumer electronics necessitate precise and reliable control components, positioning potentiometers as crucial elements in product design. While the market enjoys strong growth drivers, certain restraints such as the increasing competition from digital encoders and the price sensitivity in some high-volume applications could temper absolute growth rates. However, ongoing innovation in materials, manufacturing processes, and the development of specialized potentiometers for high-performance applications are expected to mitigate these challenges, ensuring continued market vitality and a positive outlook for potentiometer manufacturers and suppliers worldwide.

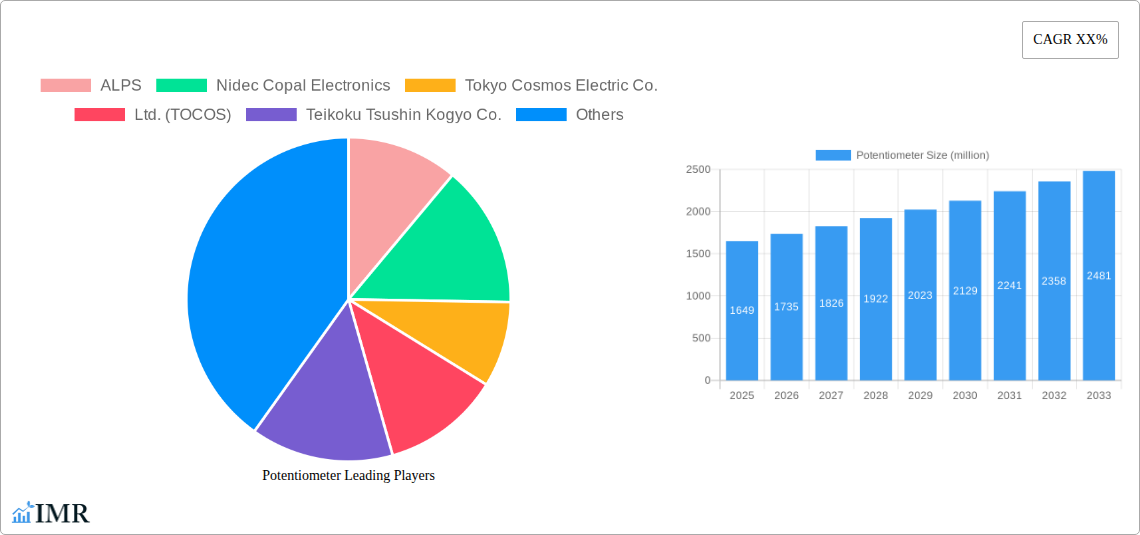

Potentiometer Company Market Share

Potentiometer Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the global potentiometer market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and a detailed outlook. Designed for industry professionals, investors, and decision-makers, this report provides actionable insights and quantitative data, leveraging high-traffic keywords to maximize search engine visibility. The report focuses on the parent market and its child segments, offering a granular understanding of market penetration and evolution. All values are presented in million units.

Potentiometer Market Dynamics & Structure

The global potentiometer market is characterized by a moderate level of concentration, with key players like ALPS, Nidec Copal Electronics, Tokyo Cosmos Electric Co.,Ltd. (TOCOS), Teikoku Tsushin Kogyo Co.,Ltd (NOBLE), Panasonic, and Bourns, Inc. holding significant market shares. Technological innovation remains a primary driver, fueled by the increasing demand for sophisticated control systems in consumer electronics, automotive, and industrial automation. Advancements in materials, such as carbon film and conductive plastic potentiometers, are enhancing performance and durability. Regulatory frameworks, while generally supportive of technological advancement, can influence product design and manufacturing standards, particularly concerning environmental compliance and safety. Competitive product substitutes, including encoders and solid-state switches, pose a threat, especially in applications requiring high precision or digital control. End-user demographics are shifting towards a greater demand for user-friendly interfaces and integrated control solutions. Mergers and acquisitions (M&A) activity, though not consistently high, has been observed as companies seek to expand their product portfolios and geographical reach. For instance, TT Electronics’ acquisition of Optek broadened its sensor and control offerings, impacting market structure. Innovation barriers include the high cost of research and development for novel materials and miniaturization, as well as the established dominance of traditional potentiometer technologies in certain legacy applications.

- Market Concentration: Moderate, with a few key global players dominating.

- Technological Innovation Drivers: Miniaturization, improved linearity, enhanced durability, and integration capabilities.

- Regulatory Frameworks: Focus on RoHS compliance, REACH regulations, and automotive-specific standards.

- Competitive Product Substitutes: Encoders, touch sensors, and solid-state switches.

- End-User Demographics: Increasing demand from IoT devices, advanced driver-assistance systems (ADAS), and smart home applications.

- M&A Trends: Strategic acquisitions for portfolio expansion and market access. For example, the acquisition of specific sensor divisions by larger electronics conglomerates.

Potentiometer Growth Trends & Insights

The global potentiometer market has witnessed consistent growth over the historical period (2019-2024), driven by the ubiquitous need for variable resistance control across a multitude of applications. The base year, 2025, is estimated to represent a significant point in this growth trajectory, with the market poised for sustained expansion throughout the forecast period (2025-2033). The compound annual growth rate (CAGR) is projected to be robust, fueled by increasing adoption rates in emerging economies and the continuous evolution of existing end-use industries. Technological disruptions, while introducing alternatives, have also spurred innovation within the potentiometer sector, leading to the development of more specialized and efficient devices. For instance, the integration of potentiometers into smart devices and the Internet of Things (IoT) ecosystem has opened new avenues for growth. Consumer behavior shifts, such as the demand for intuitive user interfaces and personalized control in home appliances and automotive infotainment systems, further propel the market. The market penetration of advanced potentiometer types, like multi-turn and sealed rotary potentiometers, is on the rise, catering to industries with stringent performance requirements. The market size is projected to reach approximately $3,800 million by 2025, with an estimated growth rate that will see it exceed $5,500 million by 2033. Adoption rates are particularly high in the automotive sector for applications like climate control, seat adjustment, and throttle position sensing. In the industrial segment, their role in motor speed control, automation systems, and instrumentation remains critical, contributing significantly to market volume. The "Others" segment, encompassing medical devices, audio equipment, and scientific instrumentation, also demonstrates steady growth due to the irreplaceable nature of precise analog control in these fields. The continuous miniaturization of electronic devices is a key trend driving the demand for smaller and more integrated potentiometers.

Dominant Regions, Countries, or Segments in Potentiometer

The Automotive application segment is currently the most dominant force driving growth in the global potentiometer market. This supremacy is underpinned by several key factors, including stringent regulatory mandates for vehicle safety and emissions, which necessitate sophisticated control systems. The burgeoning demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and in-car infotainment systems further amplifies the need for precise and reliable potentiometers. Countries like China, the United States, and Germany, being major automotive manufacturing hubs, contribute significantly to this regional dominance. Furthermore, the increasing complexity of vehicle electronics and the trend towards autonomous driving are creating a sustained demand for high-performance potentiometers that can withstand harsh operating environments and offer precise analog feedback.

Key Drivers in Automotive:

- Increasing production of EVs and hybrid vehicles.

- Growth of ADAS features like adaptive cruise control and lane-keeping assist.

- Demand for in-car entertainment and climate control systems.

- Stringent safety and emission regulations requiring precise control.

- Development of autonomous driving technologies.

Dominance Factors:

- Market Share: The automotive segment is estimated to command approximately 35% of the total potentiometer market share by 2025.

- Growth Potential: Projected to exhibit a CAGR of around 7.5% over the forecast period, outpacing other segments.

- Technological Integration: Potentiometers are integral to various automotive subsystems, from engine management to user interface controls.

- Economic Policies: Government incentives for EV adoption and automotive manufacturing drive demand.

- Infrastructure Development: Investment in automotive R&D and manufacturing facilities.

While Automotive leads, the Industrial segment remains a strong contender, driven by automation and smart factory initiatives. The Home Appliances segment also shows consistent growth due to the proliferation of smart home devices and the need for intuitive controls. In terms of Types, Rotary Potentiometers continue to hold a larger market share due to their widespread application in volume control, adjustable settings, and sensor applications, though Linear Potentiometers are gaining traction in precision instrumentation and medical devices.

Potentiometer Product Landscape

The potentiometer product landscape is evolving with a focus on enhanced performance, miniaturization, and integration. Innovations include sealed potentiometers offering superior environmental resistance for industrial and automotive applications, and multi-turn potentiometers providing higher resolution and precision for instrumentation. Conductive plastic and cermet elements are gaining prominence for their durability and stability over carbon-based materials. The unique selling proposition of potentiometers lies in their direct, analog control capability, offering a simple yet effective method for adjusting voltage or resistance. Technological advancements are also leading to potentiometers with integrated switches, reduced noise levels, and extended operational lifespans, making them indispensable in applications ranging from high-fidelity audio equipment to critical medical devices and sophisticated industrial control systems.

Key Drivers, Barriers & Challenges in Potentiometer

Key Drivers:

- Increasing Demand for Automation: The global push for industrial automation and smart manufacturing directly fuels the need for precise control components like potentiometers in robotics, PLCs, and HMI devices.

- Growth in Automotive Electronics: The rising complexity and feature set in vehicles, including ADAS, infotainment, and EV powertrains, require a significant number of potentiometers for various control functions.

- Consumer Electronics Miniaturization: The ongoing trend towards smaller and more integrated consumer devices necessitates compact and high-performance potentiometers.

- IoT Expansion: The proliferation of connected devices in smart homes, healthcare, and industrial settings creates new applications for variable resistance control.

Barriers & Challenges:

- Competition from Digital Alternatives: Encoders, digital potentiometers, and touch-based interfaces are increasingly substituting traditional potentiometers in certain applications where digital precision or advanced features are paramount.

- Supply Chain Volatility: Fluctuations in the availability and cost of raw materials, such as carbon, plastic resins, and metals, can impact production costs and lead times. The global supply chain disruptions have highlighted this vulnerability.

- Technological Obsolescence: In rapidly evolving sectors, the risk of a potentiometer design becoming obsolete due to new technological paradigms is a constant concern.

- Cost Pressures: Intense competition often leads to price pressures, requiring manufacturers to optimize production processes and material sourcing to maintain profitability. For example, the cost of specialized conductive polymers can impact overall pricing.

- Environmental Regulations: Increasing stringent environmental regulations, such as RoHS and REACH, necessitate adherence to material restrictions and lead to higher compliance costs.

Emerging Opportunities in Potentiometer

Emerging opportunities in the potentiometer market are largely driven by advancements in the Internet of Things (IoT) and the growing demand for personalized and intuitive user interfaces. The development of smart sensors and connected devices in the healthcare sector, for instance, presents a significant untapped market for specialized potentiometers used in diagnostic equipment and wearable health monitors. The continued expansion of the electric vehicle (EV) market, with its complex battery management systems and advanced charging infrastructure, offers substantial growth potential for high-reliability potentiometers. Furthermore, the burgeoning market for augmented reality (AR) and virtual reality (VR) devices requires precise analog input for immersive experiences, opening new application frontiers. The demand for robust and environmentally sealed potentiometers in harsh industrial settings and outdoor applications also represents a growing niche.

Growth Accelerators in the Potentiometer Industry

Several catalysts are accelerating growth in the potentiometer industry. Technological breakthroughs in materials science, leading to the development of more durable, precise, and miniaturized potentiometers, are a primary accelerator. Strategic partnerships between potentiometer manufacturers and leading electronics companies, particularly in the automotive and consumer electronics sectors, facilitate market penetration and the co-development of innovative solutions. The increasing adoption of Industry 4.0 principles and the rise of smart manufacturing environments are creating a sustained demand for automation components, including potentiometers. Furthermore, market expansion strategies by key players into emerging economies, where industrialization and consumer electronics adoption are rapidly increasing, are significant growth drivers. The growing trend towards customizable solutions and integrated electronic modules further boosts the need for adaptable potentiometer designs.

Key Players Shaping the Potentiometer Market

- ALPS

- Nidec Copal Electronics

- Tokyo Cosmos Electric Co.,Ltd. (TOCOS)

- Teikoku Tsushin Kogyo Co.,Ltd (NOBLE)

- Panasonic

- Sakae Tsushin Kogyo Co.,Ltd

- Bourns, Inc

- Vishay

- TT Electronics

- Honeywell

- CTS Corporation

- ABB

- Siemens

- TE Connectivity

- Taiwan Alpha Electronic

- Forward Electronics Co

- Song Huei Electric Co.,Ltd

- Hohner Automaticos

- Elap Srl

- Omeg Limited

- Chengdu Hongming Electronics Co Ltd

- Everson Technology Ltd

Notable Milestones in Potentiometer Sector

- 2019: Introduction of new series of miniature rotary potentiometers with improved sealing for automotive applications by ALPS.

- 2020: Nidec Copal Electronics launches a range of high-precision digital potentiometers for industrial automation, enhancing control capabilities.

- 2021: Bourns, Inc. announces expansion of its sensor product line, including potentiometers for EV battery management systems.

- 2022: Panasonic develops advanced conductive plastic potentiometers with extended lifespan for consumer electronics.

- 2023: TE Connectivity introduces a new line of ruggedized linear potentiometers designed for harsh environments in industrial machinery.

- 2024 (Q1): Vishay expands its portfolio of through-hole and surface-mount potentiometers to meet increasing demand in audio and medical devices.

- 2024 (Q2): TT Electronics completes the acquisition of a specialized sensor manufacturer, strengthening its presence in the automotive sector.

In-Depth Potentiometer Market Outlook

The future of the potentiometer market is characterized by robust growth, driven by the relentless march of technological innovation and the expanding applications across diverse industries. The increasing demand for sophisticated control systems in automotive, industrial automation, and consumer electronics will continue to be a primary growth accelerator. Emerging opportunities in the IoT, healthcare, and renewable energy sectors present significant untapped potential. Strategic partnerships, focus on miniaturization, enhanced performance, and sustainability in manufacturing will be key for companies to thrive. The market is expected to see continued evolution with the integration of smart functionalities and improved digital interfaces, alongside the enduring demand for reliable analog control.

Potentiometer Segmentation

-

1. Application

- 1.1. Home Appliances

- 1.2. Industrial

- 1.3. Automotive

- 1.4. Others

-

2. Types

- 2.1. Rotary Potentiometer

- 2.2. Linear Potentiometer

Potentiometer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

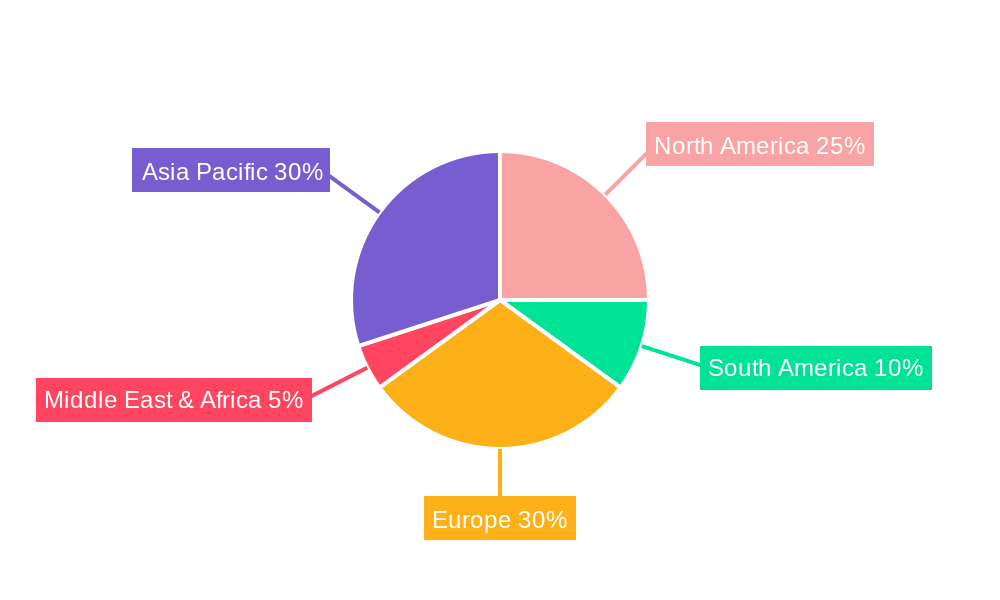

Potentiometer Regional Market Share

Geographic Coverage of Potentiometer

Potentiometer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Potentiometer Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Appliances

- 5.1.2. Industrial

- 5.1.3. Automotive

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Rotary Potentiometer

- 5.2.2. Linear Potentiometer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Potentiometer Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home Appliances

- 6.1.2. Industrial

- 6.1.3. Automotive

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Rotary Potentiometer

- 6.2.2. Linear Potentiometer

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Potentiometer Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home Appliances

- 7.1.2. Industrial

- 7.1.3. Automotive

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Rotary Potentiometer

- 7.2.2. Linear Potentiometer

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Potentiometer Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home Appliances

- 8.1.2. Industrial

- 8.1.3. Automotive

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Rotary Potentiometer

- 8.2.2. Linear Potentiometer

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Potentiometer Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home Appliances

- 9.1.2. Industrial

- 9.1.3. Automotive

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Rotary Potentiometer

- 9.2.2. Linear Potentiometer

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Potentiometer Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home Appliances

- 10.1.2. Industrial

- 10.1.3. Automotive

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Rotary Potentiometer

- 10.2.2. Linear Potentiometer

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ALPS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nidec Copal Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tokyo Cosmos Electric Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd. (TOCOS)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teikoku Tsushin Kogyo Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ltd (NOBLE)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Panasonic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sakae Tsushin Kogyo Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bourns

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vishay

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TT Electronics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Honeywell

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CTS Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ABB

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Siemens

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 TE Connectivity

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Taiwan Alpha Electronic

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Forward Electronics Co

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Song Huei Electric Co.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Ltd

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Hohner Automaticos

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Elap Srl

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Omeg Limited

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Chengdu Hongming Electronics Co Ltd

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Everson Technology Ltd

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 ALPS

List of Figures

- Figure 1: Global Potentiometer Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Potentiometer Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Potentiometer Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Potentiometer Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Potentiometer Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Potentiometer Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Potentiometer Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Potentiometer Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Potentiometer Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Potentiometer Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Potentiometer Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Potentiometer Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Potentiometer Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Potentiometer Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Potentiometer Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Potentiometer Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Potentiometer Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Potentiometer Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Potentiometer Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Potentiometer Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Potentiometer Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Potentiometer Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Potentiometer Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Potentiometer Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Potentiometer Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Potentiometer Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Potentiometer Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Potentiometer Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Potentiometer Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Potentiometer Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Potentiometer Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Potentiometer Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Potentiometer Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Potentiometer Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Potentiometer Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Potentiometer Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Potentiometer Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Potentiometer Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Potentiometer Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Potentiometer Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Potentiometer Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Potentiometer Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Potentiometer Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Potentiometer Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Potentiometer Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Potentiometer Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Potentiometer Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Potentiometer Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Potentiometer Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Potentiometer Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Potentiometer?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Potentiometer?

Key companies in the market include ALPS, Nidec Copal Electronics, Tokyo Cosmos Electric Co., Ltd. (TOCOS), Teikoku Tsushin Kogyo Co., Ltd (NOBLE), Panasonic, Sakae Tsushin Kogyo Co., Ltd, Bourns, Inc, Vishay, TT Electronics, Honeywell, CTS Corporation, ABB, Siemens, TE Connectivity, Taiwan Alpha Electronic, Forward Electronics Co, Song Huei Electric Co., Ltd, Hohner Automaticos, Elap Srl, Omeg Limited, Chengdu Hongming Electronics Co Ltd, Everson Technology Ltd.

3. What are the main segments of the Potentiometer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Potentiometer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Potentiometer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Potentiometer?

To stay informed about further developments, trends, and reports in the Potentiometer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence