Key Insights

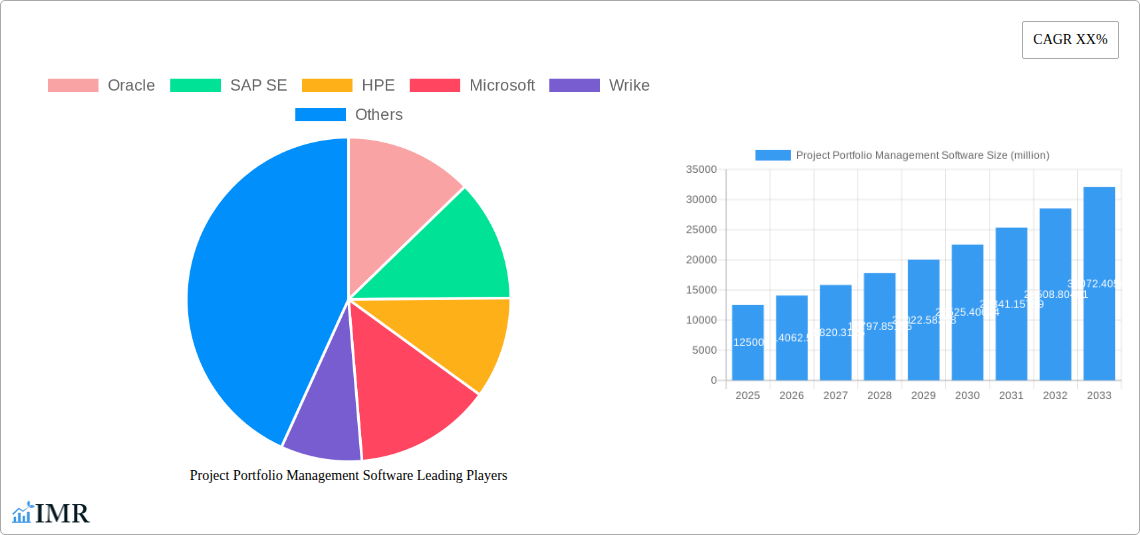

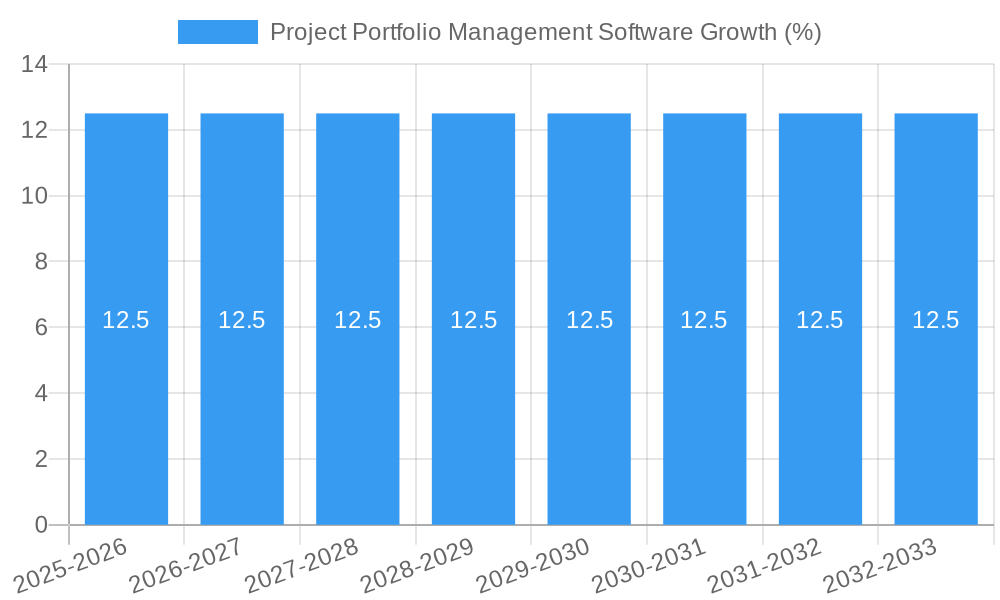

The global Project Portfolio Management (PPM) software market is experiencing robust expansion, projected to reach a substantial market size of USD 12,500 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025-2033. This significant growth is primarily fueled by the increasing need for organizations to effectively manage complex projects, optimize resource allocation, and align strategic objectives with operational execution. The digital transformation initiatives across various industries, coupled with the growing adoption of agile methodologies, are creating a fertile ground for PPM solutions. Businesses are increasingly recognizing the critical role of PPM in improving decision-making, mitigating risks, and enhancing overall project success rates.

Key drivers behind this market surge include the escalating demand for enhanced visibility and control over project portfolios, especially in sectors like BFSI, Construction and Infrastructure, and Information Technology. The rise of remote and hybrid work models further accentuates the need for collaborative PPM tools to ensure seamless project execution and stakeholder communication. While the market is characterized by the presence of established players like Oracle and SAP SE, alongside innovative disruptors such as Monday.com and Atlassian, the competitive landscape is dynamic. Emerging trends like the integration of AI and machine learning for predictive analytics, advanced resource management capabilities, and cloud-based deployment models are shaping the future of PPM software. However, challenges such as the high initial implementation costs and the need for extensive user training could pose some restraints, although the long-term benefits of improved project outcomes are largely outweighing these concerns.

Project Portfolio Management Software Market Dynamics & Structure

The global Project Portfolio Management (PPM) software market is characterized by a dynamic interplay of intense competition and strategic innovation, driven by the increasing need for organizations to optimize resource allocation and project success rates across diverse industries. The market concentration is moderate, with a mix of established enterprise players and agile SaaS providers vying for market share. Technological innovation remains a paramount driver, with a steady stream of advancements in areas like AI-powered analytics, real-time collaboration, and predictive forecasting aimed at enhancing decision-making capabilities. Regulatory frameworks, while generally permissive, are evolving to address data security and privacy concerns, particularly within the BFSI and Healthcare sectors, influencing the adoption of cloud-based solutions. Competitive product substitutes, though present in the form of generic project management tools, are increasingly being differentiated by the sophisticated portfolio-level insights offered by dedicated PPM software. End-user demographics are shifting, with a growing demand from mid-sized enterprises and even smaller businesses recognizing the value of structured project management. Mergers and acquisitions (M&A) trends are active, as larger entities seek to acquire innovative technologies or expand their customer base, reinforcing market consolidation. For instance, the volume of M&A deals in the broader enterprise software space, which often includes PPM, has been on an upward trajectory.

- Market Concentration: Moderate, with key players like Oracle, SAP SE, Microsoft, and Adobe (through Workfront) holding significant influence, alongside rising SaaS vendors like Monday.com, Wrike, and Atlassian.

- Technological Innovation Drivers: AI/ML for predictive analytics, enhanced collaboration features, integration with other business systems, and improved user experience.

- Regulatory Frameworks: Growing emphasis on data privacy (GDPR, CCPA) and industry-specific compliance requirements (e.g., HIPAA for Healthcare).

- Competitive Product Substitutes: Standalone project management tools, spreadsheets, and custom-built solutions pose a threat but lack comprehensive portfolio-level capabilities.

- End-User Demographics: Expanding from large enterprises to mid-market and SMBs across IT, BFSI, and Healthcare.

- M&A Trends: Continued consolidation as larger players acquire niche PPM capabilities or expand their suite offerings.

Project Portfolio Management Software Growth Trends & Insights

The Project Portfolio Management (PPM) software market is poised for substantial growth, driven by an escalating demand for enhanced operational efficiency and strategic alignment across organizations. The global market size is projected to expand significantly from an estimated value of $xx million in 2025 to reach an impressive $xx million by the end of 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This upward trajectory is fueled by an increasing adoption rate of PPM solutions, moving beyond traditional enterprise resource planning (ERP) systems to specialized tools that offer deeper insights into project performance and resource utilization. Technological disruptions are playing a pivotal role, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities transforming how project portfolios are managed. AI-powered analytics are enabling predictive forecasting, risk assessment, and optimized resource allocation, thereby minimizing project overruns and improving success rates.

Consumer behavior shifts are also contributing to this growth. Organizations are increasingly prioritizing agile methodologies and looking for software that supports flexible project execution and real-time collaboration. The rise of remote and hybrid work models has further amplified the need for cloud-based PPM solutions that offer accessibility and seamless collaboration across distributed teams. Market penetration is deepening as more industries recognize the strategic imperative of effective PPM. From BFSI institutions optimizing investment portfolios to construction firms managing large-scale infrastructure projects, the demand for robust PPM software is becoming ubiquitous. Furthermore, the ongoing digital transformation initiatives across various sectors are necessitating sophisticated tools to manage the complex web of projects involved. The shift from on-premise to cloud-based solutions is a dominant trend, offering scalability, reduced IT overhead, and faster deployment. This evolution in adoption rates and technological integration underpins the optimistic growth outlook for the PPM software market.

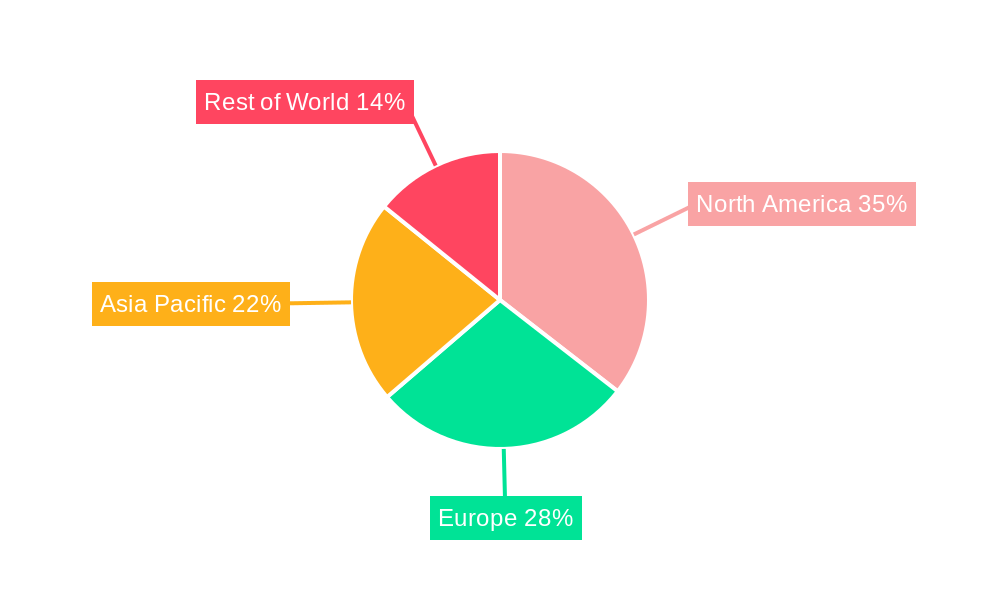

Dominant Regions, Countries, or Segments in Project Portfolio Management Software

The global Project Portfolio Management (PPM) software market is experiencing dynamic growth, with the Information and Technology (IT) segment consistently emerging as a dominant force driving expansion. This dominance is intrinsically linked to the inherent complexity and high volume of projects undertaken within the IT sector, ranging from software development and system integrations to digital transformation initiatives. Organizations in the IT industry rely heavily on PPM tools to manage intricate project lifecycles, allocate scarce technical resources effectively, and ensure alignment with overarching business strategies. The rapid pace of technological innovation in IT necessitates agile project management, making advanced PPM solutions indispensable. Market share within this segment is substantial, accounting for an estimated xx% of the total PPM software market in 2025, with projections indicating continued robust growth through 2033.

Cloud-based PPM solutions are concurrently exhibiting significant dominance across all application segments, including IT. This preference for cloud deployment is driven by its inherent scalability, cost-effectiveness, and the ease with which it facilitates remote collaboration, a critical factor in today's distributed work environments. The adoption of cloud-based PPM software in the IT sector is expected to reach xx% by 2025. Key drivers behind this regional and segmental dominance include strong economic policies fostering innovation and digital adoption, particularly in North America and Western Europe, which represent the largest regional markets. Infrastructure development, a key driver for the Construction and Infrastructure segment, is also bolstered by efficient PPM software.

- Dominant Application Segment: Information and Technology (IT)

- Key Drivers: High volume of complex projects, need for agile development, digital transformation initiatives, and resource optimization.

- Market Share (2025): xx%

- Growth Potential: Strong, driven by continuous innovation and evolving IT landscapes.

- Dominant Type of Solution: Cloud-based

- Key Drivers: Scalability, cost-efficiency, remote collaboration capabilities, faster deployment, and reduced IT overhead.

- Market Penetration (IT Segment, 2025): xx%

- Growth Potential: High, as organizations increasingly favor subscription-based models and flexible access.

- Leading Regions (Examples): North America and Europe

- Dominance Factors: High adoption of advanced technologies, robust IT infrastructure, strong presence of enterprises, and supportive economic policies.

- Market Share (Regional): North America xx%, Europe xx% (estimated 2025).

Project Portfolio Management Software Product Landscape

The Project Portfolio Management (PPM) software product landscape is characterized by continuous innovation focused on enhancing user experience and delivering actionable insights. Leading vendors are integrating advanced AI and machine learning capabilities to provide predictive analytics, risk assessments, and intelligent resource allocation. Product innovations often revolve around streamlining workflows, improving real-time collaboration across geographically dispersed teams, and offering seamless integration with existing enterprise systems like CRM, ERP, and development tools. Performance metrics are increasingly being tracked through customizable dashboards and real-time reporting, allowing stakeholders to monitor project health, budget adherence, and ROI with unprecedented clarity. Unique selling propositions often lie in the software's ability to provide a consolidated view of all projects, enabling strategic decision-making and ensuring alignment with organizational objectives. For example, Workfront (Adobe) emphasizes its integration with creative workflows, while Atlassian's offerings cater to software development teams.

Key Drivers, Barriers & Challenges in Project Portfolio Management Software

Key Drivers: The Project Portfolio Management (PPM) software market is propelled by several key drivers. The increasing complexity and number of projects within organizations necessitate sophisticated management tools to ensure successful delivery and alignment with strategic goals. Digital transformation initiatives across industries are a significant catalyst, requiring effective oversight of numerous interrelated projects. Technological advancements, particularly in AI and machine learning for predictive analytics and automation, are enhancing the capabilities of PPM software, making them more indispensable. Furthermore, the growing emphasis on agile methodologies and the need for real-time visibility into project performance and resource utilization are driving adoption.

Barriers & Challenges: Despite its growth, the PPM software market faces several barriers and challenges. The initial cost of implementation and ongoing subscription fees can be a significant barrier for smaller organizations. Resistance to change and a lack of skilled personnel to effectively utilize complex PPM tools can hinder adoption. Integration complexities with existing legacy systems often present technical hurdles. Competitive pressures from a crowded market and the availability of less sophisticated, albeit cheaper, project management tools also pose challenges. Supply chain issues are less directly impactful, but the reliance on cloud infrastructure can be indirectly affected. Regulatory hurdles, particularly around data security and privacy, require continuous compliance efforts, adding to operational overhead.

Emerging Opportunities in Project Portfolio Management Software

Emerging opportunities in the Project Portfolio Management (PPM) software sector are abundant, fueled by evolving business needs and technological advancements. The growing demand for specialized PPM solutions tailored to specific industry verticals, such as specialized offerings for the construction and infrastructure sector with its unique project complexities, presents a significant opportunity. Furthermore, the increasing adoption of AI and machine learning for advanced analytics, such as predictive risk modeling and automated resource optimization, is opening new avenues for innovation. The expansion of PPM capabilities to encompass broader strategic portfolio management, including strategic initiatives beyond traditional projects, represents another burgeoning area. The rise of hybrid work models also presents an opportunity for vendors to enhance collaboration features and develop mobile-first PPM solutions.

Growth Accelerators in the Project Portfolio Management Software Industry

Several catalysts are accelerating long-term growth in the Project Portfolio Management (PPM) software industry. Firstly, the continuous wave of digital transformation initiatives across nearly all sectors is inherently driving the need for better project oversight and strategic alignment, directly benefiting PPM adoption. Secondly, technological breakthroughs, especially in Artificial Intelligence (AI) and Machine Learning (ML), are enhancing the predictive and prescriptive capabilities of PPM tools, offering unparalleled insights into project risks, resource allocation, and ROI. Strategic partnerships between PPM software providers and other enterprise software vendors (e.g., ERP, CRM) are creating integrated ecosystems, thereby increasing the value proposition and market reach. Furthermore, the increasing global adoption of agile and hybrid work models necessitates more robust and flexible PPM solutions, acting as a significant growth accelerator.

Key Players Shaping the Project Portfolio Management Software Market

- Oracle

- SAP SE

- HPE

- Microsoft

- Wrike

- Clarizen

- Monday.com

- Atlassian

- Bubble

- Onepoint Project

- Planview

- LiquidPlanner

- Mavenlink

- Workfront (Adobe)

- Sciforma

- Sopheon

- Upland Software

- CollabNet VersionOne

Notable Milestones in Project Portfolio Management Software Sector

- 2019: Increased adoption of AI and ML in PPM for predictive analytics and risk management by leading vendors.

- 2020: Surge in demand for cloud-based PPM solutions driven by remote work and the COVID-19 pandemic.

- 2021: Significant M&A activity, with larger software companies acquiring specialized PPM providers to expand their portfolios.

- 2022: Enhanced focus on integrations with other business software (CRM, ERP) to provide a holistic view of project impact.

- 2023: Introduction of advanced collaboration features and agile project management capabilities within PPM platforms.

- 2024: Growing market penetration into mid-sized enterprises and SMBs, driven by user-friendly interfaces and scalable pricing.

In-Depth Project Portfolio Management Software Market Outlook

The Project Portfolio Management (PPM) software market outlook is exceptionally positive, driven by ongoing digital transformation and the critical need for strategic alignment and resource optimization. Growth accelerators, including AI-powered analytics, enhanced collaboration features for hybrid workforces, and strategic partnerships, will continue to fuel adoption across diverse industries. The shift towards cloud-based solutions will remain a dominant trend, offering scalability and accessibility. Emerging opportunities in specialized industry applications and advanced predictive capabilities present avenues for further innovation and market expansion. Organizations that leverage comprehensive PPM strategies will be better positioned to navigate complex project landscapes, mitigate risks, and achieve superior business outcomes, ensuring a sustained upward trajectory for the PPM software market.

Project Portfolio Management Software Segmentation

-

1. Application

- 1.1. BFSI

- 1.2. Construction and Infrastructure

- 1.3. Information and Technology

- 1.4. Healthcare

- 1.5. Other

-

2. Types

- 2.1. Cloud-based

- 2.2. On-premise

Project Portfolio Management Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Project Portfolio Management Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Project Portfolio Management Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. BFSI

- 5.1.2. Construction and Infrastructure

- 5.1.3. Information and Technology

- 5.1.4. Healthcare

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud-based

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Project Portfolio Management Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. BFSI

- 6.1.2. Construction and Infrastructure

- 6.1.3. Information and Technology

- 6.1.4. Healthcare

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud-based

- 6.2.2. On-premise

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Project Portfolio Management Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. BFSI

- 7.1.2. Construction and Infrastructure

- 7.1.3. Information and Technology

- 7.1.4. Healthcare

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud-based

- 7.2.2. On-premise

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Project Portfolio Management Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. BFSI

- 8.1.2. Construction and Infrastructure

- 8.1.3. Information and Technology

- 8.1.4. Healthcare

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud-based

- 8.2.2. On-premise

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Project Portfolio Management Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. BFSI

- 9.1.2. Construction and Infrastructure

- 9.1.3. Information and Technology

- 9.1.4. Healthcare

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud-based

- 9.2.2. On-premise

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Project Portfolio Management Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. BFSI

- 10.1.2. Construction and Infrastructure

- 10.1.3. Information and Technology

- 10.1.4. Healthcare

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud-based

- 10.2.2. On-premise

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Oracle

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SAP SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HPE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microsoft

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wrike

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Clarizen

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Monday.com

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlassian

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bubble

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Onepoint Project

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Planview

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LiquidPlanner

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mavenlink

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Workfront (Adobe)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sciforma

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sopheon

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Upland Software

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 CollabNet VersionOne

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Oracle

List of Figures

- Figure 1: Global Project Portfolio Management Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Project Portfolio Management Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Project Portfolio Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Project Portfolio Management Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Project Portfolio Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Project Portfolio Management Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Project Portfolio Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Project Portfolio Management Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Project Portfolio Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Project Portfolio Management Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Project Portfolio Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Project Portfolio Management Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Project Portfolio Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Project Portfolio Management Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Project Portfolio Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Project Portfolio Management Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Project Portfolio Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Project Portfolio Management Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Project Portfolio Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Project Portfolio Management Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Project Portfolio Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Project Portfolio Management Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Project Portfolio Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Project Portfolio Management Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Project Portfolio Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Project Portfolio Management Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Project Portfolio Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Project Portfolio Management Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Project Portfolio Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Project Portfolio Management Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Project Portfolio Management Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Project Portfolio Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Project Portfolio Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Project Portfolio Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Project Portfolio Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Project Portfolio Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Project Portfolio Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Project Portfolio Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Project Portfolio Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Project Portfolio Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Project Portfolio Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Project Portfolio Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Project Portfolio Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Project Portfolio Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Project Portfolio Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Project Portfolio Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Project Portfolio Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Project Portfolio Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Project Portfolio Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Project Portfolio Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Project Portfolio Management Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Project Portfolio Management Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Project Portfolio Management Software?

Key companies in the market include Oracle, SAP SE, HPE, Microsoft, Wrike, Clarizen, Monday.com, Atlassian, Bubble, Onepoint Project, Planview, LiquidPlanner, Mavenlink, Workfront (Adobe), Sciforma, Sopheon, Upland Software, CollabNet VersionOne.

3. What are the main segments of the Project Portfolio Management Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Project Portfolio Management Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Project Portfolio Management Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Project Portfolio Management Software?

To stay informed about further developments, trends, and reports in the Project Portfolio Management Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence