Key Insights

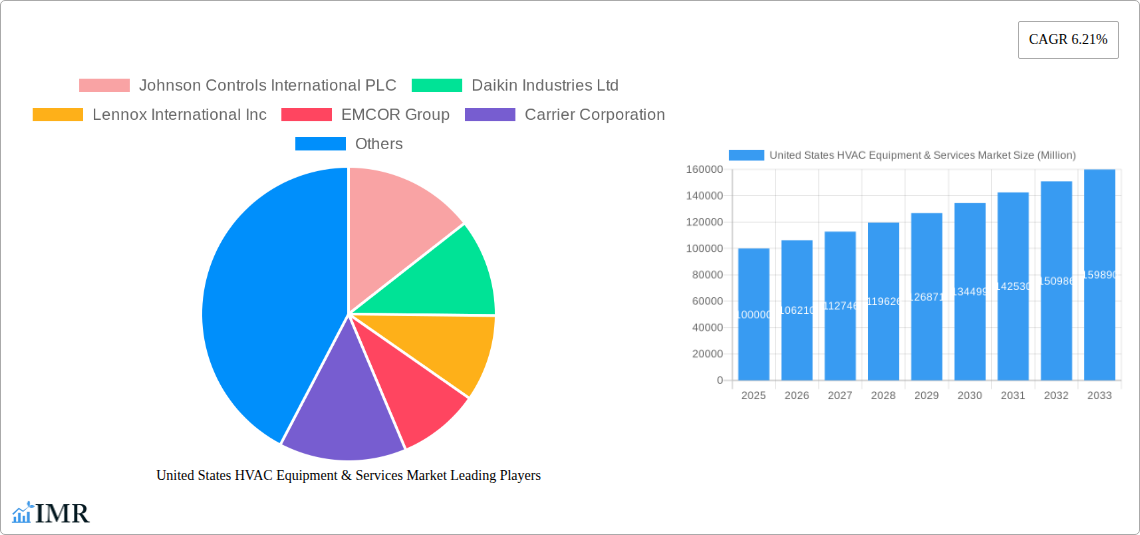

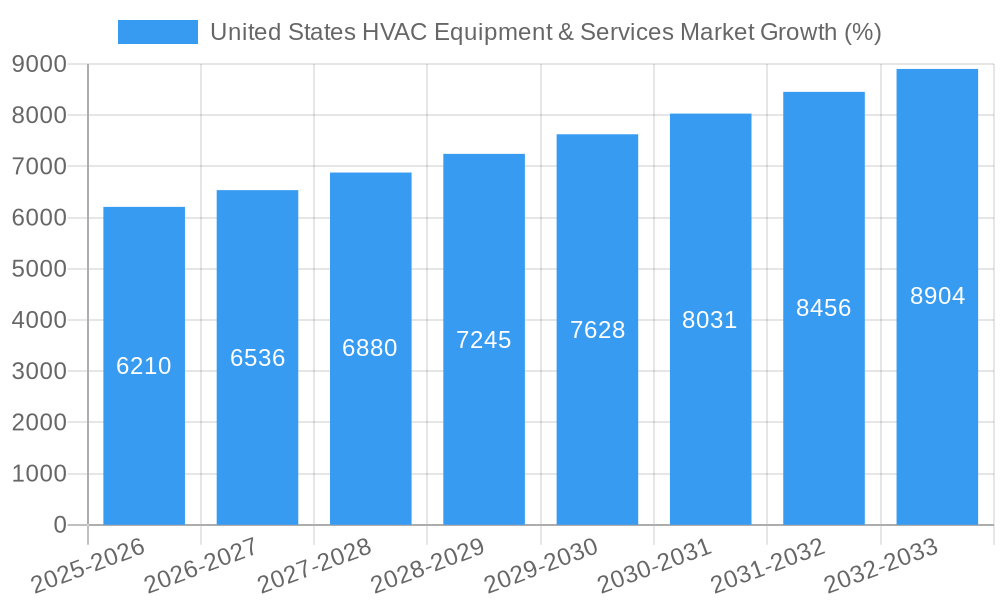

The United States HVAC (Heating, Ventilation, and Air Conditioning) Equipment & Services market is a substantial and rapidly growing sector, projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 6.21% from 2025 to 2033. This growth is fueled by several key drivers. Increasing urbanization and construction activity contribute significantly to demand for new HVAC systems. Furthermore, a rising focus on energy efficiency and sustainability, driven by government regulations and consumer awareness, is stimulating the adoption of high-efficiency equipment and smart HVAC solutions. The aging infrastructure in many existing buildings also creates a robust market for retrofits and upgrades, enhancing the overall market size. Significant technological advancements, including the integration of IoT (Internet of Things) technologies and AI-powered controls, are further propelling market expansion, offering improved energy management and enhanced user experience. Market segmentation reveals a strong demand across both residential and commercial sectors, with the commercial sector possibly holding a larger market share due to the scale of projects involved. Key players like Johnson Controls, Daikin, Lennox, and Carrier are leveraging technological innovations and strategic acquisitions to strengthen their market positions.

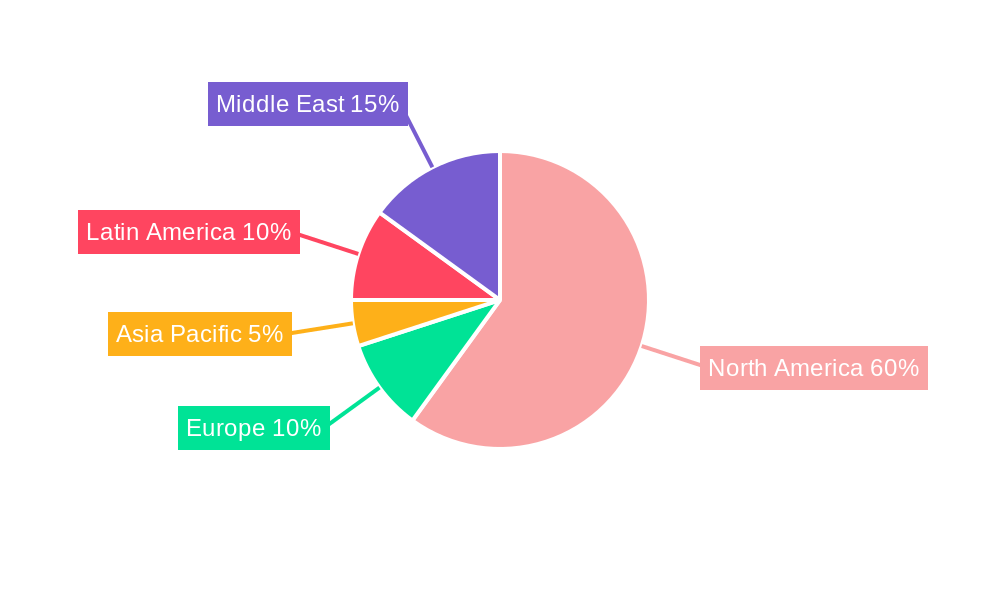

The market's growth trajectory is expected to be influenced by several factors. While increasing energy costs are likely to drive demand for energy-efficient solutions, potential economic downturns could temper investment in new installations and upgrades. Supply chain disruptions and the availability of skilled labor could also present challenges. However, the long-term outlook remains positive, driven by persistent demand for improved indoor air quality, particularly in light of increased health consciousness and the ongoing impact of the pandemic. The market segmentation by type (e.g., residential, commercial) and end-user (e.g., industrial, institutional) will likely see dynamic shifts as market needs evolve. The continuing focus on sustainability and environmentally friendly refrigerants will also shape product innovation and market share dynamics. Regional variations within the US market are anticipated, with higher growth potentially concentrated in areas with significant construction activity and a strong focus on energy efficiency.

United States HVAC Equipment & Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States HVAC equipment and services market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report utilizes both qualitative and quantitative data to deliver actionable insights for industry professionals, investors, and stakeholders. The market is segmented by Type (Residential, Commercial, Industrial) and Retrofits (Residential, Commercial). This granular segmentation allows for a detailed understanding of the parent market and its diverse child markets. The total market value in 2025 is estimated at xx Million units.

United States HVAC Equipment & Services Market Dynamics & Structure

The US HVAC equipment and services market is characterized by moderate concentration, with key players like Johnson Controls International PLC, Daikin Industries Ltd, Lennox International Inc, and Carrier Corporation holding significant market share. Technological innovation, driven by energy efficiency standards and the increasing adoption of smart home technology, is a major growth driver. Stringent environmental regulations and building codes further shape the market landscape. Competitive pressures stem from both established players and emerging technology providers offering innovative solutions. The market witnesses frequent mergers and acquisitions (M&A) activity, as evidenced by recent deals like the acquisition of DiversiTech by Partners Group in 2021.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Focus on energy efficiency (e.g., heat pumps, smart thermostats), IAQ improvements, and digitalization.

- Regulatory Framework: Stringent energy efficiency standards (e.g., ASHRAE standards) and environmental regulations drive market growth.

- Competitive Substitutes: Limited direct substitutes, but alternative energy solutions pose indirect competition.

- M&A Activity: High level of M&A activity, with xx major deals recorded between 2019-2024.

United States HVAC Equipment & Services Market Growth Trends & Insights

The US HVAC market exhibits a steady growth trajectory, fueled by factors such as rising disposable incomes, increasing urbanization, and the growing need for comfortable indoor environments. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including the integration of IoT and AI in HVAC systems, are transforming consumer behavior. Demand for smart and energy-efficient solutions is rising rapidly. The market penetration of smart thermostats continues to increase, reaching xx% in 2025. The increasing adoption of sustainable building practices also significantly contributes to the market's expansion.

Dominant Regions, Countries, or Segments in United States HVAC Equipment & Services Market

The South and West regions of the United States are currently driving market growth, owing to factors such as warmer climates, increased construction activity, and higher rates of new home building. The residential segment holds the largest market share, followed by the commercial sector. Key drivers include supportive government policies promoting energy efficiency and increasing consumer awareness about the importance of indoor air quality.

- Key Drivers: High population density in Southern and Western States, robust construction activities, rising disposable incomes, supportive government incentives for energy-efficient technologies.

- Dominance Factors: Favorable climatic conditions, high demand for residential HVAC systems, and substantial investment in commercial infrastructure projects.

United States HVAC Equipment & Services Market Product Landscape

The market offers a wide array of products, including traditional HVAC systems (furnaces, air conditioners, heat pumps), smart thermostats, ventilation systems, and air purifiers. Technological advancements are focused on improving energy efficiency, enhancing indoor air quality (IAQ), and integrating smart features for remote control and monitoring. Product innovation includes the development of high-efficiency heat pumps, variable refrigerant flow (VRF) systems, and advanced air filtration technologies. Unique selling propositions include enhanced energy savings, improved comfort, and seamless connectivity.

Key Drivers, Barriers & Challenges in United States HVAC Equipment & Services Market

Key Drivers: Increasing demand for energy-efficient solutions, stringent government regulations, growth in construction, and rising awareness of IAQ.

Challenges: Supply chain disruptions, skilled labor shortages, and intense competition among established players and emerging companies. The impact of these challenges is estimated to reduce the market growth by xx% in 2026.

Emerging Opportunities in United States HVAC Equipment & Services Market

Emerging opportunities include the growth of the smart home market, increasing demand for sustainable HVAC systems, and expansion into niche markets like data centers and healthcare facilities. Further opportunities lie in the development and implementation of innovative HVAC solutions tailored to specific needs, such as customized energy-efficient solutions for diverse building types.

Growth Accelerators in the United States HVAC Equipment & Services Market Industry

The long-term growth of the US HVAC market is accelerated by technological breakthroughs in energy-efficient technologies, strategic partnerships between HVAC manufacturers and building automation companies, and expansion into new markets through acquisitions and joint ventures. Continued development of environmentally friendly refrigerants further propels market growth.

Key Players Shaping the United States HVAC Equipment & Services Market Market

- Johnson Controls International PLC

- Daikin Industries Ltd

- Lennox International Inc

- EMCOR Group

- Carrier Corporation

- Goodman Manufacturing Company

- Uponor Corp

- Trane Technologies

- Raheem Manufacturing Company Ltd

- Emerson Electric Company

Notable Milestones in United States HVAC Equipment & Services Market Sector

- November 2021: Partners Group acquires DiversiTech, expanding its presence in the HVAC parts and accessories market.

- July 2021: Audax Private Equity sells Reedy Industries, a commercial HVAC provider, to Partners Group, indicating consolidation within the sector.

In-Depth United States HVAC Equipment & Services Market Market Outlook

The future of the US HVAC market is bright, driven by continued technological innovation, increasing demand for energy-efficient and sustainable solutions, and supportive government policies. Strategic partnerships and acquisitions will further shape the market landscape, leading to consolidation and increased competition. The market is poised for strong growth, with significant opportunities for companies that can offer innovative, sustainable, and cost-effective HVAC solutions.

United States HVAC Equipment & Services Market Segmentation

-

1. Equipment

- 1.1. Split Systems (Ducted & Ductless)

- 1.2. Indoor Packaged & Roof Tops

- 1.3. Chillers

- 1.4. Air Handling Units

- 1.5. Furnaces

- 1.6. Fain Coils

- 1.7. Window/through the Wall, Moveable & PTAC

- 1.8. Boilers

- 1.9. Heat Pumps

- 1.10. Humidifiers and Dehumidifiers

- 1.11. Other Equipment Types

-

2. End-User

- 2.1. Residential

- 2.2. Industrial & Commercial

- 3. Market Overvies

-

4. Market Segmentation

-

4.1. By Type

- 4.1.1. New Installations

- 4.1.2. Retrofits

-

4.2. By End-User

- 4.2.1. Residential

- 4.2.2. Industrial & Commercial

-

4.1. By Type

-

5. Type

- 5.1. New Installations

- 5.2. Retrofits

-

6. End-User

- 6.1. Residential

- 6.2. Industrial & Commercial

United States HVAC Equipment & Services Market Segmentation By Geography

- 1. United States

United States HVAC Equipment & Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Residential and Non-residential Users

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to IoT and Smart Devices; Higher Costs of Refurbishment of Old Buildings

- 3.4. Market Trends

- 3.4.1. New Installations to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Split Systems (Ducted & Ductless)

- 5.1.2. Indoor Packaged & Roof Tops

- 5.1.3. Chillers

- 5.1.4. Air Handling Units

- 5.1.5. Furnaces

- 5.1.6. Fain Coils

- 5.1.7. Window/through the Wall, Moveable & PTAC

- 5.1.8. Boilers

- 5.1.9. Heat Pumps

- 5.1.10. Humidifiers and Dehumidifiers

- 5.1.11. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Industrial & Commercial

- 5.3. Market Analysis, Insights and Forecast - by Market Overvies

- 5.4. Market Analysis, Insights and Forecast - by Market Segmentation

- 5.4.1. By Type

- 5.4.1.1. New Installations

- 5.4.1.2. Retrofits

- 5.4.2. By End-User

- 5.4.2.1. Residential

- 5.4.2.2. Industrial & Commercial

- 5.4.1. By Type

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. New Installations

- 5.5.2. Retrofits

- 5.6. Market Analysis, Insights and Forecast - by End-User

- 5.6.1. Residential

- 5.6.2. Industrial & Commercial

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States HVAC Equipment & Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Johnson Controls International PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daikin Industries Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lennox International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EMCOR Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carrier Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Goodman Manufacturing Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Uponor Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trane Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Raheem Manufacturing Company Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emerson Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: United States HVAC Equipment & Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States HVAC Equipment & Services Market Share (%) by Company 2024

List of Tables

- Table 1: United States HVAC Equipment & Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States HVAC Equipment & Services Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Overvies 2019 & 2032

- Table 5: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Segmentation 2019 & 2032

- Table 6: United States HVAC Equipment & Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: United States HVAC Equipment & Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States HVAC Equipment & Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States HVAC Equipment & Services Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 20: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 21: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Overvies 2019 & 2032

- Table 22: United States HVAC Equipment & Services Market Revenue Million Forecast, by Market Segmentation 2019 & 2032

- Table 23: United States HVAC Equipment & Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: United States HVAC Equipment & Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 25: United States HVAC Equipment & Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States HVAC Equipment & Services Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the United States HVAC Equipment & Services Market?

Key companies in the market include Johnson Controls International PLC, Daikin Industries Ltd, Lennox International Inc, EMCOR Group, Carrier Corporation, Goodman Manufacturing Company, Uponor Corp, Trane Technologies, Raheem Manufacturing Company Ltd *List Not Exhaustive, Emerson Electric Company.

3. What are the main segments of the United States HVAC Equipment & Services Market?

The market segments include Equipment, End-User, Market Overvies, Market Segmentation, Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Residential and Non-residential Users.

6. What are the notable trends driving market growth?

New Installations to Drive the Growth.

7. Are there any restraints impacting market growth?

Security Concerns Related to IoT and Smart Devices; Higher Costs of Refurbishment of Old Buildings.

8. Can you provide examples of recent developments in the market?

November 2021 - Partners Group, a leading global private markets firm, agreed to acquire DiversiTech, a manufacturer and supplier of parts and accessories for heating, ventilation, and air conditioning ("HVAC") equipment in the US, from funds advised by global private equity firm Permira.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States HVAC Equipment & Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States HVAC Equipment & Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States HVAC Equipment & Services Market?

To stay informed about further developments, trends, and reports in the United States HVAC Equipment & Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence