Key Insights

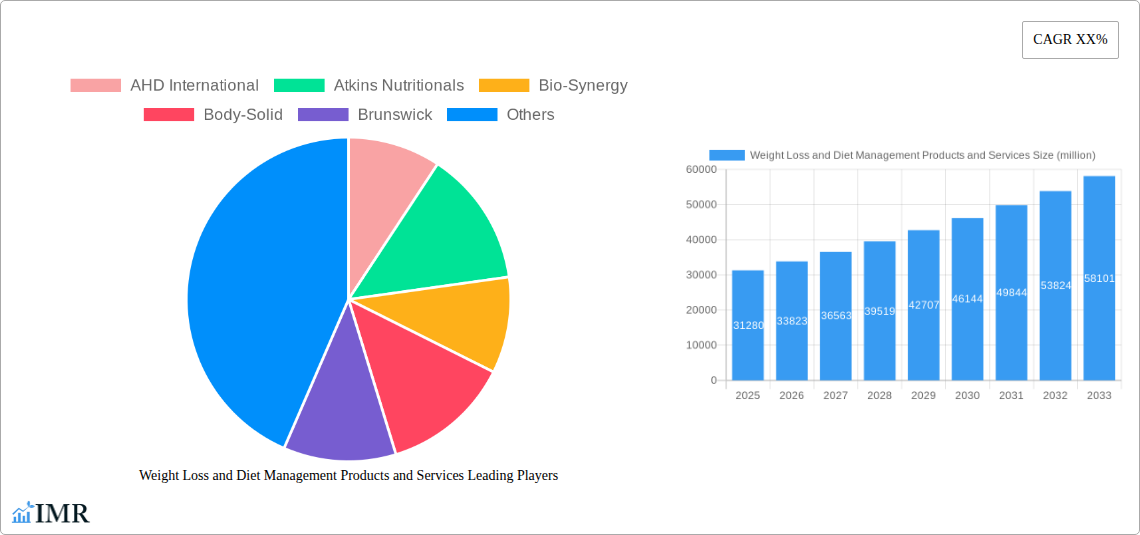

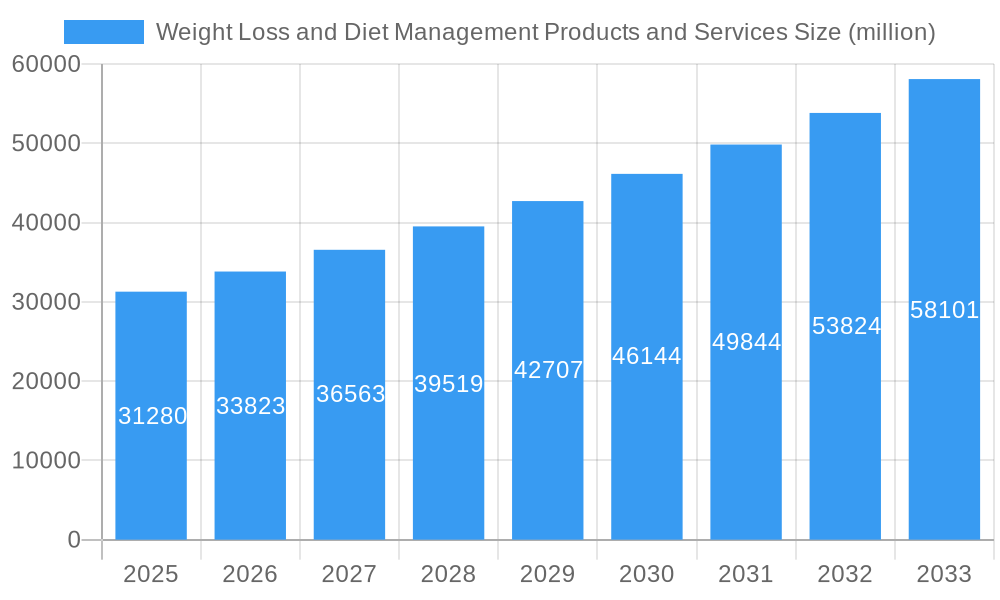

The global Weight Loss and Diet Management Products and Services market is poised for substantial expansion, with an estimated market size of $31.28 billion in 2025. This growth is fueled by a confluence of factors, including increasing global obesity rates, a heightened consumer awareness of health and wellness, and the rising prevalence of lifestyle-related diseases. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 8.1% from 2025 to 2033, indicating a dynamic and promising landscape for businesses operating within this sector. Key drivers of this growth include the escalating demand for convenient and personalized diet solutions, the expanding availability of innovative weight management technologies and digital health platforms, and the growing influence of social media and celebrity endorsements promoting healthier lifestyles. The product segment, encompassing meals and beverages, is expected to see steady demand, while the supplements category is anticipated to experience accelerated growth due to consumer interest in targeted nutritional support for weight management.

Weight Loss and Diet Management Products and Services Market Size (In Billion)

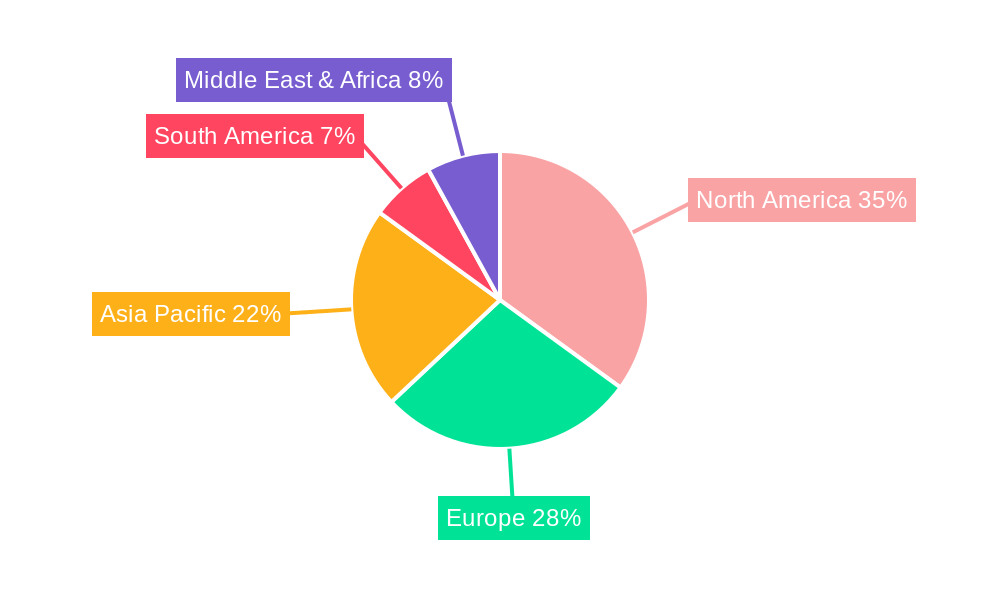

The market is segmented into Male and Female applications, with both demonstrating significant potential. The increasing health consciousness among men, coupled with a greater willingness to invest in personal well-being, is a notable trend. Similarly, women continue to be a dominant consumer group, driven by a desire for aesthetic improvements and long-term health benefits. Geographically, North America is expected to remain a dominant region, owing to high disposable incomes, established healthcare infrastructure, and a strong consumer preference for health-conscious products. However, the Asia Pacific region is anticipated to exhibit the fastest growth, driven by rising urbanization, a growing middle class, and increasing adoption of Western lifestyle trends. Despite the promising outlook, the market faces certain restraints, including the high cost of some specialized diet programs and products, the potential for rebound weight gain if lifestyle changes are not sustained, and evolving regulatory landscapes that may impact product claims and marketing.

Weight Loss and Diet Management Products and Services Company Market Share

Weight Loss and Diet Management Products and Services Market Dynamics & Structure

The global Weight Loss and Diet Management Products and Services market is a dynamic and evolving landscape driven by increasing health consciousness and the persistent challenge of obesity worldwide. Market concentration varies significantly across segments, with some areas featuring a few dominant players and others exhibiting a more fragmented structure. Technological innovation serves as a primary driver, with advancements in personalized nutrition, AI-powered coaching platforms, and scientifically formulated supplements continuously shaping product offerings. Regulatory frameworks, while essential for consumer safety, can also present barriers to market entry and product development. The competitive product substitute landscape is robust, encompassing traditional dieting methods, fitness programs, and medical interventions, all vying for consumer attention and expenditure. End-user demographics are diverse, with a growing emphasis on tailored solutions for both male and female consumers, across various age groups and lifestyle needs. Mergers and Acquisitions (M&A) trends indicate strategic consolidation, as larger companies seek to acquire innovative startups and expand their product portfolios. For instance, the historical period saw a notable increase in M&A activity, with an estimated xx billion in deal volume during 2019-2024, signaling a maturing market.

- Market Concentration: Fragmented in supplements and meal replacements, consolidated in branded diet programs.

- Technological Innovation Drivers: AI-driven personalization, wearable tech integration, genetic testing for diet.

- Regulatory Frameworks: FDA approvals for supplements, FTC oversight of marketing claims.

- Competitive Product Substitutes: Fitness apps, gym memberships, surgical procedures, at-home exercise equipment.

- End-User Demographics: Growing demand for personalized solutions for specific health conditions (e.g., diabetes, PCOS).

- M&A Trends: Acquisition of niche brands by larger conglomerates, strategic partnerships for technology integration.

Weight Loss and Diet Management Products and Services Growth Trends & Insights

The Weight Loss and Diet Management Products and Services market is projected to experience robust growth, propelled by a confluence of escalating health concerns and an increasing consumer willingness to invest in well-being. The global market size, valued at approximately $190.5 billion in 2023, is expected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated $XXX billion by the end of the forecast period. This trajectory is underpinned by significant shifts in consumer behavior, including a heightened awareness of the long-term health implications of excess weight and a greater inclination towards preventative healthcare. Technological disruptions are playing a pivotal role, transforming traditional approaches to diet management. The proliferation of digital platforms, including mobile applications offering personalized meal plans, virtual coaching sessions, and progress tracking, has democratized access to weight management solutions. These digital tools, coupled with the integration of wearable technology that monitors physical activity and biometric data, are enabling a more data-driven and personalized approach to dieting. Adoption rates for these digital solutions are surging, particularly among tech-savvy demographics. Furthermore, the market is witnessing a growing demand for scientifically validated products and services, moving beyond fads towards evidence-based strategies. This includes an increasing preference for whole foods-based meal plans, low-glycemic index options, and supplements backed by clinical research. The influence of social media and health influencers also contributes to the rapid dissemination of new trends and product endorsements, impacting consumer choices and driving market penetration. The base year 2025 is expected to see the market cross the $200 billion mark, setting a strong foundation for continued expansion. The historical period of 2019-2024 laid the groundwork for this growth, marked by increased investment in research and development and a growing acceptance of non-traditional weight loss methods.

Dominant Regions, Countries, or Segments in Weight Loss and Diet Management Products and Services

North America currently stands as the dominant region in the global Weight Loss and Diet Management Products and Services market, driven by a high prevalence of obesity, a strong consumer focus on health and wellness, and a well-established market for diet programs and supplements. The United States, in particular, represents a significant portion of this dominance, fueled by a robust economy, widespread awareness of health risks associated with weight, and a mature market for both product and service offerings. Economic policies that promote healthcare spending and a strong regulatory framework for health-related products further bolster the region's leadership. The Female application segment is a major contributor to this dominance, historically representing a larger market share due to societal pressures and a greater proactive approach to health and appearance. However, the Male segment is experiencing a significant surge in growth, driven by increasing awareness of health issues such as cardiovascular disease and diabetes, and a growing focus on fitness and physique.

Within the Types segment, Meals, encompassing meal replacement shakes, pre-packaged diet meals, and healthy snack options, command a substantial market share due to their convenience and perceived effectiveness. The demand for personalized and portion-controlled meal solutions continues to rise, catering to busy lifestyles. The Supplements segment also holds a significant position, driven by a wide array of products such as fat burners, appetite suppressants, and metabolism boosters, although regulatory scrutiny and varying efficacy can influence growth. The Beverages segment, including diet sodas, functional beverages with added nutrients, and detox drinks, is also experiencing steady growth, aligning with the trend towards convenient health consumption. The market share in North America for the overall weight loss and diet management sector is estimated at xx% of the global market in the base year 2025. The growth potential within this region remains high, with continued innovation in personalized nutrition and digital health solutions expected to further solidify its leading position.

Weight Loss and Diet Management Products and Services Product Landscape

The product landscape for weight loss and diet management is characterized by a continuous stream of innovations aimed at enhancing efficacy, convenience, and personalization. Consumers can now access a wide array of offerings, from scientifically formulated meal replacement shakes and bars to bespoke online coaching platforms and smart dietary monitoring devices. Key innovations include plant-based protein options for supplements and meals, catering to the growing vegan and vegetarian population, and functional beverages infused with probiotics or adaptogens to support gut health and stress management, both crucial for weight management. Performance metrics are increasingly tied to quantifiable results, such as percentage of body fat reduction, sustainable weight loss, and improvements in metabolic markers. The unique selling propositions often revolve around evidence-based formulations, celebrity endorsements, and community support features within digital platforms. Technological advancements in personalized nutrition, utilizing genetic testing and microbiome analysis, are also paving the way for hyper-tailored product recommendations.

Key Drivers, Barriers & Challenges in Weight Loss and Diet Management Products and Services

Key Drivers:

- Rising global obesity rates: Increasing prevalence of overweight and obese individuals globally.

- Growing health consciousness: Enhanced consumer awareness of the health risks associated with excess weight.

- Technological advancements: Innovations in digital health, AI, and personalized nutrition.

- Increased disposable income: Greater ability for consumers to invest in health and wellness solutions.

- Influence of social media and influencers: Amplified awareness and promotion of diet products and services.

Barriers & Challenges:

- Sustaining long-term adherence: Difficulty for consumers to maintain diet regimens over extended periods.

- Regulatory hurdles: Stringent regulations for product approval and marketing claims, particularly for supplements.

- Product efficacy concerns: Variability in the effectiveness of different products and services.

- Supply chain disruptions: Potential for disruptions in the sourcing of raw materials for supplements and specialty foods.

- Intense competition: A crowded market with numerous players offering similar solutions.

- Price sensitivity: Consumer price sensitivity, especially for premium or specialized products.

Emerging Opportunities in Weight Loss and Diet Management Products and Services

Emerging opportunities lie in the further integration of personalized nutrition with advanced diagnostics, such as microbiome analysis and genetic profiling, to offer highly tailored diet plans and supplement recommendations. The growing demand for sustainable and ethically sourced ingredients presents a significant avenue for product differentiation. Furthermore, the untapped potential in emerging economies, where awareness of obesity-related health issues is rising alongside economic development, offers substantial growth prospects. Digital therapeutics for weight management, combining behavioral therapy with technology, are also poised for significant expansion.

Growth Accelerators in the Weight Loss and Diet Management Products and Services Industry

Key growth accelerators for the Weight Loss and Diet Management Products and Services industry include the increasing adoption of telehealth and virtual coaching models, which expand market reach and accessibility. Strategic partnerships between technology companies, healthcare providers, and food manufacturers are crucial for developing integrated wellness solutions. Furthermore, continuous investment in research and development to validate product efficacy and identify novel active ingredients will be a significant catalyst. The focus on holistic wellness, incorporating mental health and stress management alongside diet and exercise, will also drive demand for comprehensive solutions.

Key Players Shaping the Weight Loss and Diet Management Products and Services Market

- AHD International

- Atkins Nutritionals

- Bio-Synergy

- Body-Solid

- Brunswick

- Conagra Foods

- Glaxosmithkline

- Hershey

- Kellogg

- Kraft Foods

- Medifast

- Nestle

- Nutrasweet

- Nutrisystem

- Pepsico

- Quaker Oats

- Skinny Nutritional

- Streamline Foods

- Tate And Lyle

- The Coca-Cola Company

- Unilever

- Vivus

- VLCC Group

- Weight Watcher

- Wellness International

Notable Milestones in Weight Loss and Diet Management Products and Services Sector

- 2019: Increased consumer adoption of personalized nutrition plans based on genetic testing.

- 2020: Surge in demand for at-home fitness solutions and online diet coaching amidst the global pandemic.

- 2021: Growing regulatory scrutiny on the efficacy and marketing of weight loss supplements.

- 2022: Significant investment in AI-powered platforms for customized meal planning and behavioral coaching.

- 2023: Rise of plant-based and sustainable options within meal replacement and supplement categories.

- 2024: Expansion of digital therapeutics for chronic condition management including obesity.

In-Depth Weight Loss and Diet Management Products and Services Market Outlook

The future of the Weight Loss and Diet Management Products and Services market is exceptionally promising, driven by an unwavering global commitment to health and well-being. Continued technological integration, particularly in personalized nutrition and AI-driven platforms, will unlock unprecedented levels of customization and efficacy. Strategic collaborations across various industry sectors are set to create a more holistic and accessible ecosystem for consumers. The market will witness an amplified focus on evidence-based solutions and sustainable practices, pushing innovation in product development. As health awareness continues to permeate developing economies, significant untapped potential will be realized, further accelerating global market growth.

Weight Loss and Diet Management Products and Services Segmentation

-

1. Application

- 1.1. Male

- 1.2. Female

-

2. Types

- 2.1. Meals

- 2.2. Beverages

- 2.3. Supplements

Weight Loss and Diet Management Products and Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Weight Loss and Diet Management Products and Services Regional Market Share

Geographic Coverage of Weight Loss and Diet Management Products and Services

Weight Loss and Diet Management Products and Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Weight Loss and Diet Management Products and Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Male

- 5.1.2. Female

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Meals

- 5.2.2. Beverages

- 5.2.3. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Weight Loss and Diet Management Products and Services Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Male

- 6.1.2. Female

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Meals

- 6.2.2. Beverages

- 6.2.3. Supplements

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Weight Loss and Diet Management Products and Services Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Male

- 7.1.2. Female

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Meals

- 7.2.2. Beverages

- 7.2.3. Supplements

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Weight Loss and Diet Management Products and Services Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Male

- 8.1.2. Female

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Meals

- 8.2.2. Beverages

- 8.2.3. Supplements

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Weight Loss and Diet Management Products and Services Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Male

- 9.1.2. Female

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Meals

- 9.2.2. Beverages

- 9.2.3. Supplements

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Weight Loss and Diet Management Products and Services Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Male

- 10.1.2. Female

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Meals

- 10.2.2. Beverages

- 10.2.3. Supplements

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AHD International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Atkins Nutritionals

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bio-Synergy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Body-Solid

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Brunswick

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Conagra Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Glaxosmithkline

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kellogg

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kraft Foods

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Medifast

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nautilus

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nestle

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nutrasweet

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nutrisystem

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pepsico

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Quaker Oats

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Skinny Nutritional

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Streamline Foods

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Tate And Lyle

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Coca-Cola

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Hershey

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Unilever

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Vivus

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Vlcc Group

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Weight Watcher

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Wellness International

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.1 AHD International

List of Figures

- Figure 1: Global Weight Loss and Diet Management Products and Services Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Weight Loss and Diet Management Products and Services Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Weight Loss and Diet Management Products and Services Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Weight Loss and Diet Management Products and Services Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Weight Loss and Diet Management Products and Services Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Weight Loss and Diet Management Products and Services Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Weight Loss and Diet Management Products and Services Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Weight Loss and Diet Management Products and Services Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Weight Loss and Diet Management Products and Services Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Weight Loss and Diet Management Products and Services Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Weight Loss and Diet Management Products and Services Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Weight Loss and Diet Management Products and Services Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Weight Loss and Diet Management Products and Services Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Weight Loss and Diet Management Products and Services Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Weight Loss and Diet Management Products and Services Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Weight Loss and Diet Management Products and Services Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Weight Loss and Diet Management Products and Services Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Weight Loss and Diet Management Products and Services Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Weight Loss and Diet Management Products and Services Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Weight Loss and Diet Management Products and Services Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Weight Loss and Diet Management Products and Services Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Weight Loss and Diet Management Products and Services Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Weight Loss and Diet Management Products and Services Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Weight Loss and Diet Management Products and Services Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Weight Loss and Diet Management Products and Services Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Weight Loss and Diet Management Products and Services Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Weight Loss and Diet Management Products and Services Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Weight Loss and Diet Management Products and Services Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Weight Loss and Diet Management Products and Services Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Weight Loss and Diet Management Products and Services Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Weight Loss and Diet Management Products and Services Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Weight Loss and Diet Management Products and Services Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Weight Loss and Diet Management Products and Services Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Weight Loss and Diet Management Products and Services?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Weight Loss and Diet Management Products and Services?

Key companies in the market include AHD International, Atkins Nutritionals, Bio-Synergy, Body-Solid, Brunswick, Conagra Foods, Glaxosmithkline, Kellogg, Kraft Foods, Medifast, Nautilus, Nestle, Nutrasweet, Nutrisystem, Pepsico, Quaker Oats, Skinny Nutritional, Streamline Foods, Tate And Lyle, Coca-Cola, Hershey, Unilever, Vivus, Vlcc Group, Weight Watcher, Wellness International.

3. What are the main segments of the Weight Loss and Diet Management Products and Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Weight Loss and Diet Management Products and Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Weight Loss and Diet Management Products and Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Weight Loss and Diet Management Products and Services?

To stay informed about further developments, trends, and reports in the Weight Loss and Diet Management Products and Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence