Key Insights

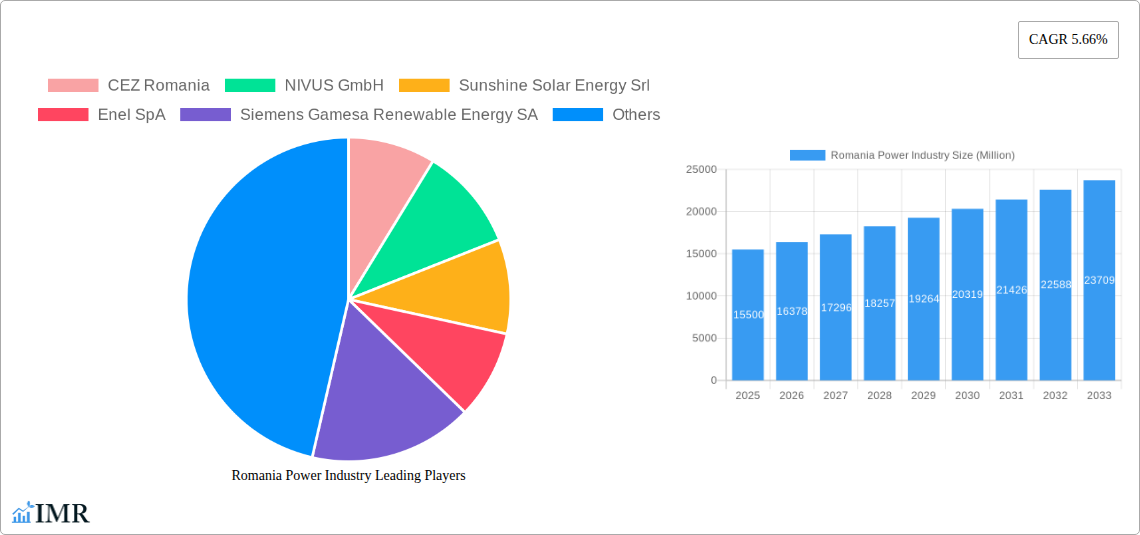

Romania's power industry is set for substantial growth, with the market size projected to reach $55.22 billion by 2033, expanding from an estimated $15.50 billion in the base year of 2025. This growth trajectory is driven by a 9.4% CAGR, fueled by a significant transition towards renewable energy sources, including solar and wind power, supported by favorable government initiatives and rising environmental awareness. Investments are increasing in the modernization and expansion of power transmission and distribution (T&D) infrastructure, essential for integrating decentralized renewable energy generation and ensuring grid reliability. Growing industrial development and a burgeoning residential sector are further boosting the demand for dependable and sustainable energy solutions. Prominent market participants such as Enel SpA, Siemens Gamesa Renewable Energy SA, and Vestas Wind Systems AS are actively contributing to technological innovation and capacity enhancement in the sector.

Romania Power Industry Market Size (In Billion)

While thermal power sources, such as natural gas and oil, continue to contribute, their market share is steadily declining in favor of cleaner energy alternatives. Hydropower and nuclear energy also form integral parts of the energy mix, providing essential baseload power stability. However, achieving this growth potential requires addressing key challenges. These include the substantial capital required for grid modernization, the complexities of integrating variable renewable energy sources, and adapting to evolving regulatory landscapes. Effectively managing these challenges is crucial for sustainable market expansion and ensuring Romania's energy security. The ongoing focus on enhancing T&D networks demonstrates a strategic commitment to managing the integration of distributed generation and optimizing power delivery throughout Romania.

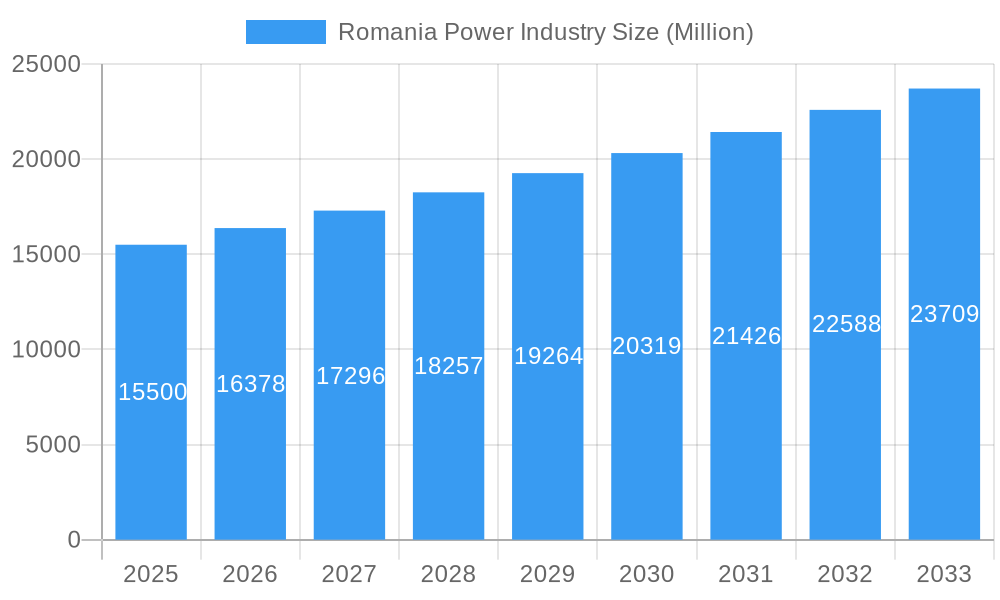

Romania Power Industry Company Market Share

Romania Power Industry Report: Unlocking Growth and Innovation (2019-2033)

This comprehensive report provides an in-depth analysis of the Romania Power Industry, meticulously covering the period from 2019 to 2033, with a base and estimated year of 2025. It delves into market dynamics, growth trends, dominant segments, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the pivotal players shaping Romania's energy future. Utilizing high-traffic keywords such as "Romania power market," "energy sector Romania," "renewable energy Romania," "nuclear energy Romania," and "power transmission distribution Romania," this report is optimized for maximum search engine visibility, engaging industry professionals and stakeholders seeking to understand the current state and future trajectory of this vital sector. We analyze both parent and child markets to provide a holistic view, presenting all quantitative values in Million units for clear comprehension.

Romania Power Industry Market Dynamics & Structure

The Romania Power Industry is characterized by a dynamic market structure with a moderate level of concentration, driven by significant investments in renewable energy sources and the ongoing modernization of traditional power generation. Technological innovation is a primary driver, with advancements in solar photovoltaic (PV), wind turbine efficiency, and smart grid technologies significantly influencing market evolution. The regulatory framework, shaped by EU directives and national energy policies, plays a crucial role in fostering investment and ensuring grid stability. Competitive product substitutes are emerging, particularly in the form of decentralized energy generation and storage solutions, challenging the traditional utility model. End-user demographics are shifting towards a greater demand for sustainable and reliable power, influenced by increasing environmental awareness and the desire for energy independence. Mergers and acquisitions (M&A) trends indicate a strategic consolidation of key players, particularly in the renewable energy and transmission segments, aiming to enhance market share and operational efficiency.

- Market Concentration: Moderate, with a growing influence of independent power producers (IPPs) in the renewables sector.

- Technological Innovation: Focus on solar PV efficiency, wind energy optimization, battery storage, and smart grid integration.

- Regulatory Framework: Aligned with EU energy policies, promoting decarbonization and grid modernization.

- Competitive Product Substitutes: Rise of rooftop solar, energy efficiency solutions, and distributed energy resources.

- End-User Demographics: Growing demand for green energy, grid reliability, and competitive pricing.

- M&A Trends: Strategic acquisitions in renewables and T&D infrastructure to gain market access and technological expertise.

Romania Power Industry Growth Trends & Insights

The Romania Power Industry is projected to experience robust growth over the forecast period, driven by a confluence of factors including supportive government policies, increasing investments in renewable energy, and the essential need for grid modernization. Market size evolution is anticipated to be significant, with the renewable energy segment leading the charge due to ambitious decarbonization targets. Adoption rates for solar and wind power are expected to accelerate, supported by favorable feed-in tariffs and a growing understanding of their economic and environmental benefits. Technological disruptions are a constant feature, with advancements in energy storage systems playing a crucial role in enhancing grid stability and the integration of intermittent renewable sources. Consumer behavior shifts are also contributing to market growth, with a rising preference for sustainable energy solutions and a greater willingness to invest in energy-efficient technologies. The increasing demand for electricity, fueled by economic development and industrial expansion, further underpins the sector's growth trajectory.

The projected Compound Annual Growth Rate (CAGR) for the Romania Power Industry is estimated to be around xx% during the forecast period (2025-2033). Market penetration of renewable energy sources is expected to reach approximately xx% by 2033, a significant increase from xx% in the historical period. The overall market size, which stood at an estimated EUR XXXX Million in 2025, is forecast to grow to EUR YYYY Million by 2033. This expansion is directly linked to substantial investments in new power generation capacity, particularly in solar and wind farms, as well as upgrades to the existing power transmission and distribution infrastructure. The government's commitment to phasing out coal-fired power plants and replacing them with cleaner alternatives will also be a major catalyst for change and growth within the sector. Furthermore, the digitalization of the energy sector, including the implementation of smart meters and advanced grid management systems, will contribute to improved efficiency and new service offerings, thereby stimulating further market expansion. The competitive landscape will continue to evolve, with both domestic and international players vying for market share.

Dominant Regions, Countries, or Segments in Romania Power Industry

The Romanian power market is a complex tapestry of regional strengths and segment-specific dominance. Among the analyzed segments – Thermal, Renewables, Hydropower, Nuclear, Other Sources (Natural Gas and Oil), and Power Transmission and Distribution (T&D) – Renewables are emerging as the dominant growth engine, largely driven by supportive European Union policies and national incentives aimed at decarbonization. This segment is experiencing unprecedented investment and rapid expansion, significantly influencing the overall market dynamics. The Power Transmission and Distribution (T&D) segment, while not a primary source of generation, is equally critical, as its modernization and expansion are essential to accommodate the influx of renewable energy and ensure grid stability.

Key drivers contributing to the dominance of Renewables include:

- Economic Policies: Favorable feed-in tariffs, tax incentives, and renewable energy certificate mechanisms encourage investment and project development.

- Infrastructure Development: Significant investments are being channeled into grid upgrades to integrate variable renewable energy sources effectively.

- Environmental Regulations: EU's Green Deal and national climate targets create a strong impetus for shifting away from fossil fuels.

- Technological Advancements: Decreasing costs of solar PV and wind turbine technology make these sources increasingly competitive.

The growth potential within the Renewables segment is immense, with ongoing projects and planned developments indicating a sustained upward trend. Thermal power, particularly fueled by natural gas, remains a significant contributor to the energy mix, providing baseload power and flexibility. However, its long-term dominance is expected to wane as the transition to cleaner energy sources accelerates. Nuclear power, with the ongoing development of Cernavodă units 3 and 4, represents a strategic long-term investment for Romania, promising stable, low-carbon energy. Hydropower continues to be a valuable asset, offering a consistent and controllable source of renewable energy, although its expansion potential is geographically limited. The Other Sources (Natural Gas and Oil) segment will see a gradual decline in its share as Romania prioritizes cleaner alternatives, though natural gas will play a crucial role as a transition fuel. The T&D segment is experiencing substantial investment to upgrade aging infrastructure and build new capacities to support the evolving energy landscape, making it a crucial, albeit secondary, driver of overall market growth.

Romania Power Industry Product Landscape

The Romania Power Industry is witnessing a surge in product innovation, primarily centered around enhancing the efficiency and sustainability of energy generation and delivery. In the Renewables segment, advancements in photovoltaic modules boast higher conversion efficiencies and improved performance in diverse weather conditions. Wind turbines are becoming larger, more powerful, and equipped with intelligent control systems to optimize energy capture. Energy storage solutions, including advanced battery technologies and grid-scale storage systems, are crucial products designed to mitigate the intermittency of renewables and ensure grid stability. For Power Transmission and Distribution, innovations include smart grid technologies, advanced metering infrastructure (AMI), and high-voltage direct current (HVDC) transmission systems that enable more efficient and reliable power flow over long distances. Thermal power plants are also seeing innovations aimed at improving efficiency and reducing emissions, with a growing focus on hydrogen-ready turbines and carbon capture technologies.

Key Drivers, Barriers & Challenges in Romania Power Industry

Key Drivers:

- EU Green Deal and Decarbonization Targets: Mandates a significant shift towards renewable energy sources.

- Energy Security and Independence: Reducing reliance on imported fossil fuels.

- Technological Advancements: Falling costs of renewables and advancements in grid technology.

- Government Support and Incentives: Favorable policies and financial mechanisms for clean energy projects.

- Growing Electricity Demand: Driven by economic growth and industrialization.

Barriers & Challenges:

- Grid Modernization and Capacity: Insufficient transmission and distribution infrastructure to fully integrate renewable energy.

- Permitting and Bureaucracy: Lengthy and complex approval processes for new projects.

- Financing and Investment Risks: High upfront capital costs for large-scale projects and market uncertainties.

- Public Acceptance and Land Use: Challenges in securing sites for renewable energy installations and overcoming local opposition.

- Supply Chain Volatility: Potential disruptions in the global supply of key components for renewable energy technologies.

- Competition from Existing Thermal Plants: The ongoing reliance on coal and gas presents a competitive hurdle for new renewable projects.

Emerging Opportunities in Romania Power Industry

The Romania Power Industry is ripe with emerging opportunities, particularly in the Renewables sector. The significant untapped potential for solar and wind energy, coupled with ongoing advancements in offshore wind technology, presents substantial growth avenues. The development of energy storage solutions at both utility-scale and residential levels is a critical emerging market, enabling better grid management and increasing the reliability of renewable energy integration. Green hydrogen production powered by renewable electricity is another promising frontier, offering a pathway to decarbonize hard-to-abate sectors. Furthermore, the modernization of the Power Transmission and Distribution (T&D) infrastructure presents opportunities for companies specializing in smart grid technologies, grid automation, and cybersecurity solutions. The demand for energy efficiency solutions in industrial and commercial sectors also represents a significant growth area.

Growth Accelerators in the Romania Power Industry Industry

Several key catalysts are accelerating growth within the Romania Power Industry. Strategic partnerships between energy companies, technology providers, and financial institutions are crucial for mobilizing the significant capital required for large-scale projects. Technological breakthroughs in areas like advanced battery storage, floating solar technologies, and digital grid management are lowering costs and improving the efficiency and viability of renewable energy integration. Government initiatives and policy reforms, aimed at streamlining permitting processes and offering more attractive investment frameworks, are vital in de-risking projects and encouraging private sector participation. The continuous drive towards achieving ambitious renewable energy targets set by the European Union provides a strong and consistent demand signal, further fueling investment and innovation across the sector.

Key Players Shaping the Romania Power Industry Market

- CEZ Romania

- NIVUS GmbH

- Sunshine Solar Energy Srl

- Enel SpA

- Siemens Gamesa Renewable Energy SA

- Danagroup hu

- SGS SA

- Romelectro SA

- Electroalfa

- Vestas Wind Systems AS

Notable Milestones in Romania Power Industry Sector

- June 2023: Development of the EUR 50 million agrivoltaic parks near Teiuş in the Romanian Alba was set to begin in October 2023. It is scheduled to be finished in 2024. The solar park will cover 80 hectares and contain 119,184 modules, with an annual electrical output of approximately 102 GWh, enough to power about 30,000 houses.

- June 2023: The Romanian government signed a support agreement with state-owned Nuclearelectrica to develop national strategic projects for building Cernavodă nuclear power plant units 3 and 4.

- March 2023: Mass Group Holding (MGH), an Iraqi energy business, expressed interest in investing more than USD 1.2 billion to convert the Mintia coal-fired thermal power plant near Deva in western Romania into a 1.5 GW gas and hydrogen power plant. The first part of the investment will last 24 months, and the project will be finished in 36 months.

In-Depth Romania Power Industry Market Outlook

The outlook for the Romania Power Industry is overwhelmingly positive, driven by a steadfast commitment to renewable energy expansion and grid modernization. The continuous influx of investments, bolstered by supportive EU policies and national strategies, will propel significant growth in solar and wind power generation capacity. The strategic development of nuclear power and the increasing adoption of energy storage solutions will further solidify Romania's energy independence and decarbonization goals. The modernization of the power transmission and distribution network is critical to facilitating this transition, presenting substantial opportunities for technological innovation and infrastructure development. The industry is poised for transformative growth, with a clear trajectory towards a cleaner, more sustainable, and resilient energy future.

Romania Power Industry Segmentation

-

1. Source

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Hydropower

- 1.4. Nuclear

- 1.5. Other Sources (Natural Gas and Oil)

- 2. Power Transmission and Distribution (T&D)

Romania Power Industry Segmentation By Geography

- 1. Romania

Romania Power Industry Regional Market Share

Geographic Coverage of Romania Power Industry

Romania Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Hydropower to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Hydropower

- 5.1.4. Nuclear

- 5.1.5. Other Sources (Natural Gas and Oil)

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CEZ Romania

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NIVUS GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sunshine Solar Energy Srl

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enel SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Danagroup hu

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SGS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Romelectro SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electroalfa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vestas Wind Systems AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CEZ Romania

List of Figures

- Figure 1: Romania Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Romania Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Romania Power Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 2: Romania Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 3: Romania Power Industry Revenue billion Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 4: Romania Power Industry Volume gigawatt Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 5: Romania Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Romania Power Industry Volume gigawatt Forecast, by Region 2020 & 2033

- Table 7: Romania Power Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 8: Romania Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 9: Romania Power Industry Revenue billion Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 10: Romania Power Industry Volume gigawatt Forecast, by Power Transmission and Distribution (T&D) 2020 & 2033

- Table 11: Romania Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Romania Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Power Industry?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Romania Power Industry?

Key companies in the market include CEZ Romania, NIVUS GmbH, Sunshine Solar Energy Srl, Enel SpA, Siemens Gamesa Renewable Energy SA, Danagroup hu, SGS SA, Romelectro SA, Electroalfa, Vestas Wind Systems AS.

3. What are the main segments of the Romania Power Industry?

The market segments include Source , Power Transmission and Distribution (T&D) .

4. Can you provide details about the market size?

The market size is estimated to be USD 55.22 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Hydropower to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

June 2023: Development of the EUR 50 million agrivoltaic parks near Teiuş in the Romanian Alba was set to begin in October 2023. It is scheduled to be finished in 2024. The solar park will cover 80 hectares and contain 119,184 modules, with an annual electrical output of approximately 102 GWh, enough to power about 30,000 houses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Power Industry?

To stay informed about further developments, trends, and reports in the Romania Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence