Key Insights

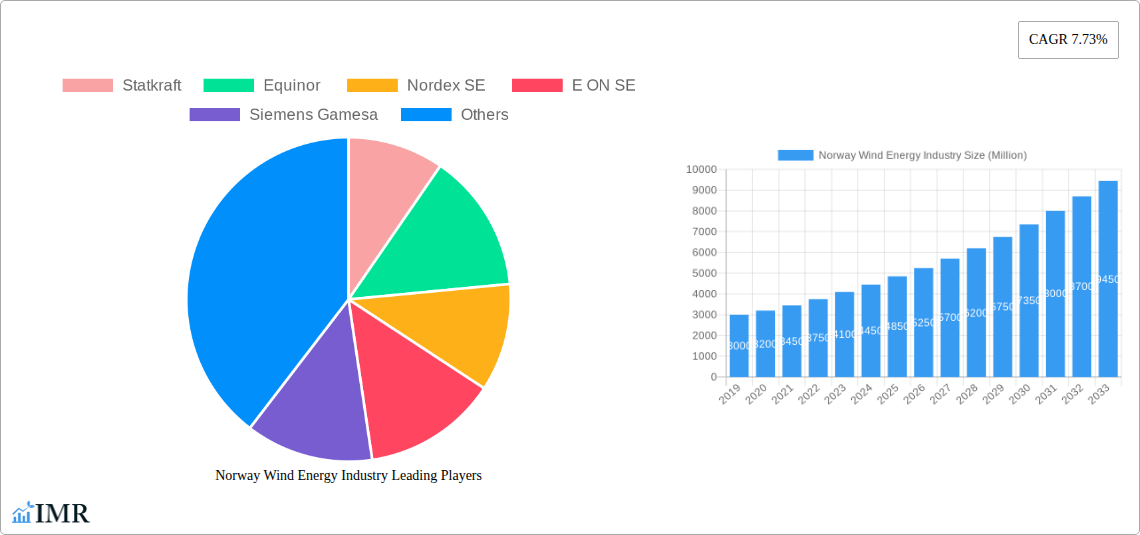

The Norway Wind Energy Industry is projected for substantial growth, reaching an estimated market size of $34.07 billion by 2025, with a robust CAGR of 13.1% forecast through 2033. This expansion is driven by Norway's strong commitment to renewable energy, significant investments in onshore and offshore wind, and favorable wind conditions. The increasing demand for clean electricity, coupled with advancements in wind turbine technology, further fuels market development.

Norway Wind Energy Industry Market Size (In Billion)

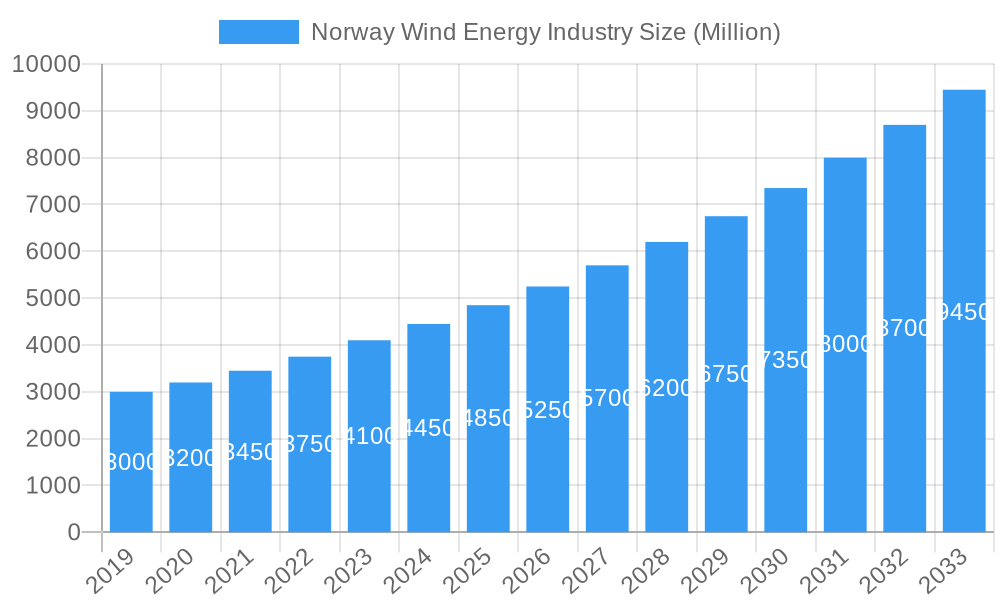

The competitive landscape features key players like Statkraft, Equinor, and Siemens Gamesa, engaged in project development, manufacturing, and installation. While environmental regulations and high initial capital costs present challenges, the national drive towards decarbonization and energy independence, supported by favorable policies and public acceptance, is expected to propel the industry forward as a crucial element of Norway's energy future.

Norway Wind Energy Industry Company Market Share

Norway Wind Energy Industry: Market Dynamics, Growth Prospects, and Future Outlook

This report provides a comprehensive analysis of the Norway Wind Energy Industry, detailing market evolution, growth drivers, and future trends. It offers granular segmentation, insights into technological advancements, and strategic player analysis, making it an essential resource for stakeholders. The study covers the historical period (2019-2024), with the base year as 2025, and provides forecasts for 2025-2033.

Norway Wind Energy Industry Market Dynamics & Structure

The Norway Wind Energy Industry is characterized by a dynamic interplay of robust regulatory support, significant investment from major energy players, and a growing demand for clean electricity. Market concentration is notably high, with leading companies actively pursuing strategic acquisitions and collaborations to expand their operational footprint and technological capabilities. Technological innovation is primarily driven by the pursuit of higher efficiency in wind turbines, particularly in the challenging offshore environment, and the integration of advanced grid management solutions. Norway's comprehensive regulatory frameworks, designed to promote renewable energy adoption and achieve ambitious climate targets, are instrumental in shaping market dynamics. Competitive product substitutes, while present in the form of other renewable sources, are increasingly positioned as complementary rather than direct competitors due to the overarching shift towards decarbonization. End-user demographics reveal a strong demand from the Utilities sector, driven by grid modernization and renewable energy mandates, followed by the Industrial sector seeking cost-effective and sustainable power solutions, and a growing interest from the Residential segment for distributed generation. Merger and acquisition (M&A) trends are prominent, reflecting the industry’s consolidation phase and the strategic imperative for companies to scale up operations and secure market share.

- Market Concentration: Dominated by a few key players with substantial market share, fostering strategic partnerships and M&A activities.

- Technological Innovation Drivers: Focus on offshore wind technology, grid integration, and turbine efficiency enhancements.

- Regulatory Frameworks: Supportive government policies, feed-in tariffs, and long-term renewable energy targets are crucial enablers.

- Competitive Product Substitutes: While other renewables exist, wind energy is a leading component in Norway's green transition.

- End-User Demographics: Strong adoption by Utilities and Industrial sectors, with nascent growth in Residential applications.

- M&A Trends: Active consolidation and strategic alliances to enhance scale and expertise.

Norway Wind Energy Industry Growth Trends & Insights

The Norway Wind Energy Industry is poised for significant expansion, driven by ambitious climate goals and a strategic commitment to renewable energy development. Market size evolution projects a substantial upward trajectory, with a projected Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This growth is underpinned by increasing adoption rates of both onshore and offshore wind technologies, fueled by substantial governmental incentives and private sector investment. Technological disruptions are continuously enhancing the efficiency and reliability of wind turbines, particularly the development of advanced floating offshore wind solutions capable of accessing deeper waters and stronger winds, thereby expanding the exploitable resource base. Consumer behavior shifts are also contributing, with a growing awareness of environmental issues and a demand for sustainable energy solutions from both industrial and residential consumers. Market penetration is expected to accelerate, moving beyond traditional utility-scale projects to include distributed generation and hybrid energy systems. The robust expansion of the offshore wind sector, in particular, will be a key determinant of overall market growth, as Norway leverages its extensive coastline and offshore expertise. This sustained growth is vital for Norway to meet its renewable energy targets and to establish itself as a leader in the global offshore wind market.

- Market Size Evolution: Expected to witness substantial growth, driven by increased capacity additions and technological advancements.

- Adoption Rates: High adoption rates for both onshore and offshore wind projects, supported by policy frameworks.

- Technological Disruptions: Innovations in turbine design, floating foundations, and grid integration are revolutionizing the sector.

- Consumer Behavior Shifts: Increasing demand for clean energy from all end-user segments, influencing investment and development.

- Market Penetration: Expanding beyond traditional utility-scale projects to encompass smaller-scale and hybrid applications.

- CAGR: Projected to be xx% over the forecast period (2025–2033).

Dominant Regions, Countries, or Segments in Norway Wind Energy Industry

The Norway Wind Energy Industry's dominance is primarily shaped by advancements in Offshore Wind Energy, driven by Norway's unique geographical advantages and supportive policy environment. The Utilities end-user industry stands as the most significant driver of market growth, owing to the national imperative to decarbonize the electricity grid and meet escalating energy demands through renewable sources. Application-wise, Electricity Generation remains the cornerstone, with a substantial portion of new capacity dedicated to feeding the national grid.

Key drivers for the dominance of Offshore Wind Energy include:

- Vast Offshore Potential: Norway possesses extensive coastlines with deep waters and strong, consistent wind resources, making it ideal for large-scale offshore wind farms.

- Technological Leadership in Floating Offshore Wind: Companies like Equinor are pioneering floating offshore wind technology, unlocking previously inaccessible deep-water sites and significantly increasing the potential for wind energy deployment.

- Governmental Support and Licensing: The Norwegian government has actively opened up offshore areas for licensing applications, such as Utsira Nord, signaling strong political will and commitment to developing this segment. This proactive approach has attracted substantial investment and expertise.

- Economic Policies: Favorable incentives, tax regimes, and long-term power purchase agreements for offshore wind projects reduce investment risk and encourage large-scale development.

- Infrastructure and Expertise: Decades of experience in the offshore oil and gas sector have provided Norway with a highly skilled workforce, established supply chains, and robust maritime infrastructure, all of which are transferable and beneficial to offshore wind development.

Within the Utilities end-user industry, growth is propelled by:

- Decarbonization Mandates: National and international commitments to reduce carbon emissions necessitate a rapid transition away from fossil fuels, making wind energy a critical component of utility portfolios.

- Grid Stability and Reliability: Advanced grid management technologies and the increasing integration of wind power are enhancing the stability and reliability of the Norwegian electricity grid.

- Energy Security: Diversifying the energy mix with domestic renewable sources enhances Norway's energy security and reduces reliance on volatile global energy markets.

The dominance of Electricity Generation as an application is directly linked to the overarching need for sustainable power. While Hybrid Systems are an emerging application, currently, the focus remains on utility-scale electricity generation to meet baseline power requirements and achieve national renewable energy targets.

Horizontal Axis Wind Turbines (HAWTs) are the predominant technology due to their established efficiency and scalability, particularly for large onshore and offshore installations. While Vertical Axis Wind Turbines (VAWTs) hold promise for specific niche applications and urban environments, HAWTs currently lead in terms of market share and deployed capacity.

The dominance of these segments underscores a strategic focus on leveraging Norway's natural resources and technological capabilities to establish a leading position in the global renewable energy market, with offshore wind and utility-scale electricity generation at the forefront.

Norway Wind Energy Industry Product Landscape

The Norway Wind Energy Industry product landscape is characterized by continuous innovation in turbine technology and a focus on maximizing energy capture in diverse environmental conditions. Horizontal Axis Wind Turbines (HAWTs) remain the dominant technology, with manufacturers like Siemens Gamesa and Nordex SE consistently introducing larger, more efficient models designed for both onshore and offshore deployment. Innovations include advanced blade aerodynamics, enhanced gearbox technologies, and sophisticated control systems that optimize performance under varying wind speeds. Offshore wind is witnessing groundbreaking developments, particularly in floating wind turbine foundations, enabling access to deeper waters and unlocking vast untapped potential. These advancements are crucial for companies like Equinor and Statkraft, which are heavily investing in large-scale offshore projects. The integration of advanced data analytics and predictive maintenance solutions further enhances the operational efficiency and longevity of wind turbines.

Key Drivers, Barriers & Challenges in Norway Wind Energy Industry

Key Drivers:

The Norway Wind Energy Industry is propelled by a potent combination of factors:

- Governmental Support and Ambitious Renewable Targets: Norway's commitment to achieving ambitious climate goals, such as net-zero emissions, translates into strong policy backing, incentives, and dedicated licensing rounds for wind energy development.

- Abundant Renewable Resources: The country's extensive coastlines and consistent wind patterns, particularly offshore, present immense potential for wind energy generation.

- Technological Advancements: Continuous innovation in turbine efficiency, offshore floating technology, and grid integration solutions are making wind energy more cost-effective and accessible.

- Corporate Sustainability Initiatives: Increasing pressure from stakeholders and a growing corporate focus on Environmental, Social, and Governance (ESG) principles are driving industrial adoption of renewable energy.

- Energy Security and Independence: Diversifying the energy mix with domestic renewable sources enhances Norway's energy security and reduces reliance on volatile fossil fuel markets.

Barriers & Challenges:

Despite its promising outlook, the industry faces significant hurdles:

- High Upfront Investment Costs: The capital-intensive nature of wind farm development, especially offshore projects, requires substantial initial investment.

- Grid Integration and Infrastructure Limitations: Expanding and modernizing the grid infrastructure to accommodate the intermittent nature of wind power and transmit electricity from remote generation sites can be challenging and costly.

- Environmental and Social Concerns: Opposition from local communities regarding visual impact, noise pollution, and potential effects on biodiversity can lead to project delays or cancellations.

- Supply Chain Constraints and Skilled Labor Shortages: As the industry scales up, securing a robust supply chain for components and ensuring the availability of skilled labor for construction and maintenance can become bottlenecks.

- Regulatory Uncertainty and Permitting Processes: Complex and lengthy permitting procedures, coupled with potential changes in regulatory frameworks, can introduce uncertainty and impact project timelines. The volume of M&A activities indicates a potential need for consolidation to overcome these challenges, with deal values estimated to be in the hundreds of millions of units.

Emerging Opportunities in Norway Wind Energy Industry

Emerging opportunities in the Norway Wind Energy Industry lie in the expansion of floating offshore wind technology, which unlocks vast, previously inaccessible deep-water areas. The development of hybrid energy systems, integrating wind power with other renewables like solar and energy storage solutions, presents a significant avenue for enhancing grid stability and reliability. Furthermore, the growing demand for green hydrogen production, powered by renewable wind energy, offers a substantial new market. Increased focus on offshore wind as a service and maintenance hub for the broader European market is also a promising development, leveraging Norway's maritime expertise. Untapped potential exists in community-owned wind projects and the integration of wind power into smart grids and distributed energy resource management systems, catering to evolving consumer preferences for local and sustainable energy.

Growth Accelerators in the Norway Wind Energy Industry Industry

Several key growth accelerators are poised to significantly boost the Norway Wind Energy Industry:

- Technological breakthroughs in floating offshore wind foundations are dramatically expanding the viable deployment areas, allowing access to superior wind resources in deeper waters. This is a critical enabler for large-scale offshore projects like those at Utsira Nord.

- Strategic partnerships and joint ventures between established energy companies (e.g., Equinor, Statkraft) and technology providers (e.g., Siemens Gamesa, Nordex SE) are crucial for de-risking large projects and leveraging synergistic expertise.

- Market expansion strategies by companies like E ON SE and Fjordkraft, focusing on both utility-scale developments and integrated energy solutions for industrial and residential clients, are broadening the market's reach. The increasing demand for Power Purchase Agreements (PPAs) from industrial consumers seeking to meet their sustainability targets also acts as a significant accelerator.

Key Players Shaping the Norway Wind Energy Industry Market

- Statkraft

- Equinor

- Nordex SE

- E ON SE

- Siemens Gamesa

- Fjordkraft

- Norsk Vind Energi

Notable Milestones in Norway Wind Energy Industry Sector

- August 2023: Equinor, Norwegian Energy Company, announced the integration of the world's largest offshore wind energy plant. The plant's total capacity is 88 MW, covering 35% of Norway's annual electricity demand.

- February 2022: Agder Energi, a leading Norwegian power utility, and Macquarie's Green Investment Group (GIG) partnered to bid for a floating offshore wind project at Utsira Nord in the Norwegian North Sea. Utsira Nord (1.5 GW) is one of two areas the Norwegian government opened to licensing applications for offshore wind development.

In-Depth Norway Wind Energy Industry Market Outlook

The Norway Wind Energy Industry market outlook is exceptionally positive, driven by a confluence of supportive policies, technological innovation, and growing demand for clean energy. Growth accelerators, such as advancements in floating offshore wind technology and strategic industry partnerships, will continue to unlock new deployment opportunities and enhance project viability. The anticipated expansion of offshore wind capacity, coupled with increasing integration of hybrid systems and a burgeoning green hydrogen sector, will significantly contribute to market growth. Strategic opportunities for market expansion by key players like Statkraft and Equinor, alongside the growing interest from industrial and residential consumers, indicate a robust and sustained upward trajectory for the Norwegian wind energy sector. The market is expected to see continued investment and consolidation, with a strong focus on sustainability and energy independence shaping its future.

Norway Wind Energy Industry Segmentation

-

1. Type of Wind Energy

- 1.1. Onshore Wind Energy

- 1.2. Offshore Wind Energy

-

2. Application

- 2.1. Electricity Generation

- 2.2. Hybrid Systems

-

3. Technology

- 3.1. Horizontal Axis Wind Turbines (HAWT)

- 3.2. Vertical Axis Wind Turbines (VAWT)

-

4. End-User Industry

- 4.1. Utilities

- 4.2. Industrial

- 4.3. Residential

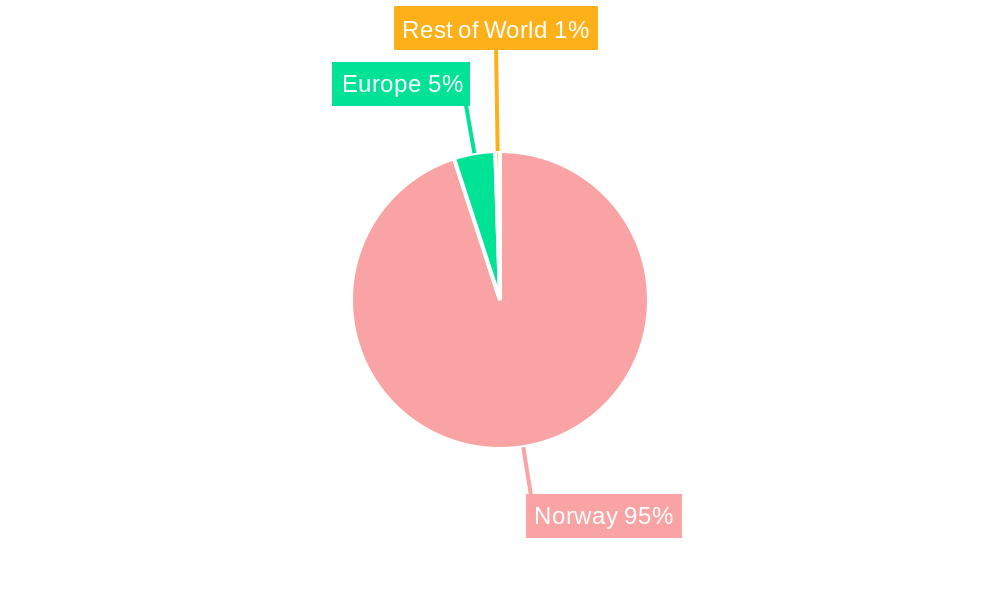

Norway Wind Energy Industry Segmentation By Geography

- 1. Norway

Norway Wind Energy Industry Regional Market Share

Geographic Coverage of Norway Wind Energy Industry

Norway Wind Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Wind Resources4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Land Availability

- 3.4. Market Trends

- 3.4.1. Onshore Wind Energy to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Wind Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Wind Energy

- 5.1.1. Onshore Wind Energy

- 5.1.2. Offshore Wind Energy

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electricity Generation

- 5.2.2. Hybrid Systems

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Horizontal Axis Wind Turbines (HAWT)

- 5.3.2. Vertical Axis Wind Turbines (VAWT)

- 5.4. Market Analysis, Insights and Forecast - by End-User Industry

- 5.4.1. Utilities

- 5.4.2. Industrial

- 5.4.3. Residential

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Type of Wind Energy

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Statkraft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equinor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nordex SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 E ON SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fjordkraft

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Norsk Vind Energi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Statkraft

List of Figures

- Figure 1: Norway Wind Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Wind Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Norway Wind Energy Industry Revenue billion Forecast, by Type of Wind Energy 2020 & 2033

- Table 2: Norway Wind Energy Industry Volume gigawatt Forecast, by Type of Wind Energy 2020 & 2033

- Table 3: Norway Wind Energy Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Norway Wind Energy Industry Volume gigawatt Forecast, by Application 2020 & 2033

- Table 5: Norway Wind Energy Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Norway Wind Energy Industry Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 7: Norway Wind Energy Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: Norway Wind Energy Industry Volume gigawatt Forecast, by End-User Industry 2020 & 2033

- Table 9: Norway Wind Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Norway Wind Energy Industry Volume gigawatt Forecast, by Region 2020 & 2033

- Table 11: Norway Wind Energy Industry Revenue billion Forecast, by Type of Wind Energy 2020 & 2033

- Table 12: Norway Wind Energy Industry Volume gigawatt Forecast, by Type of Wind Energy 2020 & 2033

- Table 13: Norway Wind Energy Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Norway Wind Energy Industry Volume gigawatt Forecast, by Application 2020 & 2033

- Table 15: Norway Wind Energy Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: Norway Wind Energy Industry Volume gigawatt Forecast, by Technology 2020 & 2033

- Table 17: Norway Wind Energy Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 18: Norway Wind Energy Industry Volume gigawatt Forecast, by End-User Industry 2020 & 2033

- Table 19: Norway Wind Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Norway Wind Energy Industry Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Wind Energy Industry?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the Norway Wind Energy Industry?

Key companies in the market include Statkraft , Equinor , Nordex SE , E ON SE, Siemens Gamesa , Fjordkraft , Norsk Vind Energi.

3. What are the main segments of the Norway Wind Energy Industry?

The market segments include Type of Wind Energy , Application , Technology, End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 34.07 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Wind Resources4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Onshore Wind Energy to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Land Availability.

8. Can you provide examples of recent developments in the market?

August 2023: Equinor, Norwegian Energy Company, announced that the company had integrated the world's largest offshore wind energy plant. The plant's total capacity is 88 MW, covering 35% of Norway's annual electricity demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Wind Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Wind Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Wind Energy Industry?

To stay informed about further developments, trends, and reports in the Norway Wind Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence