Key Insights

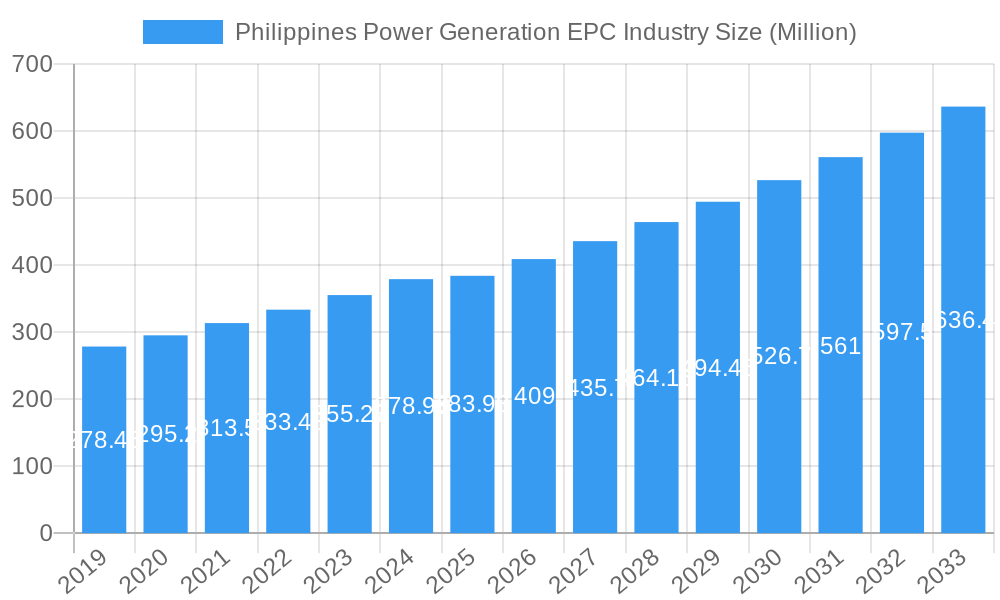

The Philippines Power Generation EPC (Engineering, Procurement, and Construction) industry is poised for significant expansion, projected to reach a market size of USD 383.98 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.89% expected through 2033. This growth trajectory is primarily driven by the nation's escalating energy demand, fueled by economic development, industrialization, and a growing population. The government's commitment to modernizing its energy infrastructure and increasing the share of renewable energy sources in the power mix is a crucial catalyst. Investments in new power plants, upgrades to existing facilities, and the expansion of the transmission and distribution network will create substantial opportunities for EPC players. Key drivers include the need for enhanced grid reliability, the pursuit of energy security, and the adoption of cleaner energy technologies to meet climate goals. The industry is experiencing a strong trend towards integrating renewable energy sources, with a particular focus on solar, wind, and hydro power, alongside a continued reliance on conventional thermal power for baseload generation. This multifaceted approach to power generation necessitates specialized EPC expertise across diverse technologies.

Philippines Power Generation EPC Industry Market Size (In Million)

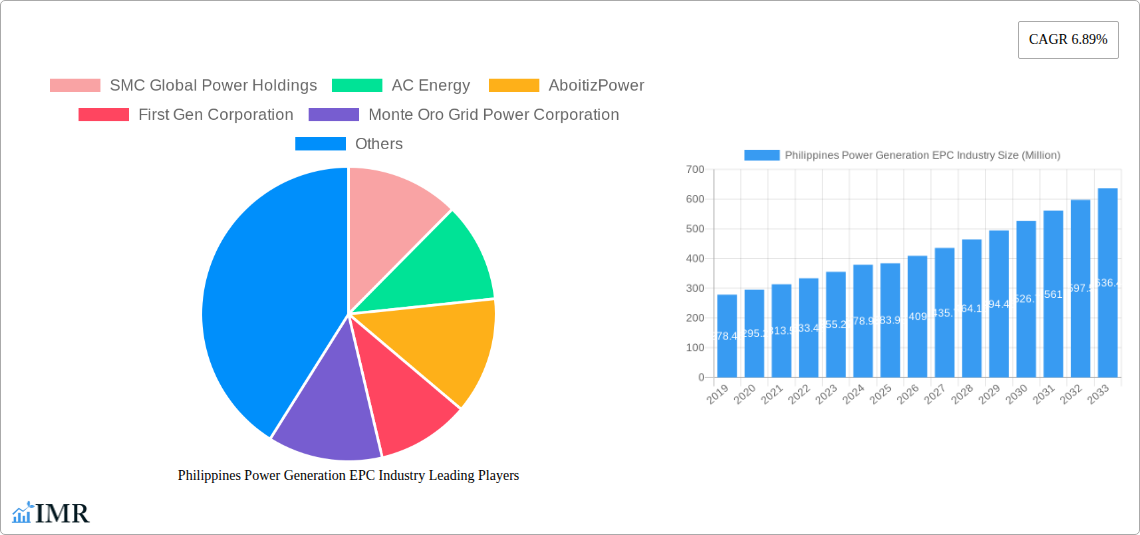

Despite the positive outlook, the industry faces certain restraints that could influence its pace of development. These include potential challenges in securing financing for large-scale projects, navigating complex regulatory frameworks and permitting processes, and the need to address land acquisition issues. Fluctuations in raw material prices and the availability of skilled labor can also present hurdles. However, the concerted efforts by both the public and private sectors to overcome these challenges, coupled with the ongoing demand for power, are expected to propel the Philippines Power Generation EPC market forward. Major players like SMC Global Power Holdings, AC Energy, AboitizPower, First Gen Corporation, and Monte Oro Grid Power Corporation are actively involved in developing and executing projects across the archipelago. The Philippines' strategic location and its focus on building a resilient and sustainable energy future underscore the vital role of the EPC sector in achieving these national objectives. The increasing integration of non-hydro renewables alongside conventional thermal and hydro power highlights a dynamic shift in the nation's energy landscape.

Philippines Power Generation EPC Industry Company Market Share

Philippines Power Generation EPC Industry Report Description

This comprehensive report offers an in-depth analysis of the Philippines Power Generation EPC (Engineering, Procurement, and Construction) Industry. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report provides critical insights into market dynamics, growth trends, and future potential. We delve into parent and child markets, covering the entire spectrum of power generation infrastructure development, from initial planning to operational handover. This report is an essential resource for industry professionals, investors, and policymakers seeking to understand the evolving landscape of power generation in the Philippines. All values are presented in Million units for clarity and ease of analysis.

Philippines Power Generation EPC Industry Market Dynamics & Structure

The Philippines Power Generation EPC Industry is characterized by a moderately concentrated market, with major players like SMC Global Power Holdings, AC Energy, AboitizPower, First Gen Corporation, and Monte Oro Grid Power Corporation holding significant influence. Technological innovation is a key driver, particularly in the adoption of advanced renewable energy technologies and the optimization of conventional thermal power plants for efficiency and reduced emissions. The regulatory framework, established by the Department of Energy (DOE) and the Energy Regulatory Commission (ERC), plays a crucial role in shaping project approvals, tariffs, and environmental standards. Competitive product substitutes, while less prevalent in the EPC phase, exist in the form of distributed generation solutions and energy storage technologies that can complement traditional power sources. End-user demographics are shifting towards a demand for reliable, affordable, and increasingly sustainable power. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate their market position, expand their service offerings, and gain economies of scale. For instance, strategic acquisitions of smaller EPC firms or stakes in generation assets are common to fortify competitive advantages.

- Market Concentration: Dominated by a few key players, leading to competitive bidding and strategic alliances.

- Technological Innovation Drivers: Increasing demand for cleaner energy solutions, grid modernization, and digital transformation in project management.

- Regulatory Frameworks: Robust policies aimed at energy security, diversification, and attracting foreign direct investment.

- Competitive Product Substitutes: Emerging technologies like battery energy storage systems (BESS) are influencing EPC strategies.

- End-User Demographics: Growing industrial and residential demand, coupled with a rising awareness of environmental impact.

- M&A Trends: Consolidation for market share, diversification of portfolios, and acquisition of specialized expertise.

Philippines Power Generation EPC Industry Growth Trends & Insights

The Philippines Power Generation EPC Industry is poised for significant expansion, driven by escalating electricity demand and the government's commitment to enhancing energy security and sustainability. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of xx% over the forecast period. This growth is underpinned by substantial investments in both conventional thermal power projects and a rapidly accelerating adoption rate of non-hydro renewable energy sources, such as solar and wind power. Technological disruptions, including advancements in modular power plant designs, smart grid integration, and the increasing efficiency of renewable energy components, are transforming the EPC landscape. Consumer behavior shifts are also playing a role, with a growing preference for cleaner energy and a greater emphasis on energy efficiency and reliability. The historical period (2019-2024) has laid the groundwork for this accelerated growth, with consistent infrastructure development and policy support. The base year of 2025 marks a pivotal point, from which the market is expected to gain considerable momentum.

The increasing electrification rate and the Philippines' status as a rapidly developing economy necessitate a continuous expansion of its power generation capacity. This demand is being met through a combination of new plant constructions and upgrades to existing facilities. EPC companies are instrumental in executing these large-scale projects, requiring sophisticated engineering expertise, efficient procurement processes, and meticulous construction management. The evolution of the industry is also being shaped by the integration of digital tools and technologies. Advanced project management software, Building Information Modeling (BIM), and data analytics are becoming indispensable for optimizing project timelines, managing costs, and ensuring the highest standards of safety and quality. Furthermore, the growing awareness of climate change and the Philippines' vulnerability to its impacts are driving a strong push towards renewable energy. This shift presents both opportunities and challenges for EPC providers, who must adapt their capabilities to design and build more complex renewable energy infrastructure, including offshore wind farms and large-scale solar arrays. The ability to navigate diverse regulatory environments, secure financing for capital-intensive projects, and manage complex supply chains will be crucial for success in this dynamic market. The market penetration of renewable energy technologies is expected to surge, driven by supportive government incentives, falling technology costs, and a growing environmental consciousness among consumers and corporations. This will necessitate a significant ramp-up in EPC services for solar farms, wind farms, and potentially geothermal and biomass projects. The interplay between these factors—rising demand, technological advancements, and policy support—creates a fertile ground for substantial growth within the Philippines Power Generation EPC Industry.

Dominant Regions, Countries, or Segments in Philippines Power Generation EPC Industry

Within the Philippines Power Generation EPC Industry, Non-hydro Renewables stands out as the dominant segment driving market growth. This segment's ascendancy is propelled by a confluence of economic policies, infrastructure development initiatives, and a concerted global and national effort to transition towards cleaner energy sources. The Philippine government, through various legislative acts and policy pronouncements, has actively encouraged the development of renewable energy projects. Key drivers include the Renewable Energy Act of 2008 and subsequent amendments, which provide fiscal incentives such as tax holidays, duty exemptions on imported capital equipment, and net metering schemes. These policies have significantly reduced the financial barriers for investors and developers, making renewable energy projects more attractive and viable.

Furthermore, substantial infrastructure development is underway to support the integration of renewable energy into the national grid. This includes the expansion and modernization of transmission and distribution networks to accommodate the intermittent nature of solar and wind power. The geographical landscape of the Philippines, with its extensive coastlines and abundant sunshine, also presents ideal conditions for large-scale solar and wind farm development. Companies are actively investing in these regions, leading to a surge in EPC projects. For instance, regions in Luzon, particularly those with strong solar irradiance, and the Visayas and Mindanao regions, with their high wind potential, are becoming hubs for renewable energy development. The market share of Non-hydro Renewables in terms of new EPC contracts and project pipeline is rapidly expanding, often surpassing that of conventional thermal power projects.

The growth potential within this segment is immense. As the cost of renewable energy technologies continues to decline, driven by economies of scale and technological advancements, their competitiveness against traditional power sources increases. This trend is further amplified by international climate commitments and the growing corporate demand for renewable energy to meet sustainability targets. EPC firms specializing in solar photovoltaic (PV) installations, onshore and offshore wind turbine deployment, and associated balance-of-plant works are experiencing unprecedented demand. The ability to deliver cost-effective, high-quality renewable energy projects on time and within budget is a key differentiator. The segment's dominance is also reinforced by the declining reliance on imported fossil fuels, enhancing the Philippines' energy security and reducing its exposure to volatile global energy prices. While Conventional Thermal Power will continue to play a role in baseload generation, the future growth trajectory is undeniably skewed towards Non-hydro Renewables. The continuous pipeline of solar and wind projects, supported by robust government policies and increasing private sector investment, solidifies its position as the primary growth engine for the Philippines Power Generation EPC Industry.

Philippines Power Generation EPC Industry Product Landscape

The product landscape within the Philippines Power Generation EPC Industry is characterized by a focus on delivering robust and efficient power generation solutions. For conventional thermal power, this includes advanced boiler systems, high-efficiency turbines, and sophisticated emission control technologies designed to meet stringent environmental regulations. In hydropower, the product focus is on reliable turbine and generator sets, dam construction technology, and associated water management systems. The most dynamic product innovation is observed in Non-hydro Renewables, encompassing high-performance solar panels with increased energy conversion efficiency, advanced wind turbines designed for varying wind conditions, and integrated energy storage solutions like battery energy storage systems (BESS). Unique selling propositions for EPC providers often lie in their ability to offer integrated solutions, leveraging cutting-edge technology for optimized plant performance, reduced operational costs, and minimized environmental impact. Technological advancements are driving the development of smarter, more interconnected power generation assets, enabling better grid integration and enhanced grid stability.

Key Drivers, Barriers & Challenges in Philippines Power Generation EPC Industry

Key Drivers:

- Rising Electricity Demand: Growing population and economic expansion necessitate increased power generation capacity.

- Government Support for Renewables: Favorable policies and incentives for solar, wind, and other renewable energy sources.

- Energy Security Goals: Diversification of the energy mix to reduce reliance on imported fossil fuels.

- Technological Advancements: Improved efficiency and cost-effectiveness of renewable energy technologies and advanced thermal power systems.

- Foreign Direct Investment: Increased interest from international players in the Philippine power sector.

Key Barriers & Challenges:

- Regulatory Hurdles: Complex permitting processes and evolving environmental regulations can cause project delays.

- Supply Chain Disruptions: Global and local supply chain issues can impact the availability and cost of critical equipment, with potential impacts of xx% on project timelines.

- Financing Challenges: Securing substantial capital for large-scale power projects, especially for emerging technologies.

- Grid Integration Issues: Challenges in integrating intermittent renewable energy sources into an aging grid infrastructure.

- Skilled Labor Shortages: A need for specialized engineers and skilled labor for the design and construction of advanced power facilities.

- Land Acquisition: Difficulties and delays in acquiring suitable land for large power plant developments.

Emerging Opportunities in Philippines Power Generation EPC Industry

Emerging opportunities within the Philippines Power Generation EPC Industry are primarily centered around the accelerated adoption of renewable energy technologies and grid modernization. The expansion of offshore wind farms presents a significant untapped market, requiring specialized engineering and construction expertise. Furthermore, the integration of battery energy storage systems (BESS) with both new and existing power plants offers substantial growth potential for enhancing grid stability and reliability. The increasing demand for green hydrogen production facilities also represents a nascent but promising area for EPC involvement. Evolving consumer preferences towards sustainability are also driving opportunities in distributed generation and microgrid solutions for remote communities and industrial parks.

Growth Accelerators in the Philippines Power Generation EPC Industry Industry

Several catalysts are accelerating growth in the Philippines Power Generation EPC Industry. Technological breakthroughs in solar PV efficiency and wind turbine design are continuously making renewable energy more competitive. Strategic partnerships between local EPC firms and international technology providers are crucial for knowledge transfer and access to advanced solutions. Market expansion strategies by established players, including diversification into new renewable energy sub-segments like geothermal or biomass, are also driving growth. The government's continued commitment to renewable energy targets and the development of enabling infrastructure, such as new transmission lines, are critical enablers of this accelerated expansion.

Key Players Shaping the Philippines Power Generation EPC Industry Market

- SMC Global Power Holdings

- AC Energy

- AboitizPower

- First Gen Corporation

- Monte Oro Grid Power Corporation

Notable Milestones in Philippines Power Generation EPC Industry Sector

- 2019: Launch of major solar farm projects across Luzon, significantly increasing solar capacity.

- 2020: Government announces ambitious targets for renewable energy development, spurring new project pipelines.

- 2021: Inauguration of significant wind farm expansions in the Visayas region, demonstrating commitment to wind power.

- 2022: Increased M&A activity as larger players acquire smaller EPC firms to consolidate market share and expertise.

- 2023: Introduction of policies to encourage energy storage solutions, paving the way for more BESS projects.

- 2024 (estimated): Commencement of pre-feasibility studies for early offshore wind projects in key coastal areas.

In-Depth Philippines Power Generation EPC Industry Market Outlook

The future market outlook for the Philippines Power Generation EPC Industry is exceptionally positive, driven by a robust pipeline of renewable energy projects and strategic government initiatives. Growth accelerators, including ongoing technological innovation in solar and wind power, coupled with the increasing integration of energy storage solutions, will continue to shape the industry's trajectory. Strategic partnerships and market expansion by key players, alongside the government's commitment to a diversified and sustainable energy mix, will fuel long-term expansion. The industry is well-positioned to capitalize on the increasing demand for clean, reliable, and affordable energy, with opportunities for innovation and substantial investment continuing to emerge.

Philippines Power Generation EPC Industry Segmentation

-

1. Power Generation Source

- 1.1. Conventional Thermal Power

- 1.2. Hydro Power

- 1.3. Non-hydro Renewables

Philippines Power Generation EPC Industry Segmentation By Geography

- 1. Philippines

Philippines Power Generation EPC Industry Regional Market Share

Geographic Coverage of Philippines Power Generation EPC Industry

Philippines Power Generation EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Energy Demand4.; Upcoming and Ongoing Projects of Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Complexity and Expensive Nature of Coal-fired and Natural-gas-fired Power Plants

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Power Generation EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Conventional Thermal Power

- 5.1.2. Hydro Power

- 5.1.3. Non-hydro Renewables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SMC Global Power Holdings

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AC Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AboitizPower

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 First Gen Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monte Oro Grid Power Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 SMC Global Power Holdings

List of Figures

- Figure 1: Philippines Power Generation EPC Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Power Generation EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Philippines Power Generation EPC Industry Revenue Million Forecast, by Power Generation Source 2020 & 2033

- Table 2: Philippines Power Generation EPC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Philippines Power Generation EPC Industry Revenue Million Forecast, by Power Generation Source 2020 & 2033

- Table 4: Philippines Power Generation EPC Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Power Generation EPC Industry?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the Philippines Power Generation EPC Industry?

Key companies in the market include SMC Global Power Holdings, AC Energy , AboitizPower , First Gen Corporation, Monte Oro Grid Power Corporation.

3. What are the main segments of the Philippines Power Generation EPC Industry?

The market segments include Power Generation Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 383.98 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Energy Demand4.; Upcoming and Ongoing Projects of Power Plants.

6. What are the notable trends driving market growth?

Conventional Thermal Power is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Complexity and Expensive Nature of Coal-fired and Natural-gas-fired Power Plants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Power Generation EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Power Generation EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Power Generation EPC Industry?

To stay informed about further developments, trends, and reports in the Philippines Power Generation EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence