Key Insights

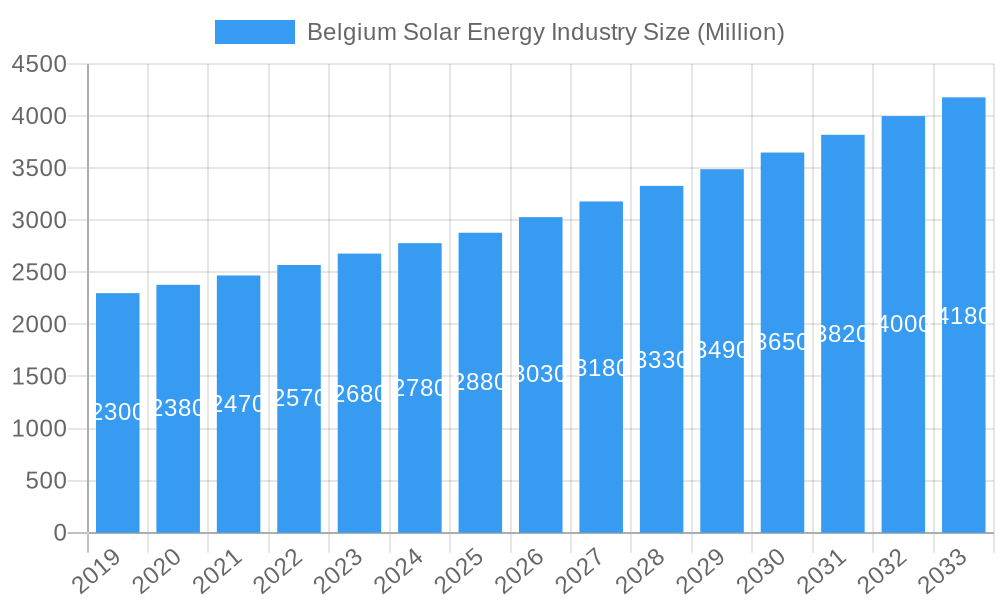

Belgium's solar energy sector is projected for significant growth, with an estimated market size of $2.80 billion by 2025. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 6.58% through 2033. This expansion is driven by supportive governmental initiatives, heightened environmental awareness, and advancements in solar photovoltaic (PV) and concentrated solar photovoltaic (CSP) technologies. Belgium's strategic European positioning and its dedication to renewable energy targets foster a favorable investment climate. Demand is rising for both large-scale solar farms and distributed rooftop systems, influenced by decreasing solar panel costs and increasing electricity prices. Key growth factors include ambitious decarbonization objectives, incentives for renewable energy adoption, and growing corporate demand for green energy.

The Belgian solar market comprises Solar Photovoltaic (PV) and Concentrated Solar Photovoltaic (CSP) segments. While PV technology currently leads, CSP is gaining prominence for its large-scale power generation and thermal energy storage capabilities, especially in industrial settings. Emerging trends include the integration of smart grid technologies for improved grid stability, the development of energy storage solutions to mitigate intermittency, and innovative financing models enhancing solar energy accessibility for residential and commercial users. Challenges include land availability for large projects and the necessity for grid infrastructure enhancements. Prominent players such as 7C Solarparken AG, First Solar Inc., and Sungrow Power Supply Co. Ltd. are instrumental in Belgium's clean energy transition.

Belgium Solar Energy Industry Company Market Share

Belgium Solar Energy Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the Belgium Solar Energy Industry, forecasting significant growth and evolution through 2033. We delve into market dynamics, uncover dominant segments, and highlight key players and technological advancements shaping the future of solar power in Belgium.

Belgium Solar Energy Industry Market Dynamics & Structure

The Belgian solar energy market exhibits a moderately concentrated structure, with a few key players holding significant market share, particularly in the Solar Photovoltaic (PV) segment. Technological innovation is a primary driver, fueled by ambitious EU renewable energy targets and national policy support. Regulatory frameworks, including feed-in tariffs and net-metering policies, have historically played a crucial role, though evolving support mechanisms are continuously reshaping the landscape. Competitive product substitutes, primarily from other renewable energy sources and evolving energy storage solutions, are becoming more prevalent. End-user demographics are shifting, with a growing adoption by residential consumers, commercial enterprises, and increasingly, industrial facilities seeking to reduce operational costs and carbon footprints. Mergers and acquisitions (M&A) trends indicate consolidation and strategic partnerships aimed at expanding market reach and technological capabilities.

- Market Concentration: Dominated by a few large-scale project developers and module manufacturers, but with a growing number of smaller installers and service providers.

- Technological Innovation Drivers: Government incentives for R&D, corporate sustainability goals, and advancements in solar panel efficiency and energy storage.

- Regulatory Frameworks: Strong EU directives for renewable energy penetration, supplemented by national support schemes and grid connection regulations.

- Competitive Product Substitutes: Wind energy, biomass, energy efficiency measures, and battery storage solutions.

- End-User Demographics: Increasing adoption across residential, commercial, and industrial sectors driven by cost savings and environmental consciousness.

- M&A Trends: Strategic acquisitions for market entry, technology acquisition, and portfolio expansion. Anticipated M&A deal volume is projected to be in the range of 5-10 significant deals annually in the forecast period.

Belgium Solar Energy Industry Growth Trends & Insights

The Belgium solar energy industry is poised for substantial growth, driven by a robust policy environment and increasing investor confidence. The market size is expected to expand significantly, with a Compound Annual Growth Rate (CAGR) of approximately 12% projected from the base year of 2025 through 2033. This expansion is underpinned by escalating adoption rates of solar PV systems across all sectors, spurred by declining technology costs and a strong societal push towards decarbonization. Technological disruptions, such as advancements in perovskite solar cells and more efficient inverters, are set to further enhance performance and reduce the levelized cost of energy (LCOE). Consumer behavior is shifting demonstrably, with a growing preference for self-consumption of solar-generated electricity and participation in energy communities. The market penetration of solar energy is projected to reach over 25% of Belgium’s total electricity generation by 2033.

- Market Size Evolution: The market size is projected to grow from an estimated €2,500 Million in 2025 to over €6,000 Million by 2033.

- Adoption Rates: A steady increase in the installation of rooftop solar PV systems for residential and commercial use, alongside the development of utility-scale solar farms.

- Technological Disruptions: Innovations in bifacial panels, smart inverters, and integrated battery storage solutions are enhancing energy yield and grid integration.

- Consumer Behavior Shifts: Growing interest in prosumer models, virtual power plants, and energy-sharing initiatives.

- Market Penetration: Expected to rise from approximately 10% in 2025 to over 25% of the national electricity mix by 2033.

Dominant Regions, Countries, or Segments in Belgium Solar Energy Industry

The Solar Photovoltaic (PV) segment is unequivocally the dominant force driving growth within the Belgian solar energy industry. This dominance is a direct result of the maturing technology, widespread availability of components, and robust policy support that has historically favored PV installations. While Concentrated Solar Photovoltaic (CSP) technology offers potential for large-scale electricity generation, its application in Belgium is significantly limited by geographical and climatic factors, making it a niche segment with minimal market share. The PV segment benefits from economic policies promoting renewable energy adoption, substantial investments in grid infrastructure to accommodate distributed generation, and a diverse range of applications from rooftop installations to utility-scale solar parks. The growth potential within the PV segment is immense, driven by continuous improvements in panel efficiency and storage solutions, making it the cornerstone of Belgium's energy transition.

- Dominant Segment: Solar Photovoltaic (PV)

- Market Share: Expected to account for over 98% of the total solar energy market value by 2033.

- Key Drivers:

- Economic Policies: Favorable feed-in tariffs, tax incentives, and subsidies for PV installations.

- Infrastructure Development: Continuous upgrades to the national grid to support distributed solar generation.

- Technological Advancements: Ongoing improvements in silicon-based PV cells and emerging thin-film technologies.

- Cost Competitiveness: Declining manufacturing costs have made solar PV one of the most affordable forms of electricity generation.

- Decentralized Energy Production: Encouragement of self-consumption and prosumer models.

- Niche Segment: Concentrated Solar Photovoltaic (CSP)

- Market Share: Negligible, with limited current installations and future growth potential in Belgium.

- Limitations: Requires high direct solar irradiation and large land areas, which are less abundant in Belgium compared to other regions.

Belgium Solar Energy Industry Product Landscape

The product landscape within the Belgium solar energy industry is characterized by continuous innovation in solar panel technology and integrated energy solutions. High-efficiency photovoltaic (PV) modules, including bifacial panels that capture sunlight from both sides, are becoming increasingly standard, enhancing energy yield and overall performance. The development of advanced inverters with smart grid capabilities and sophisticated monitoring systems further optimizes energy production and grid integration. Emerging applications include building-integrated photovoltaics (BIPV), where solar cells are incorporated into construction materials, and the widespread adoption of battery energy storage systems (BESS) that complement solar installations by providing grid stability and enabling off-peak energy utilization. These advancements are not only improving the cost-effectiveness of solar energy but also expanding its versatility.

Key Drivers, Barriers & Challenges in Belgium Solar Energy Industry

Key Drivers:

- Ambitious Renewable Energy Targets: EU and national mandates for decarbonization are the primary impetus for solar adoption.

- Declining Technology Costs: Significant reductions in the manufacturing cost of solar panels and associated components.

- Government Incentives and Subsidies: Financial support mechanisms continue to encourage investment in solar projects.

- Growing Environmental Awareness: Increased public and corporate demand for sustainable energy solutions.

- Energy Security Concerns: A drive to reduce reliance on imported fossil fuels.

Barriers & Challenges:

- Grid Integration and Capacity: The existing grid infrastructure may require upgrades to handle the increasing influx of intermittent solar power.

- Intermittency and Storage: The reliance on sunlight necessitates effective energy storage solutions to ensure a consistent power supply.

- Permitting and Bureaucracy: Complex and time-consuming approval processes can delay project development.

- Supply Chain Volatility: Global supply chain disruptions and raw material price fluctuations can impact project costs.

- Land Use and Siting Issues: Availability of suitable land for large-scale solar farms can be a challenge in a densely populated country.

- Competition from Other Renewables: While solar PV is dominant, other renewable sources are also vying for market share.

Emerging Opportunities in Belgium Solar Energy Industry

Emerging opportunities in the Belgium solar energy sector are centered around the integration of advanced technologies and novel business models. The expansion of energy storage solutions, including residential and grid-scale battery systems, presents a significant avenue for growth, enabling greater grid stability and maximizing the utilization of solar power. The development of smart grids and virtual power plants (VPPs) allows for optimized energy management and the participation of smaller prosumers in energy markets. Furthermore, innovations in building-integrated photovoltaics (BIPV) offer potential for aesthetic and functional solar solutions in new and existing constructions. The increasing focus on circular economy principles also opens opportunities for recycling and repurposing solar components.

Growth Accelerators in the Belgium Solar Energy Industry Industry

The long-term growth of the Belgium solar energy industry is being significantly accelerated by continuous technological breakthroughs, particularly in solar cell efficiency and energy storage capabilities. Strategic partnerships between technology providers, project developers, and grid operators are crucial for overcoming integration challenges and unlocking new market potentials. Market expansion strategies, including the development of floating solar farms on inland waterways and the integration of solar power into agricultural practices (agrivoltaics), are set to diversify and broaden the reach of solar energy. The increasing focus on decentralized energy systems and energy communities further fuels adoption and creates a more resilient and localized energy landscape.

Key Players Shaping the Belgium Solar Energy Industry Market

- 7C Solarparken AG

- First Solar Inc

- Orka Power

- SolarPower Europe

- 3E

- Zonnecentrale Overpelt NV

- Sungrow Power Supply Co Ltd

Notable Milestones in Belgium Solar Energy Industry Sector

- April 2023: Scientists in Belgium developed perovskite solar panels with a thermally stable device stack. The encapsulated bifacial panels they created with this configuration retained around 92% of their initial efficiency after 1,000 hours.

- March 2022: Belgium-based Belinus announced its new PV modules, featuring a nominal power rating of 420 W and a power conversion efficiency of 20.1%. They had plans to build a 500 MW solar panel factory at an unspecified Belgian site.

In-Depth Belgium Solar Energy Industry Market Outlook

The Belgium solar energy industry is poised for sustained expansion, driven by a confluence of supportive policies, technological advancements, and growing environmental consciousness. The outlook suggests a significant increase in installed solar capacity, with Solar Photovoltaic (PV) remaining the dominant technology. Growth accelerators, including innovations in energy storage and smart grid integration, will be critical in mitigating intermittency challenges and enhancing grid stability. Strategic partnerships and market expansion into novel applications will further propel the industry forward, cementing Belgium's commitment to a renewable energy future. The projected market growth indicates a robust investment landscape and significant opportunities for stakeholders across the value chain.

Belgium Solar Energy Industry Segmentation

- 1. Solar Photovotaic (PV)

- 2. Concentrated Solar Photovoltaic (CSP)

Belgium Solar Energy Industry Segmentation By Geography

- 1. Belgium

Belgium Solar Energy Industry Regional Market Share

Geographic Coverage of Belgium Solar Energy Industry

Belgium Solar Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Solar PV Type Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solar Photovotaic (PV)

- 5.2. Market Analysis, Insights and Forecast - by Concentrated Solar Photovoltaic (CSP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Solar Photovotaic (PV)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 7C Solarparken AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 First Solar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orka Power

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SolarPower Europe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3E

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zonnecentrale Overpelt NV*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sungrow Power Supply Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 7C Solarparken AG

List of Figures

- Figure 1: Belgium Solar Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Belgium Solar Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Belgium Solar Energy Industry Revenue billion Forecast, by Solar Photovotaic (PV) 2020 & 2033

- Table 2: Belgium Solar Energy Industry Revenue billion Forecast, by Concentrated Solar Photovoltaic (CSP) 2020 & 2033

- Table 3: Belgium Solar Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Belgium Solar Energy Industry Revenue billion Forecast, by Solar Photovotaic (PV) 2020 & 2033

- Table 5: Belgium Solar Energy Industry Revenue billion Forecast, by Concentrated Solar Photovoltaic (CSP) 2020 & 2033

- Table 6: Belgium Solar Energy Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Solar Energy Industry?

The projected CAGR is approximately 6.58%.

2. Which companies are prominent players in the Belgium Solar Energy Industry?

Key companies in the market include 7C Solarparken AG, First Solar Inc, Orka Power, SolarPower Europe, 3E, Zonnecentrale Overpelt NV*List Not Exhaustive, Sungrow Power Supply Co Ltd.

3. What are the main segments of the Belgium Solar Energy Industry?

The market segments include Solar Photovotaic (PV), Concentrated Solar Photovoltaic (CSP).

4. Can you provide details about the market size?

The market size is estimated to be USD XXX billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Solar PV Type Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

April 2023: Scientists in Belgium developed perovskite solar panels with a thermally stable device stack. The encapsulated bifacial panels they created with this configuration retained around 92% of their initial efficiency after 1,000 hours.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Solar Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Solar Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Solar Energy Industry?

To stay informed about further developments, trends, and reports in the Belgium Solar Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence