Key Insights

The China LNG Bunkering Market is projected for substantial growth, expected to reach $1.62 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 30.5%. This expansion is primarily fueled by the increasing adoption of Liquefied Natural Gas (LNG) as an environmentally superior maritime fuel, in response to stringent global and domestic regulations targeting sulfur oxide (SOx) and nitrogen oxide (NOx) emissions. China's strategic investment in LNG bunkering infrastructure, including dedicated terminals and an expanding LNG-fueled fleet, alongside supportive government policies and a commitment to green shipping leadership, are key accelerators for the market.

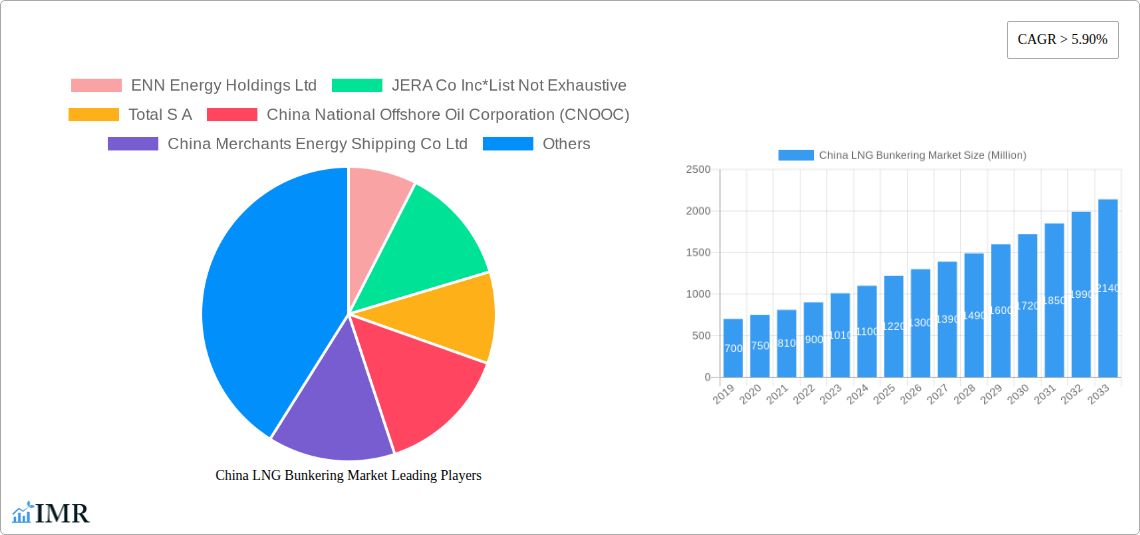

China LNG Bunkering Market Market Size (In Billion)

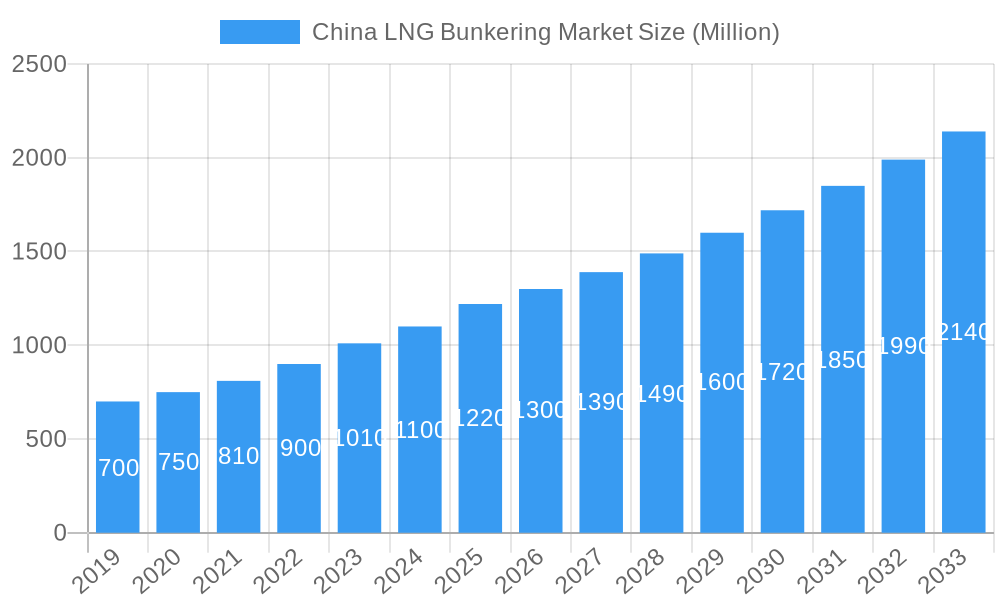

Key market segments include the Tanker and Container Fleets, which are anticipated to lead demand due to regulatory pressures and operational cost advantages. The Bulk and General Cargo Fleet, and Ferries and Offshore Support Vessels (OSVs) segments are also poised for significant growth as LNG bunkering becomes more accessible and economically viable. Emerging trends encompass advancements in bunkering technologies, strategic collaborations between fuel suppliers and shipping entities, and a rising demand for sustainable maritime solutions. Challenges may include the initial capital investment for LNG-powered vessels and infrastructure, alongside the need for standardized safety regulations and skilled personnel. Prominent companies like ENN Energy Holdings Ltd., JERA Co Inc., Total S.A., China National Offshore Oil Corporation (CNOOC), and China Petroleum & Chemical Corporation (Sinopec) are actively expanding their presence in this evolving market.

China LNG Bunkering Market Company Market Share

This comprehensive report offers an in-depth analysis of the China LNG Bunkering Market, a rapidly expanding sector driven by environmental mandates and technological advancements. Explore the dynamic interplay of market forces, growth trajectories, and key players shaping the future of marine fuel in one of the world's largest shipping economies. With a focus on the parent market (LNG bunkering in China) and its child markets (segment-specific bunkering operations), this report provides actionable insights for stakeholders.

China LNG Bunkering Market Market Dynamics & Structure

The China LNG Bunkering Market is characterized by a growing, yet moderately concentrated, competitive landscape. Technological innovation is a primary driver, with advancements in liquefaction, storage, and bunkering vessel technology enabling more efficient and safer operations. Regulatory frameworks, particularly China's commitment to carbon neutrality by 2060, are creating a favorable environment for LNG adoption, incentivizing cleaner fuels. While competitive product substitutes like traditional marine fuels and emerging alternative fuels exist, LNG offers a compelling balance of environmental benefits and cost-effectiveness in the medium term. End-user demographics are evolving, with an increasing demand from the tanker fleet, container fleet, and bulk and general cargo fleet seeking to comply with stricter emissions standards. Mergers and acquisitions (M&A) are anticipated to play a significant role in market consolidation, with large state-owned enterprises and private energy companies actively seeking strategic partnerships. The estimated market share of major players is dynamic, but key entities are steadily increasing their presence. Innovation barriers include the high upfront cost of infrastructure development and the need for standardized safety protocols.

- Market Concentration: Moderate, with a few key state-owned enterprises and growing private sector participation.

- Technological Innovation: Driven by efficiency improvements in liquefaction, storage, and bunkering vessels, with a focus on safety and environmental compliance.

- Regulatory Frameworks: Strongly influenced by national environmental policies, including carbon neutrality goals and emissions reduction targets.

- Competitive Product Substitutes: Traditional bunker fuels (HFO, MGO), methanol, ammonia, and hydrogen are emerging as alternatives, but LNG currently offers a favorable balance.

- End-User Demographics: Increasing adoption by tanker, container, bulk, and general cargo fleets, as well as ferries and OSVs.

- M&A Trends: Anticipated increase in strategic partnerships and consolidation to secure market share and operational efficiencies.

China LNG Bunkering Market Growth Trends & Insights

The China LNG Bunkering Market is poised for substantial growth, driven by a confluence of environmental imperatives and economic development. The market size evolution is projected to witness a significant upward trend throughout the study period (2019–2033). Fueled by proactive government policies aimed at reducing marine emissions, the adoption rates of LNG as a marine fuel are accelerating. China's ambitious target of becoming carbon neutral by 2060 is a pivotal factor, creating a strong demand for cleaner energy solutions across all industrial sectors, including shipping.

The technological disruptions in the bunkering infrastructure, including the development of dedicated LNG bunkering vessels and onshore receiving facilities, are enhancing accessibility and reliability. The introduction of vessels like the "Huanghai Sino" in 2022, China's first LNG bunkering vessel, signifies a critical step in building domestic capacity and expertise. Furthermore, the consumer behavior shifts among shipping companies are notable. Faced with increasingly stringent International Maritime Organization (IMO) regulations and the growing pressure from cargo owners for sustainable logistics, operators are actively seeking to transition to compliant and environmentally responsible fuels. The market penetration of LNG bunkering is expected to rise dramatically, particularly in key port regions along China's extensive coastline and inland waterways.

The CAGR for the forecast period (2025–2033) is anticipated to be robust, reflecting the strong underlying demand and supportive policy environment. The base year (2025) serves as a crucial benchmark, with the market already demonstrating considerable momentum from the historical period (2019–2024). The estimated year (2025) is projected to show significant progress in infrastructure development and fleet conversion. Industry developments, such as the new subsidies for LNG bunkering facilities and vessels announced in 2023, are poised to further catalyze this growth, making LNG bunkering a more economically viable and attractive option for shipowners and operators. The increasing focus on sustainability throughout the global supply chain will continue to drive this market's expansion, making China a pivotal hub for LNG bunkering operations.

Dominant Regions, Countries, or Segments in China LNG Bunkering Market

The Tanker Fleet segment is identified as a dominant force driving growth within the China LNG Bunkering Market. This is primarily attributed to the significant volume of crude oil, refined products, and chemical tankers that operate within and call at Chinese ports. The stringent emission regulations imposed on these large vessels, coupled with the economic viability of LNG for long-haul voyages, makes it a prime candidate for fuel transition. Furthermore, the inherent volatility of oil prices often makes LNG a more predictable and cost-effective alternative for these high-volume fuel consumers.

- Tanker Fleet Dominance: The sheer number and operational profile of tanker vessels necessitate significant fuel consumption, making them a critical target for LNG bunkering. Their compliance with stricter emissions standards further amplifies this demand.

- Economic Policies: Government incentives and preferential policies aimed at promoting LNG adoption in the maritime sector disproportionately benefit segments with higher fuel consumption, such as tankers.

- Infrastructure Development: Strategic investment in LNG bunkering infrastructure, particularly in major oil and chemical hubs, directly supports the operational needs of the tanker fleet.

- Growth Potential: The potential for emissions reduction and cost savings for tanker operators is substantial, indicating continued strong demand.

The Container Fleet segment also presents substantial growth potential. As global trade continues to rely heavily on containerized shipping, the pressure to decarbonize this vital sector is immense. Chinese ports, being major global transshipment hubs, are at the forefront of this transition.

- Global Trade Dependence: The high volume of international container traffic through Chinese ports drives the need for cleaner fuels to meet global environmental standards.

- Port Infrastructure Alignment: Major Chinese ports are actively investing in LNG bunkering facilities to cater to the growing number of LNG-powered container vessels.

- Technological Advancements: The increasing availability of dual-fuel container vessels and efficient bunkering solutions supports the segment's growth.

The Bulk and General Cargo Fleet and Ferries and OSV segments, while currently representing smaller market shares, are also expected to experience steady growth. The development of inland waterway bunkering facilities, particularly in the Yangtze River Delta region, will boost adoption by ferries and OSVs. The increasing focus on sustainable shipping practices across all vessel types will ensure a broader market penetration of LNG bunkering solutions.

China LNG Bunkering Market Product Landscape

The China LNG Bunkering Market is witnessing significant product innovation centered around enhancing efficiency, safety, and environmental performance. Innovations in liquefaction technologies at gas processing plants ensure higher quality LNG for bunkering. The development of specialized LNG bunkering vessels, such as the "Huanghai Sino," equipped with advanced cryogenic systems and safety features, is transforming the delivery of fuel. Onshore facilities are adopting modular designs for faster deployment and greater flexibility. Furthermore, advancements in gas management systems onboard vessels are improving fuel consumption and reducing emissions. The performance metrics of LNG as a marine fuel, including its significantly lower sulfur, nitrogen oxide (NOx), and particulate matter emissions compared to traditional fuels, are its unique selling propositions.

Key Drivers, Barriers & Challenges in China LNG Bunkering Market

The China LNG Bunkering Market is propelled by several key drivers. Foremost is China's unwavering commitment to environmental sustainability, underscored by its carbon neutrality goal by 2060, which mandates a shift towards cleaner energy sources, including LNG for maritime transport. Increasingly stringent global and domestic emission regulations are compelling shipping companies to adopt cleaner fuels. Technological advancements in LNG liquefaction, storage, and bunkering infrastructure are making LNG more accessible and cost-effective. The cost competitiveness of LNG compared to volatile traditional bunker fuels in certain periods also acts as a significant driver. Government subsidies and supportive policies, such as those announced in 2023, further incentivize investment and adoption.

Conversely, several barriers and challenges hinder the market's full potential. The high upfront investment required for developing LNG bunkering infrastructure, including terminals and vessels, remains a substantial hurdle. Safety concerns and the need for specialized training for handling cryogenic fuels necessitate rigorous protocols and skilled personnel. The availability of LNG-powered vessels is still growing, and the retrofitting of existing fleets can be costly. Supply chain complexities and the need for a robust distribution network across a vast geographical area present logistical challenges. Regulatory inconsistencies or delays in standardization can also impede market development. Competitive pressures from other alternative fuels and the established infrastructure for traditional fuels add to the market's complexities.

Emerging Opportunities in China LNG Bunkering Market

Emerging opportunities in the China LNG Bunkering Market are abundant and diverse. The rapid development of LNG-powered inland waterway vessels, particularly in economically vital regions like the Yangtze River Delta, presents a significant untapped market. The increasing global demand for decarbonized shipping services by cargo owners creates a strong pull for LNG adoption, offering shipping companies a competitive advantage. The expansion of international LNG bunkering hubs in Chinese ports to cater to global shipping routes is another key opportunity. Furthermore, the development of smaller-scale LNG bunkering solutions and mobile bunkering units could unlock new markets and applications. The integration of LNG with other renewable energy sources or the development of synthetic LNG could also represent future growth avenues.

Growth Accelerators in the China LNG Bunkering Market Industry

Several critical catalysts are accelerating the growth of the China LNG Bunkering Market. The relentless pace of technological breakthroughs in liquefaction efficiency, cryogenic containment, and bunkering transfer systems is steadily reducing costs and improving operational safety. Strategic partnerships and collaborations between energy companies, shipping lines, and port authorities are crucial for developing integrated bunkering solutions and securing long-term supply agreements. The proactive market expansion strategies employed by key players, including investments in new bunkering facilities and the acquisition of LNG-powered vessels, are solidifying market presence and driving demand. The ongoing global shift towards decarbonization in the shipping industry, coupled with China's leadership in this transition, provides a robust tailwind for sustained market expansion.

Key Players Shaping the China LNG Bunkering Market Market

- ENN Energy Holdings Ltd

- JERA Co Inc

- Total S A

- China National Offshore Oil Corporation (CNOOC)

- China Merchants Energy Shipping Co Ltd

- China Petroleum & Chemical Corporation (Sinopec)

- China National Petroleum Corporation (CNPC)

- Shanghai LNG

- China National Chemical Corporation (ChemChina)

- China Gas Holdings Limited

Notable Milestones in China LNG Bunkering Market Sector

- 2021: Chinese government announces its goal to become carbon neutral by 2060, significantly increasing the impetus for developing cleaner maritime fuels like LNG.

- 2022: China's first LNG bunkering vessel, the "Huanghai Sino," is put into operation, marking a critical step in domestic LNG supply capabilities for ships in the Yangtze River Delta region.

- 2023: The Chinese government announces new subsidies for LNG bunkering facilities and vessels, providing further financial support and encouraging market development.

In-Depth China LNG Bunkering Market Market Outlook

The future outlook for the China LNG Bunkering Market is exceptionally promising, driven by a confluence of supportive government policies, technological advancements, and the imperative for decarbonization in the global shipping industry. Growth accelerators, including enhanced liquefaction technologies and strategic industry collaborations, are paving the way for increased LNG adoption. The ongoing expansion of LNG-powered vessel fleets and the development of dedicated bunkering infrastructure across key Chinese ports will solidify the nation's position as a global leader in LNG bunkering. Emerging opportunities in inland waterway transport and the growing demand for sustainable logistics present further avenues for market expansion. Stakeholders can anticipate a dynamic and rapidly evolving market, characterized by significant investment and innovation, as China continues its journey towards a greener maritime future.

China LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

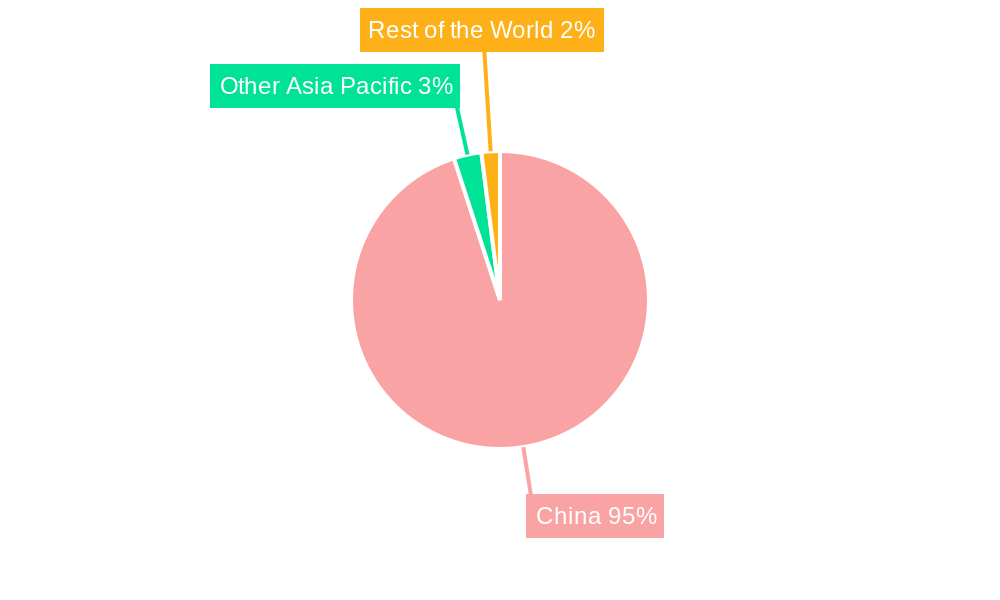

China LNG Bunkering Market Segmentation By Geography

- 1. China

China LNG Bunkering Market Regional Market Share

Geographic Coverage of China LNG Bunkering Market

China LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Ferries and OSV Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China LNG Bunkering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ENN Energy Holdings Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JERA Co Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Total S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China National Offshore Oil Corporation (CNOOC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Merchants Energy Shipping Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Petroleum & Chemical Corporation (Sinopec)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China National Petroleum Corporation (CNPC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai LNG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China National Chemical Corporation (ChemChina)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Gas Holdings Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ENN Energy Holdings Ltd

List of Figures

- Figure 1: China LNG Bunkering Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China LNG Bunkering Market Share (%) by Company 2025

List of Tables

- Table 1: China LNG Bunkering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: China LNG Bunkering Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 3: China LNG Bunkering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China LNG Bunkering Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: China LNG Bunkering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: China LNG Bunkering Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 7: China LNG Bunkering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: China LNG Bunkering Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China LNG Bunkering Market?

The projected CAGR is approximately 30.5%.

2. Which companies are prominent players in the China LNG Bunkering Market?

Key companies in the market include ENN Energy Holdings Ltd, JERA Co Inc*List Not Exhaustive, Total S A, China National Offshore Oil Corporation (CNOOC), China Merchants Energy Shipping Co Ltd, China Petroleum & Chemical Corporation (Sinopec), China National Petroleum Corporation (CNPC), Shanghai LNG, China National Chemical Corporation (ChemChina), China Gas Holdings Limited.

3. What are the main segments of the China LNG Bunkering Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.62 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy.

6. What are the notable trends driving market growth?

Ferries and OSV Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In 2021, the Chinese government announced its to become carbon neutral by 2060. This is expected to further drive the development of the LNG bunkering market in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the China LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence