Key Insights

The North America Industrial Air Quality Control Systems Market is projected for robust expansion, anticipated to reach $127.11 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This growth is propelled by increasingly stringent environmental regulations and heightened awareness of industrial emissions' impact. Key drivers include the imperative to control Nitrogen Oxides (NOx), Sulphur Oxides (SO2), and Particulate Matter (PM), alongside sustained compliance with air quality standards. The Power Generation sector leads in adoption, followed by Cement, Chemicals & Fertilizers, and Iron & Steel industries, all prioritizing emission mitigation. Innovations in efficient technologies like advanced Fabric Filters, Electrostatic Precipitators (ESPs), Flue Gas Desulfurization (FGD), and Scrubbers are defining the market landscape, with a strong emphasis on greenhouse gas reduction and overall air quality improvement.

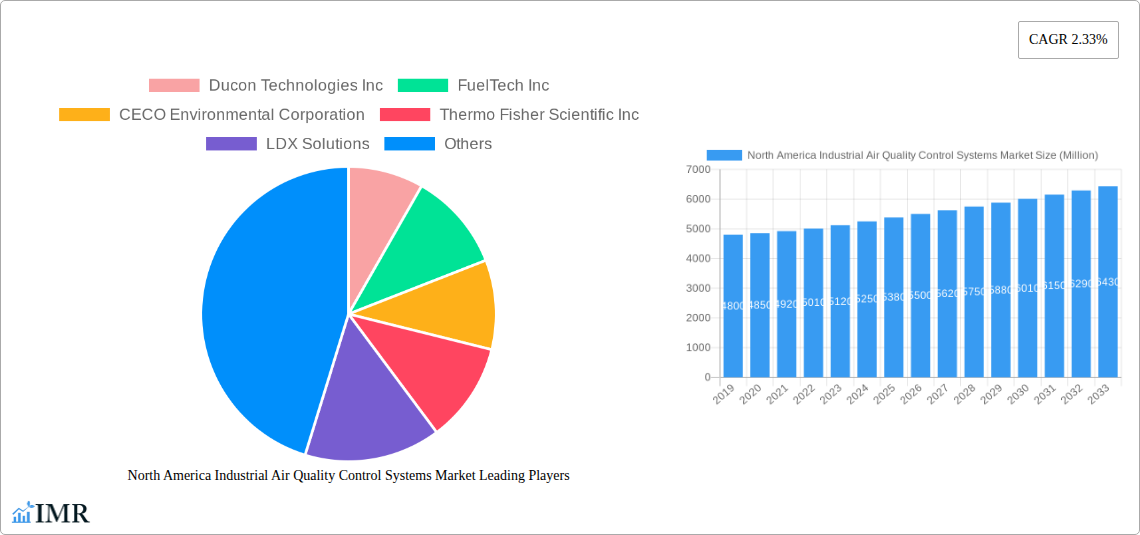

North America Industrial Air Quality Control Systems Market Market Size (In Billion)

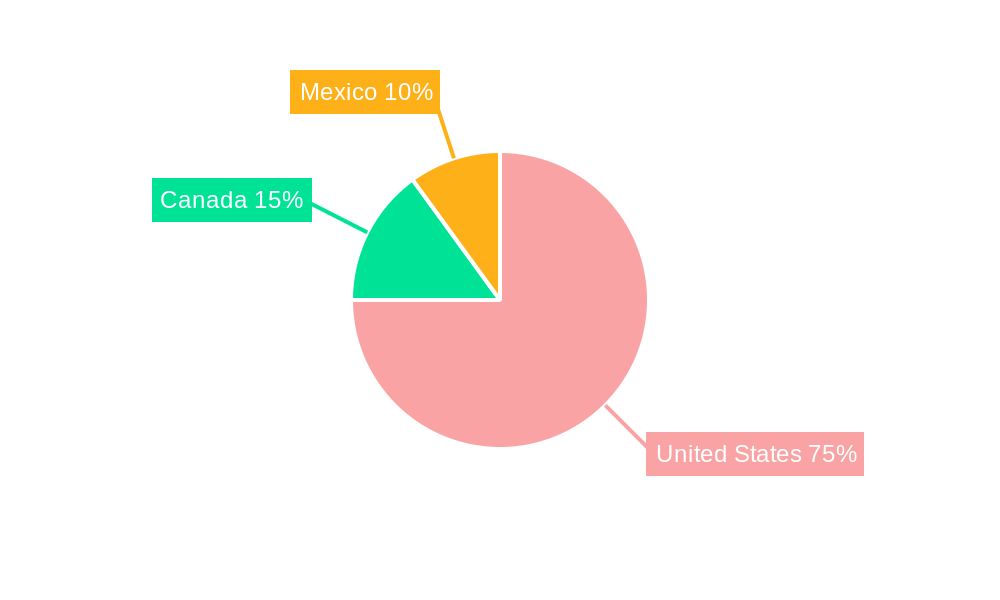

While the market shows positive momentum, initial capital investment for advanced systems presents a potential restraint, especially for small enterprises. Raw material price volatility and the development of energy-efficient industrial processes that naturally reduce emissions may also influence growth. However, these challenges are outweighed by the long-term benefits of regulatory compliance, improved public health, and enhanced corporate social responsibility. Market segmentation includes prominent technologies such as ESP, FGD & Scrubbers, SCR, and Fabric Filters. Application dominance is expected in the United States due to its extensive industrial base and stringent regulations, followed by Canada and Mexico, both prioritizing environmental protection. Leading companies are actively investing in R&D for sustainable and efficient emission control solutions.

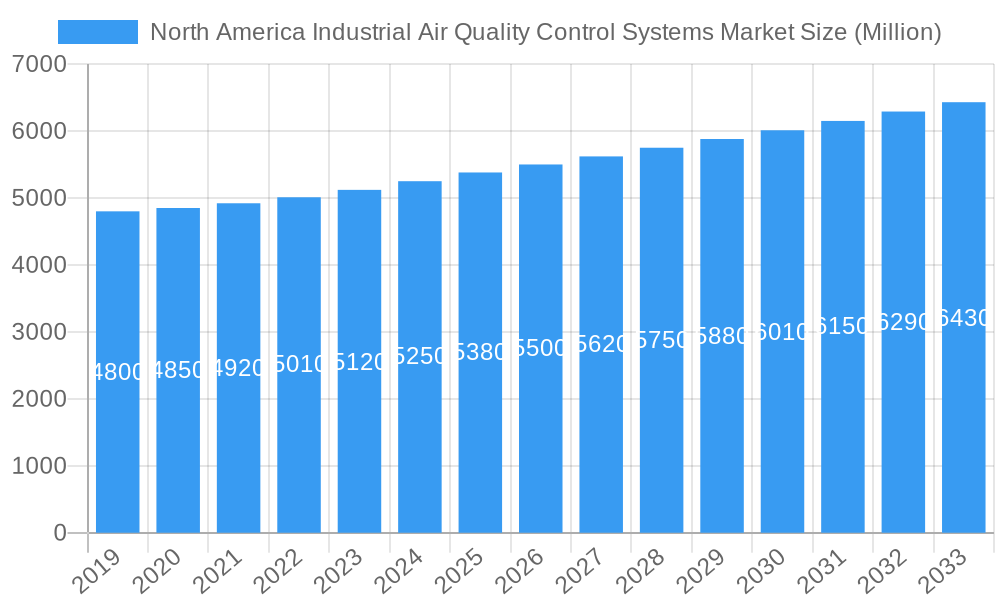

North America Industrial Air Quality Control Systems Market Company Market Share

North America Industrial Air Quality Control Systems Market: Comprehensive Report & Forecast (2019-2033)

Unlock critical insights into the North America Industrial Air Quality Control Systems Market. This in-depth report analyzes market dynamics, growth trends, dominant segments, and future opportunities. Essential for industry professionals seeking to understand the evolving landscape of industrial emissions control, including industrial air pollution control, air scrubbers, ESP systems, FGD technology, and NOx reduction solutions.

North America Industrial Air Quality Control Systems Market Market Dynamics & Structure

The North America industrial air quality control systems market exhibits a moderately concentrated structure, driven by technological innovation and stringent regulatory frameworks. Key players are investing heavily in R&D to develop more efficient and cost-effective emission control solutions. The increasing focus on environmental sustainability and public health is a significant technological innovation driver, compelling industries to adopt advanced air purification technologies. Regulatory mandates, particularly concerning Sulphur Oxides (SO2) and Particulate Matter (PM) emissions, are crucial in shaping market demand. Competitive product substitutes exist, but specialized systems tailored to specific industrial needs often hold an advantage. End-user demographics are diverse, spanning heavy industries like Power Generation, Cement, Iron and Steel, and Oil & Gas, each with unique emission profiles. Mergers and Acquisitions (M&A) are active as larger entities seek to expand their product portfolios and market reach, consolidating market share and fostering innovation.

- Market Concentration: Moderately concentrated, with key players holding significant market share.

- Technological Innovation Drivers: Growing environmental consciousness, demand for cleaner air, and advancements in filtration and catalytic conversion technologies.

- Regulatory Frameworks: Strict environmental regulations set by government bodies across the United States, Canada, and Mexico are primary demand catalysts.

- Competitive Product Substitutes: While alternatives exist, the efficacy and compliance offered by advanced industrial air quality control systems often outweigh cost considerations for regulated industries.

- End-User Demographics: Dominated by power plants, cement factories, chemical production facilities, and metallurgical operations.

- M&A Trends: Strategic acquisitions and partnerships are observed to enhance technological capabilities and market penetration.

North America Industrial Air Quality Control Systems Market Growth Trends & Insights

The North America Industrial Air Quality Control Systems Market is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is fueled by escalating environmental awareness, coupled with increasingly rigorous government regulations on industrial emissions across the United States, Canada, and Mexico. The market size is expected to evolve from $XX,XXX million units in 2025 to $XX,XXX million units by 2033. Adoption rates of advanced air purification technologies, such as Selective Catalytic Reduction (SCR) for Nitrogen Oxides (NOx) control and advanced Flue Gas Desulfurization (FGD) and Scrubbers for SO2 abatement, are accelerating significantly. Technological disruptions are primarily centered around developing more energy-efficient systems, enhancing pollutant capture rates, and integrating smart monitoring and control capabilities. Consumer behavior shifts are evident as industries prioritize not only regulatory compliance but also corporate social responsibility and long-term sustainability, leading to greater investment in high-performance air quality solutions. The market penetration of sophisticated industrial air quality control systems is expected to rise, particularly in sectors like Power Generation and Oil & Gas, which are under immense pressure to decarbonize and reduce their environmental footprint. The development of modular and scalable systems is also a growing trend, catering to the diverse needs of industries of all sizes.

Dominant Regions, Countries, or Segments in North America Industrial Air Quality Control Systems Market

The United States currently stands as the dominant region in the North America Industrial Air Quality Control Systems Market, driven by its expansive industrial base and stringent environmental protection agency (EPA) regulations. The sheer volume of its Power Generation Industry, Cement Industry, and Chemicals and Fertilizers sectors, coupled with significant investments in the Iron and Steel Industry and Oil & Gas Industry, creates a perpetual demand for advanced air quality control solutions. The country’s robust regulatory framework, particularly concerning emissions of Particulate Matter (PM), Sulphur Oxides (SO2), and Nitrogen Oxides (NOx), compels industries to adopt sophisticated technologies like Electrostatic Precipitators (ESP), Flue Gas Desulfurization (FGD) and Scrubbers, and Selective Catalytic Reduction (SCR).

- Key Drivers in the United States:

- Strict EPA regulations and enforcement policies aimed at improving air quality.

- Large-scale industrial operations across critical sectors like power generation and manufacturing.

- Significant government incentives and funding for green technologies and emission reduction initiatives.

- High adoption rates of advanced technologies like SCR for NOx control and ESP for particulate matter removal.

- Growing awareness and pressure from environmental advocacy groups.

Canada and Mexico are also significant contributors to the market, with their industrial sectors increasingly aligning with North American environmental standards. Canada's focus on Oil & Gas and mining, along with its commitment to reducing greenhouse gas emissions, fuels demand for advanced air quality control. Mexico, with its burgeoning manufacturing and Automotive Industry, presents a growing market for emission control systems, particularly as it strives to meet international environmental benchmarks.

In terms of Type, Flue Gas Desulfurization (FGD) and Scrubbers and Electrostatic Precipitators (ESP) continue to be dominant due to their proven effectiveness in controlling major industrial pollutants from large-scale combustion processes. However, Selective Catalytic Reduction (SCR) systems are experiencing rapid growth, driven by the increasing need for stringent NOx emission control, especially in the power sector.

North America Industrial Air Quality Control Systems Market Product Landscape

The North America Industrial Air Quality Control Systems Market is characterized by continuous product innovation focused on enhancing efficiency, reducing operational costs, and minimizing environmental impact. Leading manufacturers are developing advanced Electrostatic Precipitators (ESP) with higher collection efficiencies for fine Particulate Matter (PM) and integrated diagnostic systems for predictive maintenance. Flue Gas Desulfurization (FGD) and Scrubbers are being engineered for wider operating windows and reduced water consumption. A significant trend is the advancement of Selective Catalytic Reduction (SCR) systems, offering improved catalyst performance for greater NOx reduction and extended lifespan. Innovations also include integrated control systems that optimize performance based on real-time emission data, ensuring maximum compliance and operational flexibility across diverse applications like Power Generation, Cement Industry, and Oil & Gas.

Key Drivers, Barriers & Challenges in North America Industrial Air Quality Control Systems Market

Key Drivers:

- Stringent Environmental Regulations: Government mandates on emissions of SO2, NOx, and PM are the primary growth drivers.

- Technological Advancements: Development of more efficient, cost-effective, and energy-saving air quality control technologies.

- Industry Expansion and Modernization: Growth in sectors like Power Generation, Oil & Gas, and Cement necessitates advanced emission controls.

- Corporate Sustainability Initiatives: Increasing focus on Environmental, Social, and Governance (ESG) factors by corporations.

Barriers & Challenges:

- High Capital Investment: The initial cost of implementing advanced air quality control systems can be substantial for some industries.

- Operational Complexity and Maintenance: Requiring skilled labor and regular maintenance, which can increase operational expenses.

- Fluctuating Raw Material Prices: The cost of materials used in scrubbers and catalysts can impact the overall price of systems.

- Regulatory Uncertainty and Enforcement Variability: Inconsistent application of regulations across different jurisdictions can create market unpredictability.

- Integration with Existing Infrastructure: Retrofitting older industrial facilities with new emission control technology can be complex and costly.

Emerging Opportunities in North America Industrial Air Quality Control Systems Market

Emerging opportunities lie in the development of smart, IoT-enabled air quality control systems offering real-time monitoring, predictive analytics, and remote management capabilities. The increasing demand for circular economy solutions presents opportunities for systems that enable resource recovery from industrial emissions, such as the capture of valuable by-products during FGD processes. Furthermore, the growing emphasis on reducing greenhouse gas emissions beyond traditional criteria pollutants opens doors for technologies that can capture or abate CO2 from industrial sources. Untapped markets within smaller industrial operations and specialized applications within the Chemicals and Fertilizers and Automotive Industry also present significant growth potential.

Growth Accelerators in the North America Industrial Air Quality Control Systems Market Industry

Growth accelerators for the North America Industrial Air Quality Control Systems Market include the continuous push towards stricter emission standards for NOx, SO2, and PM across all major industrial sectors. Technological breakthroughs in catalyst development for SCR systems, leading to higher efficiency and longer lifespans, will significantly drive adoption. Strategic partnerships between system manufacturers and industrial clients, focusing on customized and integrated solutions, will foster market expansion. Moreover, the increasing focus on industrial decarbonization and the potential for carbon capture technologies integrated with emission control systems represent a major long-term growth avenue.

Key Players Shaping the North America Industrial Air Quality Control Systems Market Market

- Ducon Technologies Inc

- FuelTech Inc

- CECO Environmental Corporation

- Thermo Fisher Scientific Inc

- LDX Solutions

- Babcock & Wilcox Enterprises Ltd

- Pollution Systems

- Tri-Mer Corporation

- General Electric Company

- Sly Inc

Notable Milestones in North America Industrial Air Quality Control Systems Market Sector

- December 2022: General Electric Company announced a technical solution to reduce carbon emissions, including engineering studies for integrating and installing a Selective Catalytic Reduction (SCR) technology system. This solution reduced nitrogen oxide (NOx) and carbon monoxide (CO) emissions by over 90%, surpassing World Bank Emissions Standards.

- December 2022: ProcessBarron, an air and gas handling products manufacturer in the United States, announced the establishment of its wholly-owned subsidiary in Toronto, Canada. This new subsidiary is anticipated to offer electrostatic precipitator and air pollution control services through its Southern Field-Environmental Elements division.

In-Depth North America Industrial Air Quality Control Systems Market Market Outlook

The future outlook for the North America Industrial Air Quality Control Systems Market is exceptionally strong, driven by an unwavering commitment to environmental stewardship and the imperative for industries to operate sustainably. Growth accelerators such as advanced material science in catalysts, sophisticated digital monitoring, and increasing demand for integrated emission solutions will redefine market offerings. Strategic investments in research and development, coupled with supportive government policies and incentives for clean technologies, will further propel market expansion. The transition towards cleaner energy sources and stringent emission norms across diverse industrial applications like Power Generation, Cement Industry, and Oil & Gas Industry will solidify the market’s robust growth trajectory, creating significant opportunities for innovation and market penetration in the coming years.

North America Industrial Air Quality Control Systems Market Segmentation

-

1. Type

- 1.1. Electrostatic Precipitators (ESP)

- 1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 1.3. Selective Catalytic Reduction (SCR)

- 1.4. Fabric Filters

- 1.5. Others

-

2. Application

- 2.1. Power Generation Industry

- 2.2. Cement Industry

- 2.3. Chemicals and Fertilizers

- 2.4. Iron and Steel Industry

- 2.5. Automotive Industry

- 2.6. Oil & Gas Industry

- 2.7. Other Applications

-

3. Emissions (Qualitative Analysis only)

- 3.1. Nitrogen Oxides (NOx)

- 3.2. Sulphur Oxides (SO2)

- 3.3. Particulate Matter (PM)

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Industrial Air Quality Control Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Industrial Air Quality Control Systems Market Regional Market Share

Geographic Coverage of North America Industrial Air Quality Control Systems Market

North America Industrial Air Quality Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Power Generation Industry Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electrostatic Precipitators (ESP)

- 5.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3. Selective Catalytic Reduction (SCR)

- 5.1.4. Fabric Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation Industry

- 5.2.2. Cement Industry

- 5.2.3. Chemicals and Fertilizers

- 5.2.4. Iron and Steel Industry

- 5.2.5. Automotive Industry

- 5.2.6. Oil & Gas Industry

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 5.3.1. Nitrogen Oxides (NOx)

- 5.3.2. Sulphur Oxides (SO2)

- 5.3.3. Particulate Matter (PM)

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electrostatic Precipitators (ESP)

- 6.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 6.1.3. Selective Catalytic Reduction (SCR)

- 6.1.4. Fabric Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation Industry

- 6.2.2. Cement Industry

- 6.2.3. Chemicals and Fertilizers

- 6.2.4. Iron and Steel Industry

- 6.2.5. Automotive Industry

- 6.2.6. Oil & Gas Industry

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 6.3.1. Nitrogen Oxides (NOx)

- 6.3.2. Sulphur Oxides (SO2)

- 6.3.3. Particulate Matter (PM)

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electrostatic Precipitators (ESP)

- 7.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 7.1.3. Selective Catalytic Reduction (SCR)

- 7.1.4. Fabric Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation Industry

- 7.2.2. Cement Industry

- 7.2.3. Chemicals and Fertilizers

- 7.2.4. Iron and Steel Industry

- 7.2.5. Automotive Industry

- 7.2.6. Oil & Gas Industry

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 7.3.1. Nitrogen Oxides (NOx)

- 7.3.2. Sulphur Oxides (SO2)

- 7.3.3. Particulate Matter (PM)

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electrostatic Precipitators (ESP)

- 8.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 8.1.3. Selective Catalytic Reduction (SCR)

- 8.1.4. Fabric Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation Industry

- 8.2.2. Cement Industry

- 8.2.3. Chemicals and Fertilizers

- 8.2.4. Iron and Steel Industry

- 8.2.5. Automotive Industry

- 8.2.6. Oil & Gas Industry

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 8.3.1. Nitrogen Oxides (NOx)

- 8.3.2. Sulphur Oxides (SO2)

- 8.3.3. Particulate Matter (PM)

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Ducon Technologies Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 FuelTech Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CECO Environmental Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Thermo Fisher Scientific Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 LDX Solutions

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Babcock & Wilcox Enterprises Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Pollution Systems

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tri-Mer Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 General Electric Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Sly Inc*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Ducon Technologies Inc

List of Figures

- Figure 1: North America Industrial Air Quality Control Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Industrial Air Quality Control Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 4: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 9: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 14: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 19: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Air Quality Control Systems Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the North America Industrial Air Quality Control Systems Market?

Key companies in the market include Ducon Technologies Inc, FuelTech Inc, CECO Environmental Corporation, Thermo Fisher Scientific Inc, LDX Solutions, Babcock & Wilcox Enterprises Ltd, Pollution Systems, Tri-Mer Corporation, General Electric Company, Sly Inc*List Not Exhaustive.

3. What are the main segments of the North America Industrial Air Quality Control Systems Market?

The market segments include Type, Application, Emissions (Qualitative Analysis only), Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 127.11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Power Generation Industry Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In December 2022, General Electric Company announced a technical solution to reduce carbon emissions. The solution includes engineering studies for integrating and installing a Selective Catalytic Reduction (SCR) technology system. The solution reduced nitrogen oxide (NOx) and carbon monoxide (CO) emissions by over 90%, surpassing World Bank Emissions Standards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Air Quality Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Air Quality Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Air Quality Control Systems Market?

To stay informed about further developments, trends, and reports in the North America Industrial Air Quality Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence