Key Insights

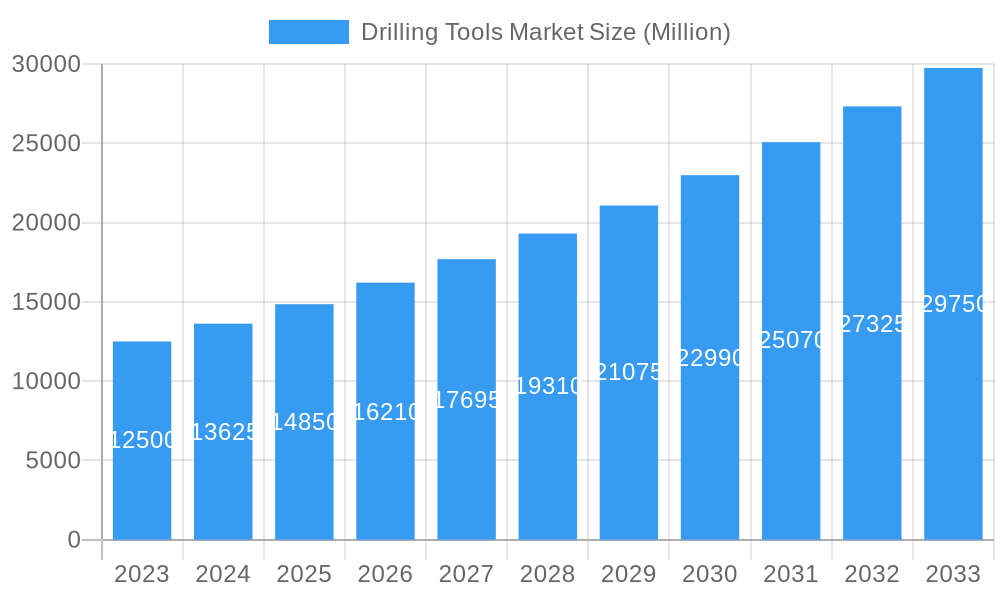

The global Drilling Tools Market is poised for robust expansion, projected to reach a substantial market size and exhibit a Compound Annual Growth Rate (CAGR) exceeding 9.00%. This significant growth trajectory is underpinned by a confluence of dynamic drivers, including escalating global energy demand, increasing investments in upstream oil and gas exploration and production activities, and the continuous development of advanced drilling technologies. The market's value unit is in millions, reflecting the substantial economic activity within this sector. Key segments like Drill Bits, Drill Collars, and Drill Pipes are expected to witness sustained demand, driven by their critical role in efficient wellbore construction. Furthermore, advancements in materials science and manufacturing processes are leading to the development of more durable, efficient, and specialized drilling tools, catering to diverse geological formations and challenging operating environments.

Drilling Tools Market Market Size (In Billion)

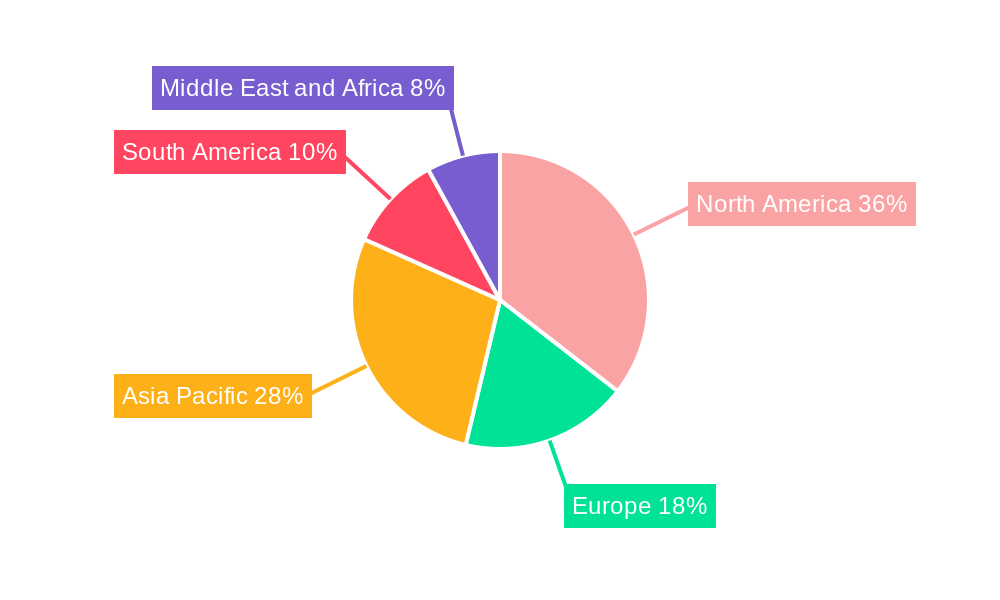

The market is characterized by strong growth trends, with a particular emphasis on innovative solutions that enhance operational efficiency, reduce downtime, and improve safety. The increasing complexity of exploration projects, especially in offshore and unconventional resource plays, is creating significant opportunities for specialized drilling tools and related services. However, the market also faces certain restraints, such as the volatility of oil prices, which can impact exploration budgets, and stringent environmental regulations, necessitating the adoption of more sustainable drilling practices and technologies. Geographically, regions such as North America and the Asia Pacific are anticipated to lead market expansion, fueled by substantial exploration activities and the presence of major oil and gas producing nations. The competitive landscape is dominated by key players like Schlumberger, Halliburton, and Baker Hughes, who are actively engaged in research and development and strategic collaborations to maintain their market positions.

Drilling Tools Market Company Market Share

This comprehensive report provides an in-depth analysis of the Drilling Tools Market, offering critical insights for industry stakeholders. Spanning from 2019 to 2033, with a Base Year of 2025, the study meticulously examines historical trends, current dynamics, and future projections. The report utilizes a robust research methodology to deliver data-driven forecasts and actionable intelligence.

Drilling Tools Market Market Dynamics & Structure

The global Drilling Tools Market is characterized by a moderate to high level of concentration, with leading players like Baker Hughes Company, Halliburton Company, and Schlumberger Limited holding significant market share. Technological innovation is a primary driver, fueled by the increasing demand for efficiency, safety, and cost-effectiveness in drilling operations. Advanced materials, automation, and data analytics are continuously being integrated into drilling tools to enhance performance and reduce downtime. Regulatory frameworks, particularly concerning environmental impact and worker safety, play a crucial role in shaping market trends, driving the adoption of cleaner and safer drilling technologies. Competitive product substitutes, such as alternative drilling methods or specialized equipment for niche applications, present a constant challenge, necessitating continuous product development and differentiation. End-user demographics are diverse, encompassing major oil and gas exploration and production companies, as well as service providers. Mergers and acquisitions (M&A) are a recurring theme, with companies consolidating to expand their product portfolios, geographic reach, and technological capabilities. For instance, recent years have seen several strategic acquisitions aimed at integrating advanced digital solutions into traditional drilling equipment. Barriers to innovation include the high cost of research and development, stringent testing requirements, and the long adoption cycles within the industry.

- Market Concentration: Dominated by a few key global players with significant market share.

- Technological Innovation Drivers: Efficiency, safety, cost reduction, automation, data analytics.

- Regulatory Frameworks: Environmental protection, worker safety standards.

- Competitive Product Substitutes: Alternative drilling methods, specialized equipment.

- End-User Demographics: Oil and gas E&P companies, service providers.

- M&A Trends: Consolidation for portfolio expansion, geographic reach, and technological integration.

- Innovation Barriers: High R&D costs, rigorous testing, long adoption cycles.

Drilling Tools Market Growth Trends & Insights

The global Drilling Tools Market is poised for substantial growth, driven by the insatiable global energy demand and the ongoing exploration for new hydrocarbon reserves. Our analysis projects a robust Compound Annual Growth Rate (CAGR) of XX% for the forecast period of 2025–2033. The market size is estimated to reach approximately $XX,XXX Million units by 2033, up from an estimated $XX,XXX Million units in 2025. This growth trajectory is further propelled by advancements in drilling technology, including the development of more durable and efficient drill bits, advanced downhole tools for complex geological formations, and the increasing adoption of automated drilling systems. The market penetration of high-performance drilling tools is steadily increasing as companies seek to optimize operational efficiency and reduce drilling costs. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) for predictive maintenance and real-time performance optimization, are reshaping the industry landscape. Consumer behavior shifts are evident, with a growing preference for integrated solutions and lifecycle services rather than standalone equipment. The increasing focus on deepwater and unconventional resource exploration also necessitates the deployment of sophisticated drilling tools capable of withstanding extreme conditions. Furthermore, government initiatives promoting energy independence and exploration activities in various regions are creating new avenues for market expansion. The adoption rates of next-generation drilling technologies are accelerating, driven by the need to access challenging reserves and enhance recovery rates.

Dominant Regions, Countries, or Segments in Drilling Tools Market

The Onshore segment is currently the dominant force within the Drilling Tools Market, accounting for an estimated XX% of the total market value in 2025. This dominance is primarily attributed to the extensive existing infrastructure for onshore oil and gas exploration and production, particularly in established energy hubs. Countries like the United States, China, Russia, and Canada are significant contributors to onshore drilling activities, driven by their substantial proven reserves and ongoing exploration efforts. Economic policies that encourage domestic energy production and provide incentives for exploration further bolster the onshore market. The Drill Bit segment, within the Type classification, is consistently the largest and most crucial segment, driven by its indispensable role in initiating and advancing the drilling process. Its market share is estimated at XX% of the overall market. The demand for drill bits is directly correlated with the volume of drilling activity across all deployment locations. Key drivers for the dominance of the onshore segment and the drill bit segment include:

- Economic Policies: Government incentives for domestic energy production and exploration.

- Infrastructure: Well-established onshore infrastructure supporting drilling operations.

- Technological Advancements: Continuous innovation in drill bit technology for enhanced durability and efficiency in various rock formations.

- Cost-Effectiveness: Generally lower operational costs associated with onshore drilling compared to offshore.

- Market Share & Growth Potential: The onshore segment and drill bit type exhibit a steady growth potential, driven by ongoing exploration and maintenance of existing wells.

While Offshore drilling represents a smaller but rapidly growing segment, particularly in deepwater exploration, the sheer volume of activity and existing infrastructure firmly establish onshore as the current leader. The Drill Pipe segment also holds a significant share due to the continuous need for robust and reliable pipes for conveying drilling fluids and torque.

Drilling Tools Market Product Landscape

The Drilling Tools Market is witnessing a surge in product innovations aimed at enhancing operational efficiency, durability, and safety. Advanced materials such as specialized alloys and composite materials are being incorporated into drill bits and drill pipes to withstand extreme pressures and temperatures. Smart drilling tools equipped with sensors and real-time data transmission capabilities are enabling predictive maintenance and optimized drilling parameters. Applications range from conventional oil and gas exploration to geothermal energy extraction and mining operations. Performance metrics like increased penetration rates, reduced wear and tear, and minimized environmental impact are key selling propositions. Unique selling propositions include extended tool life, enhanced directional drilling accuracy, and solutions for challenging geological formations. Technological advancements are also focusing on the development of automated drilling systems and robotic solutions to improve safety and reduce human intervention in hazardous environments.

Key Drivers, Barriers & Challenges in Drilling Tools Market

The Drilling Tools Market is primarily propelled by the unrelenting global demand for energy, driving continuous exploration and production activities. Technological advancements, such as the development of advanced drill bits and downhole tools capable of operating in harsh environments, are significant growth accelerators. Favorable government policies promoting energy independence and investment in the oil and gas sector further fuel market expansion.

Key challenges include supply chain disruptions, which can lead to material shortages and increased lead times for critical components. Stringent regulatory hurdles related to environmental protection and safety standards can also pose significant restraints, necessitating substantial investment in compliance. Competitive pressures from both established players and emerging manufacturers, coupled with price sensitivity in certain market segments, add to the complexity of the market landscape.

Emerging Opportunities in Drilling Tools Market

Emerging opportunities in the Drilling Tools Market lie in the development of solutions for unconventional resources and deepwater exploration, where specialized and high-performance tools are paramount. The growing emphasis on sustainability is also creating a demand for eco-friendly drilling fluids and technologies that minimize environmental impact. Untapped markets in regions with developing energy sectors present significant growth potential. Innovative applications of AI and IoT in drilling operations, enabling predictive analytics and remote monitoring, are also poised to transform the market.

Growth Accelerators in the Drilling Tools Market Industry

Long-term growth in the Drilling Tools Market is being accelerated by significant technological breakthroughs, including the development of self-healing drill bits and advanced materials for extreme conditions. Strategic partnerships between technology providers and oilfield service companies are fostering innovation and market penetration. Furthermore, market expansion strategies focused on emerging economies and unconventional resource plays are creating substantial growth avenues. The increasing adoption of digital drilling solutions and the drive towards automation are also key catalysts for sustained growth.

Key Players Shaping the Drilling Tools Market Market

- Rival Downhole Tools

- Drilling Tools International

- Cougar Drilling Solutions

- Hunting PLC

- Weatherford International PLC

- Baker Hughes Company

- Halliburton Company

- United Drilling Tools Limited

- Schlumberger Limited

- NOV Inc

Notable Milestones in Drilling Tools Market Sector

- 2019: Schlumberger launched its new line of intelligent drill bits designed for enhanced data acquisition and performance optimization.

- 2020: Halliburton Company acquired an additional stake in its drilling services joint venture in a move to consolidate its market position.

- 2021: Baker Hughes Company unveiled an advanced automated drilling system aimed at improving safety and efficiency in onshore operations.

- 2022: Weatherford International PLC introduced a novel drill pipe with enhanced fatigue resistance for deepwater applications.

- 2023: NOV Inc announced a strategic partnership to develop next-generation drilling fluids for environmentally conscious operations.

In-Depth Drilling Tools Market Market Outlook

The Drilling Tools Market is projected for sustained growth, driven by a confluence of factors including robust global energy demand, technological innovation, and strategic market expansion. Growth accelerators such as the development of specialized tools for unconventional and deepwater exploration, coupled with the increasing integration of digital technologies like AI and IoT, will continue to propel the market forward. Strategic partnerships and investments in research and development will be crucial for players to maintain a competitive edge. The outlook indicates a strong future for companies that can adapt to evolving industry needs, offering efficient, safe, and sustainable drilling solutions.

Drilling Tools Market Segmentation

-

1. Type

- 1.1. Drill Bit

- 1.2. Drill Collar

- 1.3. Drill Pipe

- 1.4. Drill Reamer and Stabilizer

- 1.5. Drill Swivel

- 1.6. Other Types

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

Drilling Tools Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Drilling Tools Market Regional Market Share

Geographic Coverage of Drilling Tools Market

Drilling Tools Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Drill Bit Emerging as a Prominent Drilling Tool in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Drill Bit

- 5.1.2. Drill Collar

- 5.1.3. Drill Pipe

- 5.1.4. Drill Reamer and Stabilizer

- 5.1.5. Drill Swivel

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Drill Bit

- 6.1.2. Drill Collar

- 6.1.3. Drill Pipe

- 6.1.4. Drill Reamer and Stabilizer

- 6.1.5. Drill Swivel

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Drill Bit

- 7.1.2. Drill Collar

- 7.1.3. Drill Pipe

- 7.1.4. Drill Reamer and Stabilizer

- 7.1.5. Drill Swivel

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Drill Bit

- 8.1.2. Drill Collar

- 8.1.3. Drill Pipe

- 8.1.4. Drill Reamer and Stabilizer

- 8.1.5. Drill Swivel

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Drill Bit

- 9.1.2. Drill Collar

- 9.1.3. Drill Pipe

- 9.1.4. Drill Reamer and Stabilizer

- 9.1.5. Drill Swivel

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Drill Bit

- 10.1.2. Drill Collar

- 10.1.3. Drill Pipe

- 10.1.4. Drill Reamer and Stabilizer

- 10.1.5. Drill Swivel

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rival Downhole Tools

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Drilling Tools International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cougar Drilling Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hunting PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Weatherford International PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Hughes Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 United Drilling Tools Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NOV Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rival Downhole Tools

List of Figures

- Figure 1: Global Drilling Tools Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Drilling Tools Market Volume Breakdown (Kg, %) by Region 2025 & 2033

- Figure 3: North America Drilling Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Drilling Tools Market Volume (Kg), by Type 2025 & 2033

- Figure 5: North America Drilling Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Drilling Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Drilling Tools Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 8: North America Drilling Tools Market Volume (Kg), by Location of Deployment 2025 & 2033

- Figure 9: North America Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 10: North America Drilling Tools Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 11: North America Drilling Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Drilling Tools Market Volume (Kg), by Country 2025 & 2033

- Figure 13: North America Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Drilling Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Drilling Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Drilling Tools Market Volume (Kg), by Type 2025 & 2033

- Figure 17: Europe Drilling Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Drilling Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Drilling Tools Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 20: Europe Drilling Tools Market Volume (Kg), by Location of Deployment 2025 & 2033

- Figure 21: Europe Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 22: Europe Drilling Tools Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 23: Europe Drilling Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Drilling Tools Market Volume (Kg), by Country 2025 & 2033

- Figure 25: Europe Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Drilling Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Drilling Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific Drilling Tools Market Volume (Kg), by Type 2025 & 2033

- Figure 29: Asia Pacific Drilling Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Drilling Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Drilling Tools Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 32: Asia Pacific Drilling Tools Market Volume (Kg), by Location of Deployment 2025 & 2033

- Figure 33: Asia Pacific Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 34: Asia Pacific Drilling Tools Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 35: Asia Pacific Drilling Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Drilling Tools Market Volume (Kg), by Country 2025 & 2033

- Figure 37: Asia Pacific Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Drilling Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Drilling Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Drilling Tools Market Volume (Kg), by Type 2025 & 2033

- Figure 41: South America Drilling Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Drilling Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Drilling Tools Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 44: South America Drilling Tools Market Volume (Kg), by Location of Deployment 2025 & 2033

- Figure 45: South America Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 46: South America Drilling Tools Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 47: South America Drilling Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Drilling Tools Market Volume (Kg), by Country 2025 & 2033

- Figure 49: South America Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Drilling Tools Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Drilling Tools Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Drilling Tools Market Volume (Kg), by Type 2025 & 2033

- Figure 53: Middle East and Africa Drilling Tools Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Drilling Tools Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Drilling Tools Market Revenue (Million), by Location of Deployment 2025 & 2033

- Figure 56: Middle East and Africa Drilling Tools Market Volume (Kg), by Location of Deployment 2025 & 2033

- Figure 57: Middle East and Africa Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 58: Middle East and Africa Drilling Tools Market Volume Share (%), by Location of Deployment 2025 & 2033

- Figure 59: Middle East and Africa Drilling Tools Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Drilling Tools Market Volume (Kg), by Country 2025 & 2033

- Figure 61: Middle East and Africa Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Drilling Tools Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Drilling Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Drilling Tools Market Volume Kg Forecast, by Type 2020 & 2033

- Table 3: Global Drilling Tools Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 4: Global Drilling Tools Market Volume Kg Forecast, by Location of Deployment 2020 & 2033

- Table 5: Global Drilling Tools Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Drilling Tools Market Volume Kg Forecast, by Region 2020 & 2033

- Table 7: Global Drilling Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Drilling Tools Market Volume Kg Forecast, by Type 2020 & 2033

- Table 9: Global Drilling Tools Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 10: Global Drilling Tools Market Volume Kg Forecast, by Location of Deployment 2020 & 2033

- Table 11: Global Drilling Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Drilling Tools Market Volume Kg Forecast, by Country 2020 & 2033

- Table 13: Global Drilling Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Drilling Tools Market Volume Kg Forecast, by Type 2020 & 2033

- Table 15: Global Drilling Tools Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 16: Global Drilling Tools Market Volume Kg Forecast, by Location of Deployment 2020 & 2033

- Table 17: Global Drilling Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Drilling Tools Market Volume Kg Forecast, by Country 2020 & 2033

- Table 19: Global Drilling Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Drilling Tools Market Volume Kg Forecast, by Type 2020 & 2033

- Table 21: Global Drilling Tools Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 22: Global Drilling Tools Market Volume Kg Forecast, by Location of Deployment 2020 & 2033

- Table 23: Global Drilling Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Drilling Tools Market Volume Kg Forecast, by Country 2020 & 2033

- Table 25: Global Drilling Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Drilling Tools Market Volume Kg Forecast, by Type 2020 & 2033

- Table 27: Global Drilling Tools Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 28: Global Drilling Tools Market Volume Kg Forecast, by Location of Deployment 2020 & 2033

- Table 29: Global Drilling Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Drilling Tools Market Volume Kg Forecast, by Country 2020 & 2033

- Table 31: Global Drilling Tools Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Drilling Tools Market Volume Kg Forecast, by Type 2020 & 2033

- Table 33: Global Drilling Tools Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 34: Global Drilling Tools Market Volume Kg Forecast, by Location of Deployment 2020 & 2033

- Table 35: Global Drilling Tools Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Drilling Tools Market Volume Kg Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drilling Tools Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Drilling Tools Market?

Key companies in the market include Rival Downhole Tools, Drilling Tools International, Cougar Drilling Solutions, Hunting PLC, Weatherford International PLC, Baker Hughes Company, Halliburton Company, United Drilling Tools Limited, Schlumberger Limited, NOV Inc.

3. What are the main segments of the Drilling Tools Market?

The market segments include Type, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Drill Bit Emerging as a Prominent Drilling Tool in the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kg.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drilling Tools Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drilling Tools Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drilling Tools Market?

To stay informed about further developments, trends, and reports in the Drilling Tools Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence