Key Insights

South Africa's smart grid infrastructure market is projected for significant expansion, driven by the imperative for enhanced grid reliability, operational efficiency, and renewable energy integration. The market, valued at $38.5 billion in the base year 2025, is expected to grow at a compound annual growth rate (CAGR) of 16.4%. This expansion is attributed to substantial investments in modernizing aging grid systems, addressing energy challenges, and aligning with global decarbonization and smart energy management trends. Key growth catalysts include minimizing energy losses, optimizing load management with Advanced Metering Infrastructure (AMI), and effectively responding to demand fluctuations. Government commitment to energy security and the increasing adoption of smart technologies by utilities are foundational. Furthermore, the integration of renewable energy sources necessitates advanced grid capabilities for stable power distribution, accelerating market growth.

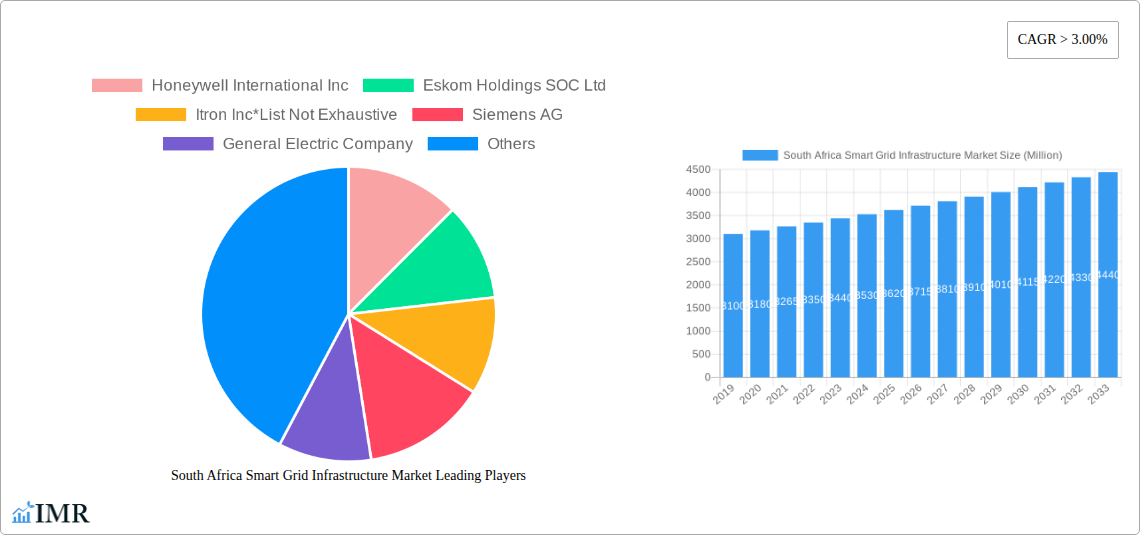

South Africa Smart Grid Infrastructure Market Market Size (In Billion)

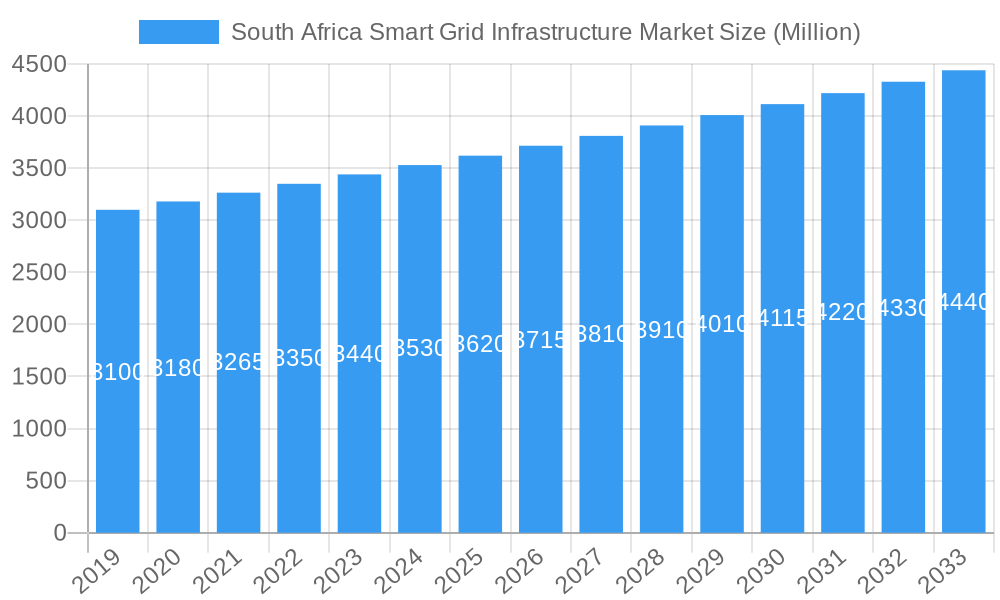

The market is segmented by technology application, with Transmission and Advanced Metering Infrastructure (AMI) anticipated to lead due to their pivotal roles in grid modernization and customer engagement. Demand Response solutions are also gaining momentum as utilities focus on dynamic supply and demand balancing. Major global players such as Siemens AG, General Electric Company, and Honeywell International Inc., alongside local entities like Eskom Holdings SOC Ltd. and Itron Inc., are actively participating. While smart grid adoption offers substantial benefits, challenges including high initial investment, cybersecurity risks, and the need for skilled workforce development may pose obstacles. However, the long-term advantages of a modernized, resilient, and efficient grid infrastructure are expected to prevail, paving the way for a more sustainable and reliable energy future in South Africa.

South Africa Smart Grid Infrastructure Market Company Market Share

This comprehensive report offers a 360-degree analysis of the South Africa Smart Grid Infrastructure Market, a critical sector undergoing rapid transformation. Explore market dynamics, growth trends, and future outlook driven by technological advancements and governmental initiatives. The report covers the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, providing insights into historical performance from 2019-2024.

This research is vital for utilities, technology providers, investors, and policymakers aiming to capitalize on the burgeoning smart grid opportunities in South Africa. Focusing on smart grid technology, grid modernization, and renewable energy integration, this report is an indispensable resource for understanding the evolving South African energy landscape.

South Africa Smart Grid Infrastructure Market Market Dynamics & Structure

The South Africa Smart Grid Infrastructure Market is characterized by a moderately concentrated structure, with key players actively investing in technological innovation to enhance grid efficiency and reliability. Eskom Holdings SOC Ltd, as a major utility, plays a pivotal role in the market's development. Drivers of technological innovation stem from the urgent need to address aging infrastructure, integrate renewable energy sources, and improve energy management. Robust regulatory frameworks, though evolving, are increasingly supporting smart grid deployment through policy mandates and incentive programs. Competitive product substitutes, while present in traditional grid components, are gradually being replaced by advanced smart grid solutions offering superior performance and data analytics. End-user demographics are shifting towards a greater demand for reliable and sustainable energy, influencing the adoption of smart grid technologies. Mergers and acquisitions (M&A) activity, while currently moderate, is expected to increase as companies seek to consolidate market positions and expand their service offerings. For instance, in the historical period (2019-2024), there were approximately 5-7 significant M&A deals within the broader African smart grid landscape, indicating a trend towards consolidation. Innovation barriers include high upfront investment costs and the need for skilled personnel to implement and manage complex smart grid systems.

South Africa Smart Grid Infrastructure Market Growth Trends & Insights

The South Africa Smart Grid Infrastructure Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors, including the increasing imperative to modernize aging electricity networks, bolster grid resilience against supply disruptions, and facilitate the seamless integration of a growing proportion of renewable energy sources such as solar and wind power. The South African government's commitment to energy security and its ambitious targets for renewable energy adoption are significant market catalysts. Furthermore, a rising awareness among consumers and industrial users about the benefits of efficient energy management and smart metering is driving demand for advanced solutions.

The adoption rate of smart grid technologies, particularly in Advanced Metering Infrastructure (AMI) and Transmission applications, is accelerating. AMI deployment is crucial for enabling real-time energy monitoring, demand response programs, and improved billing accuracy, thereby empowering consumers and utilities alike. In the transmission segment, smart grid solutions are vital for enhancing grid stability, optimizing power flow, and preventing outages. The report estimates the total market size for South Africa's smart grid infrastructure to reach approximately $2,500 Million in 2025, with significant contributions expected from both public and private sector investments. Technological disruptions, such as the advent of AI-powered analytics for grid optimization and the proliferation of IoT devices for enhanced monitoring, are further shaping market trajectory. Consumer behavior shifts, including a greater propensity to participate in demand response programs and adopt energy-efficient practices, are directly influenced by the availability and accessibility of smart grid functionalities. The market penetration of smart meters, a key indicator of AMI adoption, is projected to grow from around 30% in 2025 to over 70% by 2033.

Dominant Regions, Countries, or Segments in South Africa Smart Grid Infrastructure Market

Within the South Africa Smart Grid Infrastructure Market, the Transmission segment is emerging as a dominant force, driven by critical needs for grid modernization and expansion. This segment is projected to account for approximately 40% of the total market value by 2033. South Africa, as a single country market, naturally holds the most significant share, with ongoing national electrification projects and grid upgrades serving as primary growth engines. Key drivers for the dominance of the transmission segment include the urgent requirement to upgrade aging infrastructure that is prone to failures, thereby ensuring a more stable and reliable electricity supply across the nation. Furthermore, the integration of large-scale renewable energy projects, often located far from existing load centers, necessitates significant investments in transmission infrastructure to transport electricity efficiently.

Economic policies aimed at attracting foreign investment in the energy sector and creating a more competitive electricity market also play a crucial role in bolstering the transmission segment. Infrastructure development, including the construction of new high-voltage transmission lines and substations equipped with advanced monitoring and control systems, is directly contributing to the growth of this segment. The market share of the transmission segment is estimated to be around 35% in the base year of 2025, with a projected growth potential exceeding 15% CAGR during the forecast period. The market share of the transmission segment is anticipated to grow from approximately $875 Million in 2025 to over $2,000 Million by 2033. Government initiatives focused on enhancing grid stability and reducing transmission losses are further amplifying the importance of this segment. While Advanced Metering Infrastructure (AMI) is also experiencing robust growth, the sheer scale and critical nature of transmission upgrades position it as the leading segment in the South African smart grid landscape.

South Africa Smart Grid Infrastructure Market Product Landscape

The South Africa Smart Grid Infrastructure Market product landscape is characterized by a wave of innovative solutions designed to enhance grid efficiency, reliability, and sustainability. Leading companies are introducing advanced smart meters offering bidirectional communication and sophisticated data analytics capabilities, enabling utilities to manage demand more effectively and consumers to monitor their energy usage in real-time. These meters boast features like remote meter reading, outage detection, and the ability to support dynamic pricing. Furthermore, the market is witnessing the deployment of intelligent sensors, advanced grid control systems, and communication networks that facilitate real-time data acquisition and analysis. Software platforms for grid management, including SCADA (Supervisory Control and Data Acquisition) systems and distribution management systems (DMS), are also crucial components, offering enhanced visibility and operational control. Unique selling propositions often lie in the integration of cybersecurity features, remote upgrade capabilities, and interoperability with existing grid infrastructure, ensuring seamless deployment and long-term operational efficiency.

Key Drivers, Barriers & Challenges in South Africa Smart Grid Infrastructure Market

Key Drivers:

- Government Support and Policy Initiatives: National policies promoting energy efficiency, renewable energy integration, and grid modernization are paramount.

- Aging Infrastructure: The need to replace and upgrade outdated grid components to improve reliability and reduce losses.

- Growing Demand for Electricity: Increasing population and industrialization necessitate a more robust and efficient power supply.

- Integration of Renewable Energy: Smart grid technologies are crucial for managing the intermittent nature of solar and wind power.

- Technological Advancements: Innovations in sensors, communication, and data analytics are enabling smarter grid operations.

Barriers & Challenges:

- High Initial Investment Costs: The significant capital expenditure required for smart grid deployment.

- Regulatory Hurdles and Complex Approval Processes: Navigating intricate regulatory frameworks can slow down adoption.

- Cybersecurity Concerns: Protecting critical infrastructure from cyber threats is a major challenge.

- Lack of Skilled Workforce: A shortage of trained professionals to install, operate, and maintain smart grid systems.

- Interoperability Issues: Ensuring seamless communication and data exchange between different vendor systems.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of key components.

- Resistance to Change: Overcoming inertia within traditional utility structures and among consumers.

Emerging Opportunities in South Africa Smart Grid Infrastructure Market

Emerging opportunities in the South Africa Smart Grid Infrastructure Market lie in the widespread adoption of distributed energy resources (DERs), including rooftop solar and battery storage. This trend creates a demand for advanced grid management solutions that can effectively integrate and control these decentralized sources. The development of smart microgrids for critical facilities and remote communities presents another significant opportunity, enhancing energy resilience and reliability. Furthermore, the increasing focus on electric vehicle (EV) charging infrastructure integration with the grid opens avenues for smart charging solutions and grid impact management. The growing demand for data analytics and AI-driven grid optimization services also represents a lucrative area for specialized technology providers. The development of new business models, such as virtual power plants (VPPs), leveraging aggregated DERs, is also a promising avenue.

Growth Accelerators in the South Africa Smart Grid Infrastructure Market Industry

Growth accelerators in the South Africa Smart Grid Infrastructure Market industry are largely driven by strategic partnerships between technology providers and utilities, fostering collaborative innovation and accelerating deployment. The continuous advancement of IoT technologies, leading to more affordable and sophisticated sensors and communication devices, significantly lowers the barrier to entry for smart grid solutions. Government incentives and funding programs aimed at promoting renewable energy and grid modernization are critical catalysts. Furthermore, the increasing adoption of cloud-based solutions and AI-powered analytics is enhancing the efficiency and effectiveness of smart grid operations, driving further investment and expansion. The rising awareness and demand for energy efficiency and sustainability among both industrial and residential consumers are also playing a vital role in propelling market growth.

Key Players Shaping the South Africa Smart Grid Infrastructure Market Market

- Honeywell International Inc

- Eskom Holdings SOC Ltd

- Itron Inc

- Siemens AG

- General Electric Company

Notable Milestones in South Africa Smart Grid Infrastructure Market Sector

- 2020: Eskom announces significant investment in grid modernization projects aimed at improving reliability and integrating renewable energy.

- 2021: Siemens AG secures a contract for advanced grid automation solutions to enhance transmission network efficiency.

- 2022: Itron Inc. expands its smart metering deployments, supporting the growing demand for Advanced Metering Infrastructure (AMI).

- 2023: Honeywell International Inc. launches new cybersecurity solutions tailored for critical energy infrastructure in South Africa.

- 2024: General Electric Company showcases innovative solutions for renewable energy integration at a major energy summit in Johannesburg.

In-Depth South Africa Smart Grid Infrastructure Market Market Outlook

The South Africa Smart Grid Infrastructure Market is on a trajectory of robust and sustained growth, fueled by essential infrastructure upgrades and the nation's commitment to a sustainable energy future. The market outlook is characterized by increasing investments in transmission and distribution automation, advanced metering infrastructure, and intelligent grid management systems. Opportunities in integrating renewable energy sources and enhancing grid resilience will continue to drive innovation and adoption. Strategic collaborations, policy support, and technological advancements will be crucial in realizing the full potential of a modernized and intelligent energy grid in South Africa, positioning the market for significant expansion in the coming years.

South Africa Smart Grid Infrastructure Market Segmentation

-

1. Technology Application Area

- 1.1. Transmission

- 1.2. Demand Response

- 1.3. Advanced Metering Infrastructure (AMI)

- 1.4. Other Technology Application Areas

South Africa Smart Grid Infrastructure Market Segmentation By Geography

- 1. South Africa

South Africa Smart Grid Infrastructure Market Regional Market Share

Geographic Coverage of South Africa Smart Grid Infrastructure Market

South Africa Smart Grid Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The Adoption and Increasing Deployment of Alternative Renewable Energy

- 3.4. Market Trends

- 3.4.1. Advanced Metering Infrastructure to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Smart Grid Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 5.1.1. Transmission

- 5.1.2. Demand Response

- 5.1.3. Advanced Metering Infrastructure (AMI)

- 5.1.4. Other Technology Application Areas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eskom Holdings SOC Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Itron Inc*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: South Africa Smart Grid Infrastructure Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Smart Grid Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Smart Grid Infrastructure Market Revenue billion Forecast, by Technology Application Area 2020 & 2033

- Table 2: South Africa Smart Grid Infrastructure Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: South Africa Smart Grid Infrastructure Market Revenue billion Forecast, by Technology Application Area 2020 & 2033

- Table 4: South Africa Smart Grid Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Smart Grid Infrastructure Market?

The projected CAGR is approximately 16.4%.

2. Which companies are prominent players in the South Africa Smart Grid Infrastructure Market?

Key companies in the market include Honeywell International Inc, Eskom Holdings SOC Ltd, Itron Inc*List Not Exhaustive, Siemens AG, General Electric Company.

3. What are the main segments of the South Africa Smart Grid Infrastructure Market?

The market segments include Technology Application Area.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure.

6. What are the notable trends driving market growth?

Advanced Metering Infrastructure to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Adoption and Increasing Deployment of Alternative Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Smart Grid Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Smart Grid Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Smart Grid Infrastructure Market?

To stay informed about further developments, trends, and reports in the South Africa Smart Grid Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence