Key Insights

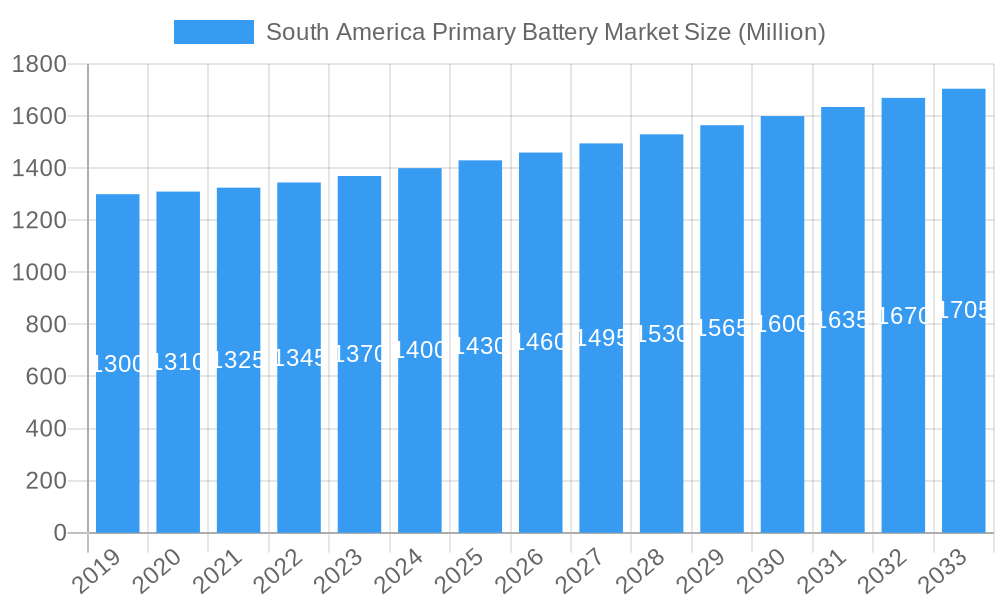

The South America Primary Battery Market is projected for substantial growth, expected to reach an estimated market size of 5.3 billion by 2032, driven by a Compound Annual Growth Rate (CAGR) of 6.6%. This expansion is fueled by increasing demand for portable electronics, the adoption of renewable energy solutions, and rising consumer spending across the region. South America's evolving economic landscape and infrastructure development solidify the essential role of primary batteries in powering consumer and industrial applications.

South America Primary Battery Market Market Size (In Billion)

Key growth drivers include sustained demand for traditional consumer electronics and the rapid expansion of the Internet of Things (IoT) ecosystem, which necessitates reliable, long-lasting primary batteries. Challenges such as the advancement of rechargeable battery technologies and fluctuations in raw material prices may influence the market. However, ongoing innovation in primary battery technology, focusing on enhanced energy density and shelf life, is expected to sustain market growth. The market is segmented by type, with Primary Alkaline Batteries dominating due to their affordability and availability, followed by Nickel-cadmium (NiCD) and Nickel-metal Hydride (NiMH) batteries for specialized applications.

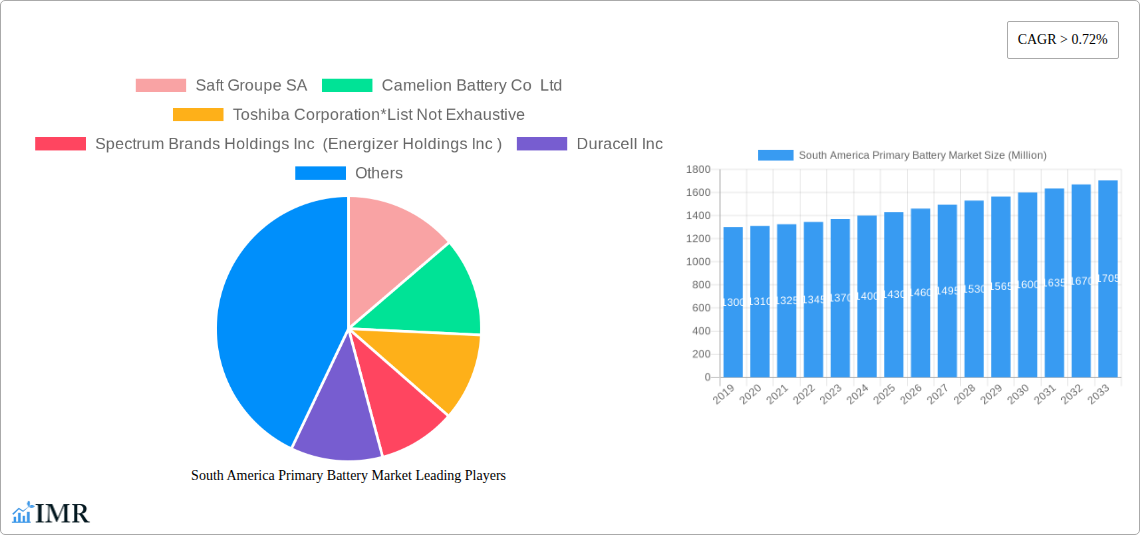

South America Primary Battery Market Company Market Share

South America Primary Battery Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock critical insights into the dynamic South America primary battery market with this in-depth report. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report provides an exhaustive analysis of market trends, growth drivers, challenges, and key players. With a focus on the primary alkaline battery, NiCD battery, NiMH battery, and other battery types, alongside regional analysis of Brazil, Argentina, Colombia, and the Rest of South America, this report is an indispensable resource for industry professionals seeking to understand and capitalize on emerging opportunities. Valued in Million Units, this report offers quantitative data and qualitative analysis essential for strategic decision-making.

South America Primary Battery Market Dynamics & Structure

The South America primary battery market is characterized by a moderate level of market concentration, with a few key players holding significant shares, alongside a growing presence of smaller, specialized manufacturers. Technological innovation is primarily driven by the demand for higher energy density, longer shelf life, and improved safety features in primary battery technologies. Regulatory frameworks, while evolving, are becoming increasingly focused on environmental sustainability and battery disposal, influencing product development and market entry strategies. Competitive product substitutes, such as rechargeable battery technologies and alternative power sources for certain applications, present a constant challenge, necessitating continuous innovation in primary battery offerings. End-user demographics are diverse, spanning consumer electronics, medical devices, industrial equipment, and automotive applications, each with specific performance and cost requirements. Mergers and acquisitions (M&A) trends are expected to play a role in consolidating market share and fostering technological advancements. For instance, the integration of new battery chemistries and manufacturing processes through strategic partnerships or acquisitions will likely shape the competitive landscape. The increasing adoption of primary batteries in emerging economies within South America also indicates a significant growth potential, driven by rising disposable incomes and expanding industrial sectors.

- Market Concentration: Dominated by a few multinational corporations with a growing niche for regional players.

- Technological Innovation: Focus on enhanced energy density, extended shelf life, and eco-friendly materials.

- Regulatory Frameworks: Increasing emphasis on battery recycling and sustainable manufacturing practices.

- Competitive Substitutes: Growing adoption of rechargeable batteries and alternative energy solutions.

- End-User Demographics: Diverse applications across consumer, industrial, and medical sectors.

- M&A Trends: Potential for consolidation and strategic alliances to drive innovation and market reach.

South America Primary Battery Market Growth Trends & Insights

The South America primary battery market is poised for substantial growth, fueled by a confluence of economic development, technological advancements, and shifting consumer behaviors across the region. The market size evolution is projected to witness a steady upward trajectory, driven by increasing demand from the burgeoning consumer electronics sector, the expansion of portable medical devices, and the consistent need for reliable power solutions in remote or off-grid industrial applications. Adoption rates for various primary battery types are expected to be influenced by their respective cost-effectiveness and performance characteristics, with primary alkaline batteries likely to maintain a dominant position due to their widespread availability and affordability. However, specialized primary batteries offering superior performance for niche applications will also see increased uptake.

Technological disruptions are playing a pivotal role. Innovations in materials science are leading to the development of primary batteries with enhanced energy density and longer shelf lives, catering to the growing demand for longer-lasting portable devices. Furthermore, advancements in battery safety and leak-proof designs are crucial for building consumer trust and expanding applications, particularly in sensitive sectors like healthcare. The drive towards sustainability is also influencing the market, with a growing consumer preference for eco-friendlier battery options and manufacturers exploring greener production processes and recyclable materials.

Consumer behavior shifts are equally significant. The increasing reliance on portable electronics, the growing prevalence of Internet of Things (IoT) devices requiring long-term, maintenance-free power, and the demand for convenience are all contributing to the sustained need for primary batteries. As connectivity expands across South America, the requirement for reliable power in a multitude of devices, from remote sensors to essential medical equipment, will continue to escalate. The report will leverage a proprietary XXX methodology to deliver specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates, providing a quantitative backbone to these qualitative insights. This comprehensive analysis will illuminate the underlying forces shaping the market's expansion, enabling stakeholders to anticipate future trends and formulate effective strategies.

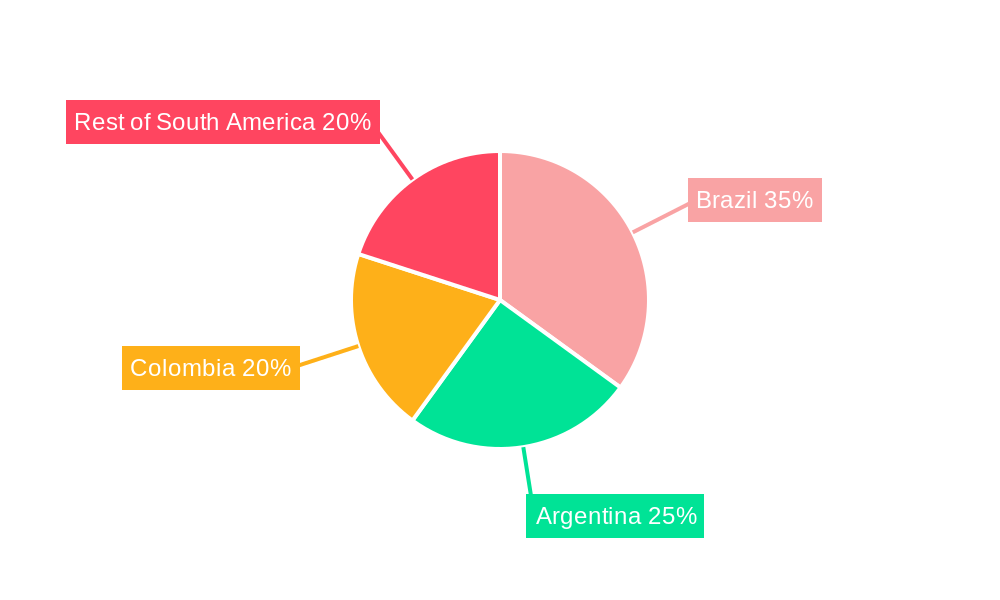

Dominant Regions, Countries, or Segments in South America Primary Battery Market

Brazil is identified as the dominant region driving growth within the South America primary battery market, owing to its substantial economic scale, large population, and diverse industrial landscape. The country's significant consumer base fuels the demand for primary batteries across a wide array of applications, from everyday household electronics like remote controls and toys to essential portable medical devices and industrial equipment. Brazil’s robust manufacturing sector, particularly in the consumer electronics and automotive segments, further amplifies the need for a consistent and reliable supply of primary batteries. Furthermore, government initiatives aimed at promoting technological adoption and infrastructure development contribute to the expanding market. The presence of major battery manufacturers and distributors within Brazil also solidifies its leadership position, ensuring efficient market penetration and product availability.

Primary Alkaline Battery emerges as the dominant segment within the South America primary battery market. This dominance is primarily attributed to its widespread availability, cost-effectiveness, and versatility, making it the go-to choice for a vast majority of consumer electronic devices. Its long shelf life and reliable performance under various conditions further solidify its position as the preferred battery type for everyday use.

- Brazil's Economic Scale: A large and growing economy with significant purchasing power.

- Diverse End-User Industries: Strong demand from consumer electronics, medical devices, and industrial applications.

- Infrastructure Development: Government investment in infrastructure supports the adoption of battery-powered devices.

- Manufacturing Hub: Significant production of consumer electronics and automotive components requiring primary batteries.

- Extensive Distribution Networks: Well-established channels ensure widespread product availability.

Argentina and Colombia, while also showing promising growth, are currently secondary to Brazil in terms of market size and overall contribution. Argentina’s recent strides in lithium battery technology, as highlighted in the industry developments, signal a future shift towards advanced battery solutions, potentially impacting the primary battery market dynamics in the long term. However, for the current primary battery landscape, Brazil's established demand and supply chain infrastructure cement its position as the leading contributor to market growth and volume. The Rest of South America, comprising countries like Peru, Chile, and Ecuador, collectively represents a growing but fragmented market, offering opportunities for specialized market entry strategies.

South America Primary Battery Market Product Landscape

The South America primary battery market is characterized by a steady stream of product innovations focused on enhancing performance and user experience. Primary alkaline batteries continue to be the workhorse, with manufacturers optimizing formulations for extended shelf life and improved energy output, making them ideal for a wide range of consumer electronics. Nickel-cadmium (NiCD) and Nickel-metal Hydride (NiMH) batteries, though facing competition from rechargeable lithium-ion alternatives, retain relevance in specific industrial and specialized applications where their unique discharge characteristics are advantageous. Emerging trends include the development of batteries with improved leak-proof designs for enhanced safety and a growing emphasis on eco-friendly materials and manufacturing processes. Applications span from powering remote controls, toys, and flashlights to critical medical devices, portable tools, and emergency backup systems.

Key Drivers, Barriers & Challenges in South America Primary Battery Market

Key Drivers:

- Growing Demand for Portable Electronics: The proliferation of smartphones, tablets, wireless peripherals, and other battery-dependent consumer devices is a primary growth catalyst.

- Expansion of Healthcare Sector: Increased adoption of portable medical devices, such as glucose meters and hearing aids, necessitates reliable primary power sources.

- Industrial Automation and IoT: The deployment of sensors, remote monitoring systems, and automated equipment in industries like mining and agriculture drives demand for long-lasting primary batteries.

- Economic Development and Urbanization: Rising disposable incomes and increasing access to electricity in developing regions within South America boost consumer spending on battery-powered goods.

- Technological Advancements: Innovations leading to higher energy density, longer shelf life, and improved safety features make primary batteries more attractive for a wider range of applications.

Barriers & Challenges:

- Competition from Rechargeable Batteries: The increasing availability and improving performance of rechargeable battery technologies, especially lithium-ion, pose a significant threat to primary battery market share in certain applications.

- Environmental Concerns and Regulations: Growing awareness and stringent regulations regarding battery disposal and recycling can increase operational costs for manufacturers and necessitate investment in sustainable practices.

- Supply Chain Volatility: Fluctuations in raw material prices and availability, such as zinc and manganese, can impact production costs and lead times, affecting market stability.

- Counterfeit Products: The prevalence of counterfeit batteries can damage brand reputation, compromise consumer safety, and create an uneven competitive playing field.

- Infrastructure Limitations in Remote Areas: In less developed regions, unreliable power grids can sometimes lead to a preference for rechargeable solutions, limiting primary battery penetration.

Emerging Opportunities in South America Primary Battery Market

Emerging opportunities in the South America primary battery market lie in the expanding Internet of Things (IoT) ecosystem, particularly in smart home devices, industrial sensors for resource management, and remote agricultural monitoring. The increasing demand for disposable medical devices that require reliable, long-term power also presents a significant growth avenue. Furthermore, the untapped potential in developing rural and remote areas for basic power solutions, powering essential devices like emergency lighting and communication tools, offers substantial market penetration possibilities. The growing consumer preference for sustainable products also opens doors for manufacturers to develop and market eco-friendly primary battery options, tapping into a conscious consumer base.

Growth Accelerators in the South America Primary Battery Market Industry

Several key factors are accelerating the growth of the South America primary battery market. Technological breakthroughs in materials science are enabling the creation of batteries with superior energy density and significantly longer shelf lives, catering to the demand for more efficient and enduring portable power. Strategic partnerships between battery manufacturers and device makers are crucial for co-developing tailored battery solutions that optimize performance for specific applications. Market expansion strategies, including aggressive distribution network development in underserved regions and targeted marketing campaigns focusing on the convenience and reliability of primary batteries, are also significant growth accelerators. The increasing demand from emerging sectors like electric mobility (for auxiliary power) and advanced medical devices will further propel market expansion.

Key Players Shaping the South America Primary Battery Market Market

- Saft Groupe SA

- Camelion Battery Co Ltd

- Toshiba Corporation

- Spectrum Brands Holdings Inc (Energizer Holdings Inc)

- Duracell Inc

- Energizer Holdings Inc

- Panasonic Corporation

Notable Milestones in South America Primary Battery Market Sector

- December 2022: Argentina's state-run Y-TEC YPF announced its plans to install a lithium battery manufacturing plant in the Catamarca. According to the deal signed, the company will produce cells, lithium-ion batteries, and active materials to add to the current work by the provincial mining company CAMYEN in Fiambal.

- November 2022: Argentina announced its plans to begin operations at its first lithium battery plant after the necessary equipment arrived in the city of La Plata from China. The plant will be constructed by Universidad Nacional de La Plata (UNLP), YPF-Tecnología (Y-TEC), and the National Scientific and Technical Research Council, with the support of the Ministry of Science, Technology, and Innovation (MSTI).

In-Depth South America Primary Battery Market Market Outlook

The future outlook for the South America primary battery market is exceptionally promising, driven by sustained demand from diverse sectors and ongoing technological advancements. The increasing reliance on portable electronics, coupled with the expansion of the healthcare and industrial automation industries, will continue to fuel market growth. Strategic investments in research and development aimed at enhancing battery performance, safety, and environmental sustainability are expected to open new market segments and strengthen competitive advantages. Manufacturers that can effectively navigate supply chain challenges and adapt to evolving regulatory landscapes will be well-positioned for success. Emerging opportunities in smart city initiatives and the burgeoning IoT market present significant long-term growth potential. The region's rich mineral resources also offer a foundation for developing localized battery production capabilities, further solidifying its market position.

South America Primary Battery Market Segmentation

-

1. Type

- 1.1. Primary Alkaline Battery

- 1.2. Nickel-cadmium (NiCD) Battery

- 1.3. Nickel-metal Hydride (NiMH) Battery

- 1.4. Other Types

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Primary Battery Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Primary Battery Market Regional Market Share

Geographic Coverage of South America Primary Battery Market

South America Primary Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure

- 3.3. Market Restrains

- 3.3.1. Limited Investments to Support Medium-voltage Transmission Network

- 3.4. Market Trends

- 3.4.1. Primary Alkaline Battery to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Alkaline Battery

- 5.1.2. Nickel-cadmium (NiCD) Battery

- 5.1.3. Nickel-metal Hydride (NiMH) Battery

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Primary Alkaline Battery

- 6.1.2. Nickel-cadmium (NiCD) Battery

- 6.1.3. Nickel-metal Hydride (NiMH) Battery

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Primary Alkaline Battery

- 7.1.2. Nickel-cadmium (NiCD) Battery

- 7.1.3. Nickel-metal Hydride (NiMH) Battery

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Primary Alkaline Battery

- 8.1.2. Nickel-cadmium (NiCD) Battery

- 8.1.3. Nickel-metal Hydride (NiMH) Battery

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Primary Alkaline Battery

- 9.1.2. Nickel-cadmium (NiCD) Battery

- 9.1.3. Nickel-metal Hydride (NiMH) Battery

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Saft Groupe SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Camelion Battery Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Spectrum Brands Holdings Inc (Energizer Holdings Inc )

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Duracell Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Energizer Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Panasonic Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Saft Groupe SA

List of Figures

- Figure 1: South America Primary Battery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Primary Battery Market Share (%) by Company 2025

List of Tables

- Table 1: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: South America Primary Battery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Primary Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Primary Battery Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the South America Primary Battery Market?

Key companies in the market include Saft Groupe SA, Camelion Battery Co Ltd, Toshiba Corporation*List Not Exhaustive, Spectrum Brands Holdings Inc (Energizer Holdings Inc ), Duracell Inc, Energizer Holdings Inc, Panasonic Corporation.

3. What are the main segments of the South America Primary Battery Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure.

6. What are the notable trends driving market growth?

Primary Alkaline Battery to Dominate the Market.

7. Are there any restraints impacting market growth?

Limited Investments to Support Medium-voltage Transmission Network.

8. Can you provide examples of recent developments in the market?

December 2022: Argentina's state-run Y-TEC YPF announced its plans to install a lithium battery manufacturing plant in the Catamarca. According to the deal signed, the company will produce cells, lithium-ion batteries, and active materials to add to the current work by the provincial mining company CAMYEN in Fiambal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Primary Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Primary Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Primary Battery Market?

To stay informed about further developments, trends, and reports in the South America Primary Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence