Key Insights

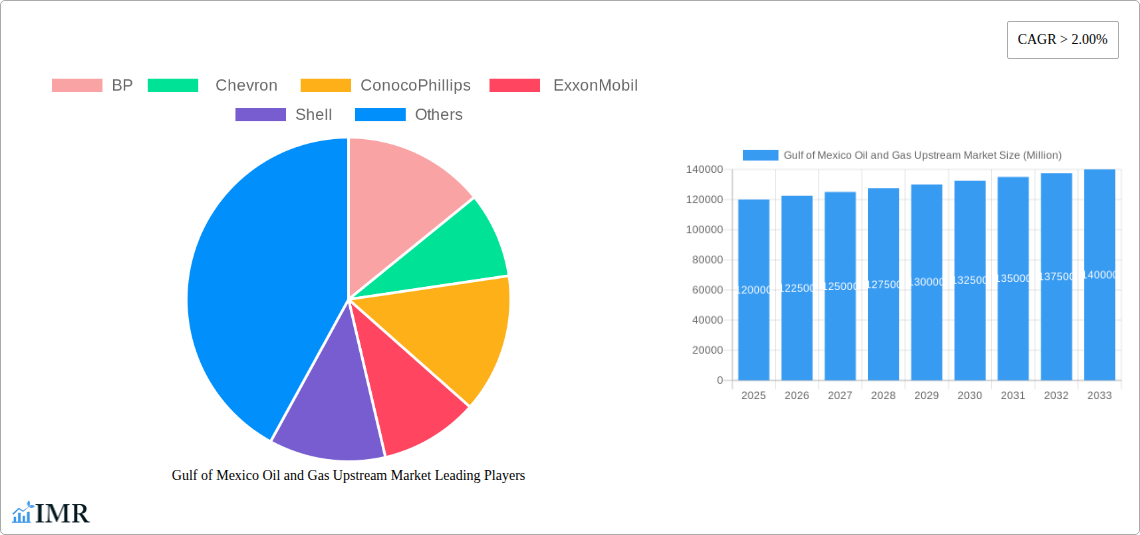

The Gulf of Mexico Oil and Gas Upstream Market is projected to achieve a market size of $52.2 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 4.4%. This growth is propelled by escalating demand for crude oil and natural gas, technological advancements in exploration and production, and substantial investments in deepwater projects. The region's abundant reserves and its critical role in global energy supply underpin this expansion. Key industry players such as BP, Chevron, ConocoPhillips, ExxonMobil, Shell, and TotalEnergies are actively participating, focusing on exploration, development, and production to meet increasing global energy needs.

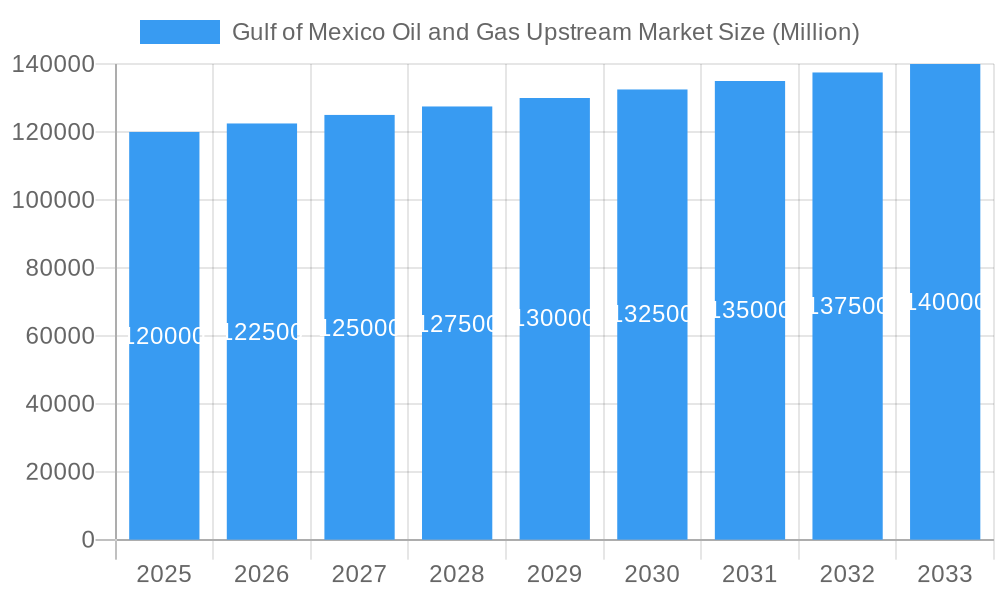

Gulf of Mexico Oil and Gas Upstream Market Market Size (In Billion)

While the market outlook is positive, challenges such as stringent environmental regulations and the global energy transition necessitate strategic adaptation. However, the inherent volatility in global energy prices also presents opportunities. The market's comprehensive analysis encompasses production, consumption, import/export dynamics, and pricing trends. The United States segment is expected to lead, supported by extensive offshore infrastructure and ongoing deepwater initiatives, with Mexico and other regions also contributing to the diverse upstream landscape.

Gulf of Mexico Oil and Gas Upstream Market Company Market Share

Gain critical insights into the Gulf of Mexico Oil and Gas Upstream Market. This comprehensive report (2019-2033, base year 2025) details market dynamics, growth drivers, regional performance, and strategic outlooks for industry leaders. Essential for navigating the evolving energy sector and identifying key investment opportunities.

Gulf of Mexico Oil and Gas Upstream Market Market Dynamics & Structure

The Gulf of Mexico oil and gas upstream market is characterized by a moderately concentrated structure, with a few supermajor oil companies like BP, Chevron, ConocoPhillips, ExxonMobil, Shell, and TotalEnergies holding significant market share. Technological innovation remains a primary driver, with advancements in deepwater exploration and production (E&P) technologies, including seismic imaging, subsea systems, and enhanced oil recovery (EOR) techniques, continuously pushing operational boundaries. Regulatory frameworks, particularly from bodies like the Bureau of Ocean Energy Management (BOEM), play a crucial role in shaping exploration, leasing, and environmental compliance, impacting investment decisions and operational costs. While direct competitive product substitutes are limited in the upstream sector, indirect competition from renewable energy sources and evolving energy policies influences long-term investment strategies. End-user demographics are primarily industrial consumers of crude oil and natural gas, with demand intricately linked to global economic activity and energy consumption patterns. Mergers and acquisitions (M&A) trends are observed as companies seek to optimize portfolios, gain access to new reserves, and achieve economies of scale. For instance, a recent trend involves consolidation around advanced technological capabilities in challenging offshore environments.

- Market Concentration: Dominated by a few major integrated oil and gas companies.

- Technological Innovation: Driven by deepwater E&P, subsea, and EOR advancements.

- Regulatory Frameworks: BOEM's influence on leasing, exploration, and environmental standards.

- Competitive Landscape: Limited direct substitutes; indirect competition from renewables.

- End-User Base: Primarily industrial consumers of crude oil and natural gas.

- M&A Activity: Driven by portfolio optimization and reserve acquisition.

Gulf of Mexico Oil and Gas Upstream Market Growth Trends & Insights

The Gulf of Mexico oil and gas upstream market has witnessed robust growth driven by its vast, yet complex, hydrocarbon reserves. The market size has evolved significantly, with estimated market revenue reaching approximately USD 50,000 Million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. Adoption rates of advanced technologies are high, particularly in the deepwater segment, where operators are leveraging cutting-edge solutions to mitigate risks and improve recovery rates. Technological disruptions, such as the increasing integration of artificial intelligence (AI) and machine learning (ML) in seismic interpretation and reservoir management, are fundamentally reshaping exploration and production strategies. Consumer behavior, in the context of upstream markets, refers to the demand for energy commodities, which remains strong due to global industrial needs and evolving geopolitical landscapes influencing energy security concerns. Market penetration is characterized by significant investments in exploration blocks and the development of new fields, with the total estimated production capacity projected to reach 12,500 thousand barrels of oil equivalent per day by 2033. This growth is underpinned by the increasing reliance on these resources for global energy needs, despite the ongoing energy transition.

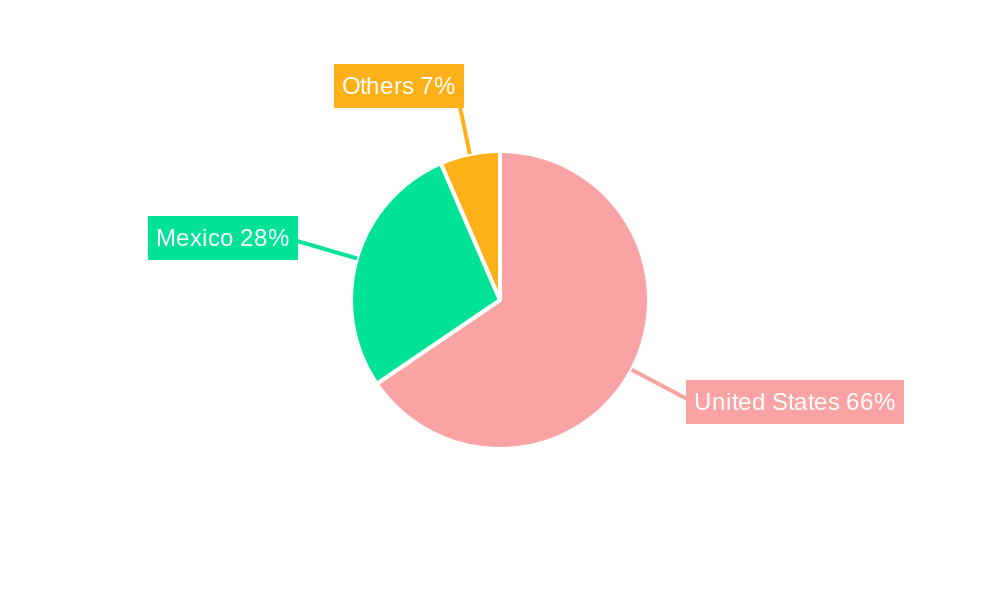

Dominant Regions, Countries, or Segments in Gulf of Mexico Oil and Gas Upstream Market

The U.S. Gulf of Mexico stands as the undisputed dominant region within the broader Gulf of Mexico oil and gas upstream market. This dominance is driven by several interconnected factors. In terms of Production Analysis, the U.S. Federal waters in the Gulf consistently lead, accounting for over 70% of the region's total oil and gas production. Key producing fields are concentrated in areas like the deepwater shelf and ultra-deepwater regions, characterized by prolific hydrocarbon discoveries. For Consumption Analysis, while direct consumption within the immediate offshore region is limited, the crude oil and natural gas produced are vital inputs for refineries and power generation facilities across the United States, making it a crucial national supply hub. The Import Market Analysis (Value & Volume) for the U.S. Gulf of Mexico upstream is minimal, as the region is a net exporter. Conversely, the Export Market Analysis (Value & Volume) is significant, with substantial volumes of crude oil and liquefied natural gas (LNG) being exported globally. The Price Trend Analysis in this region is closely tied to global benchmarks like West Texas Intermediate (WTI) and Brent crude, with regional differentials influenced by logistical factors and local supply-demand dynamics.

- Dominant Region: U.S. Gulf of Mexico Federal Waters.

- Production Drivers: Prolific deepwater and ultra-deepwater hydrocarbon reserves.

- Consumption Linkage: Essential feedstock for U.S. refineries and power generation.

- Export Significance: Major contributor to U.S. crude oil and LNG exports.

- Price Influence: Aligns with global benchmarks (WTI, Brent), with regional adjustments.

- Market Share in Production: Estimated over 70% of regional output.

Gulf of Mexico Oil and Gas Upstream Market Product Landscape

The product landscape in the Gulf of Mexico oil and gas upstream market primarily encompasses crude oil and natural gas. Innovations in subsea technology have enabled access to previously unreachable deepwater reserves, enhancing recovery rates. Advanced drilling fluids and cementing techniques are crucial for maintaining well integrity in challenging geological formations. Performance metrics are evaluated through factors like production efficiency, reserve life, and cost per barrel of oil equivalent (BOE). Unique selling propositions for offshore operators lie in their ability to manage complex deepwater environments, implement rigorous safety protocols, and leverage sophisticated geological data analysis for optimized field development. Technological advancements focus on reducing operational footprints, minimizing environmental impact, and maximizing hydrocarbon extraction efficiency.

Key Drivers, Barriers & Challenges in Gulf of Mexico Oil and Gas Upstream Market

Key Drivers:

- Technological Advancements: Continued innovation in deepwater exploration and production technologies (e.g., autonomous underwater vehicles, advanced seismic imaging).

- Economic Viability: Favorable oil and gas prices, coupled with cost efficiencies achieved through technology and operational improvements, make new projects economically attractive.

- Reserve Potential: The Gulf of Mexico possesses significant, largely untapped, hydrocarbon reserves, particularly in deepwater and ultra-deepwater areas, offering substantial growth potential.

- Energy Security Demands: Growing global demand for oil and gas fuels continued investment in exploration and production.

Barriers & Challenges:

- Environmental Regulations & Permitting: Stringent environmental regulations and lengthy permitting processes can lead to project delays and increased operational costs.

- Capital Intensity: High upfront capital expenditure required for offshore exploration and development, coupled with volatile commodity prices, presents financial risks.

- Geopolitical Instability: Global geopolitical events can impact oil prices and investment sentiment.

- Supply Chain Disruptions: Potential for disruptions in the specialized supply chains required for offshore operations.

- Natural Disasters: Susceptibility to hurricanes and other severe weather events necessitates robust infrastructure and contingency planning.

Emerging Opportunities in Gulf of Mexico Oil and Gas Upstream Market

Emerging opportunities in the Gulf of Mexico oil and gas upstream market lie in the development of ultra-deepwater reserves, which still hold significant untapped potential. The growing focus on decarbonization and emissions reduction presents opportunities for companies investing in carbon capture, utilization, and storage (CCUS) technologies integrated with existing or new offshore infrastructure. Subsea processing and tie-backs of marginal fields are becoming increasingly viable, maximizing resource utilization. Furthermore, the application of digitalization and AI for predictive maintenance and operational optimization offers avenues for enhanced efficiency and cost reduction. The potential for offshore wind energy integration with existing oil and gas infrastructure, creating hybrid energy hubs, also represents a novel opportunity.

Growth Accelerators in the Gulf of Mexico Oil and Gas Upstream Market Industry

Long-term growth in the Gulf of Mexico oil and gas upstream market is being accelerated by a confluence of factors. Technological breakthroughs in subsea systems and enhanced oil recovery (EOR) techniques are unlocking previously uneconomical reserves, thereby extending the life of existing fields and enabling the development of new ones. Strategic partnerships and joint ventures between major oil companies and specialized technology providers are fostering innovation and risk-sharing, particularly in complex deepwater projects. Government incentives and evolving lease sale strategies designed to encourage exploration and production in frontier areas are also acting as significant growth catalysts. Moreover, the increasing global demand for natural gas as a transition fuel continues to drive investment in associated gas production from oil fields.

Key Players Shaping the Gulf of Mexico Oil and Gas Upstream Market Market

- BP

- Chevron

- ConocoPhillips

- ExxonMobil

- Shell

- TotalEnergies

Notable Milestones in Gulf of Mexico Oil and Gas Upstream Market Sector

- 2019: Increased lease sales by BOEM, opening new exploration blocks in deeper waters.

- 2020: Significant impact of COVID-19 pandemic on oil prices and operational activity, leading to temporary production adjustments.

- 2021: Resumption of major deepwater project development and investment following price recovery.

- 2022: Focus on enhancing production efficiency and integrating digital technologies across operations.

- 2023: Growing interest in CCUS technologies for offshore applications.

- 2024: Continued exploration and appraisal drilling in ultra-deepwater areas, with several new discoveries announced.

In-Depth Gulf of Mexico Oil and Gas Upstream Market Market Outlook

The future outlook for the Gulf of Mexico oil and gas upstream market remains promising, driven by sustained global energy demand and the region's vast resource potential. Growth accelerators such as ongoing technological advancements in deepwater exploration, coupled with strategic investments in infrastructure, will continue to unlock complex reserves. The increasing integration of digital technologies for operational efficiency and cost optimization, alongside a growing emphasis on decarbonization efforts like CCUS, will shape the competitive landscape. Strategic partnerships and favorable regulatory environments will further bolster exploration and production activities, ensuring the Gulf of Mexico's continued significance as a vital contributor to global energy supply in the coming decade.

Gulf of Mexico Oil and Gas Upstream Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Gulf of Mexico Oil and Gas Upstream Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Others

Gulf of Mexico Oil and Gas Upstream Market Regional Market Share

Geographic Coverage of Gulf of Mexico Oil and Gas Upstream Market

Gulf of Mexico Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Intermittent Nature of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Deep-Water and Ultra Deep-Water Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Mexico

- 5.6.3. Others

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Mexico Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Others Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 BP

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chevron

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ConocoPhillips

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ExxonMobil

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Shell

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 TotalEnergies

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 BP

List of Figures

- Figure 1: Gulf of Mexico Oil and Gas Upstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Gulf of Mexico Oil and Gas Upstream Market Share (%) by Company 2025

List of Tables

- Table 1: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 20: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gulf of Mexico Oil and Gas Upstream Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Gulf of Mexico Oil and Gas Upstream Market?

Key companies in the market include BP, Chevron , ConocoPhillips , ExxonMobil , Shell , TotalEnergies.

3. What are the main segments of the Gulf of Mexico Oil and Gas Upstream Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy.

6. What are the notable trends driving market growth?

Deep-Water and Ultra Deep-Water Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Intermittent Nature of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gulf of Mexico Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gulf of Mexico Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gulf of Mexico Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Gulf of Mexico Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence