Key Insights

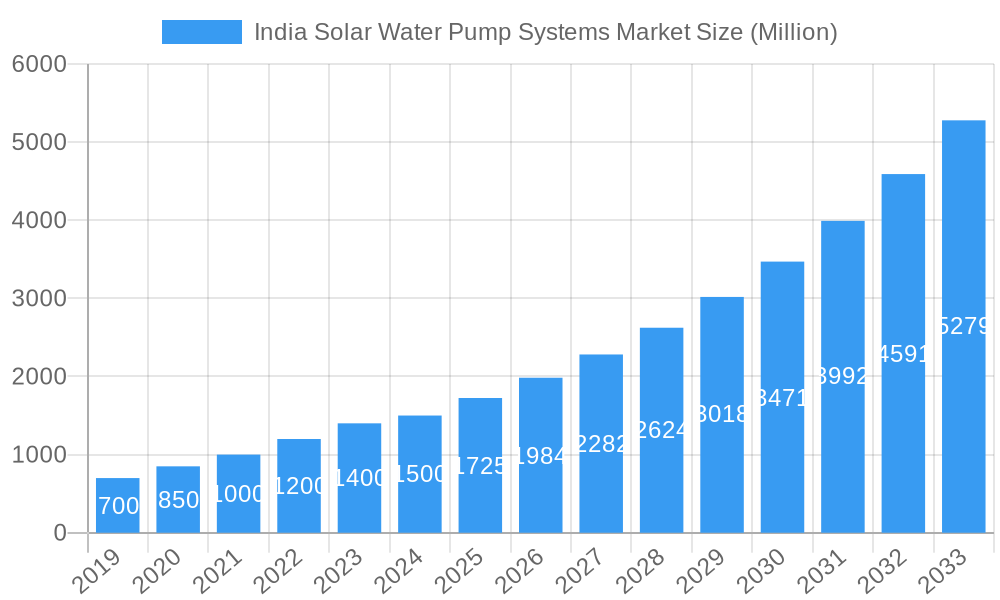

The India Solar Water Pump Systems Market is projected for significant expansion, driven by government initiatives, agricultural mechanization, and growing awareness of sustainable energy. With a market size of $2.9 billion in the base year 2024, the market is anticipated to reach substantial growth by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.11%. This growth is primarily attributed to government subsidies and schemes promoting solar irrigation, reducing reliance on conventional energy and electricity costs for farmers. Initiatives like the "Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan" (PM-KUSUM) are accelerating solar water pump adoption nationwide. Increasing demand for efficient agricultural water management and declining solar technology costs further support market growth. The industrial sector is also emerging as a key adopter seeking cost-effective, eco-friendly pumping solutions.

India Solar Water Pump Systems Market Market Size (In Billion)

Segmentation analysis reveals Centrifugal Pump Technology dominates due to its widespread irrigation and water supply use. Positive Displacement Technology is gaining traction for its efficiency with specific fluid types and flow rates. The Irrigation segment is the largest application, highlighting water's critical role in India's agrarian economy. The Drinking and Cooking Water Supply segment shows steady growth, especially in rural areas lacking reliable water sources. While government support and technological advancements are strong drivers, challenges like initial upfront costs, skilled technician availability, and intermittent power supply during cloudy weather may present minor restraints. Nonetheless, the outlook for the India Solar Water Pump Systems Market is highly positive, promising a future driven by sustainability and economic viability.

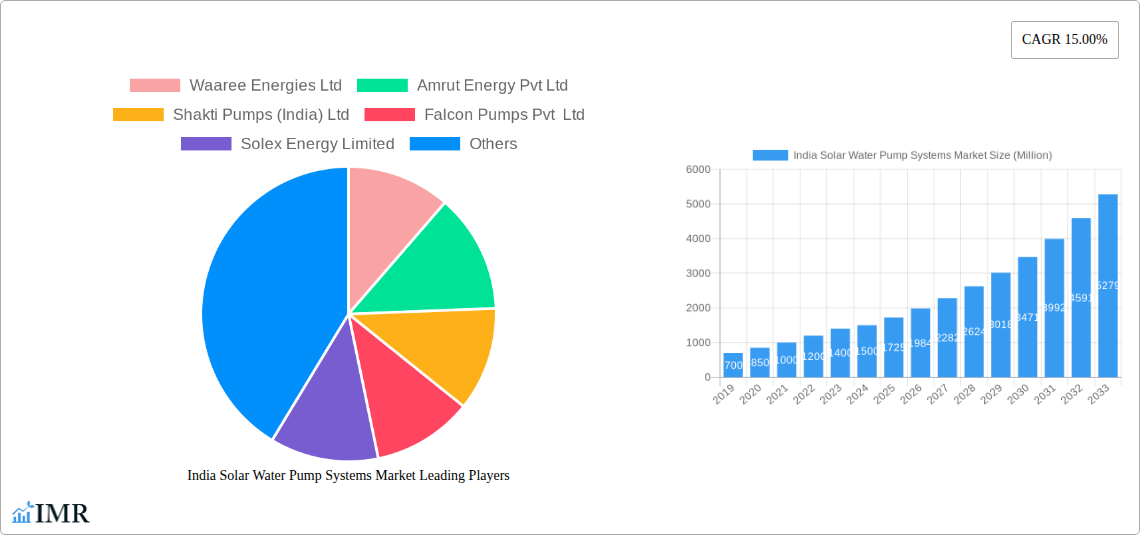

India Solar Water Pump Systems Market Company Market Share

Gain unparalleled insights into India's booming solar water pump systems market. This comprehensive report offers in-depth analysis of market dynamics, growth trends, regional dominance, product innovations, and strategic opportunities for stakeholders. With detailed forecasts and a base year analysis, acquire actionable intelligence for a vital sector in India's agricultural and rural development.

India Solar Water Pump Systems Market Market Dynamics & Structure

The India solar water pump systems market is characterized by a moderately concentrated structure, with a blend of established large players and a growing number of regional manufacturers. Technological innovation is primarily driven by advancements in solar panel efficiency, pump motor technology, and integrated control systems aimed at enhancing energy conversion and operational lifespan. The regulatory framework, spearheaded by government initiatives like the PM KUSUM Program, plays a pivotal role in shaping market growth by offering subsidies and targets for solar pump installations. Competitive product substitutes, predominantly diesel and grid-connected electric pumps, are gradually losing ground due to the rising operational costs and environmental concerns associated with them. End-user demographics are heavily skewed towards the agricultural sector, with a significant portion of the demand originating from small and marginal farmers seeking cost-effective and reliable irrigation solutions.

- Market Concentration: Dominated by a few key players, with increasing entry of niche manufacturers.

- Technological Innovation Drivers: Improved solar panel efficiency (e.g., PERC, bifacial), brushless DC motors, smart controllers with IoT capabilities.

- Regulatory Frameworks: Government subsidies, preferential tariffs for solar power, ambitious installation targets under national programs.

- Competitive Product Substitutes: Diesel pumps, grid-connected electric pumps, increasingly being displaced by solar alternatives.

- End-User Demographics: Primarily farmers (irrigation), followed by rural households for drinking water and limited industrial applications.

- M&A Trends: Expected to increase as larger players seek to consolidate market share and acquire innovative technologies.

India Solar Water Pump Systems Market Growth Trends & Insights

The India solar water pump systems market is experiencing robust growth, driven by a confluence of factors including government support, declining solar component costs, and the imperative for sustainable agricultural practices. The PM KUSUM Program has been a significant catalyst, setting ambitious targets for solar pump installations to reduce reliance on fossil fuels and improve energy access in rural areas. This program has spurred considerable investment and adoption, leading to an increasing market penetration of solar water pumps across the nation. Technological disruptions, such as the development of more efficient and durable solar panels and pumps, coupled with advancements in battery storage for off-grid applications, are further enhancing the appeal and performance of these systems. Consumer behavior is shifting towards a preference for long-term cost savings and environmental consciousness, making solar water pumps an attractive proposition for farmers and rural communities. The market size is projected to witness a substantial Compound Annual Growth Rate (CAGR) over the forecast period. Adoption rates are accelerating, particularly in states with higher agricultural intensity and limited access to reliable grid electricity.

- Market Size Evolution: Significant expansion driven by government schemes and private sector investment.

- Adoption Rates: Rapidly increasing, especially in key agricultural states, fueled by economic benefits and environmental awareness.

- Technological Disruptions: Continuous improvements in solar PV efficiency, pump motor technology (e.g., variable frequency drives), and energy storage solutions.

- Consumer Behavior Shifts: Growing preference for sustainable, low-maintenance, and cost-effective energy solutions, particularly among farmers.

- Market Penetration: Steadily rising, with a substantial portion of the rural population now considering or actively adopting solar water pumps.

- CAGR: Predicted to remain high, reflecting sustained demand and supportive policies.

Dominant Regions, Countries, or Segments in India Solar Water Pump Systems Market

The Irrigation application segment overwhelmingly dominates the India solar water pump systems market, driven by the country's vast agricultural landscape and the critical need for efficient water management. Farmers are increasingly recognizing the economic and environmental benefits of utilizing solar power for irrigation, leading to widespread adoption. Within this segment, Centrifugal Pump Technology holds a significant market share due to its efficiency in handling large volumes of water, suitable for various irrigation needs.

Dominant Application: Irrigation: This segment accounts for the largest market share, fueled by the substantial agricultural sector in India.

- Key Drivers: Need for sustainable and cost-effective irrigation, government subsidies for agricultural modernization, reducing dependence on diesel/grid electricity, improving crop yields.

- Market Share: Estimated to be over 70% of the total market.

- Growth Potential: Continues to be strong due to ongoing government focus and farmer adoption.

Dominant Pump Technology: Centrifugal Pump Technology: This technology is favored for its reliability and capacity to move large volumes of water efficiently.

- Key Drivers: Proven performance in agricultural applications, availability of a wide range of models, relatively lower initial cost compared to some specialized pumps.

- Market Share: Holds a dominant position within the pump technology segment.

- Growth Potential: Stable growth, with continuous improvements in efficiency and durability.

Leading Regions: States like Rajasthan, Gujarat, Maharashtra, Uttar Pradesh, and Haryana are leading in solar water pump installations due to their significant agricultural base and proactive government policies promoting renewable energy adoption.

- Key Drivers: High solar irradiance, large agrarian populations, supportive state-level incentives, presence of leading manufacturers and distributors.

- Economic Policies: State governments actively promoting solar pump adoption through subsidies and financing schemes.

- Infrastructure: Development of local service networks and availability of skilled technicians.

Other Significant Segments:

- Drinking and Cooking Water Supply: Crucial for rural electrification and providing access to clean water in remote areas.

- Industrial Applications: Growing demand for solar pumps in various industrial processes requiring water circulation or transfer.

India Solar Water Pump Systems Market Product Landscape

The product landscape of the India solar water pump systems market is evolving rapidly with a focus on enhanced efficiency, durability, and smart features. Manufacturers are introducing advanced solar water pumps that integrate high-efficiency solar panels with optimized pump designs, including both centrifugal and positive displacement technologies. Innovations include improved motor efficiency, corrosion-resistant materials, and integrated controllers that optimize water output based on solar availability and user needs. Many systems are now equipped with features like dry-run protection, over-voltage/under-voltage protection, and remote monitoring capabilities through mobile applications. The market also sees a growing demand for customized solutions tailored to specific agricultural needs and local environmental conditions.

Key Drivers, Barriers & Challenges in India Solar Water Pump Systems Market

Key Drivers:

- Government Initiatives & Subsidies: Programs like PM KUSUM provide significant financial incentives, making solar pumps more affordable.

- Declining Solar Component Costs: The decreasing price of solar panels and other components makes solar systems economically viable.

- Environmental Consciousness: Growing awareness of climate change and the need for sustainable energy solutions.

- Rural Electrification & Energy Access: Solar pumps offer a reliable alternative to grid electricity in remote areas.

- Rising Diesel & Grid Electricity Prices: Increases the operational cost-effectiveness of solar solutions.

Barriers & Challenges:

- High Initial Investment: Despite subsidies, the upfront cost can still be a barrier for some farmers.

- Technical Expertise & Maintenance: Limited availability of skilled technicians for installation and maintenance in some rural areas.

- Supply Chain Disruptions: Potential for delays and increased costs in component sourcing.

- Water Scarcity & Groundwater Depletion: Over-extraction of groundwater can impact the long-term viability of pumping systems.

- Grid Integration & Power Evacuation Issues: For grid-connected systems, challenges related to stable power evacuation can arise.

Emerging Opportunities in India Solar Water Pump Systems Market

Emerging opportunities lie in the development of integrated solar pumping solutions with energy storage systems to ensure consistent water supply even during cloudy periods or at night. The expansion of solar water pumps for aquaculture and livestock farming presents a significant untapped market. Furthermore, the integration of IoT and AI for smart water management, enabling real-time data analytics on water usage, pump performance, and crop irrigation needs, offers substantial growth potential. Rural housing projects and community water supply schemes also present new avenues for market expansion.

Growth Accelerators in the India Solar Water Pump Systems Market Industry

Growth in the India solar water pump systems market is being accelerated by policy support and target-driven initiatives from the government, which provides a strong impetus for widespread adoption. Continuous technological advancements leading to more efficient, reliable, and cost-effective solar pump systems are crucial growth accelerators. Strategic partnerships between solar panel manufacturers, pump manufacturers, and financial institutions are also playing a vital role in expanding market reach and improving accessibility for end-users. The increasing focus on micro-irrigation and water conservation techniques further bolsters the demand for efficient solar water pumping solutions.

Key Players Shaping the India Solar Water Pump Systems Market Market

- Waaree Energies Ltd

- Amrut Energy Pvt Ltd

- Shakti Pumps (India) Ltd

- Falcon Pumps Pvt Ltd

- Solex Energy Limited

- Aqua Group

- Mecwin Technologies India Pvt Ltd

- Greenmax Technology

- Novergy Energy Solutions Pvt Ltd

- Lubi Electronics

Notable Milestones in India Solar Water Pump Systems Market Sector

- August 2021: Indian government sets a target of 1.75 million installations of solar water pumps for irrigation and 1 million grid-connected solar systems by 2022 under the PM KUSUM Program.

- 2021-2022: Shakti Pumps (India) Ltd distributes approximately 30,000 solar water pumps to farmers under the PM KUSUM Scheme.

- 2022-2023: Shakti Pumps (India) Ltd plans to distribute 75,000 solar water pumps, with 10,000 already distributed.

In-Depth India Solar Water Pump Systems Market Market Outlook

The future outlook for the India solar water pump systems market is exceptionally promising, driven by a sustained commitment to renewable energy and agricultural modernization. The PM KUSUM Program continues to be a primary growth accelerator, with ongoing government support and ambitious targets expected to fuel significant market expansion. Technological innovations in solar panel efficiency, pump performance, and smart control systems will further enhance the value proposition of these solutions. Opportunities abound in expanding applications beyond traditional irrigation, including domestic water supply and industrial uses, especially in remote and off-grid locations. Strategic collaborations and increased investment are anticipated to bolster market penetration and address existing barriers, solidifying the role of solar water pumps as a cornerstone of sustainable rural development in India.

India Solar Water Pump Systems Market Segmentation

-

1. Pump Technology

- 1.1. Centrifugal Pump Technology

- 1.2. Positive Displacement Technology

-

2. Application

- 2.1. Irrigation

- 2.2. Drinking and Cooking Water Supply

- 2.3. Industrial

- 2.4. Other Applications

India Solar Water Pump Systems Market Segmentation By Geography

- 1. India

India Solar Water Pump Systems Market Regional Market Share

Geographic Coverage of India Solar Water Pump Systems Market

India Solar Water Pump Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Crew Transfer Ships

- 3.4. Market Trends

- 3.4.1. Surface Pumps Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Water Pump Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pump Technology

- 5.1.1. Centrifugal Pump Technology

- 5.1.2. Positive Displacement Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Irrigation

- 5.2.2. Drinking and Cooking Water Supply

- 5.2.3. Industrial

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Pump Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waaree Energies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amrut Energy Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shakti Pumps (India) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Falcon Pumps Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Solex Energy Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aqua Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mecwin Technologies India Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Greenmax Technology

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novergy Energy Solutions Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lubi Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Waaree Energies Ltd

List of Figures

- Figure 1: India Solar Water Pump Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Solar Water Pump Systems Market Share (%) by Company 2025

List of Tables

- Table 1: India Solar Water Pump Systems Market Revenue billion Forecast, by Pump Technology 2020 & 2033

- Table 2: India Solar Water Pump Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: India Solar Water Pump Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Solar Water Pump Systems Market Revenue billion Forecast, by Pump Technology 2020 & 2033

- Table 5: India Solar Water Pump Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Solar Water Pump Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Water Pump Systems Market?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the India Solar Water Pump Systems Market?

Key companies in the market include Waaree Energies Ltd, Amrut Energy Pvt Ltd, Shakti Pumps (India) Ltd, Falcon Pumps Pvt Ltd, Solex Energy Limited, Aqua Group, Mecwin Technologies India Pvt Ltd, Greenmax Technology, Novergy Energy Solutions Pvt Ltd, Lubi Electronics.

3. What are the main segments of the India Solar Water Pump Systems Market?

The market segments include Pump Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects.

6. What are the notable trends driving market growth?

Surface Pumps Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Competition from Crew Transfer Ships.

8. Can you provide examples of recent developments in the market?

August 2021: the Indian government decided to set a target of 1.75 million installations of solar water pumps for irrigation and installations of solar systems for another 1 million grid-connected pumps by 2022 under the PM KUSUM Program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Water Pump Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Water Pump Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Water Pump Systems Market?

To stay informed about further developments, trends, and reports in the India Solar Water Pump Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence