Key Insights

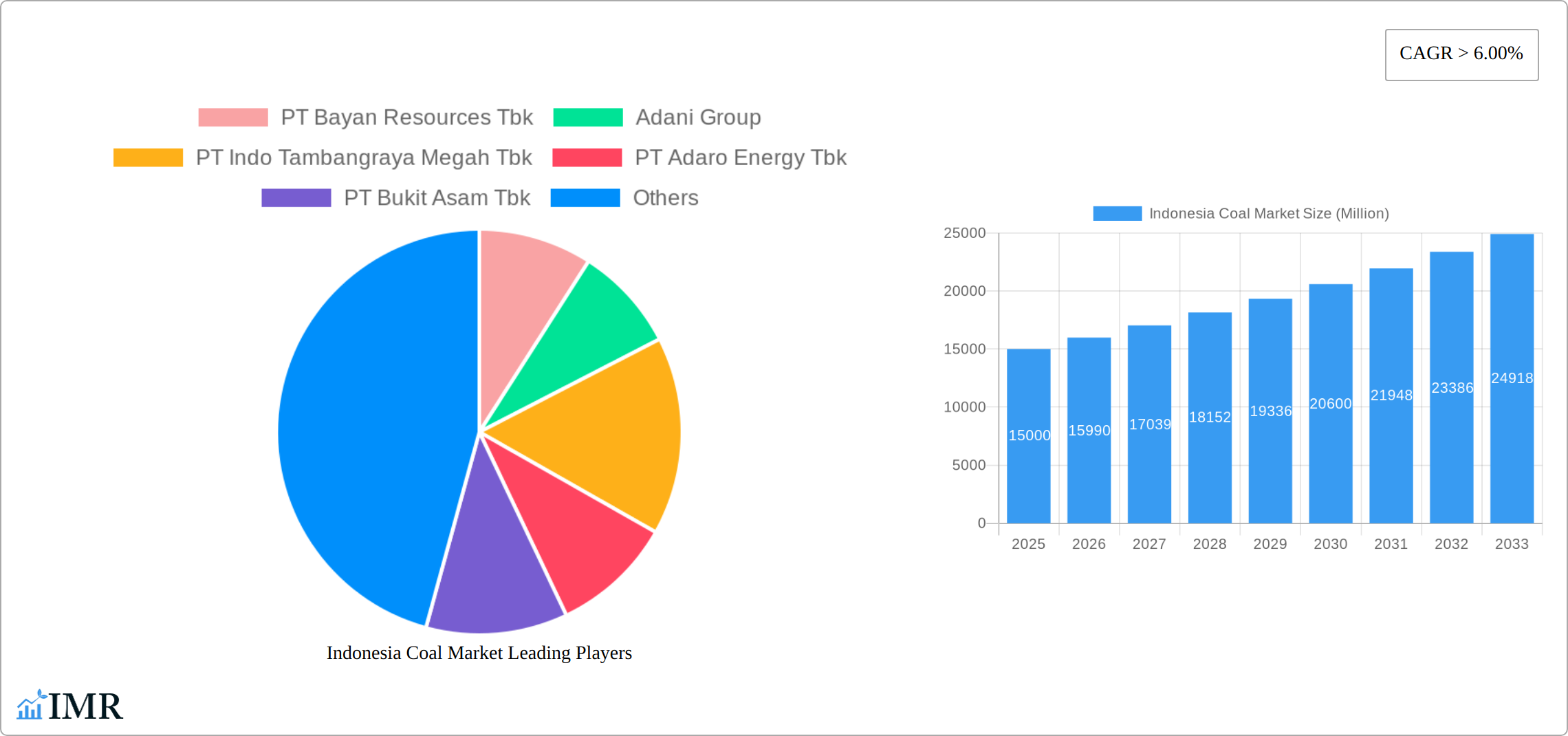

The Indonesian coal market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the strong demand from the electricity sector, a significant consumer of coal in Indonesia, continues to underpin market growth. Secondly, the iron and steel industry's reliance on coal for its production processes contributes substantially to the overall market size. While other applications represent a smaller segment, their collective contribution to market growth is not insignificant. The growth trajectory is expected to be influenced by government policies regarding energy transition and environmental regulations, which could potentially act as constraints. However, the sustained demand from established sectors is anticipated to outweigh these potential limitations in the short-to-medium term. Major players like PT Bayan Resources Tbk, Adani Group, and PT Indo Tambangraya Megah Tbk are key contributors to the market's dynamism, shaping its competitive landscape through strategic investments and production capabilities. The market's future depends on a careful balance between meeting current energy demands and adapting to a future with a greater emphasis on renewable energy sources.

Indonesia Coal Market Market Size (In Billion)

The forecast period of 2025-2033 presents a significant opportunity for stakeholders in the Indonesian coal market. However, understanding the market's evolving dynamics is crucial for informed decision-making. While the current drivers suggest continued growth, potential headwinds related to global climate change initiatives and the increasing adoption of renewable energy sources need careful consideration. Furthermore, the analysis of regional disparities within Indonesia and the competitive strategies employed by key players will be pivotal in determining individual market shares and overall profitability. Companies need to invest in efficiency improvements, explore opportunities for diversification and prioritize sustainable practices to thrive in this evolving market. The continued growth is expected to be positively impacted by the consistent domestic demand from major industries.

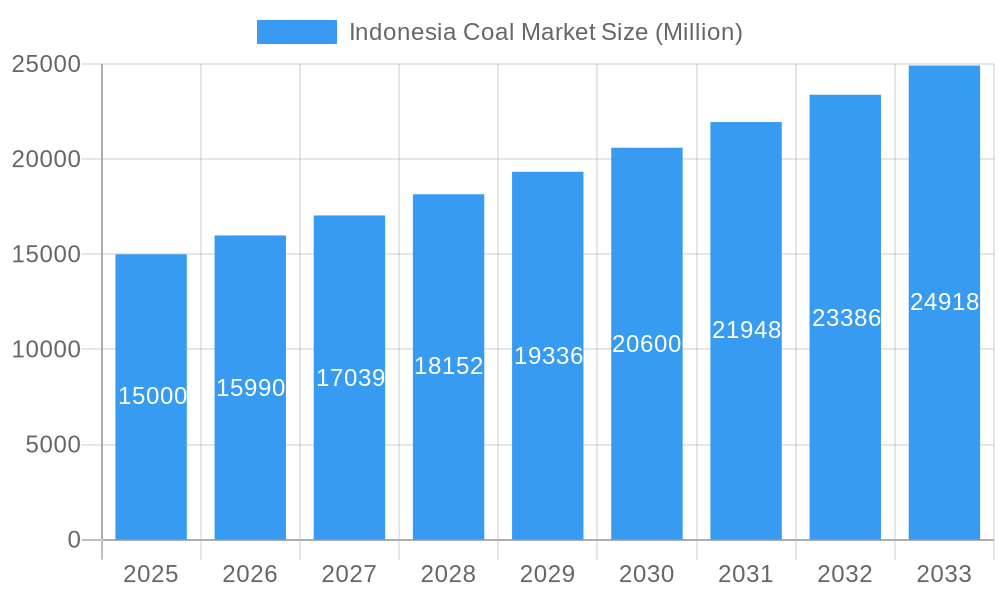

Indonesia Coal Market Company Market Share

Indonesia Coal Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia coal market, encompassing market dynamics, growth trends, dominant segments, and key players. The report covers the historical period (2019-2024), base year (2025), and forecasts the market's trajectory until 2033. This detailed study is crucial for businesses, investors, and policymakers navigating the complexities of this dynamic sector. The report analyzes the parent market (coal mining and production in Indonesia) and dives deep into the child market segments (Electricity, Iron and Steel Industry, and Other Applications).

Keywords: Indonesia coal market, coal mining Indonesia, Indonesian coal industry, coal production Indonesia, electricity generation coal Indonesia, steel industry coal Indonesia, coal market analysis, coal market forecast, Adaro Energy, Bukit Asam, Bayan Resources, Indo Tambangraya Megah, Bumi Resources, BlackGold Group, Golden Energy and Resources, Adani Group, Bhakti Energi Persada, Indonesian energy sector.

Indonesia Coal Market Dynamics & Structure

The Indonesian coal market, while exhibiting significant growth potential, operates within a complex framework of market concentration, technological advancements, stringent regulations, and the emergence of competitive alternatives. The market is characterized by a mix of large, publicly listed companies and smaller, privately held entities. Several major players hold substantial market share, resulting in a moderately concentrated market.

- Market Concentration: The top five players (PT Adaro Energy Tbk, PT Bukit Asam Tbk, PT Indo Tambangraya Megah Tbk, PT Bayan Resources Tbk, PT Bumi Resources Tbk) account for approximately xx% of the total market share in 2025.

- Technological Innovation: While technological innovation in coal mining focuses mainly on efficiency improvements in extraction and transportation, significant advancements in cleaner coal technologies and carbon capture are limited.

- Regulatory Frameworks: Government regulations play a crucial role, impacting production quotas, environmental compliance, and export policies. The recent announcement concerning new coal plants reveals the government’s continued commitment to the coal sector despite broader sustainability considerations.

- Competitive Substitutes: Renewables such as solar and geothermal energy pose an increasing threat to coal's dominance in power generation. The pace of this substitution is xx Million tons/year during the forecast period.

- End-User Demographics: The primary end users are the electricity generation sector and the iron and steel industry. Other applications include cement production and industrial heating.

- M&A Trends: The Indonesian coal market has witnessed xx M&A deals between 2019 and 2024, primarily focused on consolidation and expansion by larger players. This trend is expected to continue at a rate of xx deals per year during the forecast period.

Indonesia Coal Market Growth Trends & Insights

The Indonesian coal market experienced a fluctuating growth pattern during the historical period (2019-2024), influenced by global economic conditions, energy demand, and regulatory changes. Market size, measured in million tons, exhibited a Compound Annual Growth Rate (CAGR) of xx% from 2019-2024, reaching approximately xx Million tons in 2024. The forecast period (2025-2033) projects a CAGR of xx%, driven by increasing domestic energy demand and continued coal exports. Factors influencing this growth include the government's long-term energy plan and ongoing infrastructural developments. However, the increasing adoption of renewable energy sources is expected to moderate the overall growth rate. Market penetration of coal in the electricity sector is expected to remain high, while its role in other applications might face some decline due to the rise of alternative fuels. Technological advancements in mining efficiency will be a major factor influencing production levels. Changes in global energy policies and sustainability targets will significantly impact future demand and investments.

Dominant Regions, Countries, or Segments in Indonesia Coal Market

The electricity generation sector remains the dominant segment in the Indonesian coal market, accounting for approximately xx% of total consumption in 2025. East Kalimantan and Sumatra are the leading coal-producing regions, primarily due to the abundance of readily available coal reserves and established mining infrastructure.

Key Drivers for Electricity Segment:

- Strong domestic electricity demand driven by population growth and economic development.

- Government support for coal-fired power plants, as evidenced by the November 2022 announcement on new plant construction.

- Existing infrastructure supporting coal-based power generation.

Dominance Factors:

- High coal reserves in key regions.

- Established mining and transportation infrastructure.

- Consistent demand from the power sector.

- Government policies supporting coal-fired power plants, at least in the short to medium term.

- Comparatively lower cost compared to other energy sources (currently).

The iron and steel industry constitutes a significant secondary segment, while "Other Applications" represent a smaller but growing portion of the market. The growth potential of this segment is linked to the expansion of the industrial sector and diversification of coal applications. The forecast projects increased coal consumption across all segments, albeit at varying rates.

Indonesia Coal Market Product Landscape

The Indonesian coal market is characterized by various coal types, classified by energy content and ash content, catering to different industrial needs. Technological advancements are focused on optimizing mining processes for higher efficiency and reduced environmental impact. While significant breakthroughs in coal's inherent characteristics are unlikely, improvements in extraction, transportation, and beneficiation methods continue to evolve, improving productivity and reducing operational costs. The main selling proposition remains the relative cost-effectiveness of coal compared to other energy sources in the short-term, although this gap is slowly closing.

Key Drivers, Barriers & Challenges in Indonesia Coal Market

Key Drivers: The Indonesian coal market is driven by several factors. The government's continued support for coal-fired power plants remains a significant driver, underpinned by robust domestic electricity demand fueled by ongoing economic growth. Indonesia's established mining infrastructure and the relatively cost-competitive nature of coal, at least in the short to medium term, further contribute to market strength. Furthermore, the nation's focus on industrial development necessitates substantial energy provision, creating consistent demand for coal.

Key Challenges and Restraints: However, the sector faces considerable headwinds. Mounting environmental concerns and the global push for decarbonization pose significant challenges. The increasing adoption of renewable energy sources is placing downward pressure on coal demand, leading to uncertainty regarding long-term market viability. Price volatility in the global coal market adds another layer of complexity, as do potential future regulatory changes impacting environmental policies. These challenges could significantly impact investment and market share, potentially resulting in a substantial reduction in demand – estimates suggest a possible xx% decrease by 2033. The balancing act between economic development reliant on coal and the global imperative for decarbonization presents a major ongoing policy challenge.

Emerging Opportunities in Indonesia Coal Market

The utilization of coal in other industrial applications beyond electricity generation and steel production presents significant untapped potential. Developing technologies for cleaner coal utilization and carbon capture, along with exploring opportunities in coal gasification and liquefaction, could unlock new market segments and enhance sustainability. Furthermore, focusing on export markets for high-quality coal could maintain growth.

Growth Accelerators in the Indonesia Coal Market Industry

Despite the challenges, several factors could accelerate growth. Strategic partnerships between mining companies and power producers can enhance efficiency and market reach. Investments in advanced mining technologies and infrastructure improvements are crucial for boosting production capacity and overall efficiency. Government policies supporting industrial development and the resulting energy demand will continue to sustain the coal market for the foreseeable future. Although renewable energy is gaining traction, a complete transition away from coal is projected to take considerable time, ensuring continued growth for the sector for years to come. Opportunities exist in optimizing existing operations, developing new applications for coal, and exploring carbon capture and storage (CCS) technologies to mitigate environmental impact.

Key Players Shaping the Indonesia Coal Market Market

- PT Bayan Resources Tbk

- Adani Group

- PT Indo Tambangraya Megah Tbk

- PT Adaro Energy Tbk

- PT Bukit Asam Tbk

- BlackGold Group

- Golden Energy and Resources Limited

- PT Bumi Resources Tbk

- PT Bhakti Energi Persada

Notable Milestones in Indonesia Coal Market Sector

- November 2022: The Indonesian government approved the construction of 13 GW of new coal-fired power plants, underscoring the continued reliance on coal for power generation in the near term.

- November 2022: The Asian Development Bank and a private firm announced plans to refinance and prematurely retire the Cirebon 1 coal plant, illustrating the growing shift toward renewable energy adoption and the pressure to transition away from coal. This highlights the complex interplay of competing interests within Indonesia's energy policy landscape.

- [Add other notable milestones with dates and brief descriptions] Include any significant policy changes, investments, mergers and acquisitions, or technological advancements impacting the Indonesian coal market.

In-Depth Indonesia Coal Market Market Outlook

The Indonesian coal market is poised for continued growth, albeit at a moderating pace. While the long-term trend points towards a decreased reliance on coal due to sustainability concerns and the rise of renewables, the foreseeable future will likely see continued significant domestic demand and, therefore, market expansion. Opportunities lie in optimizing existing operations, developing new applications for coal, and exploring strategic partnerships to enhance efficiency and sustainability. A careful balancing of existing infrastructure needs, sustainable energy transition policies, and economic growth will be essential in shaping the long-term outlook of the sector.

Indonesia Coal Market Segmentation

-

1. Application

- 1.1. Electricity

- 1.2. Iron and Steel Industry

- 1.3. Other Applications

Indonesia Coal Market Segmentation By Geography

- 1. Indonesia

Indonesia Coal Market Regional Market Share

Geographic Coverage of Indonesia Coal Market

Indonesia Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Electricity Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electricity

- 5.1.2. Iron and Steel Industry

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Bayan Resources Tbk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Indo Tambangraya Megah Tbk

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Adaro Energy Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Bukit Asam Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BlackGold Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Golden Energy and Resources Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Bumi Resources Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Bhakti Energi Persada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PT Bayan Resources Tbk

List of Figures

- Figure 1: Indonesia Coal Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Coal Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Indonesia Coal Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Indonesia Coal Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Indonesia Coal Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Indonesia Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Coal Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Indonesia Coal Market?

Key companies in the market include PT Bayan Resources Tbk, Adani Group, PT Indo Tambangraya Megah Tbk, PT Adaro Energy Tbk, PT Bukit Asam Tbk, BlackGold Group, Golden Energy and Resources Limited, PT Bumi Resources Tbk, PT Bhakti Energi Persada.

3. What are the main segments of the Indonesia Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Electricity Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In November 2022, the Indonesian government announced that they would allow the construction of new coal plants, with a combined capacity of 13 gigawatts, that have already been tendered out. The plan is laid out in the country's 10-year energy plan for 2021-2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Coal Market?

To stay informed about further developments, trends, and reports in the Indonesia Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence