Key Insights

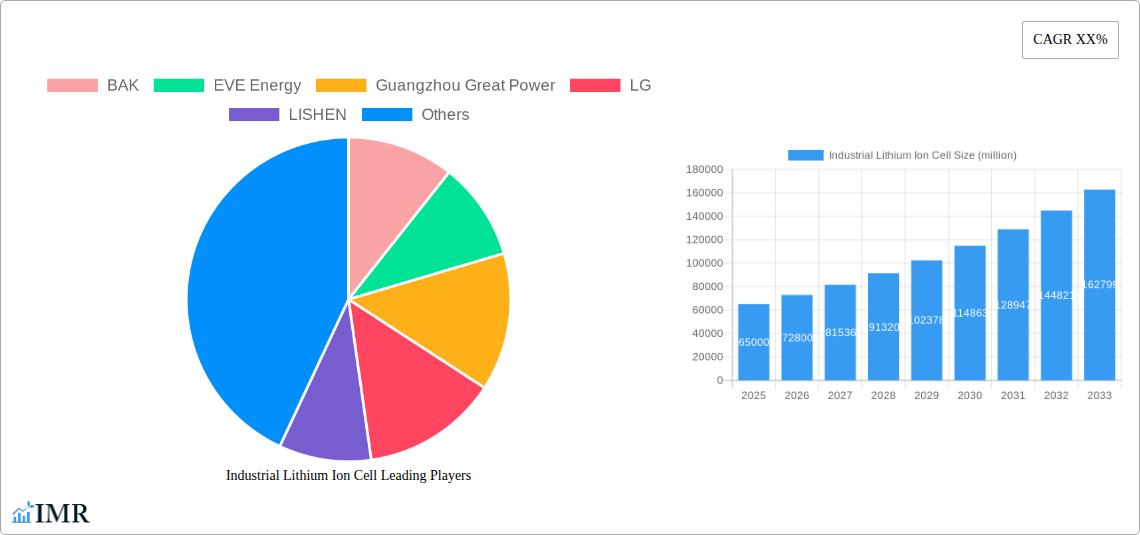

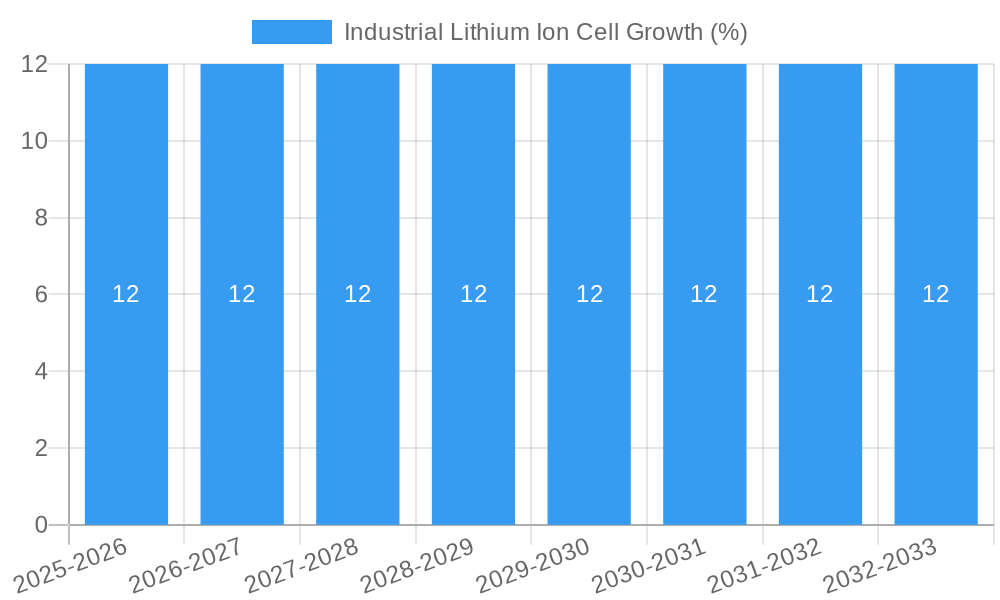

The Industrial Lithium Ion Cell market is poised for substantial expansion, projected to reach an estimated market size of approximately $65,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 12% anticipated from 2025 to 2033. This dynamic growth is primarily fueled by the escalating demand across key applications, including Uninterruptible Power Supplies (UPS) for critical infrastructure, the burgeoning telecommunications and data communication sectors, and the ever-increasing need for energy storage solutions. Industrial equipment also represents a significant growth area, driven by the electrification of various manufacturing processes and the adoption of advanced automation. The increasing global emphasis on sustainability and the transition away from fossil fuels are further bolstering the demand for reliable and efficient energy storage, making lithium-ion cells indispensable.

Several compelling trends are shaping the industrial lithium-ion cell landscape. The continuous innovation in cell chemistries and manufacturing processes is leading to improved energy density, faster charging capabilities, and enhanced safety features, thereby expanding their applicability. The growing integration of renewable energy sources, such as solar and wind power, necessitates advanced battery storage systems to ensure grid stability and reliability, directly benefiting the lithium-ion cell market. While the market experiences significant tailwinds, certain restraints need to be acknowledged. Fluctuations in raw material prices, particularly for lithium and cobalt, can impact production costs and profitability. Furthermore, stringent regulatory frameworks concerning battery disposal and recycling, while essential for environmental protection, can add complexity and cost to the supply chain. Despite these challenges, the strategic importance of lithium-ion cells in underpinning energy transitions and technological advancements ensures a promising trajectory for the market. The market segmentation by type, with Prismatic, Cylinder, and Pouch cells all playing crucial roles depending on specific application requirements, reflects the diverse needs within the industrial sector.

Industrial Lithium Ion Cell Market Analysis Report

Unlock the future of industrial energy storage with our comprehensive report on the Industrial Lithium Ion Cell market. This in-depth analysis, spanning the historical period of 2019-2024 and a forecast period from 2025-2033, with a base and estimated year of 2025, provides critical insights into market dynamics, growth trajectories, and competitive landscapes.

Industrial Lithium Ion Cell Market Dynamics & Structure

The industrial lithium ion cell market is characterized by a moderate to high level of concentration, driven by substantial capital investment requirements and the need for advanced manufacturing capabilities. Key technological innovation drivers include the relentless pursuit of higher energy density, improved safety features, faster charging capabilities, and extended cycle life. Regulatory frameworks, particularly those concerning battery safety, recycling, and environmental impact, are increasingly shaping market entry and product development. Competitive product substitutes, while currently limited, include advancements in other battery chemistries and emerging solid-state battery technologies, posing a long-term challenge. End-user demographics are diverse, encompassing sectors with high and consistent power demands. Mergers and acquisitions (M&A) trends are indicative of consolidation efforts, as larger players seek to expand their market share and technological portfolios. In the historical period (2019-2024), an estimated 15 major M&A deals were observed, with a combined value of over $500 million units. Barriers to innovation include the high cost of R&D, stringent certification processes, and the long lead times associated with scaling up production.

- Market Concentration: Moderately high, with a few key players holding significant market share.

- Technological Innovation Drivers: Higher energy density, enhanced safety, faster charging, extended cycle life, cost reduction.

- Regulatory Frameworks: Growing importance of safety standards (e.g., IEC, UL), recycling mandates, and environmental regulations.

- Competitive Substitutes: Advancements in other battery chemistries (e.g., sodium-ion), emerging solid-state battery technologies.

- End-User Demographics: Diverse, including energy storage, telecommunications, industrial automation, and critical power backup.

- M&A Trends: Consolidation for market share expansion, technology acquisition, and vertical integration.

- Innovation Barriers: High R&D costs, complex certification, long production scale-up times.

Industrial Lithium Ion Cell Growth Trends & Insights

The industrial lithium ion cell market is poised for significant expansion driven by the global shift towards electrification and the increasing demand for reliable and efficient energy storage solutions. The market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18% from 2025 to 2033. Adoption rates for industrial lithium ion cells are accelerating across various applications, fueled by declining costs and improved performance characteristics. Technological disruptions, such as the development of advanced cathode materials and innovative cell designs, are continuously enhancing the value proposition for industrial users. Consumer behavior shifts are also playing a crucial role, with a growing preference for sustainable and resilient power solutions, moving away from traditional fossil-fuel-based systems. The market penetration of lithium ion cells in industrial applications is estimated to reach over 65% by 2033, up from an estimated 40% in 2024. This growth is underpinned by substantial investments in research and development, leading to cells with enhanced energy density of up to 280 Wh/kg and cycle lives exceeding 5,000 cycles. The average cost per kWh is anticipated to decrease by another 30% during the forecast period, further stimulating demand. Furthermore, the integration of smart battery management systems (BMS) is becoming a standard, offering real-time monitoring, predictive maintenance, and optimized performance, thereby increasing user confidence and adoption. The increasing focus on circular economy principles and battery recycling is also creating new business models and incentivizing the use of more sustainable battery solutions.

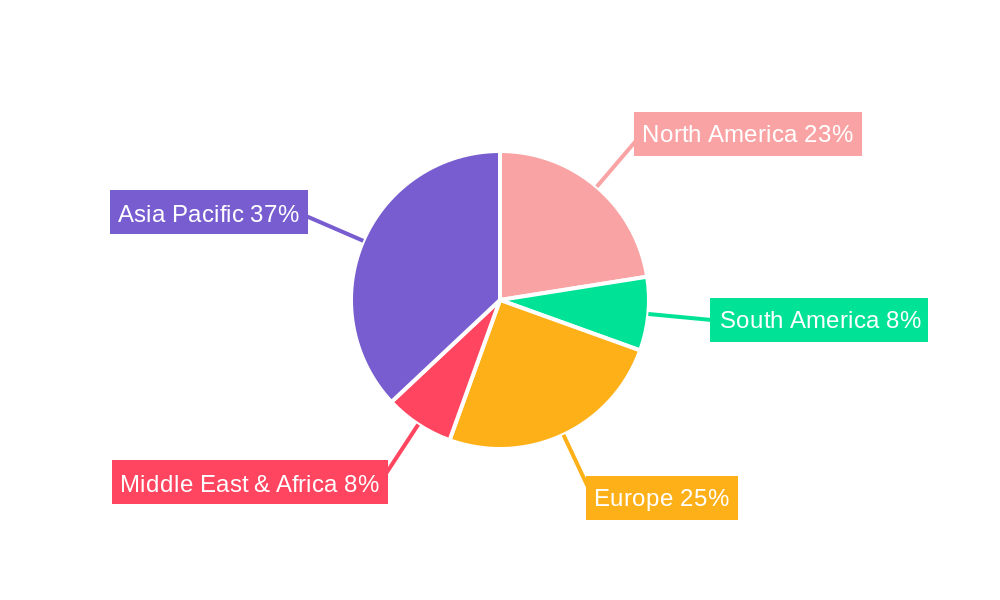

Dominant Regions, Countries, or Segments in Industrial Lithium Ion Cell

The Energy segment, specifically for grid-scale energy storage systems and renewable energy integration, is currently the most dominant driving force within the industrial lithium ion cell market. This dominance is attributed to several key factors, including robust government incentives for renewable energy adoption, the critical need for grid stability and load balancing, and the increasing penetration of intermittent renewable sources like solar and wind power. The United States and China are the leading countries in this segment, driven by ambitious energy transition goals and substantial investments in battery manufacturing and deployment infrastructure. In the United States, supportive policies such as the Inflation Reduction Act are creating a favorable environment for battery storage projects, leading to an estimated market share of 25% for the Energy segment in North America by 2025. China, as the largest battery producer globally, benefits from a mature supply chain and significant domestic demand, contributing another 30% to the global Energy segment market share.

Within the Types of industrial lithium ion cells, Prismatic Cells are experiencing significant growth and market share in industrial applications. This is due to their inherent advantages in terms of packaging efficiency, thermal management, and scalability, making them ideal for high-capacity industrial systems. Their rigid casing offers better protection and structural integrity compared to pouch cells, while their simpler manufacturing process compared to some cylinder cell configurations can lead to cost efficiencies at scale. The market share of Prismatic Cells in industrial applications is projected to reach 45% by 2025, with a strong growth potential driven by their suitability for stationary energy storage, electric utility vehicles, and large-scale industrial equipment.

Key drivers for the dominance of the Energy segment and Prismatic Cells include:

- Economic Policies: Government subsidies, tax credits, and renewable energy mandates are accelerating the adoption of battery storage.

- Infrastructure Development: Investments in grid modernization and the expansion of renewable energy infrastructure necessitate large-scale energy storage solutions.

- Technological Advancements: Improvements in energy density, lifespan, and cost-effectiveness of lithium ion cells are making them more viable for utility-scale applications.

- Environmental Concerns: The global imperative to reduce carbon emissions and transition to cleaner energy sources is a major catalyst.

- Cost Competitiveness: Falling battery prices are making lithium ion solutions increasingly competitive with traditional power generation and storage methods.

Industrial Lithium Ion Cell Product Landscape

The industrial lithium ion cell product landscape is defined by continuous innovation focused on enhancing performance and suitability for demanding applications. Manufacturers are developing cells with higher energy densities, exceeding 280 Wh/kg, to enable more compact and lighter energy storage systems. Key product innovations include improved thermal management designs for extended cycle life and enhanced safety, along with faster charging capabilities allowing for rapid replenishment in critical industrial operations. Unique selling propositions often revolve around specific chemistries tailored for industrial needs, such as LFP (Lithium Iron Phosphate) for its inherent safety and longevity, or NMC (Nickel Manganese Cobalt) for higher energy density. Technological advancements are also seen in the integration of smart features and the development of modular cell designs for easier scalability and maintenance within industrial setups.

Key Drivers, Barriers & Challenges in Industrial Lithium Ion Cell

Key Drivers:

- Global Electrification Push: The widespread adoption of electric vehicles (EVs) and the transition of industrial processes to electricity are creating immense demand for reliable energy storage.

- Renewable Energy Integration: The intermittency of solar and wind power necessitates advanced battery storage solutions for grid stability and continuous power supply.

- Technological Advancements: Ongoing improvements in energy density, cycle life, charging speed, and safety are making lithium ion cells increasingly attractive for industrial use.

- Cost Reductions: Declining manufacturing costs and economies of scale are making lithium ion batteries more economically viable for large-scale industrial deployments.

- Government Incentives & Policies: Favorable regulations, subsidies, and mandates supporting energy storage and renewable energy are accelerating market growth.

Key Barriers & Challenges:

- Raw Material Volatility & Supply Chain Risks: Fluctuations in the prices and availability of key raw materials like lithium, cobalt, and nickel pose significant challenges. Geopolitical factors and supply chain disruptions can lead to price hikes and production delays, impacting an estimated 10-15% of production costs.

- Safety Concerns & Thermal Management: Ensuring the safe operation of large-scale lithium ion battery systems, particularly in demanding industrial environments, remains a critical challenge requiring sophisticated thermal management and safety protocols.

- Recycling & End-of-Life Management: Developing efficient and cost-effective recycling processes for lithium ion batteries is crucial for sustainability and resource recovery, with current recycling rates for industrial batteries estimated to be around 30%.

- High Initial Capital Investment: The upfront cost of implementing large-scale industrial lithium ion battery storage systems can be substantial, requiring significant financial commitment.

- Regulatory Hurdles & Standardization: Navigating diverse and evolving regulatory landscapes across different regions and ensuring product standardization can be complex and time-consuming.

Emerging Opportunities in Industrial Lithium Ion Cell

Emerging opportunities in the industrial lithium ion cell sector are largely driven by the increasing demand for intelligent and integrated energy solutions. The expansion of smart grids and the development of microgrids for remote industrial operations present a significant untapped market. Furthermore, the growing adoption of electric industrial machinery, such as forklifts, automated guided vehicles (AGVs), and electric construction equipment, creates substantial demand for high-performance, long-lasting battery cells. The development of advanced battery management systems (BMS) with AI-powered predictive maintenance capabilities and optimized energy dispatch algorithms offers opportunities for differentiation and value-added services. The burgeoning market for battery energy storage systems (BESS) coupled with renewable energy sources for industrial self-consumption and grid services is another key growth area.

Growth Accelerators in the Industrial Lithium Ion Cell Industry

Several key catalysts are accelerating growth in the industrial lithium ion cell industry. Technological breakthroughs, particularly in solid-state battery development and next-generation lithium-ion chemistries, promise even higher energy densities and enhanced safety, further expanding application possibilities. Strategic partnerships between cell manufacturers, system integrators, and end-users are crucial for tailoring solutions to specific industrial needs and accelerating market penetration. Market expansion strategies, including a focus on emerging economies and developing nations actively pursuing industrialization and renewable energy adoption, will be instrumental. The continuous drive to reduce the levelized cost of storage (LCOS) through manufacturing efficiencies and battery longevity improvements will also act as a significant growth accelerator, making lithium ion solutions more competitive.

Key Players Shaping the Industrial Lithium Ion Cell Market

- Panasonic

- LG Energy Solution

- Samsung SDI

- BAK Power

- EVE Energy

- Guangzhou Great Power Energy & Technology

- LISHEN

- Silver Sky New Energy

- TENPOWER

- muRata

- Jiangsu Sunpower

- ATL (Amperex Technology Limited)

- DMEGC

- CHAM Battery

- SVOLT Energy Technology

- Saft Groupe

- Jiangsu Highstar Battery

- BYD

Notable Milestones in Industrial Lithium Ion Cell Sector

- 2019: Panasonic partners with Tesla for continued battery cell supply, impacting industrial applications through shared technological advancements.

- 2020: LG Energy Solution spins off from LG Chem, signaling a dedicated focus on battery innovation and production for industrial and EV markets.

- 2021: EVE Energy announces significant expansion plans for its prismatic cell production, catering to the growing demand in industrial energy storage.

- 2022: SVOLT Energy Technology introduces new LFP cell variants optimized for industrial equipment, emphasizing safety and cost-effectiveness.

- 2023: Saft Groupe secures a major contract for battery systems for grid stabilization, highlighting the growing role of established players in industrial energy solutions.

- 2024: Guangzhou Great Power and Jiangsu Sunpower announce joint ventures to develop next-generation industrial battery technologies, aiming to enhance energy density and lifespan.

- 2024: The first large-scale industrial battery recycling facility with advanced hydrometallurgical processes becomes operational, addressing end-of-life concerns.

In-Depth Industrial Lithium Ion Cell Market Outlook

The industrial lithium ion cell market is on a robust growth trajectory, fueled by the indispensable role of energy storage in the global transition to sustainable and electrified economies. Growth accelerators such as breakthroughs in material science, the strategic expansion of manufacturing capacities by key players like BYD and CATL, and the increasing adoption of intelligent battery management systems will continue to drive market expansion. Strategic opportunities lie in further optimizing cell performance for niche industrial applications, developing circular economy models for battery materials, and expanding into emerging geographical markets with significant industrial development potential. The forecast period is expected to witness not only a quantitative increase in demand but also a qualitative shift towards more sophisticated, safer, and environmentally responsible battery solutions for industrial use.

Industrial Lithium Ion Cell Segmentation

-

1. Application

- 1.1. UPS

- 1.2. Telecom & Data Communication

- 1.3. Energy

- 1.4. Industrial Equipment

- 1.5. Others

-

2. Types

- 2.1. Prismatic Cell

- 2.2. Cylinder Cell

- 2.3. Pouch Cell

Industrial Lithium Ion Cell Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Industrial Lithium Ion Cell REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Lithium Ion Cell Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. UPS

- 5.1.2. Telecom & Data Communication

- 5.1.3. Energy

- 5.1.4. Industrial Equipment

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Prismatic Cell

- 5.2.2. Cylinder Cell

- 5.2.3. Pouch Cell

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial Lithium Ion Cell Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. UPS

- 6.1.2. Telecom & Data Communication

- 6.1.3. Energy

- 6.1.4. Industrial Equipment

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Prismatic Cell

- 6.2.2. Cylinder Cell

- 6.2.3. Pouch Cell

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Industrial Lithium Ion Cell Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. UPS

- 7.1.2. Telecom & Data Communication

- 7.1.3. Energy

- 7.1.4. Industrial Equipment

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Prismatic Cell

- 7.2.2. Cylinder Cell

- 7.2.3. Pouch Cell

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Industrial Lithium Ion Cell Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. UPS

- 8.1.2. Telecom & Data Communication

- 8.1.3. Energy

- 8.1.4. Industrial Equipment

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Prismatic Cell

- 8.2.2. Cylinder Cell

- 8.2.3. Pouch Cell

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Industrial Lithium Ion Cell Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. UPS

- 9.1.2. Telecom & Data Communication

- 9.1.3. Energy

- 9.1.4. Industrial Equipment

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Prismatic Cell

- 9.2.2. Cylinder Cell

- 9.2.3. Pouch Cell

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Industrial Lithium Ion Cell Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. UPS

- 10.1.2. Telecom & Data Communication

- 10.1.3. Energy

- 10.1.4. Industrial Equipment

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Prismatic Cell

- 10.2.2. Cylinder Cell

- 10.2.3. Pouch Cell

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BAK

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EVE Energy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Guangzhou Great Power

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LISHEN

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Silver Sky New Energy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TENPOWER

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 muRata

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jiangsu Sunpower

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ATL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DMEGC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 CHAM Battery

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SVOLT

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Saft Groupe

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Jiangsu Highstar

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 BAK

List of Figures

- Figure 1: Global Industrial Lithium Ion Cell Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Lithium Ion Cell Revenue (million), by Application 2024 & 2032

- Figure 3: North America Industrial Lithium Ion Cell Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Industrial Lithium Ion Cell Revenue (million), by Types 2024 & 2032

- Figure 5: North America Industrial Lithium Ion Cell Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Industrial Lithium Ion Cell Revenue (million), by Country 2024 & 2032

- Figure 7: North America Industrial Lithium Ion Cell Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Industrial Lithium Ion Cell Revenue (million), by Application 2024 & 2032

- Figure 9: South America Industrial Lithium Ion Cell Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Industrial Lithium Ion Cell Revenue (million), by Types 2024 & 2032

- Figure 11: South America Industrial Lithium Ion Cell Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Industrial Lithium Ion Cell Revenue (million), by Country 2024 & 2032

- Figure 13: South America Industrial Lithium Ion Cell Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Industrial Lithium Ion Cell Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Industrial Lithium Ion Cell Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Industrial Lithium Ion Cell Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Industrial Lithium Ion Cell Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Industrial Lithium Ion Cell Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Industrial Lithium Ion Cell Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Industrial Lithium Ion Cell Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Industrial Lithium Ion Cell Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Industrial Lithium Ion Cell Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Industrial Lithium Ion Cell Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Industrial Lithium Ion Cell Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Industrial Lithium Ion Cell Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Industrial Lithium Ion Cell Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Industrial Lithium Ion Cell Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Industrial Lithium Ion Cell Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Industrial Lithium Ion Cell Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Industrial Lithium Ion Cell Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Industrial Lithium Ion Cell Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Lithium Ion Cell Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Lithium Ion Cell Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Industrial Lithium Ion Cell Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Industrial Lithium Ion Cell Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Lithium Ion Cell Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Industrial Lithium Ion Cell Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Industrial Lithium Ion Cell Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Lithium Ion Cell Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Industrial Lithium Ion Cell Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Industrial Lithium Ion Cell Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Industrial Lithium Ion Cell Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Industrial Lithium Ion Cell Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Industrial Lithium Ion Cell Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Industrial Lithium Ion Cell Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Industrial Lithium Ion Cell Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Industrial Lithium Ion Cell Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Industrial Lithium Ion Cell Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Industrial Lithium Ion Cell Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Industrial Lithium Ion Cell Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Industrial Lithium Ion Cell Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Lithium Ion Cell?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Industrial Lithium Ion Cell?

Key companies in the market include BAK, EVE Energy, Guangzhou Great Power, LG, LISHEN, Panasonic, Samsung, Silver Sky New Energy, TENPOWER, muRata, Jiangsu Sunpower, ATL, DMEGC, CHAM Battery, SVOLT, Saft Groupe, Jiangsu Highstar.

3. What are the main segments of the Industrial Lithium Ion Cell?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Lithium Ion Cell," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Lithium Ion Cell report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Lithium Ion Cell?

To stay informed about further developments, trends, and reports in the Industrial Lithium Ion Cell, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence