Key Insights

The Indian LPG market, valued at approximately $136.548 billion in 2025, is projected for robust expansion with a Compound Annual Growth Rate (CAGR) of 4.71%. This growth is propelled by escalating urbanization, rising disposable incomes, and an expanding middle class, driving demand for cleaner, convenient cooking fuels and a shift from traditional biomass. The residential and commercial sectors are primary growth drivers, with notable contributions also from industrial and autofuel segments. Government initiatives promoting clean energy access and rural infrastructure development further bolster market reach.

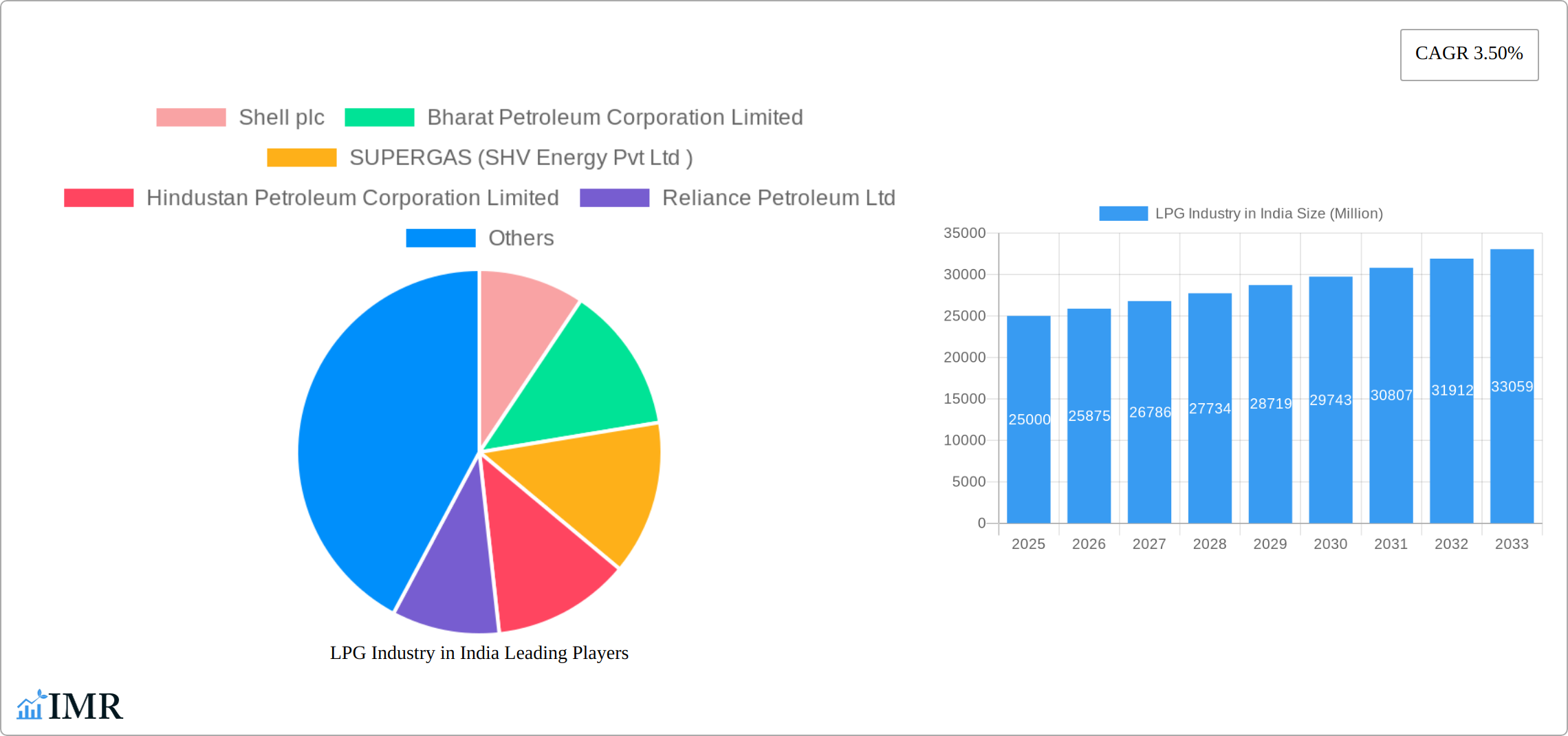

LPG Industry in India Market Size (In Billion)

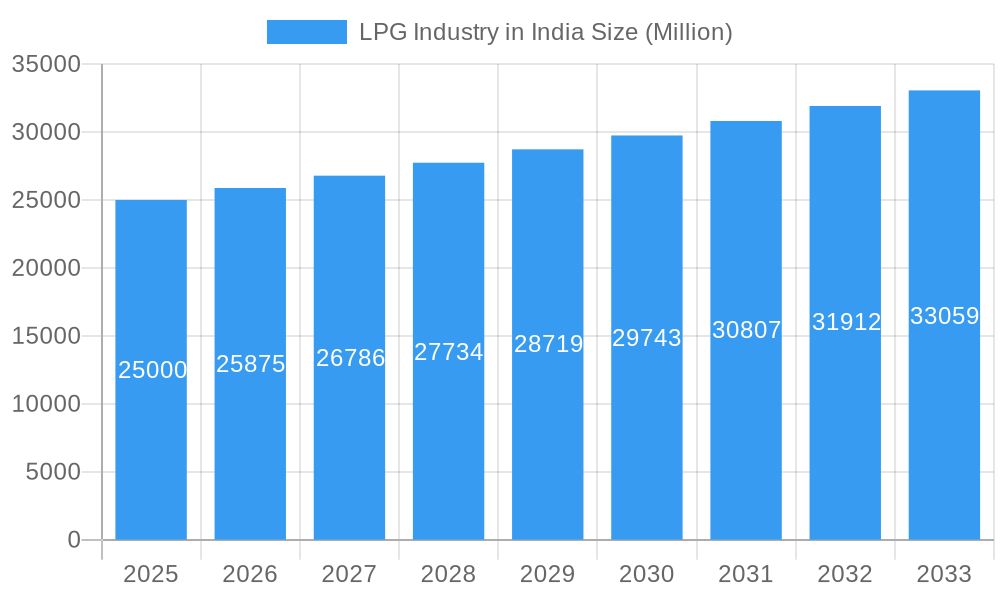

Key challenges include the impact of volatile global crude oil prices on LPG affordability and potential hindrances in price-sensitive segments. The competitive landscape features established entities like Indian Oil Corporation Ltd., Bharat Petroleum Corporation Limited, and Shell plc, alongside regional players, necessitating strategic pricing and efficient supply chains. Long-term threats to the autofuel segment may arise from alternative cleaner fuels and the adoption of electric vehicles. LPG companies must implement effective diversification and targeted marketing to overcome these complexities and capitalize on market growth from 2025 to 2033.

LPG Industry in India Company Market Share

This report offers an in-depth analysis of the Indian LPG industry, covering market dynamics, growth trends, key players, and future projections for the 2019-2033 period, with 2025 as the base year. It serves as an essential resource for industry professionals, investors, and policymakers seeking comprehensive insights into this vital sector.

LPG Industry in India Market Dynamics & Structure

The Indian LPG market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market is witnessing technological innovation, primarily focused on enhancing efficiency in production, distribution, and safety. Regulatory frameworks, including government subsidies and safety regulations, significantly influence market dynamics. Competitive substitutes, such as CNG and electricity, exert pressure on LPG demand, particularly in certain applications. End-user demographics are diverse, ranging from residential consumers in rural areas to large industrial users. M&A activity has been moderate, primarily focused on strengthening distribution networks and expanding market reach.

- Market Concentration: Top 5 players hold approximately 70% market share (estimated).

- Technological Innovation: Focus on automation, improved safety features, and efficient transportation.

- Regulatory Framework: Government subsidies and safety standards influence pricing and adoption.

- Competitive Substitutes: CNG and electricity compete for market share, particularly in industrial and transportation sectors.

- End-User Demographics: Significant variation in consumption patterns across residential, commercial, and industrial sectors.

- M&A Trends: xx deals recorded in the historical period (2019-2024), primarily focused on expansion and consolidation.

LPG Industry in India Growth Trends & Insights

The Indian LPG market has witnessed robust growth over the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and government initiatives promoting LPG adoption in rural areas. The market size (in Million units) expanded from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. Technological disruptions, such as the introduction of smart meters and automated filling plants, have enhanced efficiency and consumer experience. Shifting consumer preferences towards convenient and cleaner cooking fuels are also driving demand. The forecast period (2025-2033) projects continued growth, albeit at a slightly moderated pace, driven by factors such as sustained economic growth and government policies. Market penetration is expected to reach xx% by 2033.

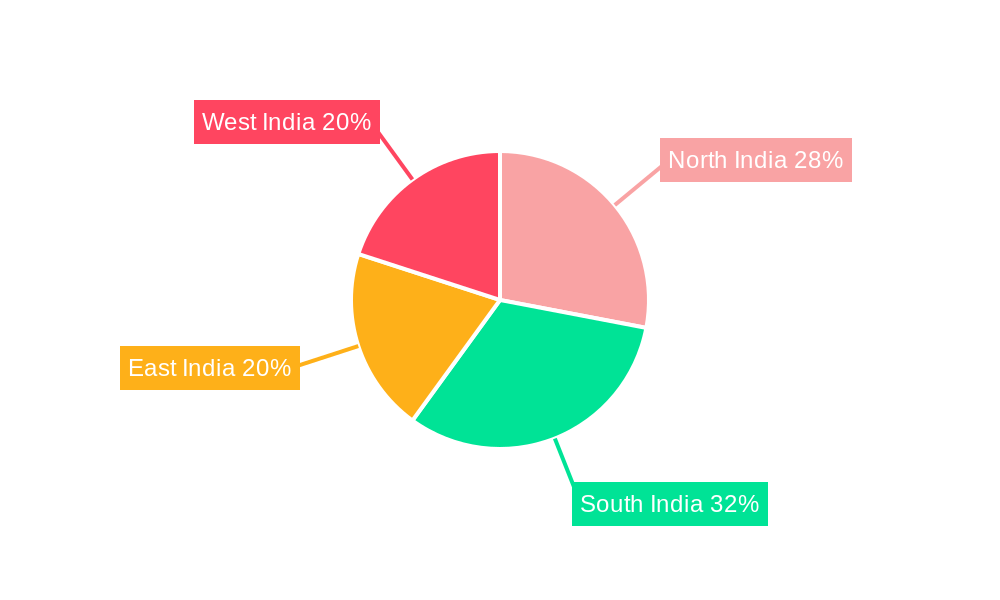

Dominant Regions, Countries, or Segments in LPG Industry in India

The Indian LPG market is significantly driven by the residential and commercial sectors, which together constituted approximately 85% of total consumption in 2024. This high demand stems from the widespread use of LPG for cooking and heating, particularly prevalent in urban and semi-urban areas. The industrial sector also contributes substantially to the overall consumption, while the autofuel segment remains relatively smaller. India's LPG production heavily relies on imported crude oil, although there's a growing trend towards utilizing domestically sourced natural gas liquids to enhance energy independence and security.

- Residential & Commercial: The dominant market segment, accounting for approximately 85% of total consumption, primarily fueled by cooking and heating needs in urban and semi-urban areas. Growth in this sector is linked to rising urbanization and disposable incomes.

- Industrial: A significant consumer segment, utilizing LPG in diverse industrial processes and applications. This segment is poised for growth with increasing industrialization.

- Autofuels: A comparatively smaller segment, though possessing potential for expansion as cleaner fuel options gain traction.

- Source of Production: While predominantly reliant on imported crude oil, India is actively pursuing increased utilization of domestically produced natural gas liquids, aiming for greater self-sufficiency and reduced vulnerability to global price fluctuations.

- Key Drivers: The growth of the Indian LPG market is propelled by a multitude of factors, including rapid urbanization, rising disposable incomes, expanding middle class, government initiatives promoting LPG adoption in rural areas (like Ujjwala Yojana), and increasing awareness regarding cleaner cooking solutions. These factors are collaboratively fueling the consistent growth of the LPG sector.

LPG Industry in India Product Landscape

The Indian LPG market features a relatively standardized product offering, primarily consisting of various cylinder sizes catering to different consumption needs. However, recent innovations focus on enhanced safety features, such as improved valve designs and leak detection systems. There’s a growing trend toward the introduction of smart meters that provide real-time consumption data and enhance billing accuracy. Companies are also exploring options for improved distribution channels and delivery systems to enhance customer convenience.

Key Drivers, Barriers & Challenges in LPG Industry in India

Key Drivers:

- The expanding middle class and rising urbanization are leading to increased LPG demand, especially in the residential sector. This demographic shift is a significant factor driving market growth.

- Government initiatives, such as the Pradhan Mantri Ujjwala Yojana (PMUY), which aims to provide LPG connections to underprivileged households, are significantly expanding market reach and penetration in rural areas.

- Technological advancements, including improved safety features in cylinders and appliances, as well as more efficient distribution networks, are enhancing the overall user experience and market appeal.

- The growing preference for cleaner cooking fuels is creating a positive market environment for LPG, further pushing its adoption.

Key Challenges:

- The volatile nature of international crude oil prices directly impacts LPG pricing, posing a significant challenge to maintaining price stability and affordability for consumers.

- Infrastructure limitations, particularly in remote and rural areas, create bottlenecks in efficient distribution and last-mile delivery, hindering wider market penetration.

- Safety concerns related to LPG handling and storage persist, necessitating continuous improvements in safety protocols, robust consumer education initiatives, and stricter regulatory frameworks.

- Competition from alternative fuels and the need to maintain competitiveness within the energy market present ongoing challenges.

Emerging Opportunities in LPG Industry in India

- Significant untapped potential exists in rural markets, presenting opportunities for expansion through strategic investment in distribution networks, targeted marketing campaigns tailored to rural demographics, and partnerships with local communities.

- Exploring and developing innovative LPG applications, such as using LPG as a fuel source for decentralized power generation, opens up avenues for diversification and increased market share.

- The global shift towards cleaner energy solutions presents opportunities for LPG to position itself as a transition fuel, bridging the gap between traditional fossil fuels and renewable energy sources.

- Expansion into niche segments like industrial applications requiring specialized LPG solutions presents avenues for growth and value addition.

Growth Accelerators in the LPG Industry in India Industry

Sustained investment in modernizing infrastructure, forging strategic partnerships to enhance distribution efficiency, and developing safer, more convenient, and user-friendly LPG handling technologies are critical for driving long-term growth. Supportive government policies that promote clean cooking solutions and actively encourage LPG adoption in rural areas will play a vital role in unlocking substantial growth potential. Furthermore, technological innovations like smart gas meters and digital platforms to enhance supply chain management can contribute significantly to industry growth.

Key Players Shaping the LPG Industry in India Market

- Shell plc

- Bharat Petroleum Corporation Limited

- SUPERGAS (SHV Energy Pvt Ltd)

- Hindustan Petroleum Corporation Limited

- Reliance Petroleum Ltd

- TotalEnergies SE

- Indian Oil Corporation Ltd

- Eastern Gases Lt

- Jyothi Gas Pvt Ltd

- Other regional and local LPG distributors

Notable Milestones in LPG Industry in India Sector

- February 2022: Indian Oil Corp (IOC) announced plans to construct three new plants in Northeast India, increasing LPG bottling capacity by 53% (to 8 crore cylinders annually by 2030). Investment: INR 325-350 crore.

In-Depth LPG Industry in India Market Outlook

The Indian LPG market is poised for sustained growth, driven by a combination of factors, including rising incomes, government support, and technological innovation. Strategic investments in infrastructure, exploration of new applications, and focusing on enhancing safety and convenience will unlock significant future market potential. The expansion into untapped rural markets and the adoption of cleaner energy solutions presents attractive opportunities for key players to capture market share.

LPG Industry in India Segmentation

-

1. Source of Production

- 1.1. Crude Oil

- 1.2. Natural Gas Liquids

-

2. Application

- 2.1. Residential & Commercial

- 2.2. Industrial

- 2.3. Autofuels

- 2.4. Other Applications

LPG Industry in India Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

LPG Industry in India Regional Market Share

Geographic Coverage of LPG Industry in India

LPG Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Declining Cost of Wind Energy

- 3.2.2 Increasing Investments in Wind Energy Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Alternate Clean Power Sources

- 3.4. Market Trends

- 3.4.1. LPG Extracted From Natural Gas is Expected to Have Considerable Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LPG Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Production

- 5.1.1. Crude Oil

- 5.1.2. Natural Gas Liquids

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential & Commercial

- 5.2.2. Industrial

- 5.2.3. Autofuels

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source of Production

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bharat Petroleum Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SUPERGAS (SHV Energy Pvt Ltd )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hindustan Petroleum Corporation Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reliance Petroleum Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eastern Gases Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jyothi Gas Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Shell plc

List of Figures

- Figure 1: Global LPG Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific LPG Industry in India Revenue (billion), by Source of Production 2025 & 2033

- Figure 3: Asia Pacific LPG Industry in India Revenue Share (%), by Source of Production 2025 & 2033

- Figure 4: Asia Pacific LPG Industry in India Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific LPG Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific LPG Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific LPG Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LPG Industry in India Revenue billion Forecast, by Source of Production 2020 & 2033

- Table 2: Global LPG Industry in India Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global LPG Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global LPG Industry in India Revenue billion Forecast, by Source of Production 2020 & 2033

- Table 5: Global LPG Industry in India Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global LPG Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 7: India LPG Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LPG Industry in India?

The projected CAGR is approximately 4.71%.

2. Which companies are prominent players in the LPG Industry in India?

Key companies in the market include Shell plc, Bharat Petroleum Corporation Limited, SUPERGAS (SHV Energy Pvt Ltd ), Hindustan Petroleum Corporation Limited, Reliance Petroleum Ltd, TotalEnergies SE, Indian Oil Corporation Ltd, Eastern Gases Lt, Jyothi Gas Pvt Ltd.

3. What are the main segments of the LPG Industry in India?

The market segments include Source of Production, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.548 billion as of 2022.

5. What are some drivers contributing to market growth?

Declining Cost of Wind Energy. Increasing Investments in Wind Energy Power Generation Projects.

6. What are the notable trends driving market growth?

LPG Extracted From Natural Gas is Expected to Have Considerable Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Adoption of Alternate Clean Power Sources.

8. Can you provide examples of recent developments in the market?

In February 2022, Indian Oil Corp (IOC) announced the plans to construct three new plants in Northeast India to increase its LPG bottling capacity by nearly 53% or to 8 crore cylinders annually by 2030, to meet the growing demand in the region. Furthermore, the total investment in the plant expansion is likely to range between INR 325-350 crore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LPG Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LPG Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LPG Industry in India?

To stay informed about further developments, trends, and reports in the LPG Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence