Key Insights

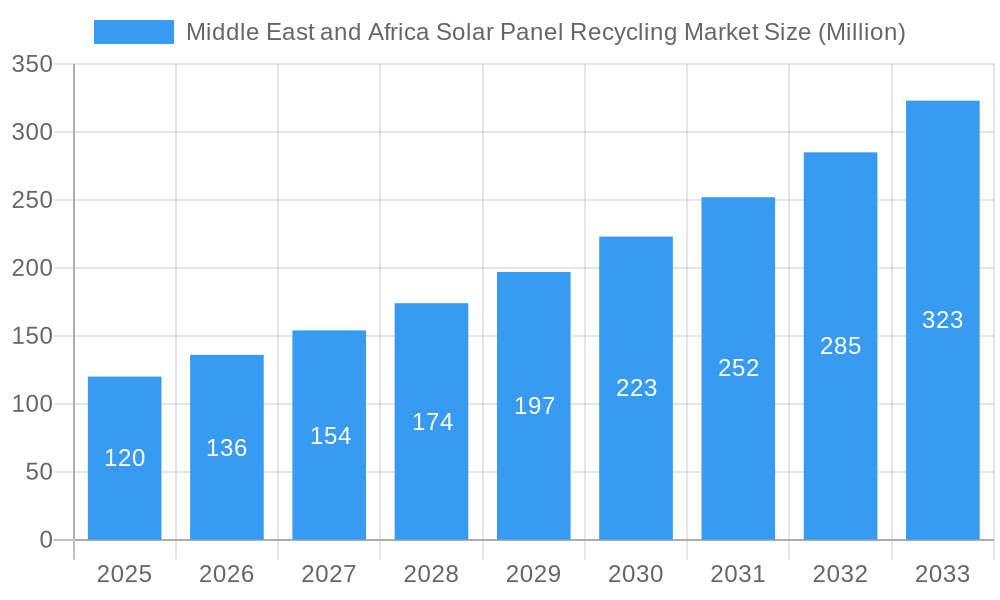

The Middle East and Africa (MEA) solar panel recycling market is set for substantial growth, projected to expand at a compound annual growth rate (CAGR) of 14.4%. The market, valued at approximately $344.7 million in the base year of 2025, is anticipated to reach significant figures by 2033. This expansion is driven by the accelerating adoption of solar energy infrastructure across the region, leading to an increase in end-of-life solar panels. Stringent environmental regulations and growing awareness of the economic value of recovering materials such as silicon, silver, and copper are key growth drivers. Government initiatives supporting circular economy principles and waste management are further stimulating the development of recycling facilities and services. The imperative for sustainable practices within the renewable energy sector positions solar panel recycling as a vital element of the region's green transition.

Middle East and Africa Solar Panel Recycling Market Market Size (In Million)

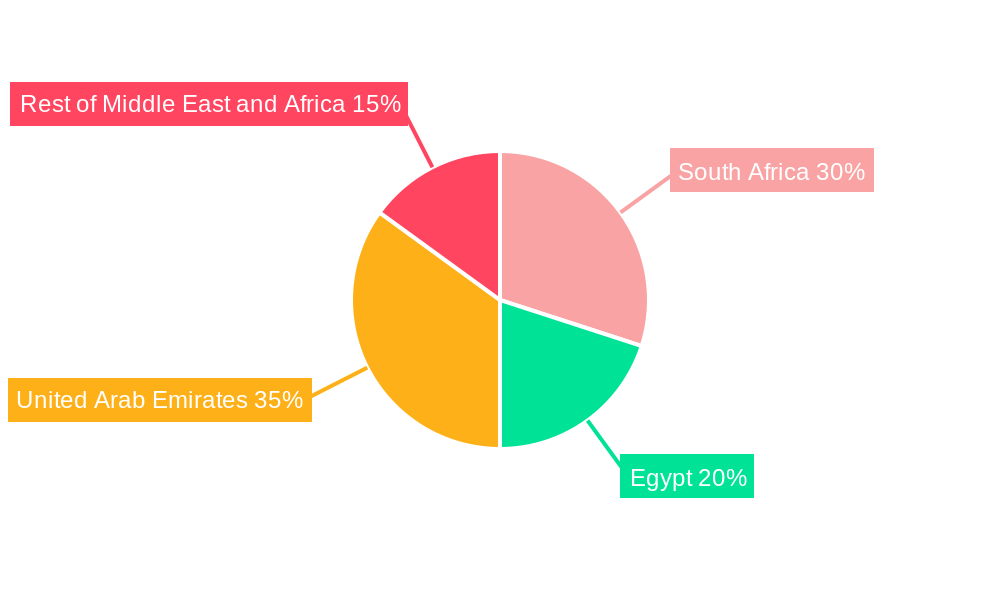

Geographically, key solar-dominant nations like the United Arab Emirates and South Africa are leading MEA's solar panel recycling efforts, mirroring their significant solar installations. Egypt also represents a developing market with its increasing solar capacity. The "Rest of Middle East and Africa" segment is poised for considerable growth as more nations embrace solar technology and address asset lifecycle management. The market is segmented by recycling process, with Thermal and Mechanical methods currently prevalent, while Chemical recycling is gaining momentum for its efficient material recovery. Crystalline Silicon panels constitute the largest segment due to widespread deployment, with Thin Film panels emerging as a notable area for recyclers. Prominent industry players, including First Solar Inc., Canadian Solar Inc., and Trina Solar Ltd., are actively engaged in recycling operations or collaborations, underscoring a competitive environment focused on innovation and scalable solutions for responsible solar panel disposal and material reclamation.

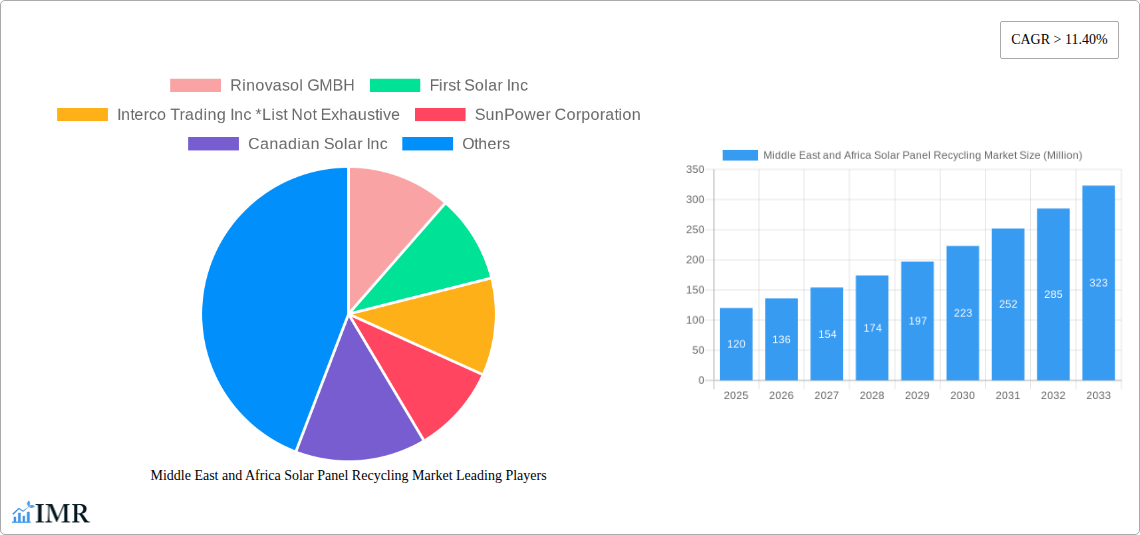

Middle East and Africa Solar Panel Recycling Market Company Market Share

Middle East and Africa Solar Panel Recycling Market: Comprehensive Market Analysis & Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) solar panel recycling market, a rapidly evolving sector driven by the surge in solar energy adoption and the increasing need for sustainable waste management solutions. With a study period spanning from 2019 to 2033, this report offers a robust understanding of market dynamics, growth trends, regional dominance, product landscape, and key industry players. We delve into both the parent and child markets to offer a holistic view, integrating high-traffic keywords for maximum SEO visibility and engaging industry professionals worldwide.

Middle East and Africa Solar Panel Recycling Market Market Dynamics & Structure

The MEA solar panel recycling market is characterized by a moderately concentrated structure, with a growing number of specialized players alongside established solar manufacturers venturing into recycling. Technological innovation is a significant driver, focusing on enhancing recovery rates of valuable materials like silicon, silver, copper, and aluminum, while minimizing hazardous waste. Regulatory frameworks are beginning to take shape, with governments in key markets like the UAE and South Africa developing policies to manage end-of-life solar photovoltaic (PV) modules. Competitive product substitutes are limited in the recycling space itself, but the primary substitute pressure comes from extending the lifespan of solar panels and the development of more durable PV technologies. End-user demographics are shifting towards industrial-scale solar farms and commercial installations, which generate larger volumes of end-of-life panels. Merger and acquisition (M&A) trends are anticipated to increase as companies seek to secure market share, acquire advanced recycling technologies, and achieve economies of scale.

- Market Concentration: Moderate, with a rising number of specialized recycling firms and integrated solar value chain players.

- Technological Innovation Drivers: Focus on improving material recovery efficiency, reducing processing costs, and developing environmentally friendly recycling methods.

- Regulatory Frameworks: Emerging policies and extended producer responsibility (EPR) schemes are crucial for market growth.

- Competitive Product Substitutes: Limited within the recycling segment; focus is on optimizing panel lifespan and developing sustainable materials.

- End-User Demographics: Industrial, commercial, and utility-scale solar installations are the primary generators of end-of-life panels.

- M&A Trends: Expected to increase as companies seek strategic partnerships and consolidation for competitive advantage.

Middle East and Africa Solar Panel Recycling Market Growth Trends & Insights

The MEA solar panel recycling market is poised for substantial growth, propelled by a confluence of factors including increasing solar energy deployment, a growing environmental consciousness, and the economic imperative to recover valuable materials from retired solar panels. The forecast period (2025-2033) is expected to witness a significant upswing in market size, driven by the sheer volume of solar panels installed over the past decade reaching their end-of-life. Adoption rates for dedicated solar panel recycling services are projected to accelerate as regulatory pressures mount and the economic viability of material recovery becomes more pronounced. Technological disruptions, such as advanced optical sorting and automated dismantling techniques, will play a pivotal role in improving the efficiency and cost-effectiveness of recycling processes. Consumer behavior shifts are less direct in this B2B-centric market; however, the increasing demand for sustainability across the entire energy value chain will indirectly influence the adoption of responsible recycling practices by solar project developers and operators. The crystalline silicon solar panel recycling segment, being the dominant technology in current installations, is expected to lead the market in volume.

- Market Size Evolution: Significant expansion anticipated due to the increasing volume of end-of-life solar panels.

- Adoption Rates: Growing adoption of specialized recycling services driven by regulations and economic incentives.

- Technological Disruptions: Innovations in automation, material separation, and chemical recycling will enhance efficiency.

- Consumer Behavior Shifts: Indirect influence through the demand for sustainable energy value chains and corporate social responsibility.

- Market Penetration: Increasing penetration of formal recycling processes as informal disposal becomes less viable.

- CAGR: Predicted to be robust, reflecting the nascent stage and high growth potential of the market.

Dominant Regions, Countries, or Segments in Middle East and Africa Solar Panel Recycling Market

The MEA solar panel recycling market is witnessing a dynamic shift in dominance, with the United Arab Emirates (UAE) emerging as a frontrunner due to its aggressive renewable energy targets and proactive regulatory initiatives. South Africa and Egypt are also showing significant potential, driven by large-scale solar deployments and a growing awareness of waste management challenges. Within the segmentation, Crystalline Silicon panels represent the largest type due to their widespread installation across the region. From a Process perspective, Mechanical recycling is currently dominant due to its relative maturity and cost-effectiveness in initial material separation, though Chemical and Thermal processes are gaining traction for their ability to recover higher-purity materials. The "Rest of Middle East and Africa" segment, while diverse, encompasses countries with nascent but rapidly expanding solar markets, indicating future growth pockets.

- Dominant Geography: United Arab Emirates is leading, with South Africa and Egypt showing strong growth potential.

- Dominant Type: Crystalline Silicon panels, forming the bulk of current installations.

- Dominant Process: Mechanical recycling is currently prevalent, with Chemical and Thermal processes poised for growth.

- Key Drivers for UAE Dominance: Ambitious renewable energy targets, supportive government policies, and significant investment in solar infrastructure.

- Growth Potential in South Africa & Egypt: Large installed solar base and increasing focus on sustainable waste management.

- Rest of Middle East and Africa: Emerging markets with substantial future recycling opportunities.

- Market Share: The UAE is expected to hold a significant market share within the forecast period.

Middle East and Africa Solar Panel Recycling Market Product Landscape

The MEA solar panel recycling market product landscape is defined by the evolution of recycling technologies designed to efficiently process diverse solar panel types, primarily Crystalline Silicon and Thin Film. Innovations are focused on maximizing the recovery of valuable materials like silicon, silver, copper, and aluminum, while also addressing the safe disposal of hazardous components. Unique selling propositions for recycling service providers revolve around high recovery rates, environmental compliance, cost-effectiveness, and the ability to handle large volumes of end-of-life modules. Technological advancements in automated sorting, material identification, and advanced chemical leaching are enhancing the performance metrics of recycling processes, making them more competitive and sustainable.

Key Drivers, Barriers & Challenges in Middle East and Africa Solar Panel Recycling Market

Key Drivers:

- Surging Solar Energy Installation: Exponential growth in solar PV deployment necessitates effective end-of-life management.

- Growing Environmental Regulations: Increasingly stringent policies on e-waste management are compelling recycling.

- Economic Value of Recovered Materials: High commodity prices for silicon, silver, and other metals incentivize recycling.

- Corporate Social Responsibility (CSR): Companies are prioritizing sustainable practices across their value chains.

- Technological Advancements: Innovations in recycling processes are improving efficiency and reducing costs.

Barriers & Challenges:

- Nascent Recycling Infrastructure: Limited availability of specialized recycling facilities across the region.

- High Initial Investment Costs: Setting up advanced recycling plants requires significant capital outlay.

- Logistical Complexities: Collection and transportation of bulky solar panels from remote installations.

- Lack of Standardized Regulations: Inconsistent policy frameworks across different MEA countries.

- Awareness and Education Gaps: Insufficient understanding of recycling benefits among stakeholders.

- Competitive Pressure: Cost-effectiveness compared to raw material sourcing can be a challenge for some recycled materials.

Emerging Opportunities in Middle East and Africa Solar Panel Recycling Market

Emerging opportunities in the MEA solar panel recycling market lie in the development of advanced, localized recycling hubs, particularly in countries with high solar installation rates. There is a significant opportunity to establish specialized facilities capable of handling both Crystalline Silicon and Thin Film technologies efficiently. Innovative applications for recycled materials, such as in the manufacturing of new solar components or other industrial products, represent a promising avenue for value creation. Evolving consumer preferences for circular economy solutions will also drive demand for responsible recycling services. Furthermore, partnerships between solar manufacturers, recycling companies, and government bodies can unlock new business models and facilitate greater adoption of sustainable practices.

Growth Accelerators in the Middle East and Africa Solar Panel Recycling Market Industry

Growth in the MEA solar panel recycling market will be significantly accelerated by technological breakthroughs in material recovery, such as enhanced photovoltaic silicon extraction and advanced separation techniques for thin-film modules. Strategic partnerships between global recycling leaders and local entities will be crucial for knowledge transfer and infrastructure development. Market expansion strategies, including the establishment of collection networks and the development of integrated recycling solutions, will further propel growth. The increasing emphasis on a circular economy within the renewable energy sector, coupled with supportive government incentives and international collaborations, will act as potent catalysts for sustained long-term growth.

Key Players Shaping the Middle East and Africa Solar Panel Recycling Market Market

- Rinovasol GMBH

- First Solar Inc

- Interco Trading Inc

- SunPower Corporation

- Canadian Solar Inc

- Trina Solar Ltd

- Sharp Corporation

(List Not Exhaustive)

Notable Milestones in Middle East and Africa Solar Panel Recycling Market Sector

- April 2021: A new research project at the UNEP DTU Partnership is expected to create better opportunities for collecting and recycling electronic waste from small solar PV systems in Kenya and other African countries.

- [Year/Month]: [Company Name] announces strategic expansion into the MEA solar panel recycling market, [brief impact].

- [Year/Month]: [Governmental Body] introduces new regulations mandating solar panel recycling, [brief impact].

- [Year/Month]: [Technology Provider] develops and pilots a novel chemical recycling process for solar panels, [brief impact].

- [Year/Month]: A major solar farm in [Country] partners with a local recycling firm for end-of-life panel management, [brief impact].

In-Depth Middle East and Africa Solar Panel Recycling Market Market Outlook

The Middle East and Africa solar panel recycling market is on an upward trajectory, with significant growth accelerators poised to shape its future. The increasing volume of solar panels reaching their end-of-life, coupled with robust governmental support and advancements in recycling technologies, creates a fertile ground for market expansion. Strategic opportunities lie in fostering collaboration between industry stakeholders to develop efficient collection infrastructure and advanced processing facilities. The economic imperative of recovering valuable materials from retired solar modules will continue to drive investment and innovation, positioning the MEA region as a key player in the global circular economy for renewable energy components. This market is set to become increasingly vital for sustainable energy development.

Middle East and Africa Solar Panel Recycling Market Segmentation

-

1. Process

- 1.1. Thermal

- 1.2. Mechanical

- 1.3. Chemical

- 1.4. Other Processes

-

2. Type

- 2.1. Crystalline Silicon

- 2.2. Thin Film

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East and Africa

Middle East and Africa Solar Panel Recycling Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle East and Africa Solar Panel Recycling Market Regional Market Share

Geographic Coverage of Middle East and Africa Solar Panel Recycling Market

Middle East and Africa Solar Panel Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Strong Dependence on Prevailing Weather Condition

- 3.4. Market Trends

- 3.4.1. Crystalline Silicon (c-Si) Type to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Thermal

- 5.1.2. Mechanical

- 5.1.3. Chemical

- 5.1.4. Other Processes

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Crystalline Silicon

- 5.2.2. Thin Film

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. South Africa Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Thermal

- 6.1.2. Mechanical

- 6.1.3. Chemical

- 6.1.4. Other Processes

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Crystalline Silicon

- 6.2.2. Thin Film

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Egypt Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Thermal

- 7.1.2. Mechanical

- 7.1.3. Chemical

- 7.1.4. Other Processes

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Crystalline Silicon

- 7.2.2. Thin Film

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. United Arab Emirates Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Thermal

- 8.1.2. Mechanical

- 8.1.3. Chemical

- 8.1.4. Other Processes

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Crystalline Silicon

- 8.2.2. Thin Film

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Rest of Middle East and Africa Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Thermal

- 9.1.2. Mechanical

- 9.1.3. Chemical

- 9.1.4. Other Processes

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Crystalline Silicon

- 9.2.2. Thin Film

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Egypt

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Rinovasol GMBH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 First Solar Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Interco Trading Inc *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SunPower Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Canadian Solar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Trina Solar Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sharp Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Rinovasol GMBH

List of Figures

- Figure 1: Middle East and Africa Solar Panel Recycling Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Solar Panel Recycling Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 2: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 6: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 7: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 10: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 14: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 15: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 18: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 19: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Solar Panel Recycling Market?

The projected CAGR is approximately 14.4%.

2. Which companies are prominent players in the Middle East and Africa Solar Panel Recycling Market?

Key companies in the market include Rinovasol GMBH, First Solar Inc, Interco Trading Inc *List Not Exhaustive, SunPower Corporation, Canadian Solar Inc, Trina Solar Ltd, Sharp Corporation.

3. What are the main segments of the Middle East and Africa Solar Panel Recycling Market?

The market segments include Process, Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 344.7 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems.

6. What are the notable trends driving market growth?

Crystalline Silicon (c-Si) Type to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Strong Dependence on Prevailing Weather Condition.

8. Can you provide examples of recent developments in the market?

April 2021: A new research project at the UNEP DTU Partnership is expected to create better opportunities for collecting and recycling electronic waste from small solar PV systems in Kenya and other African countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Solar Panel Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Solar Panel Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Solar Panel Recycling Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Solar Panel Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence