Key Insights

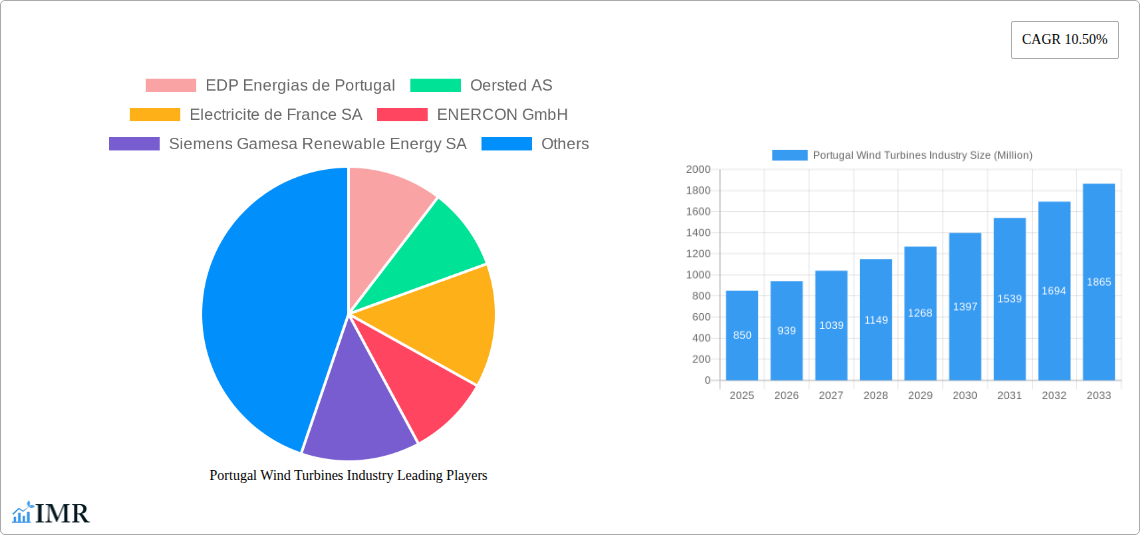

Portugal's wind turbine market is set for substantial growth, propelled by a projected CAGR of 13%. Valued at an estimated $178.89 billion in the base year of 2025, the industry is demonstrating significant upward momentum. Key growth catalysts include supportive government policies aimed at renewable energy expansion, a national commitment to decarbonization, and the country's abundant wind resources. The increasing demand for both onshore and offshore wind turbine installations is a direct response to Portugal's strategic goals of enhancing energy independence and reducing reliance on fossil fuels. Furthermore, advancements in turbine efficiency and the deployment of larger, more powerful units are driving market innovation.

Portugal Wind Turbines Industry Market Size (In Billion)

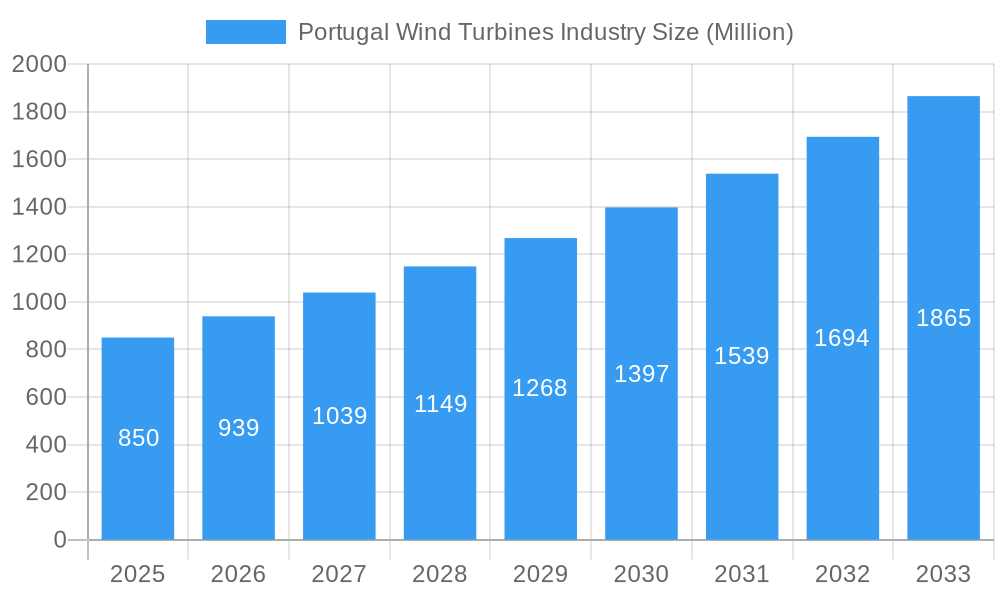

Leading companies such as Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, and EDP Energias de Portugal are instrumental in shaping this sector through continuous innovation and strategic investments. Emerging trends like the integration of wind power with advanced energy storage systems and the repowering of existing wind farms are also contributing to market dynamism. Challenges such as protracted permitting procedures and potential grid integration issues require proactive management to ensure sustained growth. Despite these considerations, the Portuguese wind turbine industry exhibits a robust and positive trajectory, driven by environmental mandates and economic prospects.

Portugal Wind Turbines Industry Company Market Share

This report delivers a thorough analysis of the Portugal Wind Turbines Industry, offering crucial insights into market dynamics, growth trajectories, and future opportunities. Covering the forecast period up to 2033, with 2025 as the base and estimated year, this research is an indispensable tool for stakeholders aiming to understand and leverage the expanding Portuguese wind energy market. All values are presented in billions for clarity and consistency.

Portugal Wind Turbines Industry Market Dynamics & Structure

The Portugal Wind Turbines Industry is characterized by a dynamic market structure influenced by evolving technological advancements, robust regulatory frameworks, and strategic consolidations. Market concentration is gradually shifting as new entrants and established global players vie for dominance. Technological innovation is primarily driven by the pursuit of higher efficiency, improved grid integration, and enhanced offshore wind turbine designs, addressing challenges like harsh marine environments and deeper water installations. Regulatory frameworks, particularly government incentives and permitting processes, play a pivotal role in shaping investment decisions and project development timelines. Competitive product substitutes, such as solar energy and other renewable sources, necessitate continuous innovation and cost optimization within the wind turbine sector. End-user demographics are increasingly focused on utility-scale projects and corporate power purchase agreements, driven by sustainability goals and energy security imperatives. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger companies acquiring smaller innovators to expand their technological portfolios and market reach.

- Market Concentration: Moderate, with increasing influence of global manufacturers.

- Technological Innovation Drivers: Enhanced turbine efficiency, offshore solutions, grid integration, digitalization.

- Regulatory Frameworks: Supportive government policies, auction mechanisms for offshore capacity.

- Competitive Product Substitutes: Solar PV, battery storage.

- End-User Demographics: Utilities, large corporations, independent power producers.

- M&A Trends: Strategic acquisitions to gain market share and technological edge.

Portugal Wind Turbines Industry Growth Trends & Insights

The Portugal Wind Turbines Industry is poised for significant expansion, driven by ambitious renewable energy targets and substantial investment in both onshore and offshore wind power. The market size is projected to evolve considerably over the forecast period, reflecting the increasing adoption rates of advanced wind turbine technologies. Technological disruptions, such as the development of larger and more efficient turbines, alongside advancements in floating offshore wind platforms, are set to redefine the industry's landscape. These innovations not only enhance energy generation capacity but also open up new geographical areas for wind farm development. Consumer behavior shifts are evident in the growing demand for clean energy, leading to increased investment in renewable infrastructure by both public and private entities. The Portuguese government's commitment to decarbonization, coupled with the strategic positioning of the country to leverage its extensive coastline, acts as a strong catalyst for market penetration. The CAGR for the Portugal Wind Turbines Industry is expected to be robust, driven by a combination of new installations and the repowering of older wind farms. Market penetration will be significantly boosted by large-scale offshore projects that offer the potential for gigawatt-scale capacity additions. The transition from fossil fuels to renewable energy sources is further accelerating this growth, with wind power playing a central role in Portugal's energy transition strategy. The industry's growth is also supported by a growing pool of skilled labor and an expanding supply chain infrastructure.

Dominant Regions, Countries, or Segments in Portugal Wind Turbines Industry

The Offshore segment is emerging as the dominant driver of growth within the Portugal Wind Turbines Industry, signaling a strategic shift in the nation's renewable energy deployment. This dominance is underpinned by Portugal's extensive and resource-rich Atlantic coastline, offering immense potential for large-scale wind farm development. The deep waters along the Portuguese coast are particularly suited for the deployment of floating offshore wind turbines, a technology that is rapidly maturing and becoming economically viable. This geographic advantage, combined with strong government backing for offshore wind, is attracting significant international investment and fostering a competitive environment for leading turbine manufacturers and developers.

- Key Drivers for Offshore Dominance:

- Abundant Offshore Wind Resources: Consistent and strong wind speeds along the coast.

- Favorable Deep-Water Conditions: Ideal for floating offshore wind technology.

- Government Support and Policy Frameworks: Ambitious targets for offshore wind capacity, including upcoming auctions.

- Strategic Location: Proximity to major European energy markets.

- Technological Advancements: Maturation of floating offshore wind platforms and large-scale turbine designs.

The Portuguese government's commitment to developing 10 GW of offshore wind power capacity by the coming years is a cornerstone of this segment's rapid expansion. The upcoming auction of licenses for offshore wind farms, with a target of over 1 GW of installed capacity, further solidifies offshore as the primary growth frontier. This policy direction is attracting major global energy companies, fostering partnerships, and stimulating the development of necessary port infrastructure and supply chain capabilities. While onshore wind continues to contribute to Portugal's renewable energy mix, the sheer scale of potential and strategic investment being directed towards offshore projects positions it as the segment with the most significant growth potential and market share expansion in the coming decade.

Portugal Wind Turbines Industry Product Landscape

The Portugal Wind Turbines Industry is witnessing rapid product innovation, with a focus on enhancing efficiency, reliability, and adaptability to diverse deployment environments. Leading manufacturers are introducing larger rotor diameters and higher power output turbines for onshore applications, maximizing energy capture from available wind resources. For offshore environments, advancements are concentrated on robust designs capable of withstanding harsh marine conditions, including specialized foundations and advanced control systems for floating platforms. Performance metrics are continuously improving, with increased capacity factors and reduced levelized cost of energy (LCOE). Unique selling propositions revolve around smart grid integration capabilities, predictive maintenance technologies, and modular designs that facilitate easier installation and servicing. Technological advancements are also extending to blade materials, direct-drive systems, and advanced aerodynamics, all aimed at optimizing energy generation and minimizing environmental impact.

Key Drivers, Barriers & Challenges in Portugal Wind Turbines Industry

Key Drivers: The Portugal Wind Turbines Industry is propelled by strong government commitment to renewable energy targets, significant international investment attracted by favorable offshore wind potential, and continuous technological advancements in turbine efficiency and reliability. Economic incentives, such as tax credits and feed-in tariffs, coupled with increasing corporate demand for green energy, further accelerate market growth. The drive for energy independence and decarbonization are overarching policy imperatives creating a fertile ground for wind power expansion.

Barriers & Challenges: Key challenges include the high upfront capital investment required for large-scale wind farm development, particularly for offshore projects. Regulatory hurdles, including lengthy permitting processes and grid connection complexities, can impede project timelines. Supply chain bottlenecks, especially for specialized components and skilled labor for offshore installations, pose significant constraints. Furthermore, public perception and environmental impact assessments, while important for sustainable development, can sometimes present obstacles. Competitive pressures from other renewable energy sources also necessitate ongoing cost reductions and performance improvements.

Emerging Opportunities in Portugal Wind Turbines Industry

Emerging opportunities in the Portugal Wind Turbines Industry are largely centered around the untapped potential of its extensive offshore wind resources. The development of floating offshore wind farms presents a significant frontier, enabling deployment in deeper waters where fixed-bottom foundations are not feasible. This opens up vast new areas for renewable energy generation. Furthermore, opportunities exist in the repowering of older onshore wind farms with more advanced, higher-capacity turbines, enhancing overall energy output and efficiency. The integration of wind energy with battery storage solutions is another growing area, addressing intermittency issues and improving grid stability. Innovations in digital technologies for remote monitoring, predictive maintenance, and optimized operations also offer substantial growth prospects, reducing operational costs and maximizing asset performance.

Growth Accelerators in the Portugal Wind Turbines Industry Industry

The long-term growth of the Portugal Wind Turbines Industry is being significantly accelerated by several key factors. Technological breakthroughs, such as the development of even larger and more efficient wind turbines, are continuously improving the economics of wind power. Strategic partnerships between global energy majors, local developers, and technology providers are crucial for mobilizing the substantial capital required for large-scale offshore projects. Market expansion strategies, including the development of robust port infrastructure and specialized vessels for offshore construction and maintenance, are vital for supporting this growth. Furthermore, the increasing integration of wind energy into national and regional power grids, facilitated by smart grid technologies and improved transmission infrastructure, enhances the reliability and dispatchability of wind power, solidifying its role in the energy mix.

Key Players Shaping the Portugal Wind Turbines Industry Market

- EDP Energias de Portugal

- Oersted AS

- Electricite de France SA

- ENERCON GmbH

- Siemens Gamesa Renewable Energy SA

- Rulis Electrica Lda

- Vestas Wind Systems AS

- Acciona SA

Notable Milestones in Portugal Wind Turbines Industry Sector

- June 2023: Galp and TotalEnergies agreed to jointly explore potential offshore wind opportunities in Portugal, signaling a major push towards developing the country's extensive offshore wind capacity.

- May 2023: The Portuguese government announced plans to launch the first auction for offshore wind farm licenses by the end of the year, targeting projects with a total installed capacity exceeding 1 gigawatt (GW).

In-Depth Portugal Wind Turbines Industry Market Outlook

The future market outlook for the Portugal Wind Turbines Industry is exceptionally promising, driven by sustained policy support and significant investment in renewable energy infrastructure. Growth accelerators such as continuous technological advancements in turbine design and the maturation of floating offshore wind technology will unlock vast new energy generation potential. Strategic partnerships and the development of a comprehensive offshore wind supply chain will be critical for realizing ambitious capacity targets. The increasing demand for clean energy, coupled with Portugal's strategic advantage in offshore wind resources, positions the industry for robust and sustained growth, contributing significantly to the nation's decarbonization goals and energy security.

Portugal Wind Turbines Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

Portugal Wind Turbines Industry Segmentation By Geography

- 1. Portugal

Portugal Wind Turbines Industry Regional Market Share

Geographic Coverage of Portugal Wind Turbines Industry

Portugal Wind Turbines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost Of Wind Power Generation4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration Of Solar Energy And Gas-Fired Power Plants

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Portugal Wind Turbines Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Portugal

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EDP Energias de Portugal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oersted AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Electricite de France SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENERCON GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rulis Electrica Lda

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vestas Wind Systems AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Acciona SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 EDP Energias de Portugal

List of Figures

- Figure 1: Portugal Wind Turbines Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Portugal Wind Turbines Industry Share (%) by Company 2025

List of Tables

- Table 1: Portugal Wind Turbines Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Portugal Wind Turbines Industry Volume gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 3: Portugal Wind Turbines Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Portugal Wind Turbines Industry Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: Portugal Wind Turbines Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 6: Portugal Wind Turbines Industry Volume gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 7: Portugal Wind Turbines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Portugal Wind Turbines Industry Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portugal Wind Turbines Industry?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the Portugal Wind Turbines Industry?

Key companies in the market include EDP Energias de Portugal, Oersted AS, Electricite de France SA, ENERCON GmbH, Siemens Gamesa Renewable Energy SA, Rulis Electrica Lda, Vestas Wind Systems AS, Acciona SA.

3. What are the main segments of the Portugal Wind Turbines Industry?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 178.89 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost Of Wind Power Generation4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration Of Solar Energy And Gas-Fired Power Plants.

8. Can you provide examples of recent developments in the market?

In June 2023, Galp and TotalEnergies agreed to jointly explore potential offshore wind opportunities in Portugal as the country prepares to promote a plan for 10GW of offshore wind-power capacity in the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portugal Wind Turbines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portugal Wind Turbines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portugal Wind Turbines Industry?

To stay informed about further developments, trends, and reports in the Portugal Wind Turbines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence