Key Insights

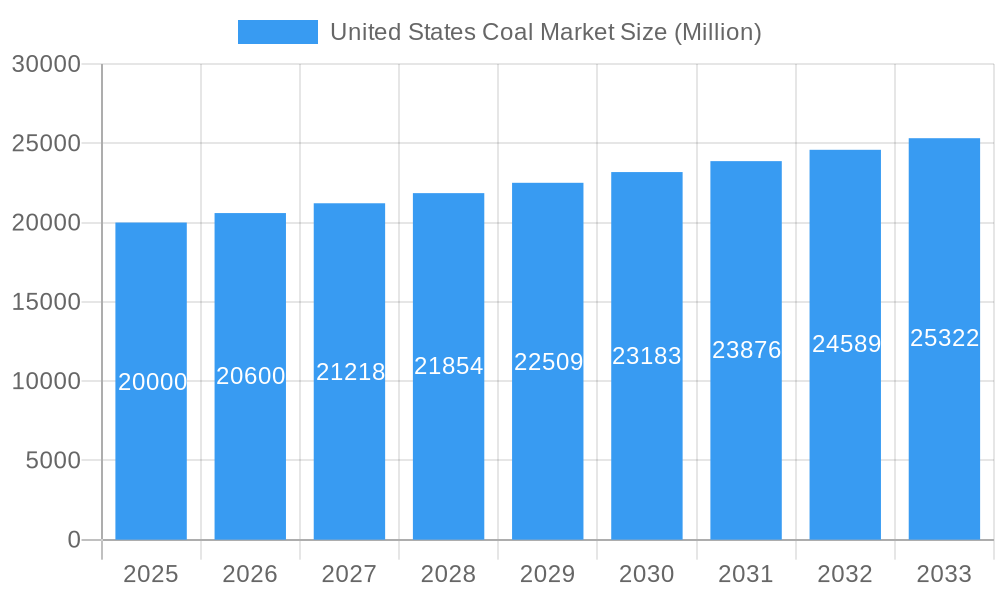

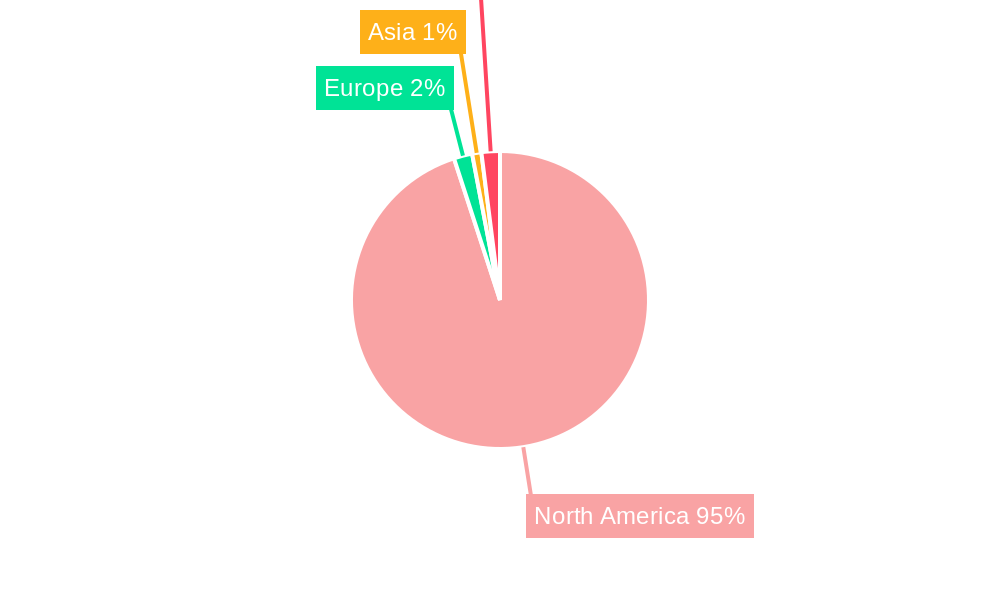

The United States coal market, valued at approximately $20 billion in 2025, is projected to experience a compound annual growth rate (CAGR) exceeding 3% from 2025 to 2033. This growth is primarily driven by the continued demand from the power generation sector, particularly in regions heavily reliant on coal-fired power plants. While the transition to renewable energy sources is undeniable, the current global energy landscape necessitates a continued, albeit reduced, role for coal, especially in bridging the gap until renewable infrastructure reaches sufficient scale. Metallurgy also remains a significant consumer of coal, further contributing to market stability. However, stringent environmental regulations aimed at reducing carbon emissions pose a significant restraint, driving the need for cleaner coal technologies and potentially impacting the overall growth trajectory. The market is segmented by application (metallurgy, power generation, others), with power generation holding the largest share. Key players, including Arch Coal Inc, Kiewit Corporation, and Peabody Energy Corp, are actively navigating this evolving landscape through strategic investments in efficiency improvements and diversification. Growth will likely be uneven, with fluctuations influenced by global energy prices and government policies. The North American region, particularly the United States, dominates the market due to its significant coal reserves and established infrastructure.

United States Coal Market Market Size (In Billion)

The forecast period (2025-2033) is expected to witness a gradual but consistent expansion of the US coal market, influenced by regional variations in energy demand and regulatory environments. Growth will likely be concentrated in areas where coal-fired power plants remain operational and where the economics of coal-based energy production are still competitive. Furthermore, technological advancements in carbon capture and storage could play a crucial role in mitigating environmental concerns and extending the lifespan of coal as a power source. However, sustained investment in renewable energy alternatives is likely to gradually erode the market share of coal over the long term, resulting in a more moderate growth trajectory by the end of the forecast period compared to the initial years. The competitive landscape will be characterized by consolidation among major players seeking efficiency gains and diversification strategies to navigate the challenges and opportunities presented by a shifting energy paradigm.

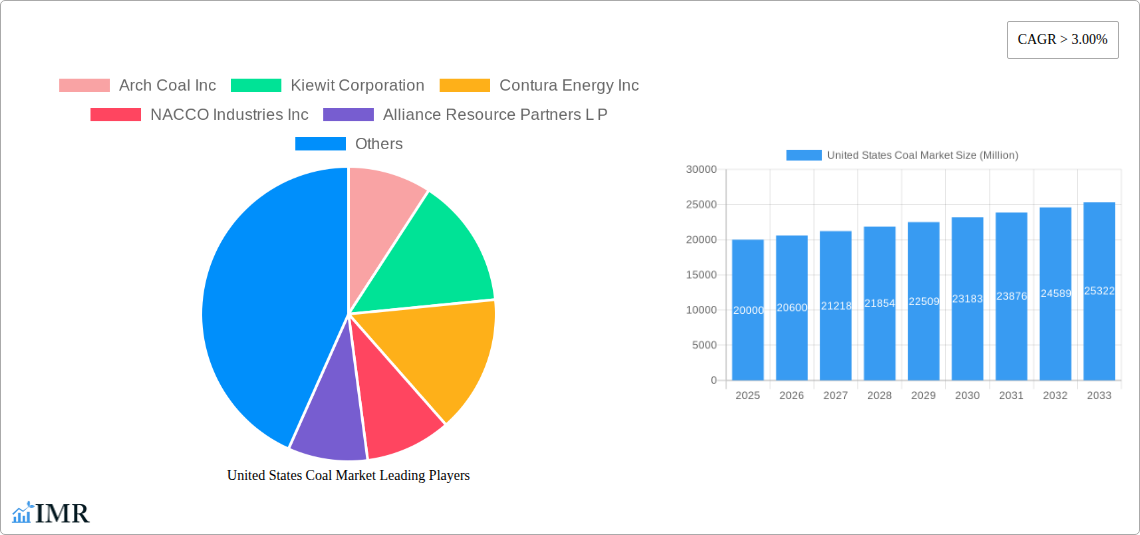

United States Coal Market Company Market Share

United States Coal Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States coal market, encompassing market dynamics, growth trends, regional performance, and key player strategies. It covers the historical period (2019-2024), base year (2025), and forecasts until 2033, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by application (Metallurgy, Power Generation, Others) providing granular data and analysis for informed decision-making. The total market size is projected to reach xx Million units by 2033.

United States Coal Market Dynamics & Structure

The US coal market exhibits a moderately concentrated structure, with a few major players commanding significant market share. Arch Coal Inc, Peabody Energy Corp, and Alliance Resource Partners L P, among others, hold considerable influence. Market concentration is further influenced by M&A activity, with xx number of deals recorded between 2019 and 2024, resulting in a xx% shift in market share. Technological innovation, primarily focused on improving extraction efficiency and reducing environmental impact, plays a crucial role. However, the high capital investment required and regulatory hurdles pose significant barriers to innovation. Stringent environmental regulations, including emission standards and mine reclamation laws, significantly impact market dynamics. The market also faces competition from alternative energy sources like natural gas and renewables, impacting demand in the power generation sector. End-user demographics are primarily driven by the power generation industry, but metallurgical applications also play a significant role.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- M&A Activity: xx deals between 2019 and 2024, resulting in a xx% shift in market share.

- Technological Innovation: Focus on efficiency gains and environmental impact reduction; high capital investment barriers.

- Regulatory Framework: Stringent environmental regulations, impacting operational costs and demand.

- Competitive Substitutes: Natural gas and renewable energy sources pose significant competition.

- End-User Demographics: Primarily power generation, with significant contribution from metallurgy.

United States Coal Market Growth Trends & Insights

The US coal market experienced a decline in the historical period (2019-2024), primarily due to the shift towards cleaner energy sources and stringent environmental regulations. However, the market is projected to witness a moderate recovery in the forecast period (2025-2033), driven by increased demand from certain industrial sectors and geopolitical factors. The CAGR for the forecast period is estimated at xx%, driven largely by increasing demand in metallurgy and sustained demand from certain power generation sectors. This growth is expected despite continued pressure from renewable energy sources and ongoing regulatory scrutiny. Consumer behavior shifts, influenced by environmental concerns and energy price fluctuations, continue to shape market demand. Technological disruptions in coal mining and utilization technologies are expected to impact overall efficiency and market competitiveness.

Dominant Regions, Countries, or Segments in United States Coal Market

The Power Generation segment dominates the US coal market, accounting for xx% of total consumption in 2024. The strong performance of this segment is primarily attributed to its established role in electricity generation and the relatively low short-term cost of coal compared to some renewable options in specific regions. Key growth drivers include:

- Existing Power Plant Infrastructure: A significant portion of the US power generation infrastructure relies on coal, ensuring consistent demand.

- Regional Economic Factors: Certain regions with heavy industrial concentration continue to rely on coal for power.

- Coal Price Fluctuations: Lower coal prices relative to other energy sources can stimulate demand in the short term.

The Metallurgy segment also plays a significant role, driven by its continued usage in steel production and related industries. Geographically, the Appalachian region and the Powder River Basin remain key production and consumption areas. However, production and consumption patterns are shifting based on resource availability, transportation costs, and environmental regulations.

United States Coal Market Product Landscape

The US coal market offers a range of coal types, including bituminous, sub-bituminous, and lignite, each with specific applications and performance characteristics. Recent innovations focus on improving coal quality for specific applications and enhancing combustion efficiency to mitigate environmental impact. The focus is on meeting stringent emission standards while maintaining cost competitiveness. Unique selling propositions often center on lower ash content, higher calorific value, and consistent quality.

Key Drivers, Barriers & Challenges in United States Coal Market

Key Drivers:

- Reliable and Affordable Energy Source: Coal remains a relatively low-cost energy source compared to other options, particularly for legacy power generation plants.

- Established Infrastructure: The extensive infrastructure for coal mining, transport, and power generation continues to support its use.

- Demand from Specific Industries: Metallurgy and some industrial processes still heavily rely on coal.

Key Challenges & Restraints:

- Stringent Environmental Regulations: Emission standards and mine reclamation regulations increase operational costs and limit expansion. This represents a significant cost burden estimated at xx Million units annually.

- Competition from Renewable Energy: The growth of renewable energy sources is reducing the market share of coal in power generation.

- Supply Chain Disruptions: Transportation costs and infrastructure limitations can disrupt coal supply.

Emerging Opportunities in United States Coal Market

Emerging opportunities lie in advanced coal technologies focusing on carbon capture, utilization, and storage (CCUS). This offers a pathway to reducing coal's environmental impact. Furthermore, innovative applications in industrial processes beyond traditional power generation and metallurgy might emerge. The development of more efficient and cleaner coal technologies to meet stringent environmental standards presents significant market opportunities.

Growth Accelerators in the United States Coal Market Industry

Technological advancements, particularly in carbon capture and efficient combustion technologies, are vital for the long-term growth of the coal market. Strategic partnerships between coal producers, technology providers, and power generation companies can facilitate the adoption of new technologies. Moreover, market expansion into niche applications and export markets may offer growth potential.

Key Players Shaping the United States Coal Market Market

- Arch Coal Inc

- Kiewit Corporation

- Contura Energy Inc

- NACCO Industries Inc

- Alliance Resource Partners L P

- Peabody Energy Corp

- Vistra Corp *List Not Exhaustive

Notable Milestones in United States Coal Market Sector

- 2020: Implementation of stricter emission standards in several states.

- 2021: Announcement of major investment in CCUS technology by a leading coal producer.

- 2022: Completion of a significant merger between two coal companies.

- 2023: Launch of a new, high-efficiency coal-fired power plant incorporating advanced emission control technologies.

- 2024: Increased focus on coal exports to certain international markets.

In-Depth United States Coal Market Market Outlook

The future of the US coal market hinges on technological advancements, regulatory changes, and global energy demand. While facing persistent challenges from renewable energy, coal will likely retain a role, albeit a diminished one, driven by certain industrial needs and geopolitical factors. Opportunities exist for companies focusing on innovation and sustainability, paving the way for a more environmentally responsible coal sector. Long-term growth will depend on successfully navigating environmental regulations and fostering technological advancements that address the sector's sustainability concerns.

United States Coal Market Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

United States Coal Market Segmentation By Geography

- 1. United States

United States Coal Market Regional Market Share

Geographic Coverage of United States Coal Market

United States Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arch Coal Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kiewit Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Contura Energy Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NACCO Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alliance Resource Partners L P

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistra Corp*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Arch Coal Inc

List of Figures

- Figure 1: United States Coal Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Coal Market Share (%) by Company 2025

List of Tables

- Table 1: United States Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: United States Coal Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: United States Coal Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Coal Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: United States Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: United States Coal Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: United States Coal Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Coal Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Coal Market?

The projected CAGR is approximately 0.8%.

2. Which companies are prominent players in the United States Coal Market?

Key companies in the market include Arch Coal Inc, Kiewit Corporation, Contura Energy Inc, NACCO Industries Inc, Alliance Resource Partners L P, Peabody Energy Corp, Vistra Corp*List Not Exhaustive.

3. What are the main segments of the United States Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Coal Market?

To stay informed about further developments, trends, and reports in the United States Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence