Key Insights

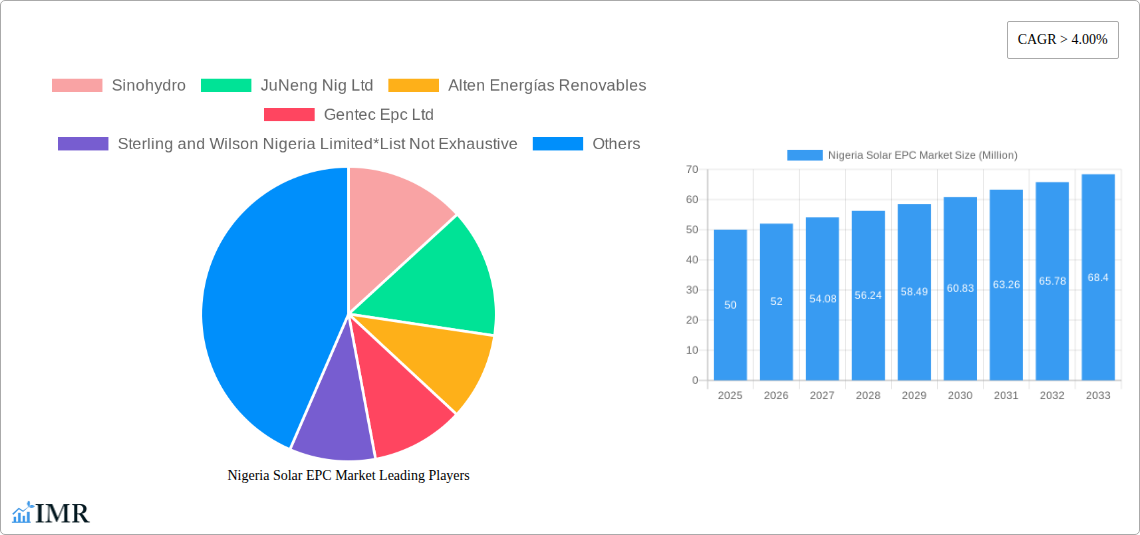

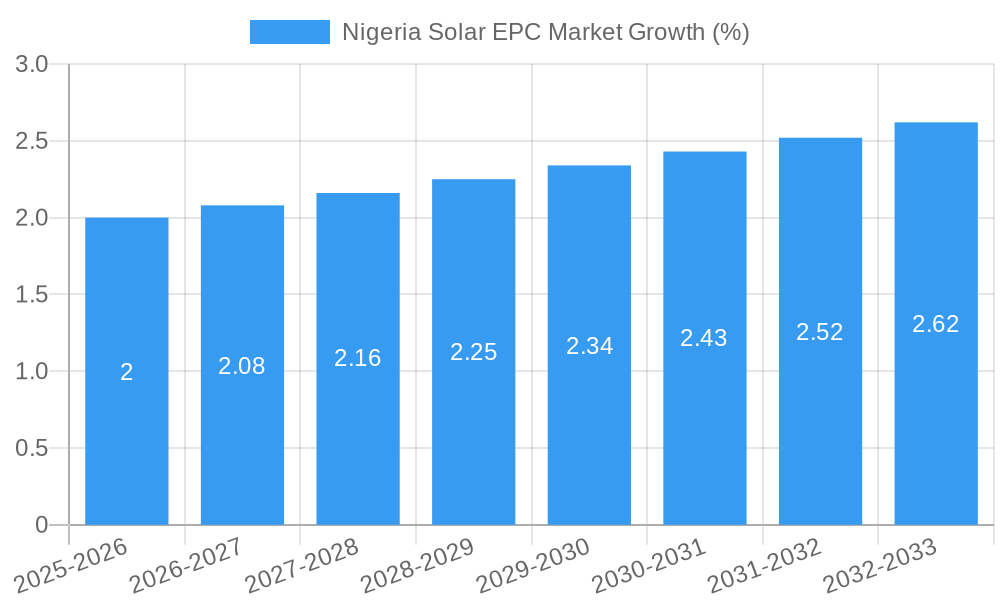

The Nigerian solar EPC (Engineering, Procurement, and Construction) market is experiencing robust growth, driven by increasing energy demand, government initiatives promoting renewable energy adoption, and the relatively high cost of traditional power sources. With a CAGR exceeding 4% from 2019 to 2024, and a projected continuation of this trend through 2033, the market presents significant opportunities for investors and EPC companies. The market's segmentation reveals a strong focus on renewable energy sources, particularly solar, indicating a shift away from reliance on thermal power generation. Key players such as Sinohydro, JuNeng Nig Ltd, and Sterling and Wilson Nigeria Limited are actively contributing to the market's expansion, competing through project execution capabilities, technological expertise, and cost-effectiveness. The market's growth is further fueled by factors such as favorable government policies, including tax incentives and subsidies for solar projects, and a growing awareness among consumers and businesses of the benefits of sustainable energy solutions. Challenges include the intermittent nature of solar power requiring effective energy storage solutions and addressing potential infrastructural limitations in certain regions.

While precise market size figures are not available, based on the provided CAGR of >4% and the knowledge that the Nigerian renewable energy market is expanding rapidly, we can reasonably infer a significant upward trajectory. The existing players and the ongoing investment in solar projects suggest a market size in the tens of millions of dollars in 2025, projected to grow considerably by 2033. The thermal power generation segment, though still present, is expected to witness a decline in market share as the renewable segment expands. The "Other Power Generation Sources" segment likely includes smaller-scale or niche solutions, with growth potentially linked to emerging technologies and specialized applications within the Nigerian energy landscape. Continued growth will depend on sustained government support, technological advancements, and addressing the challenges related to grid integration and energy storage.

Nigeria Solar EPC Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Nigeria Solar EPC market, encompassing market dynamics, growth trends, key players, and future outlook. With a detailed examination of the parent market (Nigerian Power Generation) and child market (Solar EPC), this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market size is presented in million units.

Keywords: Nigeria Solar EPC Market, Solar Energy Nigeria, Renewable Energy Nigeria, Power Generation Nigeria, EPC Contractors Nigeria, Solar Projects Nigeria, Nigerian Energy Market, Afam III Power Plant, Dangote Group, NNPC, Sinohydro, JuNeng Nig Ltd, Alten Energías Renovables, Gentec EPC Ltd, Sterling and Wilson Nigeria Limited, Energo Nigeria Ltd, Andritz AG.

Nigeria Solar EPC Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Nigerian Solar EPC market. We explore market concentration, identifying key players and their respective market shares (xx%). The report examines the influence of technological innovation, including advancements in solar panel efficiency and EPC project management software, and assesses the impact of government regulations on market growth. Furthermore, we delve into the competitive dynamics, considering the presence of substitute technologies and the implications of mergers and acquisitions (M&A) activity. The volume of M&A deals in the historical period (2019-2024) is estimated at xx deals, with an expected increase to xx deals during the forecast period (2025-2033).

- Market Concentration: Highly fragmented (xx%), with a few dominant players.

- Technological Innovation: Driven by efficiency gains in solar panels and improved EPC project management.

- Regulatory Framework: Government policies and incentives significantly impact market growth.

- Competitive Substitutes: Traditional power generation sources pose a competitive challenge.

- End-User Demographics: Focus on residential, commercial, and industrial sectors.

- M&A Trends: Consolidation expected to increase during the forecast period.

Nigeria Solar EPC Market Growth Trends & Insights

The Nigeria Solar EPC market is experiencing robust growth fueled by increasing electricity demand, government support for renewable energy, and declining solar technology costs. This section presents a detailed analysis of market size evolution, penetration rates, and technological disruptions impacting the sector. The compound annual growth rate (CAGR) is projected at xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033. We analyze consumer behavior shifts, exploring factors influencing adoption rates of solar EPC solutions across various segments. The report also examines the impact of technological advancements, such as the integration of battery storage systems and smart grid technologies.

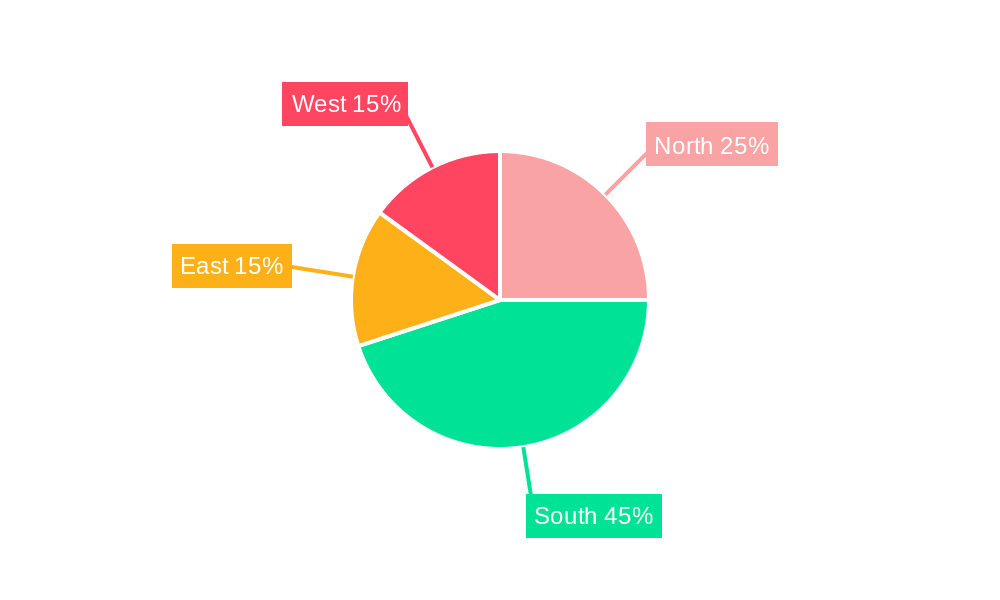

Dominant Regions, Countries, or Segments in Nigeria Solar EPC Market

This section identifies the leading regions and segments within the Nigerian Solar EPC market driving growth. While data is limited on specific regional breakdowns, the analysis indicates a strong focus on urban centers with high energy demands. The renewables segment within power generation is the dominant driver, fueled by government initiatives and growing environmental awareness.

- Key Drivers:

- Government incentives and policies promoting renewable energy adoption.

- Increasing electricity demand and unreliable grid infrastructure.

- Decreasing costs of solar PV technology.

- Dominant Segment: Renewables (Solar) within Power Generation. This segment is projected to hold a xx% market share in 2025.

Nigeria Solar EPC Market Product Landscape

The Nigerian Solar EPC market offers a diverse range of products, from small-scale residential systems to large-scale utility-scale projects. Innovation is focused on enhancing efficiency, reducing costs, and improving integration with existing grid infrastructure. Products include grid-tied and off-grid systems, encompassing various solar panel technologies and energy storage solutions. Key selling propositions center around cost savings, reliability, and sustainability.

Key Drivers, Barriers & Challenges in Nigeria Solar EPC Market

Key Drivers:

- Government incentives and policies supporting renewable energy.

- Growing energy demand and unreliable grid infrastructure.

- Decreasing cost of solar PV technology.

Challenges:

- High initial investment costs can be a barrier to entry for some consumers.

- Financing options remain limited, particularly for smaller-scale projects.

- Regulatory complexities and bureaucratic hurdles can hinder project development.

Emerging Opportunities in Nigeria Solar EPC Market

The Nigerian Solar EPC market presents significant untapped potential. Opportunities lie in expanding into rural areas with limited grid access, developing innovative financing models, and integrating solar energy with other renewable sources. The growth of the commercial and industrial sectors creates further demand for large-scale solar solutions. Furthermore, there is potential for increased investment in battery storage solutions to enhance grid stability.

Growth Accelerators in the Nigeria Solar EPC Market Industry

Long-term growth will be driven by technological advancements, such as improved battery storage technology and more efficient solar panels. Strategic partnerships between EPC providers and investors are crucial for scaling up project deployment. Government policies promoting renewable energy integration into the national grid will also significantly contribute to the sector's growth.

Key Players Shaping the Nigeria Solar EPC Market Market

- Sinohydro

- JuNeng Nig Ltd

- Alten Energías Renovables

- Gentec EPC Ltd

- Sterling and Wilson Nigeria Limited

- Energo Nigeria Ltd

- Andritz AG

Notable Milestones in Nigeria Solar EPC Market Sector

- February 2023: GE Gas Power announces plans to invest nearly 500 MW in power assets, including projects with NNPC and Dangote Group.

- December 2022: The Nigerian Federal Government initiates 11 hydropower projects totaling 3,750 MW.

In-Depth Nigeria Solar EPC Market Outlook

The Nigeria Solar EPC market possesses immense long-term potential, driven by escalating energy demand, government support for renewable energy, and continuous advancements in solar technology. Strategic investments in grid infrastructure and innovative financing solutions will be vital for unlocking the sector's full potential. The market is projected to witness significant growth in the coming years, offering substantial opportunities for industry players.

Nigeria Solar EPC Market Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Other Power Generation Sources

Nigeria Solar EPC Market Segmentation By Geography

- 1. Niger

Nigeria Solar EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. 4.; The New Government's Intentions to Reduce Private Investments

- 3.4. Market Trends

- 3.4.1. Thermal Power to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Solar EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sinohydro

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JuNeng Nig Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alten Energías Renovables

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gentec Epc Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sterling and Wilson Nigeria Limited*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Energo Nigeria Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Andritz AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Sinohydro

List of Figures

- Figure 1: Nigeria Solar EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Solar EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Solar EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Nigeria Solar EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 4: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Power Generation 2019 & 2032

- Table 5: Nigeria Solar EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Nigeria Solar EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Nigeria Solar EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 10: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Power Generation 2019 & 2032

- Table 11: Nigeria Solar EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Solar EPC Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Nigeria Solar EPC Market?

Key companies in the market include Sinohydro, JuNeng Nig Ltd, Alten Energías Renovables, Gentec Epc Ltd, Sterling and Wilson Nigeria Limited*List Not Exhaustive, Energo Nigeria Ltd, Andritz AG.

3. What are the main segments of the Nigeria Solar EPC Market?

The market segments include Power Generation.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects.

6. What are the notable trends driving market growth?

Thermal Power to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The New Government's Intentions to Reduce Private Investments.

8. Can you provide examples of recent developments in the market?

February 2023: GE Gas Power, an American energy company, revealed plans to invest in power assets that will add nearly 500 megawatts (MW) to Nigeria's national electricity grid by the second quarter of 2023. The 240 MW Afam III power plant in Port Harcourt, the 50 MW Maiduguri project with the Nigerian National Petroleum Company Limited (NNPC), and another 50 MW project for the Dangote Group to serve its cement and refinery plants are among them, according to the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Solar EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Solar EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Solar EPC Market?

To stay informed about further developments, trends, and reports in the Nigeria Solar EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence